chapter summary

... weak recovery plus the tax cuts and federal spending increases all contributed to a growing federal deficit, which topped $400 billion in 2004. But by 2007 the economy added more than 8 million jobs which helped cut the federal deficit by more than 50 percent. The deficit is projected to grow again ...

... weak recovery plus the tax cuts and federal spending increases all contributed to a growing federal deficit, which topped $400 billion in 2004. But by 2007 the economy added more than 8 million jobs which helped cut the federal deficit by more than 50 percent. The deficit is projected to grow again ...

AWM 2011 Second Quarter Newsletter

... As we’ve already men oned, the Fed’s controversial $600 billion bond‐buying program known as Quan ta ve Easing, or QE2, ended on June 30th with mixed opinions about its success. Quan ta ve Easing pumped money into the banking system through the purchase of approximat ...

... As we’ve already men oned, the Fed’s controversial $600 billion bond‐buying program known as Quan ta ve Easing, or QE2, ended on June 30th with mixed opinions about its success. Quan ta ve Easing pumped money into the banking system through the purchase of approximat ...

Caught in a deflation trap

... The new buzz word is deflation. Few things in economics are scarier that the prospect of deflation – a widespread, sustained decline in prices. Deflation is usually associated with the Great Depression of the 1930s and Japan’s more recent slump. Six years ago I wrote a paper along with some of my fo ...

... The new buzz word is deflation. Few things in economics are scarier that the prospect of deflation – a widespread, sustained decline in prices. Deflation is usually associated with the Great Depression of the 1930s and Japan’s more recent slump. Six years ago I wrote a paper along with some of my fo ...

The Great Recession: Lessons from Microeconomic Data

... prices obviously impacts the real economy through the construction sector. However, such real effects could be relatively small unless there is an “accelerator” or feedback effect from the rise in asset prices to the real economy. Several macro models based on collateral and financial frictions post ...

... prices obviously impacts the real economy through the construction sector. However, such real effects could be relatively small unless there is an “accelerator” or feedback effect from the rise in asset prices to the real economy. Several macro models based on collateral and financial frictions post ...

Document

... When levering up, institutions ignore that their fire-sales depress prices for others Inefficient pecuniary externality in incomplete market setting ...

... When levering up, institutions ignore that their fire-sales depress prices for others Inefficient pecuniary externality in incomplete market setting ...

King et al CJE 2012 - Michael Kitson: Economist

... subsequent market nervousness that pushed rates up to unaffordable levels—could, without too much difficulty, be regarded as behaviour reminiscent of that which produced the American subprime real-estate bubble. Further, like the debt resulting from that bubble, the austerity drive following the eur ...

... subsequent market nervousness that pushed rates up to unaffordable levels—could, without too much difficulty, be regarded as behaviour reminiscent of that which produced the American subprime real-estate bubble. Further, like the debt resulting from that bubble, the austerity drive following the eur ...

Chapter 6

... – T-bills – pure discount bonds with original maturity of one year or less – T-notes – coupon debt with original maturity between one and ten years – T-bonds – coupon debt with original maturity greater than ten years • Municipal Securities - debt of state and local governments – Varying degrees of ...

... – T-bills – pure discount bonds with original maturity of one year or less – T-notes – coupon debt with original maturity between one and ten years – T-bonds – coupon debt with original maturity greater than ten years • Municipal Securities - debt of state and local governments – Varying degrees of ...

Financial crisis

... to pay back its sovereign debt, this is called a sovereign default. While devaluation and default could both be voluntary decisions of the government, they are often perceived to be the involuntary results of a change in investor sentiment that leads to a sudden stop in capital inflows or a sudden i ...

... to pay back its sovereign debt, this is called a sovereign default. While devaluation and default could both be voluntary decisions of the government, they are often perceived to be the involuntary results of a change in investor sentiment that leads to a sudden stop in capital inflows or a sudden i ...

Geyser crisis

... lending and borrowing are broadly matched. However, as household mortgage debt is primarily inflation indexed, a weakening ISK will indirectly weaken household balance sheets through rising inflation. Inflationlinked mortgage debt stood at 165% of disposable income at end-2004. ...

... lending and borrowing are broadly matched. However, as household mortgage debt is primarily inflation indexed, a weakening ISK will indirectly weaken household balance sheets through rising inflation. Inflationlinked mortgage debt stood at 165% of disposable income at end-2004. ...

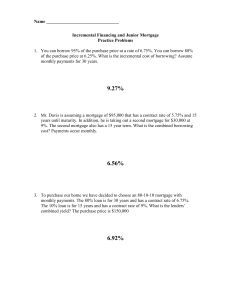

Adjustable Rate Mortgage

... assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize the value of the assumable mortgage? ...

... assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize the value of the assumable mortgage? ...

The Failure of the Euro

... 2010 to finance government borrowing by Greece and other eurozone countries, should be expanded from 400 billion euros to more than a trillion euros. This latter move was meant to provide insurance guarantees that would allow Italy and potentially Spain to access capital markets at reasonable intere ...

... 2010 to finance government borrowing by Greece and other eurozone countries, should be expanded from 400 billion euros to more than a trillion euros. This latter move was meant to provide insurance guarantees that would allow Italy and potentially Spain to access capital markets at reasonable intere ...

AER Better Regulation Rate of Return Factsheet

... historical estimates of the MRP show a long term average of about 6 per cent. We also have regard to another financial model, the dividend growth model, to determine whether we should adopt an estimate above, below or consistent with the historical estimate. This is a symmetric consideration. As at ...

... historical estimates of the MRP show a long term average of about 6 per cent. We also have regard to another financial model, the dividend growth model, to determine whether we should adopt an estimate above, below or consistent with the historical estimate. This is a symmetric consideration. As at ...

Downlaod File - Prince Mohammad Bin Fahd University

... 9.Why have some economists described money during a hyperinflation as a "hot potato" that is quickly passed from one person to another? Money loses its value at an extremely rapid rate in hyperinflation, so you want to hold it for as short a time as possible. Thus money is like a hot potato that is ...

... 9.Why have some economists described money during a hyperinflation as a "hot potato" that is quickly passed from one person to another? Money loses its value at an extremely rapid rate in hyperinflation, so you want to hold it for as short a time as possible. Thus money is like a hot potato that is ...

Slide 1

... justification for the decision to split the new system into two parts of which one is directly linked to the real economy (NDC accounts) and the other one (FDC accounts) is linked to the real economy via financial markets. For a couple of years rates of return in the FDC part of the system were hi ...

... justification for the decision to split the new system into two parts of which one is directly linked to the real economy (NDC accounts) and the other one (FDC accounts) is linked to the real economy via financial markets. For a couple of years rates of return in the FDC part of the system were hi ...

1 - BrainMass

... has remained unaltered since that time. b. Federal bankruptcy law deals only with corporation bankruptcies. Municipal and personal bankruptcy is governed solely by state laws. c. All bankruptcy petitions are filed by creditors seeking to protect their claims on firms in financial distress. Thus, all ...

... has remained unaltered since that time. b. Federal bankruptcy law deals only with corporation bankruptcies. Municipal and personal bankruptcy is governed solely by state laws. c. All bankruptcy petitions are filed by creditors seeking to protect their claims on firms in financial distress. Thus, all ...

Midwest Economic Outlook - University of Illinois at

... low inflation rate over the next two years •A big question remains about consumer spending/savings over the next several years •The consumer does appear to be putting their financial house in order – is this by their choice? ...

... low inflation rate over the next two years •A big question remains about consumer spending/savings over the next several years •The consumer does appear to be putting their financial house in order – is this by their choice? ...

Introduction to Bloomberg

... DES – Provides a detailed (4 page) description of the company and its financials. This includes an overview of the company, dividend information, index membership, ratio analysis, corporate actions, insider trading, institutional ownership, sales and EPS charts. Links to the financial statements are ...

... DES – Provides a detailed (4 page) description of the company and its financials. This includes an overview of the company, dividend information, index membership, ratio analysis, corporate actions, insider trading, institutional ownership, sales and EPS charts. Links to the financial statements are ...

Buying or Leasing a Car and Your Credit Score

... Q. Does buying or leasing a car have equal effect on your credit report? I need a new car but I'm also casually house shopping. Thinking the need for a car will increase well before I purchase a home I was wondering if there's any advantage to either strategy in this scenario. -- Shopper A. It's sma ...

... Q. Does buying or leasing a car have equal effect on your credit report? I need a new car but I'm also casually house shopping. Thinking the need for a car will increase well before I purchase a home I was wondering if there's any advantage to either strategy in this scenario. -- Shopper A. It's sma ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.