On My Radar: Fed Stuck Between Three Rocks and a Hard Place

... And here is what the risk looks like (note how much less the risk was in quintile 1 vs. 4 and 5): ...

... And here is what the risk looks like (note how much less the risk was in quintile 1 vs. 4 and 5): ...

Small Banks Gain Reprieve on Balloon Mortgages

... Under its revised rule, the CFPB also said that compensation paid by a mortgage lender or broker to a loan originator employee does not count toward a 3% cap on points and fees. That cap had been a point of contention for many lenders and was a requirement of the Dodd-Frank Act. The CFPB did not ch ...

... Under its revised rule, the CFPB also said that compensation paid by a mortgage lender or broker to a loan originator employee does not count toward a 3% cap on points and fees. That cap had been a point of contention for many lenders and was a requirement of the Dodd-Frank Act. The CFPB did not ch ...

Did you notice - T3 Equity Labs LLC

... •Investor redemptions drove the money funds to sell the bonds back to banks. •64% of cities are less able to meet their fiscal needs now than in 2007 because of rising operating costs, job losses and declining home values, according to a survey of 319 local finance officials released this month. •Th ...

... •Investor redemptions drove the money funds to sell the bonds back to banks. •64% of cities are less able to meet their fiscal needs now than in 2007 because of rising operating costs, job losses and declining home values, according to a survey of 319 local finance officials released this month. •Th ...

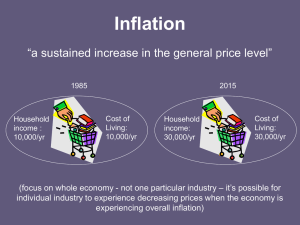

Inflation

... - gov’t has set a target of 2% for inflation – this is deemed the best rate for a stable economy (higher than that and inflation can have negative effects; lower than that can mean a stagnant economy) As prices rise, the value of money falls – the same money can’t buy as much as it used to. The Bank ...

... - gov’t has set a target of 2% for inflation – this is deemed the best rate for a stable economy (higher than that and inflation can have negative effects; lower than that can mean a stagnant economy) As prices rise, the value of money falls – the same money can’t buy as much as it used to. The Bank ...

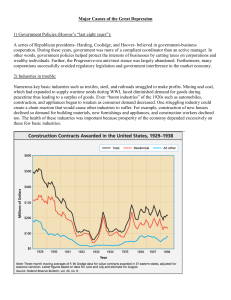

Lesson 1: Hooking Lesson

... b) Overbuying on credit in the preceding years: Although many Americans appeared prosperous during the 1920s, they were actually living beyond their means. They frequently bought goods on credit- an arrangement in which consumers agreed to buy now and pay later for purchases, often on an installment ...

... b) Overbuying on credit in the preceding years: Although many Americans appeared prosperous during the 1920s, they were actually living beyond their means. They frequently bought goods on credit- an arrangement in which consumers agreed to buy now and pay later for purchases, often on an installment ...

Monetizing the Debt - Federal Reserve Bank of St. Louis

... deficit spending by “printing” money, this would not be the purpose of the Fed’s actions and, hence, critics would be wrong to claim that the Fed has monetized the debt. I suggest that an economically meaningful definition of “monetizing the debt” must be based on the Fed’s motive for increasing the ...

... deficit spending by “printing” money, this would not be the purpose of the Fed’s actions and, hence, critics would be wrong to claim that the Fed has monetized the debt. I suggest that an economically meaningful definition of “monetizing the debt” must be based on the Fed’s motive for increasing the ...

No Slide Title

... Slovenia, Spain, Sweden, the Netherlands, United Kingdom Population: 460.1 million Total GDP: $11.7 trillion ...

... Slovenia, Spain, Sweden, the Netherlands, United Kingdom Population: 460.1 million Total GDP: $11.7 trillion ...

Phil Cosson Senior Municipal Advisor

... • May target mill rate rather than specific dollar amount of levy • Large expansion of tax base can present opportunity to borrow while minimizing mill rate impact: – Closure of a tax increment district – Large development outside of a tax increment district ...

... • May target mill rate rather than specific dollar amount of levy • Large expansion of tax base can present opportunity to borrow while minimizing mill rate impact: – Closure of a tax increment district – Large development outside of a tax increment district ...

Folie 1

... - weakness of the institutional/policy set-up has become very apparent - a large number of institutional reforms are emerging: fiscal policy frameworks (‘fiscal compact’; six-pack); EU wide regulation and supervision; increased tax base of EU?; evolution of crisis and risk management (EFSF/ESM; Bank ...

... - weakness of the institutional/policy set-up has become very apparent - a large number of institutional reforms are emerging: fiscal policy frameworks (‘fiscal compact’; six-pack); EU wide regulation and supervision; increased tax base of EU?; evolution of crisis and risk management (EFSF/ESM; Bank ...

PDF Download

... these states could take on much more debt, without the interest rates reflecting the risks. In order to enforce government budget discipline in Europe, the capital markets must receive credible signals that in the case of one country’s over-indebtedness, the creditors bear liability before help from ...

... these states could take on much more debt, without the interest rates reflecting the risks. In order to enforce government budget discipline in Europe, the capital markets must receive credible signals that in the case of one country’s over-indebtedness, the creditors bear liability before help from ...

CHAPTER 13 Capital Structure and Leverage

... EPS is maximized at 50%, but primary interest is stock price, not E(EPS). The example shows that we can push up E(EPS) by using more debt, but the risk resulting from increased leverage more than offsets the benefit of higher E(EPS). ...

... EPS is maximized at 50%, but primary interest is stock price, not E(EPS). The example shows that we can push up E(EPS) by using more debt, but the risk resulting from increased leverage more than offsets the benefit of higher E(EPS). ...

What Lenders Want in a Credit Crunch

... • MBS and CDO were purchased by the billions much riskier than was understood • Major banks and investment banks have experienced record losses • As a result Housing markets tumbled ...

... • MBS and CDO were purchased by the billions much riskier than was understood • Major banks and investment banks have experienced record losses • As a result Housing markets tumbled ...

2017 2018 policy i borrowing framework policy

... benefits. It gives the Issuer a benchmark for further issues. If there are several large maturities that are listed / quoted, it may be possible that a small add-on issue could be put into the market at a lower cost than a new issue. A Municipal Bond issue is an alternative to Bank loans or struct ...

... benefits. It gives the Issuer a benchmark for further issues. If there are several large maturities that are listed / quoted, it may be possible that a small add-on issue could be put into the market at a lower cost than a new issue. A Municipal Bond issue is an alternative to Bank loans or struct ...

Personal debt - Statistics Canada

... over the last 25 years, from $5,470 in 1980 to $28,390 in 2005. For Americans, it jumped 7.5 times, from CAN$6,510 to $48,700. Per-capita debt has been increasing steadily in both countries, but the disparity between the two countries, almost non-existent at the beginning of the 1980s, began to incr ...

... over the last 25 years, from $5,470 in 1980 to $28,390 in 2005. For Americans, it jumped 7.5 times, from CAN$6,510 to $48,700. Per-capita debt has been increasing steadily in both countries, but the disparity between the two countries, almost non-existent at the beginning of the 1980s, began to incr ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.