VictoryShares US Multi-Factor Minimum Volatility ETF

... Investing involves risk, including the potential loss of principal. There is no guarantee that the Fund will achieve its investment objective or that the strategies will be successful. The Fund has the same risks as the underlying securities traded on the exchange throughout the day. Redemptions are ...

... Investing involves risk, including the potential loss of principal. There is no guarantee that the Fund will achieve its investment objective or that the strategies will be successful. The Fund has the same risks as the underlying securities traded on the exchange throughout the day. Redemptions are ...

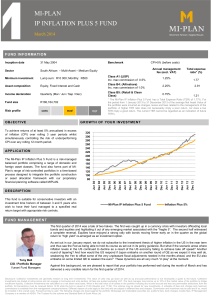

mi-plan ip inflation plus 5 fund

... Disclosure: Collective investments are generally medium to long term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are ...

... Disclosure: Collective investments are generally medium to long term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are ...

Dreyfus Emerging Markets Debt U.S. Dollar Fund

... The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor's shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. ...

... The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor's shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. ...

Fact Sheet - Columbia Management

... Investment risks — Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The fund’s investment in other funds subjects it to the investment performance (positive or negative), risks and expenses of these underlying funds. There are risks associated with fi ...

... Investment risks — Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The fund’s investment in other funds subjects it to the investment performance (positive or negative), risks and expenses of these underlying funds. There are risks associated with fi ...

Low Volatility Equity Fact Sheet

... The S&P 500 Index is an unmanaged index of common stock performance. You cannot invest directly in an index. Beta measures the correlation of returns from a stock or a fund to a benchmark index. A beta of less than 1.0 indicates lower volatility; a beta of more than 1.0, higher volatility than the b ...

... The S&P 500 Index is an unmanaged index of common stock performance. You cannot invest directly in an index. Beta measures the correlation of returns from a stock or a fund to a benchmark index. A beta of less than 1.0 indicates lower volatility; a beta of more than 1.0, higher volatility than the b ...

Franklin Quotential Balanced Income Portfolio Series A

... be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates ...

... be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates ...

CF CANLIFE GLOBAL INFRASTRUCTURE FUND DRAFT

... The investment team focuses on large companies around the globe with stable cash flows and strong returns primarily in the developed markets. The portfolio consists mainly of energy, utility and industrial infrastructure companies. Identifying companies The investment team starts with a quantitativ ...

... The investment team focuses on large companies around the globe with stable cash flows and strong returns primarily in the developed markets. The portfolio consists mainly of energy, utility and industrial infrastructure companies. Identifying companies The investment team starts with a quantitativ ...

Columbia Pacific/Asia Fund

... Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security. Top holdings include cash but exclude short-term holdings, if applicable. ©2017 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) ...

... Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security. Top holdings include cash but exclude short-term holdings, if applicable. ©2017 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) ...

GLOBAL IMPACT SPEAKER SERIES When Markets Fail -

... With average GDP growth of over 5% for the past 7 years in Africa, improvements in political stability, and a quadrupling of foreign direct investments over the past years, Africa is positioning itself as an attractive market for alternative investments, not only in terms of financial returns but al ...

... With average GDP growth of over 5% for the past 7 years in Africa, improvements in political stability, and a quadrupling of foreign direct investments over the past years, Africa is positioning itself as an attractive market for alternative investments, not only in terms of financial returns but al ...

Franklin Double Tax-Free Income Fund Fact Sheet

... Average Weighted Maturity: An estimate of the number of terms of maturity, taking the possibility of early payments into account, for the underlying holdings. Beta: A measure of the fund's volatility relative to the market, as represented by the stated Index. A beta greater than 1.00 indicates volat ...

... Average Weighted Maturity: An estimate of the number of terms of maturity, taking the possibility of early payments into account, for the underlying holdings. Beta: A measure of the fund's volatility relative to the market, as represented by the stated Index. A beta greater than 1.00 indicates volat ...

Stable Value Fund

... Are there any limitations on contributions, withdrawals, or transfers from my plan’s stable value option? Generally, there are no limitations on contributions to or withdrawals from the Fund as a result of retirement, death, disability, unforeseen hardship, separation from service, or attainment of ...

... Are there any limitations on contributions, withdrawals, or transfers from my plan’s stable value option? Generally, there are no limitations on contributions to or withdrawals from the Fund as a result of retirement, death, disability, unforeseen hardship, separation from service, or attainment of ...

International Fixed Interest Fund

... The International Fixed Interest Fund invests mainly in international fixed interest assets. Investments may include: • fixed interest assets issued by government or international companies, and • cash and cash equivalents. The fund aims to achieve a positive yearly return (after the fund charge and ...

... The International Fixed Interest Fund invests mainly in international fixed interest assets. Investments may include: • fixed interest assets issued by government or international companies, and • cash and cash equivalents. The fund aims to achieve a positive yearly return (after the fund charge and ...

Biodiversity Fund: Investing in Tasmania*sNative

... The Biodiversity Fund’s targeted investment approach provides an opportunity to focus on environments that are rich in biodiversity but which are facing increasing pressures. Such pressures include loss of habitat connectivity through land use change and declining ecosystem function due to fragmenta ...

... The Biodiversity Fund’s targeted investment approach provides an opportunity to focus on environments that are rich in biodiversity but which are facing increasing pressures. Such pressures include loss of habitat connectivity through land use change and declining ecosystem function due to fragmenta ...

Slides - WordPress.com

... exchange for equity in the business. • One note: you should always be a bootstrapper – even if you raise capital – Raise as little as possible

...

... exchange for equity in the business. • One note: you should always be a bootstrapper – even if you raise capital – Raise as little as possible

Deloitte report identifies `red flags` for hedge fund managers and

... While the hedge fund industry is maturing, the risk management and valuation practices of many hedge funds can best be characterised as in their adolescence, according to a study by Deloitte Research and Deloitte & Touche USA's Investment Management Industry Group that warns hedge fund managers and ...

... While the hedge fund industry is maturing, the risk management and valuation practices of many hedge funds can best be characterised as in their adolescence, according to a study by Deloitte Research and Deloitte & Touche USA's Investment Management Industry Group that warns hedge fund managers and ...

High Yield Bond Fund

... default and tend to be more volatile than higher-rated debt securities. Loans are subject to risks similar to those associated with other below-investment-grade bond investments, such as credit risk (for example, risk of issuer default), below-investment-grade bond risk (for example, risk of greater ...

... default and tend to be more volatile than higher-rated debt securities. Loans are subject to risks similar to those associated with other below-investment-grade bond investments, such as credit risk (for example, risk of issuer default), below-investment-grade bond risk (for example, risk of greater ...

BAE Systems Pension Scheme Additional Voluntary Contributions

... Profile with any of the available standalone funds. The only exception to this rule is for members who were With Profits contributors prior to 1 February 2011. If you fall into this category, you may combine either Profile with a With Profits fund contribution. 2. When selecting a Lifestyle Profile, ...

... Profile with any of the available standalone funds. The only exception to this rule is for members who were With Profits contributors prior to 1 February 2011. If you fall into this category, you may combine either Profile with a With Profits fund contribution. 2. When selecting a Lifestyle Profile, ...

Investor protection

... not simply meet, the rules and guidance set by the regulator on the way we look after your Vanguard fund assets and manage any risks that may affect them. We have very robust oversight measures in place designed to manage risk. These encompass people, process and systems risk. The Head of Risk withi ...

... not simply meet, the rules and guidance set by the regulator on the way we look after your Vanguard fund assets and manage any risks that may affect them. We have very robust oversight measures in place designed to manage risk. These encompass people, process and systems risk. The Head of Risk withi ...

Pengana Capital Funds

... The assumption that markets are efficient and that investors should be ambivalent about the timing of their investment is not borne out in practice,’ he says. ‘Equity market beta – the return attributable to the market only – is a volatile and unpredictable source of returns. It can generate signifi ...

... The assumption that markets are efficient and that investors should be ambivalent about the timing of their investment is not borne out in practice,’ he says. ‘Equity market beta – the return attributable to the market only – is a volatile and unpredictable source of returns. It can generate signifi ...

Real I.S. acquires office building in Brussels for BGV VI

... comprises several properties in Amsterdam and a logistics property in Moerdjik. The fund has also bought properties in Dublin, Ireland and in Brussels, Belgium. ...

... comprises several properties in Amsterdam and a logistics property in Moerdjik. The fund has also bought properties in Dublin, Ireland and in Brussels, Belgium. ...

Chilean tax ruling may affect foreign institutional investors

... Chile as a vehicle to invest into other countries in South America to obtain favorable treaty benefits, such as partial relief from non-resident capital gains taxes. Many tax treaties entered between Chile and other countries in South America provide partial relief for non-resident capital gains tax ...

... Chile as a vehicle to invest into other countries in South America to obtain favorable treaty benefits, such as partial relief from non-resident capital gains taxes. Many tax treaties entered between Chile and other countries in South America provide partial relief for non-resident capital gains tax ...

Download attachment

... bias helped the fund return 72% in the year ended March 31, handily beating its benchmark MSCI World index, which returned 22%. Tech stocks have taken a beating the past several weeks, so many Islamic equity funds might not do so well in the second quarter. But there are plenty of Muslim-targeted in ...

... bias helped the fund return 72% in the year ended March 31, handily beating its benchmark MSCI World index, which returned 22%. Tech stocks have taken a beating the past several weeks, so many Islamic equity funds might not do so well in the second quarter. But there are plenty of Muslim-targeted in ...

Five-Year Ranking: Pimco Leads 10

... certain periods shown. Absent these waivers, results would have been less favorable. Risks: The Fund is non-diversified and include risks associated with concentration risk that results from the Funds' investments in a limited number of securities. Increased portfolio turnover may result in higher tr ...

... certain periods shown. Absent these waivers, results would have been less favorable. Risks: The Fund is non-diversified and include risks associated with concentration risk that results from the Funds' investments in a limited number of securities. Increased portfolio turnover may result in higher tr ...

Indirect Investing

... All rights reserved. Reproduction or translation of this work beyond that permitted in section 117 of the 1976 United States Copyright Act without express permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John ...

... All rights reserved. Reproduction or translation of this work beyond that permitted in section 117 of the 1976 United States Copyright Act without express permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John ...