Auditor Liability and Professional Skepticism: A Look at Lehman

... excessive skepticism (however this is defined), there could as a consequence be over-auditing (defined as gathering and analyzing more evidence than is actually needed to support the auditors’ opinion on the financial statements). Over-auditing would either result in higher billings to clients – who ...

... excessive skepticism (however this is defined), there could as a consequence be over-auditing (defined as gathering and analyzing more evidence than is actually needed to support the auditors’ opinion on the financial statements). Over-auditing would either result in higher billings to clients – who ...

AMEDICA Corp (Form: 8-K, Received: 07/22/2016 17

... Mantyla McReynolds, LLC (“Mantyla”), the Company’s independent registered public accountants, merged with BDO USA, LLP (“BDO”) on July 1, 2016. As a result of this transaction, on July 19, 2016 Amedica Corporation (the “Company”) received notice that instead of Mantyla, BDO would now stand for appoi ...

... Mantyla McReynolds, LLC (“Mantyla”), the Company’s independent registered public accountants, merged with BDO USA, LLP (“BDO”) on July 1, 2016. As a result of this transaction, on July 19, 2016 Amedica Corporation (the “Company”) received notice that instead of Mantyla, BDO would now stand for appoi ...

Sample September / December 2015 answers

... This is the first set of financial statements produced since Dali Co became listed. There is a risk that the new finance director will not be familiar with the requirements specific to listed companies, for example, the company now falls under the scope of IAS 33 Earnings per Share and IFRS 8 Operat ...

... This is the first set of financial statements produced since Dali Co became listed. There is a risk that the new finance director will not be familiar with the requirements specific to listed companies, for example, the company now falls under the scope of IAS 33 Earnings per Share and IFRS 8 Operat ...

Answers

... Obtain a listing of trade payables from the purchase ledger and agree to the general ledger and the financial statements. Reconcile the total of purchase ledger accounts with the purchase ledger control account, and cast the list of balances and the purchase ledger control account. Review the list o ...

... Obtain a listing of trade payables from the purchase ledger and agree to the general ledger and the financial statements. Reconcile the total of purchase ledger accounts with the purchase ledger control account, and cast the list of balances and the purchase ledger control account. Review the list o ...

Developing a Cost Accounting System for First Government Contract

... acceptable cost accounting system for identifying recorded costs for that contract and to maintain supporting cost systems such as timekeeping, indirect costs grouping, and project cost subsidiary ledger. The company’s accounting system was rejected by DCAA during an audit, and the foreign entity re ...

... acceptable cost accounting system for identifying recorded costs for that contract and to maintain supporting cost systems such as timekeeping, indirect costs grouping, and project cost subsidiary ledger. The company’s accounting system was rejected by DCAA during an audit, and the foreign entity re ...

Audit Committee 18 September 2012

... compared to the previous year in terms of reporting requirements, changes are detailed within section 3 of the explanatory foreword. ...

... compared to the previous year in terms of reporting requirements, changes are detailed within section 3 of the explanatory foreword. ...

Don Insley, CPA

... Donald F. Insley, Jr., P.A. Certified Public Accountant After graduating from Salisbury University’s Perdue School of Business with a Bachelor’s Degree in Accounting in 1987, I began working for a regional CPA firm based in Baltimore. During this time period, I worked very hard to obtain my CPA cert ...

... Donald F. Insley, Jr., P.A. Certified Public Accountant After graduating from Salisbury University’s Perdue School of Business with a Bachelor’s Degree in Accounting in 1987, I began working for a regional CPA firm based in Baltimore. During this time period, I worked very hard to obtain my CPA cert ...

Auditor`s Responsibility

... • Management responsible for preventing and detecting fraud • Management can override internal controls and create deceptive accounting • Management representation letters from CEO, CFO, and other appropriate officers (SOX requirements) – Provided access to all known information bearing on fair pres ...

... • Management responsible for preventing and detecting fraud • Management can override internal controls and create deceptive accounting • Management representation letters from CEO, CFO, and other appropriate officers (SOX requirements) – Provided access to all known information bearing on fair pres ...

The Auditor - Whose Agent Is He Anyway

... framework would improve the quality of financial reporting. Failing this framework, Peasnell questions whether the auditing function would be a viable alternative for ‘organising and policing’ corporate disclosure. He describes how there are those who view external auditing as a largely useless lega ...

... framework would improve the quality of financial reporting. Failing this framework, Peasnell questions whether the auditing function would be a viable alternative for ‘organising and policing’ corporate disclosure. He describes how there are those who view external auditing as a largely useless lega ...

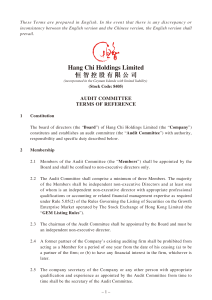

Hang Chi Holdings Limited 恒智控股有限公司

... determine, but in any event not less than twice a year with the external auditor of the Company. 3.2 Unless waived by all Members on notice, the secretary of the Audit Committee shall give seven days prior notice to all Members for any meeting to be convened and circulate the meeting agenda to the ...

... determine, but in any event not less than twice a year with the external auditor of the Company. 3.2 Unless waived by all Members on notice, the secretary of the Audit Committee shall give seven days prior notice to all Members for any meeting to be convened and circulate the meeting agenda to the ...

簡介 - CTP CPA Ltd.

... worked for a garment manufacturer (with over 2000 workers) in Dongguan, China for 3 years. Mr.Tang started his full time practise in 1996. For the past 10 years, Mr. Tang focuses on audit of Hong Kong companies, tax arrangement, handling accounting and tax issues arising from HK-China cross border t ...

... worked for a garment manufacturer (with over 2000 workers) in Dongguan, China for 3 years. Mr.Tang started his full time practise in 1996. For the past 10 years, Mr. Tang focuses on audit of Hong Kong companies, tax arrangement, handling accounting and tax issues arising from HK-China cross border t ...

November 12, 2014 International Ethics Standards Board for

... the proposal, IESBA evaluates whether the current time-on/time-off period of 7/2 remains appropriate to address the treat of long association for key audit partners (KAPs) of a public interest entity (PIE). We agree with the IESBA of the need to propose changes to increase the cooling-off period for ...

... the proposal, IESBA evaluates whether the current time-on/time-off period of 7/2 remains appropriate to address the treat of long association for key audit partners (KAPs) of a public interest entity (PIE). We agree with the IESBA of the need to propose changes to increase the cooling-off period for ...

III Local audit of project accounts

... The auditor must plan and perform the audit in order to provide a professional, unconditional statement of the contract partner's financial statements as well as of the other aspects as defined in Art. I 2 above. 1.3. Independent auditor's statement The auditor undertakes to draw up an independent s ...

... The auditor must plan and perform the audit in order to provide a professional, unconditional statement of the contract partner's financial statements as well as of the other aspects as defined in Art. I 2 above. 1.3. Independent auditor's statement The auditor undertakes to draw up an independent s ...

Major Duties and Responsibilities of Assistant Manager (Audit)

... independent department entrusts to conduct financial and management audit of its Partner Organizations (POs), which are directly implementing PKSF’s programs and projects at field level all over the country. IAD is also responsible for conducting pre-audit of all payments and expenditures of PKSF in ...

... independent department entrusts to conduct financial and management audit of its Partner Organizations (POs), which are directly implementing PKSF’s programs and projects at field level all over the country. IAD is also responsible for conducting pre-audit of all payments and expenditures of PKSF in ...

Part II. Essay Questions (60%)

... c. modify the initial assessments of inhere risk and preliminary judgments about materiality levels. d. determine the nature, timing, and extent of substantive tests for financial statement assertions. 13. Which of the following is not one of the principal CPA firm’s alternatives when issuing a repo ...

... c. modify the initial assessments of inhere risk and preliminary judgments about materiality levels. d. determine the nature, timing, and extent of substantive tests for financial statement assertions. 13. Which of the following is not one of the principal CPA firm’s alternatives when issuing a repo ...