Bonds and Their Valuation

... Par value – face amount of the bond, which is paid at maturity (assume $1,000). Coupon interest rate – stated interest rate (generally fixed) paid by the issuer. Multiply by par to get dollar payment of interest. Maturity date – years until the bond must be repaid. Issue date – when the bond was iss ...

... Par value – face amount of the bond, which is paid at maturity (assume $1,000). Coupon interest rate – stated interest rate (generally fixed) paid by the issuer. Multiply by par to get dollar payment of interest. Maturity date – years until the bond must be repaid. Issue date – when the bond was iss ...

Floating Rate Notes-3

... Unknown Coupon Periods: The main future of FRN is that the coupon rate for each coupon payment period is determined with reference to the value of an index at the beginning of each period. At any giving valuation date it is unknown that these rate will be, hence they required to be forecasted base ...

... Unknown Coupon Periods: The main future of FRN is that the coupon rate for each coupon payment period is determined with reference to the value of an index at the beginning of each period. At any giving valuation date it is unknown that these rate will be, hence they required to be forecasted base ...

- Wasatch Advisors

... LIBOR or ICE LIBOR stands for IntercontinentalExchange London Interbank Offered Rate. It is a benchmark interest rate that some of the world’s leading banks charge each other for short-term loans. LIBOR serves as the first step to calculating interest rates on various loans throughout the world. Mor ...

... LIBOR or ICE LIBOR stands for IntercontinentalExchange London Interbank Offered Rate. It is a benchmark interest rate that some of the world’s leading banks charge each other for short-term loans. LIBOR serves as the first step to calculating interest rates on various loans throughout the world. Mor ...

Financial Markets and Valuation

... The price at which the broker wants to sell is too expensive. You shouldn’t buy the bond. NOTE: The result was obvious, because a bond that pays a coupon of 3% when all market interest rates are above 3% must sell below par. Since the broker was asking a price above par, you shouldn’t buy the bond. ...

... The price at which the broker wants to sell is too expensive. You shouldn’t buy the bond. NOTE: The result was obvious, because a bond that pays a coupon of 3% when all market interest rates are above 3% must sell below par. Since the broker was asking a price above par, you shouldn’t buy the bond. ...

FAQ_Sovereign Gold Bonds Scheme

... On the date of maturity, the maturity proceeds will be credited to the bank account as per the details on record. ...

... On the date of maturity, the maturity proceeds will be credited to the bank account as per the details on record. ...

BONDS

... • A d____ instrument issued by governments, corporations and other entities in order to finance projects or activities. A l____ that investors make to the bond’s i______. Term used for the price of a bond on primary market? • F____ value. What is the face value of a bond? • The amount l_____ to the ...

... • A d____ instrument issued by governments, corporations and other entities in order to finance projects or activities. A l____ that investors make to the bond’s i______. Term used for the price of a bond on primary market? • F____ value. What is the face value of a bond? • The amount l_____ to the ...

Disclosure of Model and Assumptions Used to Determine RMBS

... aggregated into mortgage pool-level cash flows. c. Once generated, pool-level cash flows are passed through the capital structure model to calculate the specific security’s principal losses. The model captures the set of rules that determine which bonds get paid principal and interest as mortgages p ...

... aggregated into mortgage pool-level cash flows. c. Once generated, pool-level cash flows are passed through the capital structure model to calculate the specific security’s principal losses. The model captures the set of rules that determine which bonds get paid principal and interest as mortgages p ...

Lorem ipsum dolor sit amet, consetetur sadip-scing

... another number of annual payment dates. The coupon is paid on a proportionate basis on each payment date, ie, the coupon payment on each payment date corresponds to the coupon rate divided by the annual number of payment dates. Coupon payments fall due on the first calendar day of a given month foll ...

... another number of annual payment dates. The coupon is paid on a proportionate basis on each payment date, ie, the coupon payment on each payment date corresponds to the coupon rate divided by the annual number of payment dates. Coupon payments fall due on the first calendar day of a given month foll ...

Mortgage backed securities

... different classes of CMO interests, known as tranches, according to a complicated deal structure. Each tranche may have different principal balances, coupon rates, prepayment risks, and maturity dates (ranging from a few months to twenty years). CMOs are often highly sensitive to changes in interest ...

... different classes of CMO interests, known as tranches, according to a complicated deal structure. Each tranche may have different principal balances, coupon rates, prepayment risks, and maturity dates (ranging from a few months to twenty years). CMOs are often highly sensitive to changes in interest ...

FIN 331 Real Estate

... 3. Why are FHA/VA mortgages of interest to investors? 4. When is a home buyer most like to have to buy mortgage insurance? 5. What makes an Adjustable Rate Mortgage (ARM) risky for the borrower? Attractive to the lender? 6. What are Home Equity Loans? 7. When would it be a good idea to refinance a l ...

... 3. Why are FHA/VA mortgages of interest to investors? 4. When is a home buyer most like to have to buy mortgage insurance? 5. What makes an Adjustable Rate Mortgage (ARM) risky for the borrower? Attractive to the lender? 6. What are Home Equity Loans? 7. When would it be a good idea to refinance a l ...

Covered Bonds in the European Union Reflections on the

... Realkredit Danmark tap issues mortgage covered bonds with the same characteristics as the underlying loans when disbursing or refinancing loans as well as when fixed rate agreements are entered into. Only in specific situations, e.g. at refinancing auctions, Realkredit Danmark will issue en block. ...

... Realkredit Danmark tap issues mortgage covered bonds with the same characteristics as the underlying loans when disbursing or refinancing loans as well as when fixed rate agreements are entered into. Only in specific situations, e.g. at refinancing auctions, Realkredit Danmark will issue en block. ...

Fixed Income Portfolio Management Interest rate sensitivity

... price than off-the-run issues an investor without the need for liquidity may be better off selling on-the-run issues and purchasing off-the-run issues suppose that a fund owns $100M of an on-the-run 7 year T-note, selling at par with a yield of 8%. Suppose also that two 7 year off-the-run issues are ...

... price than off-the-run issues an investor without the need for liquidity may be better off selling on-the-run issues and purchasing off-the-run issues suppose that a fund owns $100M of an on-the-run 7 year T-note, selling at par with a yield of 8%. Suppose also that two 7 year off-the-run issues are ...

Investable Ideas: Generating income with premium bonds

... a 4.50 percent coupon pays interest of $45 a year per $1,000, while a par bond with a 3.50 percent coupon pays interest of $35 per $1,000 over the same period. This is an attractive feature for investors who wish to maximize current income without extending maturities or lowering quality standards. ...

... a 4.50 percent coupon pays interest of $45 a year per $1,000, while a par bond with a 3.50 percent coupon pays interest of $35 per $1,000 over the same period. This is an attractive feature for investors who wish to maximize current income without extending maturities or lowering quality standards. ...

High Yield Bond Prices – Are They Exhausted?

... period, the chart in Exhibit 2 clearly shows that bond prices just recently returned to the price levels of the 2002 through 2006 period. Any maturity or sale of the bond or bond product prior to price recovery would have resulted in a capital loss. Any capital loss can easily wipe out the extra int ...

... period, the chart in Exhibit 2 clearly shows that bond prices just recently returned to the price levels of the 2002 through 2006 period. Any maturity or sale of the bond or bond product prior to price recovery would have resulted in a capital loss. Any capital loss can easily wipe out the extra int ...

Personal Financial Literacy - Warren Hills Regional School District

... homeowner who cannot afford it, then taking possession of the home ...

... homeowner who cannot afford it, then taking possession of the home ...

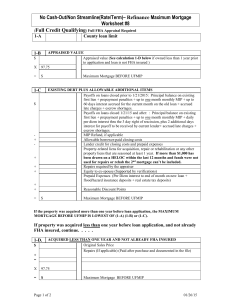

No Cash-Out/Non Streamline(Rate/Term)– Refinance Maximum

... VOM or other documentation is required which includes principal balance, date loan originated, names of original borrowers and type of loan. Other credit verifications are also required (VOE, VOD, etc.) There is no holding period. Acquisition could be a limiting factor. Max CLTV is 97.75. Borrower m ...

... VOM or other documentation is required which includes principal balance, date loan originated, names of original borrowers and type of loan. Other credit verifications are also required (VOE, VOD, etc.) There is no holding period. Acquisition could be a limiting factor. Max CLTV is 97.75. Borrower m ...

The Stock Exchange Corner

... size and liquidity of the issue. In other markets good quality corporate bonds can have an interest rate about one percent more than a government bond (meaning that if the Government is borrowing at 5%, a good corporate issuer may borrow at 6%) Shares – which represent part ownership of a company – ...

... size and liquidity of the issue. In other markets good quality corporate bonds can have an interest rate about one percent more than a government bond (meaning that if the Government is borrowing at 5%, a good corporate issuer may borrow at 6%) Shares – which represent part ownership of a company – ...

Glossary

... The written evidence of debt, bearing a stated rate or stated rates of interest, or stating a formula for determining that rate, and maturing on a date certain, on which date and upon presentation a fixed sum of money plus interest (usually represented by interest coupons attached to the bond) is pa ...

... The written evidence of debt, bearing a stated rate or stated rates of interest, or stating a formula for determining that rate, and maturing on a date certain, on which date and upon presentation a fixed sum of money plus interest (usually represented by interest coupons attached to the bond) is pa ...

More... - Kevin Kavakeb

... There are mixed messages out there about when and if interest rates are going to go up. But just as important is a thorough understanding of fixed-rate mortgages and what it could mean for you and your home investment in the long run. Keep in mind that the cost of interest rates rising by 1% is equi ...

... There are mixed messages out there about when and if interest rates are going to go up. But just as important is a thorough understanding of fixed-rate mortgages and what it could mean for you and your home investment in the long run. Keep in mind that the cost of interest rates rising by 1% is equi ...

Risk And Return - Thunderbird Trust

... Interest rates affect the price of most fixed income securities, especially bonds Interest rates (yields) go up and down, depending on what is happening in the economy; generally the better the economy, the higher the interest rate ...

... Interest rates affect the price of most fixed income securities, especially bonds Interest rates (yields) go up and down, depending on what is happening in the economy; generally the better the economy, the higher the interest rate ...

Mortgage-Related Securities

... guarantors, of mortgage securities--primarily Ginnie Mae, Freddie Mac, and Fannie Mae. These guarantors pool qualified loans together and convert these packages into securities known as mortgage-backed securities, which they then guarantee. As the borrowers whose loans are in the pool make their loa ...

... guarantors, of mortgage securities--primarily Ginnie Mae, Freddie Mac, and Fannie Mae. These guarantors pool qualified loans together and convert these packages into securities known as mortgage-backed securities, which they then guarantee. As the borrowers whose loans are in the pool make their loa ...

Lester Coyle - We look at where the bonds will be in a year

... The curves are not steep enough to compensate for longer dated bonds. The base yield on a double B 1.0 CLO might be 5% or 6%. But because of rolldown, the first year real yield could be 8% or 9%. In European CMBS we are buying paper with a two-year average life that has as much as 10% yield. Why doe ...

... The curves are not steep enough to compensate for longer dated bonds. The base yield on a double B 1.0 CLO might be 5% or 6%. But because of rolldown, the first year real yield could be 8% or 9%. In European CMBS we are buying paper with a two-year average life that has as much as 10% yield. Why doe ...