Bernanke, Fed Surprise Markets; QE3 to Continue

... closed at all time highs on September 18th. Equities have since retreated, possibly from concerns of a government shutdown. The Fed cited the potential tightening of financial conditions from rising rates could slow growth as a reason to continue the pace of bond purchases and stated it will await m ...

... closed at all time highs on September 18th. Equities have since retreated, possibly from concerns of a government shutdown. The Fed cited the potential tightening of financial conditions from rising rates could slow growth as a reason to continue the pace of bond purchases and stated it will await m ...

Businessworld - STAY AHEAD EVERY WEEK

... The surge in debt restructuring began in mid-2002 with the introduction of the corporate debt restructuring mechanism. Under this, in cases where consortium lending existed (this covers most large loans in India), if 75% of lenders by value agreed to a restructuring of debt, the plan could go ahead. ...

... The surge in debt restructuring began in mid-2002 with the introduction of the corporate debt restructuring mechanism. Under this, in cases where consortium lending existed (this covers most large loans in India), if 75% of lenders by value agreed to a restructuring of debt, the plan could go ahead. ...

Greece debt - WESTDALE WORLD ISSUES

... How the debt crisis effects Canada Why Canadians should be concerned about a Euro collapse (source: CBC Dec 1, 2011) •Matthias Kipping, professor of policy and chair in business history at Schulich School of Business, said the euro collapse would mean countries would become more protectionist, whic ...

... How the debt crisis effects Canada Why Canadians should be concerned about a Euro collapse (source: CBC Dec 1, 2011) •Matthias Kipping, professor of policy and chair in business history at Schulich School of Business, said the euro collapse would mean countries would become more protectionist, whic ...

The current financial crisis began in the United States` subprime

... a bubble in unit labor costs, particularly in Latvia and Spain explain. One way to reduce these costs and regain competitiveness would be to devalue their currency, but their ability to do this is severely restricted because of either their large stock of FX-denominated debt (X, Y, Z), they cannot d ...

... a bubble in unit labor costs, particularly in Latvia and Spain explain. One way to reduce these costs and regain competitiveness would be to devalue their currency, but their ability to do this is severely restricted because of either their large stock of FX-denominated debt (X, Y, Z), they cannot d ...

Slide 1

... A good guess is that the monetary and fiscal response we have seen so far have been sufficient to halt the economic free-fall, so that the steep rate of decline will level off in the 2nd half of this year. It won’t be enough to return us rapidly to full employment and potential output. Given the pat ...

... A good guess is that the monetary and fiscal response we have seen so far have been sufficient to halt the economic free-fall, so that the steep rate of decline will level off in the 2nd half of this year. It won’t be enough to return us rapidly to full employment and potential output. Given the pat ...

choices for financing fiscal and external deficits

... will double within 24 years. Although this period is still too long but higher growth rates will also result in pushing domestic savings rate higher, which, in turn, will further reduce this period of 24 years. So it becomes clear that mobilizing foreign resources is an activity which a poor country ...

... will double within 24 years. Although this period is still too long but higher growth rates will also result in pushing domestic savings rate higher, which, in turn, will further reduce this period of 24 years. So it becomes clear that mobilizing foreign resources is an activity which a poor country ...

THE CASE AGAINST INTEREST: IS IT COMPELLING?

... become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches of collateral, which ensures the repayment of their loans - they do not evaluate the risks carefully - tend to extend credit excessively. This promotes: ...

... become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches of collateral, which ensures the repayment of their loans - they do not evaluate the risks carefully - tend to extend credit excessively. This promotes: ...

Economic stability loss

... and individuals have borrowed in Euros from banks outside Greece. Since those loans are not covered by Greek law, the Greek government cannot change the obligation from Euros to New Drachmas. • The decline in the New Drachma relative to the euro would make it much more expensive for the Greek debtor ...

... and individuals have borrowed in Euros from banks outside Greece. Since those loans are not covered by Greek law, the Greek government cannot change the obligation from Euros to New Drachmas. • The decline in the New Drachma relative to the euro would make it much more expensive for the Greek debtor ...

Bank of England Inflation Report August 2009

... (a) The question asks how households expect unemployment to change over the next twelve months. (b) The question asks how households expect their personal financial situation to change over the next twelve months. ...

... (a) The question asks how households expect unemployment to change over the next twelve months. (b) The question asks how households expect their personal financial situation to change over the next twelve months. ...

Total liabilities and equity

... • Short-term investments decrease to zero—this is because we projected that Van Leer wouldn’t simultaneously borrow short-term and invest shortterm. • Short-term borrowing increases substantially. If this happens in subsequent years, the long-term debt policy (or dividend policy) may need to be revi ...

... • Short-term investments decrease to zero—this is because we projected that Van Leer wouldn’t simultaneously borrow short-term and invest shortterm. • Short-term borrowing increases substantially. If this happens in subsequent years, the long-term debt policy (or dividend policy) may need to be revi ...

Notification of countercyclical buffer in Denmark

... When CRD IV/CRR was implemented in Denmark a possibility was introduced whereby the countercyclical buffer could be introduced already from 2015 (up to 0.5 percent). In line with Article 160(6) of CRD IV, Denmark is hereby notifying you of this possibility. Furthermore, Denmark recognizes the rate o ...

... When CRD IV/CRR was implemented in Denmark a possibility was introduced whereby the countercyclical buffer could be introduced already from 2015 (up to 0.5 percent). In line with Article 160(6) of CRD IV, Denmark is hereby notifying you of this possibility. Furthermore, Denmark recognizes the rate o ...

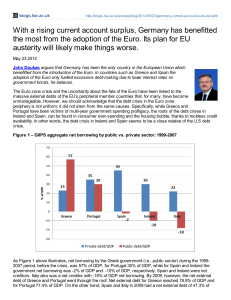

With a rising current account surplus, Germany has benefitted the

... GDP and 42.9% of GDP, respectively, similar to that of 48.5% of GDP for Germany. What is interesting here to note is that the public sector net external debt of countries like Spain and Italy, skyrocketed in a very short span of time (2007-2009). Similarly, the Irish public sector external debt dur ...

... GDP and 42.9% of GDP, respectively, similar to that of 48.5% of GDP for Germany. What is interesting here to note is that the public sector net external debt of countries like Spain and Italy, skyrocketed in a very short span of time (2007-2009). Similarly, the Irish public sector external debt dur ...

Roubini Global Economics - Italy Should Restructure Its Public Debt

... market has sharply fallen in the past few years as real rates and sovereign spreads have risen. Furthermore, most of the remaining 35% or €3 trillion of financial assets is invested in government bonds directly, indirectly through bank deposits, or through funds and securities. Levying an asset tax ...

... market has sharply fallen in the past few years as real rates and sovereign spreads have risen. Furthermore, most of the remaining 35% or €3 trillion of financial assets is invested in government bonds directly, indirectly through bank deposits, or through funds and securities. Levying an asset tax ...

MODEL ANSWERS TO FINANCIAL ECONOMICS (IOBM

... only one salary higher than the mean c) It would not be logical to conclude that the banking sector in TZ will be able to attract the financial economist from Malawi with her current salary of K800,000. The Malawi salary of K800,000 exceeds any of the salaries paid to TZ managers, meaning that the m ...

... only one salary higher than the mean c) It would not be logical to conclude that the banking sector in TZ will be able to attract the financial economist from Malawi with her current salary of K800,000. The Malawi salary of K800,000 exceeds any of the salaries paid to TZ managers, meaning that the m ...

Why Are Washington Politicians Fighting?

... rather than the $17 trillion we now have. Unfortunately, it is impossible to know the consequences of economic policies that were not taken. If Washington raised taxes by $1 trillion per year, even if only on wealthy people, the US economy would be radically different today. Since tax bills can only ...

... rather than the $17 trillion we now have. Unfortunately, it is impossible to know the consequences of economic policies that were not taken. If Washington raised taxes by $1 trillion per year, even if only on wealthy people, the US economy would be radically different today. Since tax bills can only ...

Presentation to the CFA Hawaii Seventh Annual Economic Forecast Dinner

... funds rate, the rate banks pay to borrow from each other on overnight loans, close to zero. It’s been there ever since. Given the weakness in the economy, standard monetary policy guidelines indicate that the federal funds rate should have gone deep into negative territory. But, of course, it’s not ...

... funds rate, the rate banks pay to borrow from each other on overnight loans, close to zero. It’s been there ever since. Given the weakness in the economy, standard monetary policy guidelines indicate that the federal funds rate should have gone deep into negative territory. But, of course, it’s not ...

How Europe cancelled Germany`s debt

... However, German competitiveness and undervaluation of the Deutschmark continued following the period of debt repayment, and was ‘locked-in’ with other Eurozone countries with the creation of the Euro in the 1990s. Whilst in the 1950s and 1960s West Germany’s trade surpluses enabled the debt to be pa ...

... However, German competitiveness and undervaluation of the Deutschmark continued following the period of debt repayment, and was ‘locked-in’ with other Eurozone countries with the creation of the Euro in the 1990s. Whilst in the 1950s and 1960s West Germany’s trade surpluses enabled the debt to be pa ...

Yannis Stournaras: Entrepreneurship, NPL resolution policies and

... negative net worth, while the tax treatment of impairment losses and loan write-offs is in the final stages of being legislated. On the remaining steps, it is important that bank managers and employees acting in good faith in managing non-performing loans should be protected from criminal prosecutio ...

... negative net worth, while the tax treatment of impairment losses and loan write-offs is in the final stages of being legislated. On the remaining steps, it is important that bank managers and employees acting in good faith in managing non-performing loans should be protected from criminal prosecutio ...

Household debt

Household debt is defined as the amount of money that all adults in the household owe financial institutions. It includes consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.