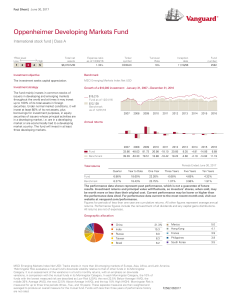

Oppenheimer Developing Markets Fund - Vanguard

... market as a whole. Smaller, less-seasoned companies may be subject to increased liquidity risk compared with mid- and large-cap companies and may experience greater price volatility than do those securities because of limited product lines, management experience, market share, or financial resources ...

... market as a whole. Smaller, less-seasoned companies may be subject to increased liquidity risk compared with mid- and large-cap companies and may experience greater price volatility than do those securities because of limited product lines, management experience, market share, or financial resources ...

- Franklin Templeton Investments

... The index data referenced herein is the property of Merrill Lynch, Pierce, Fenner & Smith Incorporated (“BofAML”) and/or its licensors and has been licensed for use by Franklin Templeton. BofAML and its licensors accept no liability in connection with this use. See www.franklintempletondatasources.c ...

... The index data referenced herein is the property of Merrill Lynch, Pierce, Fenner & Smith Incorporated (“BofAML”) and/or its licensors and has been licensed for use by Franklin Templeton. BofAML and its licensors accept no liability in connection with this use. See www.franklintempletondatasources.c ...

Vilar Gave Select Access to IPOs

... was withdrawn early this week, according to AMG Data Services. In the summer of 1999, Amerindo received 100,000 shares in the IPO of software company Ariba Inc., according to remarks by Mr. Tanaka in a December 2000 Wall Street Journal article. As Ariba's shares soared in the days following the IPO, ...

... was withdrawn early this week, according to AMG Data Services. In the summer of 1999, Amerindo received 100,000 shares in the IPO of software company Ariba Inc., according to remarks by Mr. Tanaka in a December 2000 Wall Street Journal article. As Ariba's shares soared in the days following the IPO, ...

Standard Life MyFolio Market Funds

... the range. Advisers looking to combine different styles for clients within the MyFolio range can do so knowing the portfolio will have the same underlying characteristics. Within the MyFolio fund range the Market funds have the lowest cost base and, as such, the key selection factors are cost and tr ...

... the range. Advisers looking to combine different styles for clients within the MyFolio range can do so knowing the portfolio will have the same underlying characteristics. Within the MyFolio fund range the Market funds have the lowest cost base and, as such, the key selection factors are cost and tr ...

Fact Sheet:SSgA Enhanced Emerging Markets Equity Fund, May2017

... This material is for your private information. The information provided does not constitute investment advice as such term is defined under the Markets in Financial Instruments Directive (2004/39/EC) or applicable Swiss regulation and it should not be relied on as such. It should not be considered a ...

... This material is for your private information. The information provided does not constitute investment advice as such term is defined under the Markets in Financial Instruments Directive (2004/39/EC) or applicable Swiss regulation and it should not be relied on as such. It should not be considered a ...

St Andrew`s Retirement Plan

... To advise members that UBS Global Asset Management (Australia) Ltd was making changes to the UBS Property Securities Fund. The changes being made include change of benchmark and investment strategy. To advise members that the responsible entity changed to Equity Trustees replacing Ventura Investment ...

... To advise members that UBS Global Asset Management (Australia) Ltd was making changes to the UBS Property Securities Fund. The changes being made include change of benchmark and investment strategy. To advise members that the responsible entity changed to Equity Trustees replacing Ventura Investment ...

Vanguard Energy Index Fund

... all, of its assets in the energy sector, the fund’s performance largely depends—for better or for worse—on the general condition of that sector. Companies in the energy sector could be affected by, among other things, geopolitical events, government regulation, economic cycles, and fuel prices. Sect ...

... all, of its assets in the energy sector, the fund’s performance largely depends—for better or for worse—on the general condition of that sector. Companies in the energy sector could be affected by, among other things, geopolitical events, government regulation, economic cycles, and fuel prices. Sect ...

PDF article file - Krungsri Asset Management

... are due to be included in the Nikkei 225. Thus, both funds may have risks from economic and/or political and/or social changes in the country where the master fund invested in. These risks may affect the stock prices as well. 2. The fund and/or master fund may invest in or make available a forward c ...

... are due to be included in the Nikkei 225. Thus, both funds may have risks from economic and/or political and/or social changes in the country where the master fund invested in. These risks may affect the stock prices as well. 2. The fund and/or master fund may invest in or make available a forward c ...

II. How to Read a Mutual Fund Prospectus

... (Note: Hedge Funds are NOT regulated) The company is a conduit: all earnings and dividends are distributed, thus avoiding taxes at the company level. Established by the fund sponsor, and operated and managed by an investment company hired by the sponsor. The investment company is compensated by vari ...

... (Note: Hedge Funds are NOT regulated) The company is a conduit: all earnings and dividends are distributed, thus avoiding taxes at the company level. Established by the fund sponsor, and operated and managed by an investment company hired by the sponsor. The investment company is compensated by vari ...

Dreyfus Tax Sensitive Total Return Bond Fund Mar 31

... the prospectus carefully before investing. Investors should discuss with their advisor the eligibility requirements for Class I and Y shares, which are available only to certain eligible investors, and the historical results achieved by the fund’s respective share classes. The Dreyfus Corporation an ...

... the prospectus carefully before investing. Investors should discuss with their advisor the eligibility requirements for Class I and Y shares, which are available only to certain eligible investors, and the historical results achieved by the fund’s respective share classes. The Dreyfus Corporation an ...

Franklin Quotential Growth Portfolio Series A

... be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates ...

... be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates ...

Target Date Funds Can Help Investors Diversify

... To achieve its objective, a target date fund moves along a glide path that adjusts its portfolio over time, away from an asset allocation that may be considered riskier to one that is intended to be more conservative. In fact, the fund continues along its glide path after the target date – in many c ...

... To achieve its objective, a target date fund moves along a glide path that adjusts its portfolio over time, away from an asset allocation that may be considered riskier to one that is intended to be more conservative. In fact, the fund continues along its glide path after the target date – in many c ...

JPMorgan Large Cap Growth Fund

... performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of t ...

... performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of t ...

IIGCC appoints head of EU policy

... The Institutional Investors Group on Climate Change, which represents more than 100 European investors worth a combined €10 trillion, has appointed Martin Schoenberg as head of EU policy. Martin will be responsible for developing IIGCC’s policy engagement at EU level, working closely with IIGCC’s me ...

... The Institutional Investors Group on Climate Change, which represents more than 100 European investors worth a combined €10 trillion, has appointed Martin Schoenberg as head of EU policy. Martin will be responsible for developing IIGCC’s policy engagement at EU level, working closely with IIGCC’s me ...

GNRX VanEck Vectors Generic Drugs ETF

... expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing. This content is published in the United State ...

... expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing. This content is published in the United State ...

Document

... The Law Commission in 2014 stated that A. Trustees should leave responsible investment policy entirely to fund managers ...

... The Law Commission in 2014 stated that A. Trustees should leave responsible investment policy entirely to fund managers ...

magna retirement savings plans stable value fund

... Benefit payments are made according to the market value of the fund at the time of distribution. The market value of the fund is a blend between the performance and weighting of the GFC and PSVF Components. Principal Risks While stable value is generally considered a conservative investment option, ...

... Benefit payments are made according to the market value of the fund at the time of distribution. The market value of the fund is a blend between the performance and weighting of the GFC and PSVF Components. Principal Risks While stable value is generally considered a conservative investment option, ...

Fiscal Policy - The Town of Round Hill

... 1. The Town is committed to an open and transparent government, including its financial practices. This includes maintaining high standards in accounting practices, financial reporting, ongoing review by an independent certified public accountant, and a comprehensive annual financial report prepared ...

... 1. The Town is committed to an open and transparent government, including its financial practices. This includes maintaining high standards in accounting practices, financial reporting, ongoing review by an independent certified public accountant, and a comprehensive annual financial report prepared ...

January 10, 2012 FOR IMMEDIATE RELEASE GuideStone

... You should carefully consider the investment objectives, risks, charges and expenses of GuideStone Funds before investing. For a copy of the prospectus with this and other information about the funds, please download a prospectus at www.GuideStoneFunds.org or call 1-888-98-GUIDE (1-888-984-8433). Y ...

... You should carefully consider the investment objectives, risks, charges and expenses of GuideStone Funds before investing. For a copy of the prospectus with this and other information about the funds, please download a prospectus at www.GuideStoneFunds.org or call 1-888-98-GUIDE (1-888-984-8433). Y ...

Investment Methodology and the Batting Average

... The key to understanding the investment methodology behind the Nationwide Financial Fiduciary Series is that the plan fiduciary’s task of selecting and monitoring the plan’s investments is simplified with the use of a batting average to evaluate the investments. Plan fiduciaries need only look at th ...

... The key to understanding the investment methodology behind the Nationwide Financial Fiduciary Series is that the plan fiduciary’s task of selecting and monitoring the plan’s investments is simplified with the use of a batting average to evaluate the investments. Plan fiduciaries need only look at th ...

Minutes March 2016

... As Rutabaga invests in small, turnaround situations, the benchmark agnostic strategy can be, and has been, very volatile. Mr. Scannell noted that the 7-8 stocks in the portfolio which have driven the significant under performance have been reviewed carefully and subsequent action taken where warrant ...

... As Rutabaga invests in small, turnaround situations, the benchmark agnostic strategy can be, and has been, very volatile. Mr. Scannell noted that the 7-8 stocks in the portfolio which have driven the significant under performance have been reviewed carefully and subsequent action taken where warrant ...

Richmond ETF update

... The material contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, o ...

... The material contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, o ...

foundation market-based investment funds

... Effective April 2, 2012, the Foundation created an investment account with Earnest International Investment Trust Fund, which seeks income and capital appreciation by investing principally in equity and equity-linked securities of nonU.S. companies. Earnest Partners, LLC, with principal office in At ...

... Effective April 2, 2012, the Foundation created an investment account with Earnest International Investment Trust Fund, which seeks income and capital appreciation by investing principally in equity and equity-linked securities of nonU.S. companies. Earnest Partners, LLC, with principal office in At ...

Co-operators Ethical Select Growth Portfolio - The Co

... When you make a deposit, Co-operators pays your financial advisor a commission of 3%. If you have an RRSP or non-registered account you can withdraw 10% of the value of the units of your segregated funds at December 31 without paying a deferred sales charge. If you have a registered retirement incom ...

... When you make a deposit, Co-operators pays your financial advisor a commission of 3%. If you have an RRSP or non-registered account you can withdraw 10% of the value of the units of your segregated funds at December 31 without paying a deferred sales charge. If you have a registered retirement incom ...

Emerging Market Equity Fund Investor: SEMNX SEMNX | Advisor: SEMVX SEMVX

... is derived from a weighted average of the performance figures associated with its three-, five-, and ten-year (if applicable) Morningstar Rating metrics. Morningstar RatingTM is for individual share classes only. Other classes may have different performance characteristics. Past performance is no gu ...

... is derived from a weighted average of the performance figures associated with its three-, five-, and ten-year (if applicable) Morningstar Rating metrics. Morningstar RatingTM is for individual share classes only. Other classes may have different performance characteristics. Past performance is no gu ...