Dealing with debt

... undertaken by finance companies and other lenders who were outside our core banking system. But the nature of credit booms is that some of what initially looked to be good sound borrowing - whether to finance personal consumption or to undertake productive business investment - turns out not to be. ...

... undertaken by finance companies and other lenders who were outside our core banking system. But the nature of credit booms is that some of what initially looked to be good sound borrowing - whether to finance personal consumption or to undertake productive business investment - turns out not to be. ...

Is a Very High Public Debt a Problem?

... The only reason why the governments of these countries have not used fiscal policy to expand demand to full employment is the belief that it may lead to an increase in public debt with one of the following outcomes: a too high tax burden, a default, or inflation. The question is: Why is this belief ...

... The only reason why the governments of these countries have not used fiscal policy to expand demand to full employment is the belief that it may lead to an increase in public debt with one of the following outcomes: a too high tax burden, a default, or inflation. The question is: Why is this belief ...

data1 fasb eitf abstracts 9522

... whereby remittances from the borrower’s customers reduce the debt outstanding, are considered short-term obligations. Task Force members observed that the effect of the agreement's subjective acceleration clause on the balance sheet classification of borrowings outstanding should be determined based ...

... whereby remittances from the borrower’s customers reduce the debt outstanding, are considered short-term obligations. Task Force members observed that the effect of the agreement's subjective acceleration clause on the balance sheet classification of borrowings outstanding should be determined based ...

ADVFN FilterX Set-Up List

... Deeper Analysis Net Profit Margin Deeper Analysis ROE - Return on equity (%) Deeper Analysis Price To Pre-Tax Profit PS (market cap to profit) Key Figures PE ratio Deeper Analysis Total Debt/Pre-Tax Profit Deeper Analysis Market to Book Ratio Deeper Analysis Dividend yield Key Figures Spread (%) ...

... Deeper Analysis Net Profit Margin Deeper Analysis ROE - Return on equity (%) Deeper Analysis Price To Pre-Tax Profit PS (market cap to profit) Key Figures PE ratio Deeper Analysis Total Debt/Pre-Tax Profit Deeper Analysis Market to Book Ratio Deeper Analysis Dividend yield Key Figures Spread (%) ...

FREQUENTLY ASKED QUESTIONS Explaining Debt Disclosure

... debt, approximately $73 million of this amount is general obligation debt. When you realize that Orland Park has an equalized assessed valuation (EAV), meaning total taxable value of the community, of more than $2.3 billion, one can place the in total outstanding GO in a better context. This is anal ...

... debt, approximately $73 million of this amount is general obligation debt. When you realize that Orland Park has an equalized assessed valuation (EAV), meaning total taxable value of the community, of more than $2.3 billion, one can place the in total outstanding GO in a better context. This is anal ...

Securitisation in Ireland

... FVC definition is wider than what is traditionally thought of as securitisation (i.e. vanilla securitisations of banks’ mortgage books covered in banking statistics) Some issues around the margins in determining whether some vehicles are inside or outside the FVC definition ...

... FVC definition is wider than what is traditionally thought of as securitisation (i.e. vanilla securitisations of banks’ mortgage books covered in banking statistics) Some issues around the margins in determining whether some vehicles are inside or outside the FVC definition ...

C3 Guidelines - University of California | Office of The President

... 2. Policy Basis. At its July 16, 2008 meeting, the Board of Regents authorized the use of the Regents’ CP Program for the financing of University working capital needs, as described in the enabling language below. The Regents’ CP Program is authorized for: (1) the interim financing of capital projec ...

... 2. Policy Basis. At its July 16, 2008 meeting, the Board of Regents authorized the use of the Regents’ CP Program for the financing of University working capital needs, as described in the enabling language below. The Regents’ CP Program is authorized for: (1) the interim financing of capital projec ...

Eduardo Cavallo

... 5) External financial packages are essential when initial conditions do not help. Mexico 1994: $51 billion IMF/USA rescue package. 2.8 times the total stock of short-term US$ debt by December 2004. ...

... 5) External financial packages are essential when initial conditions do not help. Mexico 1994: $51 billion IMF/USA rescue package. 2.8 times the total stock of short-term US$ debt by December 2004. ...

Lessons We Should Have Learned from the Global Financial Crisis

... preferred to focus on the “good news” in housing. In any event, the high rate of defaults on subprimes was THE triggering event, but what is more important is that we had developed an economy that was vulnerable. The total subprime “universe” was less than two trillion dollars (not that much); it wa ...

... preferred to focus on the “good news” in housing. In any event, the high rate of defaults on subprimes was THE triggering event, but what is more important is that we had developed an economy that was vulnerable. The total subprime “universe” was less than two trillion dollars (not that much); it wa ...

bank loans and private placements

... Generally no CUSIP number Not subject to some of the laws/requirements designed to protect investors U.S. Supreme Court Case Reves vs. Ernst & Young, Inc., 494 U.S. 56 (1990) ...

... Generally no CUSIP number Not subject to some of the laws/requirements designed to protect investors U.S. Supreme Court Case Reves vs. Ernst & Young, Inc., 494 U.S. 56 (1990) ...

Rethinking the Central Bank`s Mandate (and Other Things)

... 4. And to support central bank’s goals: “. . . if [government] finances are not sustainable in the long run, the Riksbank’s efforts to maintain price stability will be impeded.” [Sweden’s Convergence ...

... 4. And to support central bank’s goals: “. . . if [government] finances are not sustainable in the long run, the Riksbank’s efforts to maintain price stability will be impeded.” [Sweden’s Convergence ...

Systemic indicators

... • Includes indicators on indicators for other sectors, financial markets and real estate price indices • More emphasis on non-bank financial sectors? • Financial positions of other sectors through financial ...

... • Includes indicators on indicators for other sectors, financial markets and real estate price indices • More emphasis on non-bank financial sectors? • Financial positions of other sectors through financial ...

Chapter 5 The Time Value of Money

... Of course, companies deviate from their target capital structure when they are offered a good deal. In terms of financing, this means that if the company observes attractive interest rates for debt financing, it might lean more heavily on debt financing. ...

... Of course, companies deviate from their target capital structure when they are offered a good deal. In terms of financing, this means that if the company observes attractive interest rates for debt financing, it might lean more heavily on debt financing. ...

Modest Proposal for Overcoming the Euro Crisis

... credit rating agencies themselves! Instead of closing what was already recognised as a democratic deficit, they deepen it and, in the process, reinforce the Eurozone's unfolding predicament. Eager to please the markets, Europe's leaders ignore Treaty commitments to economic and social cohesion and, ...

... credit rating agencies themselves! Instead of closing what was already recognised as a democratic deficit, they deepen it and, in the process, reinforce the Eurozone's unfolding predicament. Eager to please the markets, Europe's leaders ignore Treaty commitments to economic and social cohesion and, ...

The Political Economy of Shadow Banking

... Although characteristically sardonic, Marx’s views on the “Crédit Mobilier” are not anachronistic - the way he saw it, industrial capitalism required a structured banking sector to finance industrial operations (with intimate ties to the State), a view later developed in depth by Rudolf Hilferding ...

... Although characteristically sardonic, Marx’s views on the “Crédit Mobilier” are not anachronistic - the way he saw it, industrial capitalism required a structured banking sector to finance industrial operations (with intimate ties to the State), a view later developed in depth by Rudolf Hilferding ...

A D F C

... following three years of severe recession, a dramatic reduction in foreign direct investment, high inflation, high interest rates and a large budget deficit. GDP declined by 10.9% (The Economist, 2010). When the Argentine government announced its default its sovereign debts amounted to $144.5 billio ...

... following three years of severe recession, a dramatic reduction in foreign direct investment, high inflation, high interest rates and a large budget deficit. GDP declined by 10.9% (The Economist, 2010). When the Argentine government announced its default its sovereign debts amounted to $144.5 billio ...

ITEM 9 Treasury Management Annual Report 2011_12

... The UK’s reliance on the Eurozone as a major trading partner was illustrated when this country followed the Eurozone into recession over the last six months of the financial year. Other factors responsible for the fall in economic activity included the government’s deficit reduction programme and th ...

... The UK’s reliance on the Eurozone as a major trading partner was illustrated when this country followed the Eurozone into recession over the last six months of the financial year. Other factors responsible for the fall in economic activity included the government’s deficit reduction programme and th ...

Excessive Macro Imbalances

... • « Innovation capacity of French private sector impaired by a prolonged dearth of investment’. ‘Insofar (!) as it allows companies to build non price competitive advantages, an improvement of their cost competitiveness would have a long term impact » ...

... • « Innovation capacity of French private sector impaired by a prolonged dearth of investment’. ‘Insofar (!) as it allows companies to build non price competitive advantages, an improvement of their cost competitiveness would have a long term impact » ...

Insecurities: How a Financial Innovation Led to the Great Recession

... regulatory changes which brought a whole new group of consumers into the market for household loans. The Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) are two US government sponsored enterprises (GSEs) which have a distinct impact on ...

... regulatory changes which brought a whole new group of consumers into the market for household loans. The Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) are two US government sponsored enterprises (GSEs) which have a distinct impact on ...

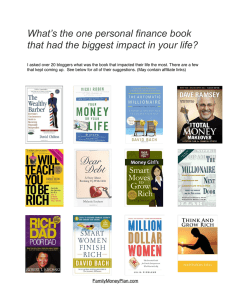

What`s the one personal finance book that had the biggest impact in

... about - retirement savings and what my 401k was, the latte factor and how saving small over time could actually be a big deal. It was an amazing book for young Bola. -Clever Girl Finance Dave Ramsey's The Total Money Makeover. It was the very first personal finance book that I read. Knowing what I k ...

... about - retirement savings and what my 401k was, the latte factor and how saving small over time could actually be a big deal. It was an amazing book for young Bola. -Clever Girl Finance Dave Ramsey's The Total Money Makeover. It was the very first personal finance book that I read. Knowing what I k ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.