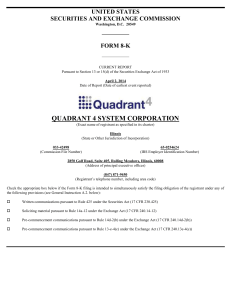

Quadrant 4 System Corp (Form: 8-K, Received: 04/14

... (a) On April 2, 2015, Quadrant 4 System Corporation (the “Company”) received notice from Sassetti, LLC, (“Sassetti”), the Company’s independent certifying accountants, that, effective April 2, 2015, Sassetti had resigned as independent accountant. Effective with this notice, Sassetti is being replac ...

... (a) On April 2, 2015, Quadrant 4 System Corporation (the “Company”) received notice from Sassetti, LLC, (“Sassetti”), the Company’s independent certifying accountants, that, effective April 2, 2015, Sassetti had resigned as independent accountant. Effective with this notice, Sassetti is being replac ...

Empirical evidence on liability caps and earnings management in

... and reached a conclusion that liability caps do not affect audit quality. The study greatly contributed to the European Commission’s recommendation on the matter (European Commission 2008b). It identifies three main reasons why auditors’ liability in Europe should be limited: (1) the poor availabili ...

... and reached a conclusion that liability caps do not affect audit quality. The study greatly contributed to the European Commission’s recommendation on the matter (European Commission 2008b). It identifies three main reasons why auditors’ liability in Europe should be limited: (1) the poor availabili ...

6. Compliance audit of a real estate agent`s trust

... The auditor must include the following in the report: a) the audit period for which the report is made; b) the name and number of each trust account audited; c) the name of the financial institution, the office or branch of the institution where each trust account was kept and the identifying num ...

... The auditor must include the following in the report: a) the audit period for which the report is made; b) the name and number of each trust account audited; c) the name of the financial institution, the office or branch of the institution where each trust account was kept and the identifying num ...

Regulating Corporate Annual Reports in Australia

... by companies as a meansof protecting the interests of the investing public.Companies with their shares listedontheStockExchange mustcomply withtheserulesandfailureto do so mayleadto the removalof securities from the market.Rudimentary listing requirements wereintroduced by the StockExchange before19 ...

... by companies as a meansof protecting the interests of the investing public.Companies with their shares listedontheStockExchange mustcomply withtheserulesandfailureto do so mayleadto the removalof securities from the market.Rudimentary listing requirements wereintroduced by the StockExchange before19 ...

Leading Practice Examples of Audit Committee Reporting

... Sales Reporting • Complete and timely sales reporting (daily) • Appropriate close-out of agent and station sales ...

... Sales Reporting • Complete and timely sales reporting (daily) • Appropriate close-out of agent and station sales ...

Contrapartida

... Según señala el párrafo 3 de la Norma Internacional de Auditoría 240 - The auditor’s responsibilities relating to fraud in an audit of financial statements- “(…) Two types of intentional misstatements are relevant to the auditor – misstatements resulting from fraudulent financial reporting and misst ...

... Según señala el párrafo 3 de la Norma Internacional de Auditoría 240 - The auditor’s responsibilities relating to fraud in an audit of financial statements- “(…) Two types of intentional misstatements are relevant to the auditor – misstatements resulting from fraudulent financial reporting and misst ...

Institute for Accounting and Auditing of FBiH

... - Medium and large shareholding companies should have audited financial statements, subject of approval of annual shareholdes assembly ...

... - Medium and large shareholding companies should have audited financial statements, subject of approval of annual shareholdes assembly ...

MANDATORY EMPHASIS PARAGRAPHS, CLARIFYING

... current audit report, auditing standards require auditors to provide reasonable assurance that the financial statements are free of material misstatements (AU 230.10; PCAOB 2006). However, the ambiguity surrounding reasonable assurance and other technical language used in the auditor’s report has re ...

... current audit report, auditing standards require auditors to provide reasonable assurance that the financial statements are free of material misstatements (AU 230.10; PCAOB 2006). However, the ambiguity surrounding reasonable assurance and other technical language used in the auditor’s report has re ...

Auditors` Reports

... We have audited the accompanying balance sheets of DUNDER-MIFFLIN, INC. as of December 31, 2012 and 2011, and the related statements of income, shareholders’ equity, and cash flows for each of the years in the three-year period ended December 31, 2012. These financial statements are the responsibili ...

... We have audited the accompanying balance sheets of DUNDER-MIFFLIN, INC. as of December 31, 2012 and 2011, and the related statements of income, shareholders’ equity, and cash flows for each of the years in the three-year period ended December 31, 2012. These financial statements are the responsibili ...

Chapter 5 The Time Value of Money

... Unqualified opinion - the auditor finds that the financial statements are presented fairly in accordance with generally accepted accounting principles. Qualified opinion - the auditor finds that the financial statements are presented fairly in accordance with generally accepted accounting principles ...

... Unqualified opinion - the auditor finds that the financial statements are presented fairly in accordance with generally accepted accounting principles. Qualified opinion - the auditor finds that the financial statements are presented fairly in accordance with generally accepted accounting principles ...

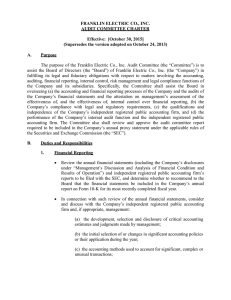

FRANKLIN ELECTRIC CO., INC. AUDIT COMMITTEE CHARTER

... The Committee’s responsibility is one of oversight. The responsibility for the completeness and accuracy of the financial statements rests with the Company’s management. The responsibility of the Company’s independent registered public accounting firm is to perform an audit of the Company’s financia ...

... The Committee’s responsibility is one of oversight. The responsibility for the completeness and accuracy of the financial statements rests with the Company’s management. The responsibility of the Company’s independent registered public accounting firm is to perform an audit of the Company’s financia ...

1305080572_448208

... AUDIT Assurance: Objective examination of evidence to provide independent assessment on governance, risk management, and control processes Consulting: Advisory and related client service activities • Nature and scope are agreed with the client • Add value and improve an organization’s governance, ri ...

... AUDIT Assurance: Objective examination of evidence to provide independent assessment on governance, risk management, and control processes Consulting: Advisory and related client service activities • Nature and scope are agreed with the client • Add value and improve an organization’s governance, ri ...

the relevance of auditing in a computerized accounting system

... 1954 to the mid -1960s, the auditing profession was still auditing around the computer. At this time only mainframe computers were used and few people had the skills and abilities to program computers. This began to change in the mid-1960s with the introduction of new, smaller and less expensive mac ...

... 1954 to the mid -1960s, the auditing profession was still auditing around the computer. At this time only mainframe computers were used and few people had the skills and abilities to program computers. This began to change in the mid-1960s with the introduction of new, smaller and less expensive mac ...

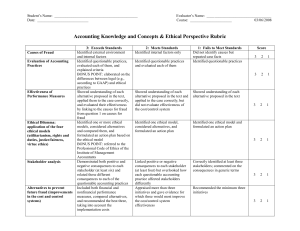

Rubric for Power Point Presentation

... Showed understanding of each alternative proposed in the text, applied them to the case correctly, and evaluated their effectiveness by linking to the causes for fraud from question 1 on causes for ...

... Showed understanding of each alternative proposed in the text, applied them to the case correctly, and evaluated their effectiveness by linking to the causes for fraud from question 1 on causes for ...

ISA 520 Analytical procedures

... analytical procedures in response to assessed risks. When such controls are effective, the auditor generally has greater confidence in the reliability of the information and, therefore, in the results of analytical procedures. The operating effectiveness of controls over non-financial information ma ...

... analytical procedures in response to assessed risks. When such controls are effective, the auditor generally has greater confidence in the reliability of the information and, therefore, in the results of analytical procedures. The operating effectiveness of controls over non-financial information ma ...

Guide to New Canadian Independence Standard

... will be an appropriate safeguard for such smaller entities. Similarly, such clients often have a long-standing relationship with an individual who is a sole practitioner or partner from a firm. Independence will not be impaired provided safeguards are applied to reduce any familiarity threat to an a ...

... will be an appropriate safeguard for such smaller entities. Similarly, such clients often have a long-standing relationship with an individual who is a sole practitioner or partner from a firm. Independence will not be impaired provided safeguards are applied to reduce any familiarity threat to an a ...

accounting theory: text and readings

... Independent - Not associated with firms that underwrite the securities they cover. Often sell their recommendations on a subscription basis ...

... Independent - Not associated with firms that underwrite the securities they cover. Often sell their recommendations on a subscription basis ...

Lecture Syllabus Financial Assurance and

... Advanced Financial Accounting 1 and Auditing, the module is designed to provide comprehensive coverage of the theoretical and practical aspects underpinning the preparation of published financial statements. It also examines current issues associated with the assurance of financial statements issued ...

... Advanced Financial Accounting 1 and Auditing, the module is designed to provide comprehensive coverage of the theoretical and practical aspects underpinning the preparation of published financial statements. It also examines current issues associated with the assurance of financial statements issued ...

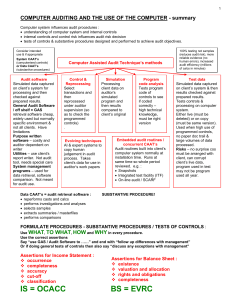

Assignment 1 is compulsory and due

... understanding of computer system and internal controls internal controls and control risk influences audit risk decision tests of controls & substantive procedures designed and performed to achieve audit objectives. Consider intended use & if appropriate System CAAT’s (computerised controls) o ...

... understanding of computer system and internal controls internal controls and control risk influences audit risk decision tests of controls & substantive procedures designed and performed to achieve audit objectives. Consider intended use & if appropriate System CAAT’s (computerised controls) o ...

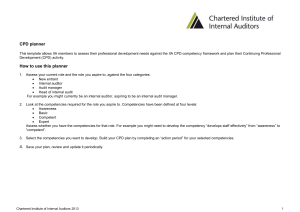

Competency area - Chartered Institute of Internal Auditors

... This template allows IIA members to assess their professional development needs against the IIA CPD competency framework and plan their Continuing Professional ...

... This template allows IIA members to assess their professional development needs against the IIA CPD competency framework and plan their Continuing Professional ...

Comprehensive Case A.1 – Enron

... Consult Paragraphs .21-.22 of AU Section 326. As an auditor, what type of evidence would you want to examine to determine whether Enron was inappropriately recording revenue from the Sithe Energies ...

... Consult Paragraphs .21-.22 of AU Section 326. As an auditor, what type of evidence would you want to examine to determine whether Enron was inappropriately recording revenue from the Sithe Energies ...

internal-auditing-instructional-material

... d. A statement of positive assurance on those items of compliance tested and negative assurance on those items not tested. This should include significant instances of noncompliance and instances of or indicating of fraud, abuse or illegal acts found during or in connection with the audit. However, ...

... d. A statement of positive assurance on those items of compliance tested and negative assurance on those items not tested. This should include significant instances of noncompliance and instances of or indicating of fraud, abuse or illegal acts found during or in connection with the audit. However, ...

Norwood Office Supplies (NOS) Case AC 432 – DeZoort Fall 2004

... Assignments 2 and 3 require you to work in audit teams of four. You are responsible for forming your own teams and coming to terms on how you will complete your work. However, you should divide the workload as evenly as possible. Before starting work on the assignment, each team needs to provide me ...

... Assignments 2 and 3 require you to work in audit teams of four. You are responsible for forming your own teams and coming to terms on how you will complete your work. However, you should divide the workload as evenly as possible. Before starting work on the assignment, each team needs to provide me ...

working program - Almaty Management University

... - to be able to adequately navigate various social situations; Work in team; to defend their positions, and suggest new approaches; Reach compromise, correlate their opinions with the opinions of the team members; Aim or professional and personal development; Use information technologies in their pr ...

... - to be able to adequately navigate various social situations; Work in team; to defend their positions, and suggest new approaches; Reach compromise, correlate their opinions with the opinions of the team members; Aim or professional and personal development; Use information technologies in their pr ...

Model og layout of project accounting (text)

... cash receipts and payments for the project [Project-name] in accordance with the guidelines for presentation of accounts for the utilisation of grants allocated by the Danish Ministry of Foreign Affairs and the accounting policies for cash receipts and payments, described on page 5. The figures from ...

... cash receipts and payments for the project [Project-name] in accordance with the guidelines for presentation of accounts for the utilisation of grants allocated by the Danish Ministry of Foreign Affairs and the accounting policies for cash receipts and payments, described on page 5. The figures from ...