IFRS Week Financial Instruments Presentation and

... a non-derivative for which the entity is or may be obliged to deliver a variable number of the entity’s own equity instruments; or a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity in ...

... a non-derivative for which the entity is or may be obliged to deliver a variable number of the entity’s own equity instruments; or a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity in ...

Italy: 2016 Article IV Consultation

... pre-crisis (2007) output peak until the mid-2020s, implying nearly two lost decades, a growing income gap with euro zone partners, and a protracted period of balance sheet vulnerability. The challenge is to turn around productivity performance, facilitate faster bank balance sheet cleanup, and lower ...

... pre-crisis (2007) output peak until the mid-2020s, implying nearly two lost decades, a growing income gap with euro zone partners, and a protracted period of balance sheet vulnerability. The challenge is to turn around productivity performance, facilitate faster bank balance sheet cleanup, and lower ...

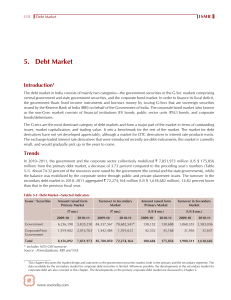

5. Debt Market

... Floating Rate Bonds: Floating rate bonds are securities that do not have a fixed coupon rate. The coupon is re-set at pre-announced intervals (say, every 6 months, or 1 year) by adding a spread over a base rate. In the case of most floating rate bonds issued by the Government of India so far, the base ...

... Floating Rate Bonds: Floating rate bonds are securities that do not have a fixed coupon rate. The coupon is re-set at pre-announced intervals (say, every 6 months, or 1 year) by adding a spread over a base rate. In the case of most floating rate bonds issued by the Government of India so far, the base ...

The Role of the IMF in Debt Restructurings: L I A , Moral Hazard and

... faced by debtor countries, particularly when adverse shocks are positively correlated and persistent, as has often been the experience in developing countries. Moreover, the IMF has shown a systematic tendency to be overoptimistic in its debt sustainability assessments. If sustainability is not reas ...

... faced by debtor countries, particularly when adverse shocks are positively correlated and persistent, as has often been the experience in developing countries. Moreover, the IMF has shown a systematic tendency to be overoptimistic in its debt sustainability assessments. If sustainability is not reas ...

1 chapter activity Is Beginning to recover after the Slowdown in 2012

... recovery in the advanced economies will remain bumpy. World output growth is forecast to reach 3¼ percent in 2013 and 4 percent in 2014 (Table 1.1). In the major advanced economies, activity is expected to gradually accelerate, following a weak start to 2013, with the United States in the lead. In e ...

... recovery in the advanced economies will remain bumpy. World output growth is forecast to reach 3¼ percent in 2013 and 4 percent in 2014 (Table 1.1). In the major advanced economies, activity is expected to gradually accelerate, following a weak start to 2013, with the United States in the lead. In e ...

general bearing corporation

... The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" for forward-looking statements, which are statements other than those of historical fact, including, without limitation, ones identified by the use of the words: "anticipates," "estimates," "believes," "expects," "intends, ...

... The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" for forward-looking statements, which are statements other than those of historical fact, including, without limitation, ones identified by the use of the words: "anticipates," "estimates," "believes," "expects," "intends, ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... domestic product (GDP), receiving approximately 2 percent of GDP in net foreign direct investment (FDI); and since the beginning of the 2000s, for the first time in decades, Brazil has been reducing its external debt. In this environment, one wonders whether this performance is the sign of a new tre ...

... domestic product (GDP), receiving approximately 2 percent of GDP in net foreign direct investment (FDI); and since the beginning of the 2000s, for the first time in decades, Brazil has been reducing its external debt. In this environment, one wonders whether this performance is the sign of a new tre ...

Incorporation of financial ratios into prudential definition of assets

... business operations and thus, modifications do not necessarily indicate borrowers’ deteriorated repayment capacity. For example, receiving working capital financing is crucial for firms to maintain normal operating cycles. In practice, this operation is funded by banks with short-term facilities tha ...

... business operations and thus, modifications do not necessarily indicate borrowers’ deteriorated repayment capacity. For example, receiving working capital financing is crucial for firms to maintain normal operating cycles. In practice, this operation is funded by banks with short-term facilities tha ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... and other financial services to middle market, large corporate and mortgage banking companies, reported a return on average assets of 1.81 percent in the third quarter and 1.76 percent for the first nine months of 1994. These ratios improved from 1.63 percent and 1.54 percent in the same periods in ...

... and other financial services to middle market, large corporate and mortgage banking companies, reported a return on average assets of 1.81 percent in the third quarter and 1.76 percent for the first nine months of 1994. These ratios improved from 1.63 percent and 1.54 percent in the same periods in ...

Liquidity Policies and Systemic Risk

... due to lower distortions. Ratnovski [2009] points out that liquidity requirements can mitigate moral hazard due to public liquidity provision via lender of last resort facilities. Rochet [2008] provides an overview of liquidity regulation within the context of the banking literature. The main diffe ...

... due to lower distortions. Ratnovski [2009] points out that liquidity requirements can mitigate moral hazard due to public liquidity provision via lender of last resort facilities. Rochet [2008] provides an overview of liquidity regulation within the context of the banking literature. The main diffe ...

Presentación de PowerPoint

... The risk factors and other key factors that Abengoa has indicated in its past and future filings and reports, including those with the U.S. Securities and Exchange Commission, could adversely affect Abengoa’ s business and financial performance. Abengoa undertakes no obligation to update or revise a ...

... The risk factors and other key factors that Abengoa has indicated in its past and future filings and reports, including those with the U.S. Securities and Exchange Commission, could adversely affect Abengoa’ s business and financial performance. Abengoa undertakes no obligation to update or revise a ...

The Myth of Home Ownership and Why Home Ownership is Not

... home ownership.' 8 Even before the recent mortgage crisis forced the government to increase its involvement in the housing market, the United States had an active role in the housing market and helped facilitate the transition from renting to home ownership. The Federal Housing Administration (FHA) ...

... home ownership.' 8 Even before the recent mortgage crisis forced the government to increase its involvement in the housing market, the United States had an active role in the housing market and helped facilitate the transition from renting to home ownership. The Federal Housing Administration (FHA) ...

Monetary Policy Coordination, Monetary Integration and Other Essays

... observers, the project of economic integration in the region had been initiated several times before the signing of the Asuncion Treaty in 1991. Marked by a history of alternating rivalries and alliances, Argentina and Brazil started to discuss regional economic integration in the late 1960s with t ...

... observers, the project of economic integration in the region had been initiated several times before the signing of the Asuncion Treaty in 1991. Marked by a history of alternating rivalries and alliances, Argentina and Brazil started to discuss regional economic integration in the late 1960s with t ...

PDF 2.55 MB - KNOT Offshore Partners LP

... Nevertheless, new factors emerge from time to time, and it is not possible for KNOP to predict all of these factors. Further, KNOP cannot assess the impact of each such factor on its business or the extent to which any factor, or combination of factors, may cause actual results to be materially diff ...

... Nevertheless, new factors emerge from time to time, and it is not possible for KNOP to predict all of these factors. Further, KNOP cannot assess the impact of each such factor on its business or the extent to which any factor, or combination of factors, may cause actual results to be materially diff ...

Convergence of Government Bond Yields in the

... Since the early 1980s, long-term government bond yields in the euro zone have declined, in line with those in other industrialized countries. In fact, by the time the euro currency was introduced in 1999, long-term government bond yields across the euro zone had largely converged to that of Germany ...

... Since the early 1980s, long-term government bond yields in the euro zone have declined, in line with those in other industrialized countries. In fact, by the time the euro currency was introduced in 1999, long-term government bond yields across the euro zone had largely converged to that of Germany ...

Optimal sovereign debt policy with private trading: Explaining

... feature was pointed out by Gourinchas and Jeanne (2007). We do not intend to provide full list of the literature here, but we should remark that most studies try to explain this allocation puzzle feature focusing on private agent’s saving and investment behavior. For example, low domestic financial ...

... feature was pointed out by Gourinchas and Jeanne (2007). We do not intend to provide full list of the literature here, but we should remark that most studies try to explain this allocation puzzle feature focusing on private agent’s saving and investment behavior. For example, low domestic financial ...

Tilburg University The Life Cycle of the Firm with

... D f are the state variables. The control variables are investment I , newly issued equity Q and newly issued debt S f . At most, a share α of the investment can be financed with newly issued debt, where α is the maximum debt-capital ratio. The same condition holds during the initial period. Debt can ...

... D f are the state variables. The control variables are investment I , newly issued equity Q and newly issued debt S f . At most, a share α of the investment can be financed with newly issued debt, where α is the maximum debt-capital ratio. The same condition holds during the initial period. Debt can ...

GMO: Six Impossible Things Before Breakfast

... One thing to note that truly is different this time is that past periods of financial repression have generally been achieved with high(ish) inflation. This is the first time we have seen low inflation and the use of negative nominal interest rates in the case of some central banks. As a quick asid ...

... One thing to note that truly is different this time is that past periods of financial repression have generally been achieved with high(ish) inflation. This is the first time we have seen low inflation and the use of negative nominal interest rates in the case of some central banks. As a quick asid ...

Francesco Caprioli Optimal Fiscal Policy, Limited Commitment and Learning

... Consider a setup in which a small open economy, which we call the home country, can trade assets with the rest of the world. The government of the home country has to collect revenues optimally in order to finance an exogenous stream of public expenditure, while the rest of the world is subject to n ...

... Consider a setup in which a small open economy, which we call the home country, can trade assets with the rest of the world. The government of the home country has to collect revenues optimally in order to finance an exogenous stream of public expenditure, while the rest of the world is subject to n ...

Capital Flows to Central and Eastern Europe Philip R. Lane

... substantial recourse to foreign capital, two important issues arise. First, as the burden of investment income and principal repayments increases over time, borrowing countries need to ensure that trade surpluses allow the external position to stabilize or decline, relative to the size of the econom ...

... substantial recourse to foreign capital, two important issues arise. First, as the burden of investment income and principal repayments increases over time, borrowing countries need to ensure that trade surpluses allow the external position to stabilize or decline, relative to the size of the econom ...

Delay in the Expansion from 2.5G to 3G Wireless Networks

... case, criticizing KPMG of helping the firm avoiding paying “hundreds of millions of dollars” is state taxes. On top of that, the report offered new insights into WorldCom’s questionable relationships with accounting firms, e.g., Anderson and KPMG Company announced it expected revenues for 2004 to de ...

... case, criticizing KPMG of helping the firm avoiding paying “hundreds of millions of dollars” is state taxes. On top of that, the report offered new insights into WorldCom’s questionable relationships with accounting firms, e.g., Anderson and KPMG Company announced it expected revenues for 2004 to de ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.