What is Systemic Risk?

... Lenders were scared when loan defaults began to rise from 2007 on: Securitized mortgages the most “toxic” ...

... Lenders were scared when loan defaults began to rise from 2007 on: Securitized mortgages the most “toxic” ...

The IMF, the World Bank and Debt

... We have to work on Europe European campaigners for economic justice have to be working on the European debt crisis: • The impacts are huge • We are irrelevant to our fellow citizens if we don’t • The crisis, and response to it, are a central part of the financial system which has dominated the worl ...

... We have to work on Europe European campaigners for economic justice have to be working on the European debt crisis: • The impacts are huge • We are irrelevant to our fellow citizens if we don’t • The crisis, and response to it, are a central part of the financial system which has dominated the worl ...

FRBSF L CONOMIC

... analysis of U.S. counties shows that this weakness is closely related to elevated levels of household debt accumulated during the housing boom. Counties where household debt grew moderately from 2002 to 2006 have seen a moderation of employment losses and a robust recovery in durable consumption and ...

... analysis of U.S. counties shows that this weakness is closely related to elevated levels of household debt accumulated during the housing boom. Counties where household debt grew moderately from 2002 to 2006 have seen a moderation of employment losses and a robust recovery in durable consumption and ...

Australia in Hock?

... greater reliance than most on foreign saving. Indeed, because private saving in Australia is relatively low and difficult to turn around, we need an even larger buffer from public sector saving. I will return to this point later. But first, a look at the household sector. Household debt In aggregate ...

... greater reliance than most on foreign saving. Indeed, because private saving in Australia is relatively low and difficult to turn around, we need an even larger buffer from public sector saving. I will return to this point later. But first, a look at the household sector. Household debt In aggregate ...

ECON366 - KONSTANTINOS KANELLOPOULOS

... be 10 percent, while with the aggressive capital structure its debt cost will be 12 percent. The firm will have $400,000 in total assets, it will face a 40 percent marginal tax rate, and the book value of equity per share under either scenario is $10.00 per share. What is the difference between the ...

... be 10 percent, while with the aggressive capital structure its debt cost will be 12 percent. The firm will have $400,000 in total assets, it will face a 40 percent marginal tax rate, and the book value of equity per share under either scenario is $10.00 per share. What is the difference between the ...

25 KB - National Homelessness Advice Service

... numbers of households have already been in long term forbearance e.g. 12 months or more and there is an expectation by the regulator (the Financial Conduct Authority) that the lender should not allow households to accrue unsustainable arrears and household debt. As property values increase in a numb ...

... numbers of households have already been in long term forbearance e.g. 12 months or more and there is an expectation by the regulator (the Financial Conduct Authority) that the lender should not allow households to accrue unsustainable arrears and household debt. As property values increase in a numb ...

Downlaod File

... through its operations. The retained earnings are assumed to be the equity of the shareholders that have been reinvested in the company rather than paid out through dividends. The sources of capital to pay for short-term assets: (1) spontaneous are liabilities that result from the purchasing of good ...

... through its operations. The retained earnings are assumed to be the equity of the shareholders that have been reinvested in the company rather than paid out through dividends. The sources of capital to pay for short-term assets: (1) spontaneous are liabilities that result from the purchasing of good ...

Grattan Institute submission - Rate of return guidelines issues paper

... concluded that the monopoly electricity distribution businesses have been making unduly high profits, given the relatively low risks they face. In our view, the risk/return balance is central to the question of rate of return for these businesses. Whilst we did identify other major issues that need ...

... concluded that the monopoly electricity distribution businesses have been making unduly high profits, given the relatively low risks they face. In our view, the risk/return balance is central to the question of rate of return for these businesses. Whilst we did identify other major issues that need ...

Week 1 Discussion Assignment Problem Sets

... 4-1 (Days Sales Outstanding) and 4.2 (Debt Ratio) on page 147 of your course textbook. 4-1: Greene Sisters has a DSO of 20 days. The company’s average daily sales are $ 20,000. What is the level of its accounts receivable? Assume there are 365 days in a year. 4.2: Vigo Vacations has an equity multip ...

... 4-1 (Days Sales Outstanding) and 4.2 (Debt Ratio) on page 147 of your course textbook. 4-1: Greene Sisters has a DSO of 20 days. The company’s average daily sales are $ 20,000. What is the level of its accounts receivable? Assume there are 365 days in a year. 4.2: Vigo Vacations has an equity multip ...

RAMS Family Law guidelines

... involved in Family Law Part A - For parties where the court has made an order on the lender Guidelines for parties involved in family law proceedings where the court has made an order on the bank. 1. In the course of a family court proceeding, the court may make an order requiring the lender to reli ...

... involved in Family Law Part A - For parties where the court has made an order on the lender Guidelines for parties involved in family law proceedings where the court has made an order on the bank. 1. In the course of a family court proceeding, the court may make an order requiring the lender to reli ...

commercial debt finance for district energy

... n Senior debt will not compete with PWLB on price or tenor n If project is de-risked it can get close n If used it will increase project returns and allow PWLB to be used for ‘core’ services ...

... n Senior debt will not compete with PWLB on price or tenor n If project is de-risked it can get close n If used it will increase project returns and allow PWLB to be used for ‘core’ services ...

Analyzing Debt Ratios Defining the Ratios

... This ratio tells us that while McDonald’s uses a lot of long-term debt compared to equity offerings, its use of debt in relation to all outstanding financing is much more reasonable. Finally, we look at times interest earned (the interest coverage ratio). Again, Starbucks has a much healthier and im ...

... This ratio tells us that while McDonald’s uses a lot of long-term debt compared to equity offerings, its use of debt in relation to all outstanding financing is much more reasonable. Finally, we look at times interest earned (the interest coverage ratio). Again, Starbucks has a much healthier and im ...

quantitative easing - Real

... how U.S. officials characterize it) understandably are seeking to protect themselves. Ultimately, the only way this serious way to do this is to erect a wall of capital controls to block foreign speculators from deranging currency and financial markets. Changing the international financial system is ...

... how U.S. officials characterize it) understandably are seeking to protect themselves. Ultimately, the only way this serious way to do this is to erect a wall of capital controls to block foreign speculators from deranging currency and financial markets. Changing the international financial system is ...

Financing a Small Business 4.00 Explain the fundamentals of

... Local and municipal governments: Sometimes make small loans of $10,000 or less. ...

... Local and municipal governments: Sometimes make small loans of $10,000 or less. ...

Annual Report 2013 - Debt Managers Standards Association

... ensure that proper rules are established with effect from 1 April. The coming year of 2014 will be a challenging one for the sector and we remain confident that the existence of our Code and the adherence to it will stand our members in good stead during the introduction of the new regulatory regime ...

... ensure that proper rules are established with effect from 1 April. The coming year of 2014 will be a challenging one for the sector and we remain confident that the existence of our Code and the adherence to it will stand our members in good stead during the introduction of the new regulatory regime ...

The New Fragile

... overcome the crisis derived from the model that led them into the crisis in the first place. As the policies have failed to achieve the desired results, central bankers have questioned policy doses rather than their model and decided to increase the doses rather than dump their model. ...

... overcome the crisis derived from the model that led them into the crisis in the first place. As the policies have failed to achieve the desired results, central bankers have questioned policy doses rather than their model and decided to increase the doses rather than dump their model. ...

PDF

... by the number of males and females in the primary and secondary labor markets. On average, households had about 0.7 members in the primary labor market and 0.28 members in the secondary labor market. More males were employed than females. The average household had 1.9 literate members and 2.4 illite ...

... by the number of males and females in the primary and secondary labor markets. On average, households had about 0.7 members in the primary labor market and 0.28 members in the secondary labor market. More males were employed than females. The average household had 1.9 literate members and 2.4 illite ...

Third Quarter Review Don`t Fight the Fed. Marty Zweig

... member country by offering much lower rates than would be otherwise available in the open market. OMTs will be financed through a new bailout fund called the European Stability Mechanism. Prior to this, both Spain and Italy have had to finance their ten-year government bonds above 7%, an unsustainab ...

... member country by offering much lower rates than would be otherwise available in the open market. OMTs will be financed through a new bailout fund called the European Stability Mechanism. Prior to this, both Spain and Italy have had to finance their ten-year government bonds above 7%, an unsustainab ...

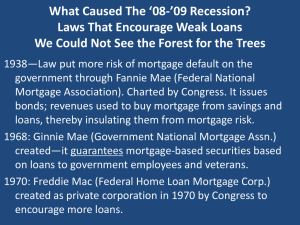

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.