Corporation

... •Index amortizing Notes, coupon rate is fixed but some principal is repaid before maturity with the amount of principal prepaid based on the level of the reference rate. ...

... •Index amortizing Notes, coupon rate is fixed but some principal is repaid before maturity with the amount of principal prepaid based on the level of the reference rate. ...

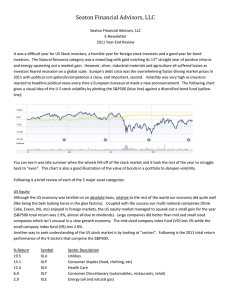

2011 - Seaton Financial Advisors, LLC

... “Inflation protected” bonds also performed very well as investors sought a hedge against future inflation. Cash Short term interest rates were kept artificially low by the Fed in order to assist banks in earning profits to shore up their balance sheets (the bailouts are never-ending). This resulted ...

... “Inflation protected” bonds also performed very well as investors sought a hedge against future inflation. Cash Short term interest rates were kept artificially low by the Fed in order to assist banks in earning profits to shore up their balance sheets (the bailouts are never-ending). This resulted ...

A Distressed Nation on the Brink of Collapse

... I spent New Year’s Eve in Seattle with my wife, watching the fireworks shooting out from under the Space Needle. This trip to Seattle has turned into a tradition. We’ve spent New Year’s there for the last three years. And every time we go it gets better. There wasn’t a worry on my mind. I don’t thin ...

... I spent New Year’s Eve in Seattle with my wife, watching the fireworks shooting out from under the Space Needle. This trip to Seattle has turned into a tradition. We’ve spent New Year’s there for the last three years. And every time we go it gets better. There wasn’t a worry on my mind. I don’t thin ...

Go Back Print this page The Minsky Moment by John Cassidy

... institutions—for many years, he served as a director of the Mark Twain Bank, in St. Louis—but he knew more about how they worked than most deskbound economists. There are basically five stages in Minsky’s model of the credit cycle: displacement, boom, euphoria, profit taking, and panic. A displaceme ...

... institutions—for many years, he served as a director of the Mark Twain Bank, in St. Louis—but he knew more about how they worked than most deskbound economists. There are basically five stages in Minsky’s model of the credit cycle: displacement, boom, euphoria, profit taking, and panic. A displaceme ...

Make and serve a statutory demand, or challenge one : When you

... If the debt’s over 6 years old, you can’t usually make a statutory demand. You can get legal advice instead. There may be faster ways of getting smaller debts paid than making a statutory demand. When the individual or company that owes you money (the ‘debtor’) receives a statutory demand, they have ...

... If the debt’s over 6 years old, you can’t usually make a statutory demand. You can get legal advice instead. There may be faster ways of getting smaller debts paid than making a statutory demand. When the individual or company that owes you money (the ‘debtor’) receives a statutory demand, they have ...

News Release - Community Data Program

... than any previous recession. It also raises a warning flag from the last two major recessions – the early 1980s and 1990s – which consisted of deep and prolonged job loss. “The loss of 387,000 full-time jobs to date could well be just the tip of the iceberg,” says Yalnizyan. “Judging from past reces ...

... than any previous recession. It also raises a warning flag from the last two major recessions – the early 1980s and 1990s – which consisted of deep and prolonged job loss. “The loss of 387,000 full-time jobs to date could well be just the tip of the iceberg,” says Yalnizyan. “Judging from past reces ...

US Construction & Cement Outlook

... “Threat to economy is not a housing issue... it is a financial/credit issue that arose from past mortgage financing.” ...

... “Threat to economy is not a housing issue... it is a financial/credit issue that arose from past mortgage financing.” ...

- the Other Canon

... the class war back in business. Military spending has not declined significantly, and governments throughout the world have now found a new source of budget deficits: tax cuts for the wealthy. In this new economic warfare, the most effective tactic is to offer modest income-tax reductions to the low ...

... the class war back in business. Military spending has not declined significantly, and governments throughout the world have now found a new source of budget deficits: tax cuts for the wealthy. In this new economic warfare, the most effective tactic is to offer modest income-tax reductions to the low ...

Capital Structure Decision

... Co.. The company has no debt. The company’s annual cash flow is $1,000, before interest and taxes. The corporate tax rate is 40%. You have the option to exchange 1/2 of your equity position for 10% bonds with a face value of $1,000. Should you do this and why? ...

... Co.. The company has no debt. The company’s annual cash flow is $1,000, before interest and taxes. The corporate tax rate is 40%. You have the option to exchange 1/2 of your equity position for 10% bonds with a face value of $1,000. Should you do this and why? ...

“Indicadores Financieros Clave en la Calificacion de Empresas por

... Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s. Copyright (c) 2008 Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. ...

... Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s. Copyright (c) 2008 Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. ...

Quarterly Report

... has however declined sequentially in FY2011. This has been on account of moderation in industrial and service sector growth. There has also been a significant slowdown in investments over the past few quarters, partly attributable to the rising interest rates, which have now been raised by 425 basis ...

... has however declined sequentially in FY2011. This has been on account of moderation in industrial and service sector growth. There has also been a significant slowdown in investments over the past few quarters, partly attributable to the rising interest rates, which have now been raised by 425 basis ...

Green - American Council on Consumer Interests

... obligation. Another related factor was age and health that affected the ability of the consumer to work and earn sufficient income. Mortgage financing options used by consumers were varied. Although some participants still held their original mortgages, others had refinanced their mortgage or had ho ...

... obligation. Another related factor was age and health that affected the ability of the consumer to work and earn sufficient income. Mortgage financing options used by consumers were varied. Although some participants still held their original mortgages, others had refinanced their mortgage or had ho ...

Carmen Reinhart is Professor of the International Financial System

... Inflation came to be seen as chronic, and politicians looked toward price controls and income policies. Real (inflation-adjusted) short-term interest rates were consistently negative in most of the advanced economies. Federal Reserve Chairman Paul Volcker’s monumental tightening of US monetary polic ...

... Inflation came to be seen as chronic, and politicians looked toward price controls and income policies. Real (inflation-adjusted) short-term interest rates were consistently negative in most of the advanced economies. Federal Reserve Chairman Paul Volcker’s monumental tightening of US monetary polic ...

Debt Settlement - ClearOne Advantage

... contraction since the Great Depression of the 1930s. Many bellwether companies have been forced into bankruptcy, home prices have fallen on average more than 20 percent, the equity markets remain 35 percent below their 2007 highs, and in excess of seven million workers have joined the ranks of the ...

... contraction since the Great Depression of the 1930s. Many bellwether companies have been forced into bankruptcy, home prices have fallen on average more than 20 percent, the equity markets remain 35 percent below their 2007 highs, and in excess of seven million workers have joined the ranks of the ...

Katrina booklet - frbatlanta.org

... 3. Describe ways to avoid or correct debt problems. 4. Summarize major consumer credit laws. ...

... 3. Describe ways to avoid or correct debt problems. 4. Summarize major consumer credit laws. ...

Atlas - Atlas - Paying for College

... 9.1.12.B.2 Compare strategies for saving and investing and the factors that influence how much should be saved or invested to meet financial goals. Strand C: Credit And Debt Management 9.1.12.C.3 Compute and assess the accumulating effect of interest paid over time when using a variety of sources of ...

... 9.1.12.B.2 Compare strategies for saving and investing and the factors that influence how much should be saved or invested to meet financial goals. Strand C: Credit And Debt Management 9.1.12.C.3 Compute and assess the accumulating effect of interest paid over time when using a variety of sources of ...

Moral Hazard in the Policy Response to the 2008 Financial Market Meltdown

... too risky a proposition. There were consumers who lived within their means and tried to save some money for the future, refusing to max out their credit cards or their home equity lines of credit to boost their consumption even further above their income. These were the participants in financial mar ...

... too risky a proposition. There were consumers who lived within their means and tried to save some money for the future, refusing to max out their credit cards or their home equity lines of credit to boost their consumption even further above their income. These were the participants in financial mar ...

Flltext - Brunel University Research Archive

... In the post-crisis period, household debt levels and house prices have risen in Canada, owing, in part, to accommodative monetary conditions. These vulnerabilities were mitigated by tightening macroprudential policy, including mortgage insurance rules, and strengthening mortgage-underwriting standa ...

... In the post-crisis period, household debt levels and house prices have risen in Canada, owing, in part, to accommodative monetary conditions. These vulnerabilities were mitigated by tightening macroprudential policy, including mortgage insurance rules, and strengthening mortgage-underwriting standa ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.