Beijing Enterprises Water Group Limited Public Offering of 2016

... public offering in 2016 corporate bonds (first phase), the current bond is classified into two types,Type I is a five-year fixed rate bond with the option for the issuer to adjust the coupon rate and for the investors to sell the bond back at the end of year 3; Type II is a seven-year fixed rate bon ...

... public offering in 2016 corporate bonds (first phase), the current bond is classified into two types,Type I is a five-year fixed rate bond with the option for the issuer to adjust the coupon rate and for the investors to sell the bond back at the end of year 3; Type II is a seven-year fixed rate bon ...

Chapter 11 Problem 2 (Page 309) If an investor is in a 30 percent

... What return would be necessary to induce an investor to buy a two-year security? What return would be necessary to induce an investor to buy a three-year security? What return would be necessary to induce an investor to buy a four-year security? Diagram the term structure of interest rates for years ...

... What return would be necessary to induce an investor to buy a two-year security? What return would be necessary to induce an investor to buy a three-year security? What return would be necessary to induce an investor to buy a four-year security? Diagram the term structure of interest rates for years ...

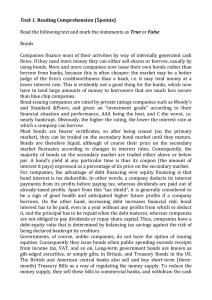

English Exam

... flows. If they need more money they can either sell shares or borrow, usually by using bonds. More and more companies now issue their own bonds rather than borrow from banks, because this is often cheaper: the market may be a better judge of the firm’s creditworthiness than a bank, i.e. it may lend ...

... flows. If they need more money they can either sell shares or borrow, usually by using bonds. More and more companies now issue their own bonds rather than borrow from banks, because this is often cheaper: the market may be a better judge of the firm’s creditworthiness than a bank, i.e. it may lend ...

derivatives

... Many of the details of these agreements are minor, such as an agreement to combine offsetting payments due on the same day into a single net payment. More significant from the perspective of risk are agreements as to the circumstances under which all the transactions will be terminated, regardless o ...

... Many of the details of these agreements are minor, such as an agreement to combine offsetting payments due on the same day into a single net payment. More significant from the perspective of risk are agreements as to the circumstances under which all the transactions will be terminated, regardless o ...

Economics 434 Financial Markets - SHANTI Pages

... – Pretty often (slightly more than 1/5 of the time) – Get a C rating for the second tranche (Security 2) ...

... – Pretty often (slightly more than 1/5 of the time) – Get a C rating for the second tranche (Security 2) ...

Advanced Derivatives: swaps beyond plain vanilla Structured notes

... S&P 500 total return x Notional Principal Payment details on next slide ...

... S&P 500 total return x Notional Principal Payment details on next slide ...

Derivatives - MyCourses

... quantity of the underlying asset; they are standardized to facilitate trading on a futures exchange. Some futures contracts may call for physical delivery of the asset, while others are settled in cash. FORWARD CONTRACT: A cash market transaction in which a seller agrees to deliver a specific cash c ...

... quantity of the underlying asset; they are standardized to facilitate trading on a futures exchange. Some futures contracts may call for physical delivery of the asset, while others are settled in cash. FORWARD CONTRACT: A cash market transaction in which a seller agrees to deliver a specific cash c ...

MATH2510 MATH2510 This paper consists of 3 printed Only

... The yield curve is flat; the continuously compounded interest rate is is 5%. What is the arbitrage-free price of a 6-month forward contract on the bond? B2. How would the answer to B1 change if the yield curve were not flat, but rather you were given zero-coupon bonds prices Pt (in particular the va ...

... The yield curve is flat; the continuously compounded interest rate is is 5%. What is the arbitrage-free price of a 6-month forward contract on the bond? B2. How would the answer to B1 change if the yield curve were not flat, but rather you were given zero-coupon bonds prices Pt (in particular the va ...

15 Mosec

... between 10% to 14% of their discounted cash flows. – FLDG is utilized in between if cash flows are insufficient to cover coupon payments. – FLDG is used at the legal final maturity (Nov 15) to pay off any principal outstanding on A1. • Each FLDG is utilized in proportion to the originators default a ...

... between 10% to 14% of their discounted cash flows. – FLDG is utilized in between if cash flows are insufficient to cover coupon payments. – FLDG is used at the legal final maturity (Nov 15) to pay off any principal outstanding on A1. • Each FLDG is utilized in proportion to the originators default a ...

fixed income strategies for a rising interest rate environment

... Opinions expressed herein are those of the featured participant, U.S. Trust, and may differ from those of Bank of America Corporation and its affiliates. The information presented in this video is for discussion purposes only and is not intended to serve as a recommendation or solicitation for the p ...

... Opinions expressed herein are those of the featured participant, U.S. Trust, and may differ from those of Bank of America Corporation and its affiliates. The information presented in this video is for discussion purposes only and is not intended to serve as a recommendation or solicitation for the p ...

what would you do with a million dollars?

... Revenue bonds may be tied to an issuer’s revenue stream. They have high credit quality, low default ...

... Revenue bonds may be tied to an issuer’s revenue stream. They have high credit quality, low default ...

Financial assets

... especially subprime mortgage borrowers are not able to make payments, investors don’t get their money, values of CDOs decrease substantially. The value decrease is write-down and counted as loss in the income statement. For example, investment bank A, equity: $10 mil, borrow $90 mil. Invest all $100 ...

... especially subprime mortgage borrowers are not able to make payments, investors don’t get their money, values of CDOs decrease substantially. The value decrease is write-down and counted as loss in the income statement. For example, investment bank A, equity: $10 mil, borrow $90 mil. Invest all $100 ...

Supplemental Instruction Finance 301: Porter 1o/22/08 A bond that

... PV=-1000 FV= 1090 (what it is worth with the 9% call premium) CPT I/Y= 15.03% 7. What is current yield? a. The annual interest payment on a bond divided by the bonds current price. b. Annual interest/PRICE 8. A bond has a par value of $1000, 10 years to maturity, a 7% coupon and it sells for $985. W ...

... PV=-1000 FV= 1090 (what it is worth with the 9% call premium) CPT I/Y= 15.03% 7. What is current yield? a. The annual interest payment on a bond divided by the bonds current price. b. Annual interest/PRICE 8. A bond has a par value of $1000, 10 years to maturity, a 7% coupon and it sells for $985. W ...

Financial assets

... especially subprime mortgage borrowers are not able to make payments, investors don’t get their money, values of CDOs decrease substantially. The value decrease is write-down and counted as loss in the income statement. For example, investment bank A, equity: $10 mil, borrow $90 mil. Invest all $100 ...

... especially subprime mortgage borrowers are not able to make payments, investors don’t get their money, values of CDOs decrease substantially. The value decrease is write-down and counted as loss in the income statement. For example, investment bank A, equity: $10 mil, borrow $90 mil. Invest all $100 ...

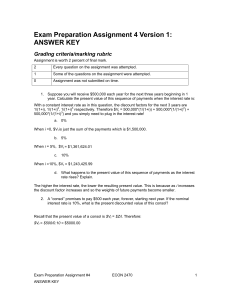

Exam Preparation Assignment 4 Version 1: ANSWER KEY

... 6. Suppose the Bank of Canada implements a contractionary monetary policy that is at least partially unexpected. Explain what effect this will have on stock prices. This contractionary monetary policy will cause the interest rate to rise and output to fall. The higher interest rate will reduce the p ...

... 6. Suppose the Bank of Canada implements a contractionary monetary policy that is at least partially unexpected. Explain what effect this will have on stock prices. This contractionary monetary policy will cause the interest rate to rise and output to fall. The higher interest rate will reduce the p ...

Term Structure

... • Allows the firm to repurchase (Call) the bond at a predetermined price (the call price) prior to its maturity – The call premium is the difference between the call price and the par value of the debt – Call premium generally starts at par plus one year’s coupon and declines to zero near maturity – ...

... • Allows the firm to repurchase (Call) the bond at a predetermined price (the call price) prior to its maturity – The call premium is the difference between the call price and the par value of the debt – Call premium generally starts at par plus one year’s coupon and declines to zero near maturity – ...

MBS Note

... • Is MBS purely rent-seeking? • How is value created? – Diversification – Risk-matching • risk-aversion of investors are compensated ...

... • Is MBS purely rent-seeking? • How is value created? – Diversification – Risk-matching • risk-aversion of investors are compensated ...

Sample Exercises Chapter 11

... million plant. Compare bond versus stock financing for: a) Issuance of 200,000 shares of common stock at the market price of $10 per share. b) Issuance of $2 million, 8% bonds at par ...

... million plant. Compare bond versus stock financing for: a) Issuance of 200,000 shares of common stock at the market price of $10 per share. b) Issuance of $2 million, 8% bonds at par ...

questions in real estate finance

... Cash flows are made up of various tranches and residual class Any mortgage prepayments are passed to bondholders thus there is no sinking fund This means that the CMO issuer faces no interest rate or reinvestment risk Yield is higher on longer tranches ...

... Cash flows are made up of various tranches and residual class Any mortgage prepayments are passed to bondholders thus there is no sinking fund This means that the CMO issuer faces no interest rate or reinvestment risk Yield is higher on longer tranches ...

Chapter 6

... – T-notes – coupon debt with original maturity between one and ten years – T-bonds – coupon debt with original maturity greater than ten years • Municipal Securities - debt of state and local governments – Varying degrees of default risk, rated similar to corporate debt – Interest received is tax-ex ...

... – T-notes – coupon debt with original maturity between one and ten years – T-bonds – coupon debt with original maturity greater than ten years • Municipal Securities - debt of state and local governments – Varying degrees of default risk, rated similar to corporate debt – Interest received is tax-ex ...

Econ 161A: Money and Banking Spring 2017: Jenkins Exam 1

... 3. (a) PZB = $99,667.78. (b) PCB = 87,537.79 (c) The rate of return on a coupon bond: ...

... 3. (a) PZB = $99,667.78. (b) PCB = 87,537.79 (c) The rate of return on a coupon bond: ...

Review Questions

... 1) A discount bond has a face value of $200, a market price of $150 and 2 years to maturity. Find the yield. 2) A coupon bond has a face value of $1000, a coupon rate of 5%, a market price of $980 and one year to maturity. Find the yield. 3) A coupon bond has a face value of $1000, a coupon rate of ...

... 1) A discount bond has a face value of $200, a market price of $150 and 2 years to maturity. Find the yield. 2) A coupon bond has a face value of $1000, a coupon rate of 5%, a market price of $980 and one year to maturity. Find the yield. 3) A coupon bond has a face value of $1000, a coupon rate of ...

GSE Credit Risk Transfer Securitizations (CRTs)

... • CRT deals primarily come in 2 series: Structured Agency Credit Risk (STACRs) for Freddie Mac, and Connecticut Avenue Securities (CAS) for Fannie Mae • 23 CRT deals with combined security balances of $12B have been issued since July 2013 • These represent exposure to ~$750B of residential single-fa ...

... • CRT deals primarily come in 2 series: Structured Agency Credit Risk (STACRs) for Freddie Mac, and Connecticut Avenue Securities (CAS) for Fannie Mae • 23 CRT deals with combined security balances of $12B have been issued since July 2013 • These represent exposure to ~$750B of residential single-fa ...

general investment information

... ISSUER AGREES TO REPAY THE BONDHOLDER AT THE MATURITY DATE. (face value) THE COUPON RATE IS THE RATE OF INTEREST THAT THE ISSUER AGREES TO PAY EACH YEAR. (Example : a bond with an 8% coupon and a principal of $1000 will pay annual interest of $ 80 ) WHAT ARE ZERO-COUPON BONDS ? ...

... ISSUER AGREES TO REPAY THE BONDHOLDER AT THE MATURITY DATE. (face value) THE COUPON RATE IS THE RATE OF INTEREST THAT THE ISSUER AGREES TO PAY EACH YEAR. (Example : a bond with an 8% coupon and a principal of $1000 will pay annual interest of $ 80 ) WHAT ARE ZERO-COUPON BONDS ? ...

Investment Strategies and Financial Assets

... •The market is unpredictable therefore the outcome is not certain. •Investors demand a higher return for a higher risk. Investment Objectives – •What is your ultimate goal in investing? •Examples include college, vacation, unemployment, retirement, etc. •Different investments require one to analyze ...

... •The market is unpredictable therefore the outcome is not certain. •Investors demand a higher return for a higher risk. Investment Objectives – •What is your ultimate goal in investing? •Examples include college, vacation, unemployment, retirement, etc. •Different investments require one to analyze ...