Teachers Guide Lesson Twelve

... invested can easily grow into larger sums. However, a person must start to save. This lesson provides students with a basic knowledge of saving and investing. The process starts with setting financial goals. Next, a commitment to saving is discussed. Various savings plans are available to consumers. ...

... invested can easily grow into larger sums. However, a person must start to save. This lesson provides students with a basic knowledge of saving and investing. The process starts with setting financial goals. Next, a commitment to saving is discussed. Various savings plans are available to consumers. ...

What is an investment?

... – The financial return will be just as good even if other moral/ethical considerations are taken into account * Harries (Bishop of Oxford) v Church Commissioners [1992] 1 WLR 1241 ...

... – The financial return will be just as good even if other moral/ethical considerations are taken into account * Harries (Bishop of Oxford) v Church Commissioners [1992] 1 WLR 1241 ...

MyNorth PIMCO Diversified Fixed Interest Fund PDS

... AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) - referred to in this PDS as 'AMP Capital', 'we' or 'us', has been appointed by the Responsible Entity to provide investment services in respect of the Fund, which includes being responsible for selecting and monitoring the Fund Manager ...

... AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) - referred to in this PDS as 'AMP Capital', 'we' or 'us', has been appointed by the Responsible Entity to provide investment services in respect of the Fund, which includes being responsible for selecting and monitoring the Fund Manager ...

Reitway Global`s Investment Process

... exposure to global real estate securities. 9. After taking into account individual security characteristics and portfolio constraints, a master portfolio is constructed from the buylist. 10. Quantitative techniques are used to optimize the portfolio in terms of return and risk. 11. We follow a subst ...

... exposure to global real estate securities. 9. After taking into account individual security characteristics and portfolio constraints, a master portfolio is constructed from the buylist. 10. Quantitative techniques are used to optimize the portfolio in terms of return and risk. 11. We follow a subst ...

Source Bloomberg Commodity UCITS ETF Factsheet

... as well as up and an investor may not get back the amount invested. Changes in exchange rates between currencies or the conversion from one currency to another may also cause the value of the investments to diminish or increase. An investment in a Fund should not constitute a substantial proportion ...

... as well as up and an investor may not get back the amount invested. Changes in exchange rates between currencies or the conversion from one currency to another may also cause the value of the investments to diminish or increase. An investment in a Fund should not constitute a substantial proportion ...

Slide 1

... biggest increases from power, ports and airports. • Private Investment in road projects estimated to be Rs.1,125 billion under the Eleventh Plan as compared to Rs.70 billion in the 10th Plan** • As project size and complexity increase, it will be difficult for smaller players to qualify for these pr ...

... biggest increases from power, ports and airports. • Private Investment in road projects estimated to be Rs.1,125 billion under the Eleventh Plan as compared to Rs.70 billion in the 10th Plan** • As project size and complexity increase, it will be difficult for smaller players to qualify for these pr ...

Mascaro Company 401(k) Plan

... remember a basic theory of investing: over time, you should be rewarded for taking greater risk. For example, despite its ups and downs, over any ten year period in the last 70 years- the stock market has outperformed any other investment category. This is not to say that everyone should invest in t ...

... remember a basic theory of investing: over time, you should be rewarded for taking greater risk. For example, despite its ups and downs, over any ten year period in the last 70 years- the stock market has outperformed any other investment category. This is not to say that everyone should invest in t ...

Endowment Investment Policy

... University. They recognize this responsibility is best performed by directing professional investment manager(s) and advisor(s), rather than by acting as investment manager(s) themselves. Therefore, this will be accomplished by appointing a Chief Investment and Investment Officer to monitor the perf ...

... University. They recognize this responsibility is best performed by directing professional investment manager(s) and advisor(s), rather than by acting as investment manager(s) themselves. Therefore, this will be accomplished by appointing a Chief Investment and Investment Officer to monitor the perf ...

Why expenses matter - Charles Schwab Investment Management

... Just a few basis points? Try nearly 20%. That’s the potential gap in final portfolio value between low cost market cap index funds and the average cost of actively managed funds after 40 years. Higher expenses eat away at a portfolio’s compounding power. The average cost of an actively managed equit ...

... Just a few basis points? Try nearly 20%. That’s the potential gap in final portfolio value between low cost market cap index funds and the average cost of actively managed funds after 40 years. Higher expenses eat away at a portfolio’s compounding power. The average cost of an actively managed equit ...

Responsible Investment Policy

... AGF Investments Inc. (AGF) is committed to helping institutional and individual investors preserve and grow their financial assets. As an asset manager, we act as a fiduciary on behalf of our clients. We seek to build and maintain strategic partnerships with our clients and to deliver strong long-te ...

... AGF Investments Inc. (AGF) is committed to helping institutional and individual investors preserve and grow their financial assets. As an asset manager, we act as a fiduciary on behalf of our clients. We seek to build and maintain strategic partnerships with our clients and to deliver strong long-te ...

Slide 0 - Astana Economic Forum 2013

... This document has been prepared to provide prospective investors with the opportunity to determine their preliminary interest regarding a product (“product”) that is being prepared by the Asian Development Bank (“ADB“) and may not be used or reproduced for any other purpose. This Program received AD ...

... This document has been prepared to provide prospective investors with the opportunity to determine their preliminary interest regarding a product (“product”) that is being prepared by the Asian Development Bank (“ADB“) and may not be used or reproduced for any other purpose. This Program received AD ...

Alpha Australian Blue Chip Fund

... Investors in the Fund can redeem their investment by completing a written request to redeem from the Fund and sending it to FundBPO, Lvl 1, 51-57 Pitt Street, Sydney, NSW 2000 or by: Making a withdrawal request through mFund by placing a sell order for units with your licensed broker. The minimum re ...

... Investors in the Fund can redeem their investment by completing a written request to redeem from the Fund and sending it to FundBPO, Lvl 1, 51-57 Pitt Street, Sydney, NSW 2000 or by: Making a withdrawal request through mFund by placing a sell order for units with your licensed broker. The minimum re ...

The case for low-cost index-fund investing for Asian investors

... appealing to investors who may have tired of the vagaries of active approaches. Diversification. Index funds and ETFs typically are more diversified than actively managed funds, a by-product of the way indices are constructed. Except for index funds that track narrow market segments, most index fund ...

... appealing to investors who may have tired of the vagaries of active approaches. Diversification. Index funds and ETFs typically are more diversified than actively managed funds, a by-product of the way indices are constructed. Except for index funds that track narrow market segments, most index fund ...

Realpool Investment Fund

... Comprehensive Income. The Fund’s investments are designated as FVTPL. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value of financial assets and liabilities trad ...

... Comprehensive Income. The Fund’s investments are designated as FVTPL. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value of financial assets and liabilities trad ...

Think active can`t outperform? Think again

... ©2017 Morningstar Inc. All rights reserved. The information contained herein is proprietary to Morningstar and/or its content providers. It may not be copied or distributed and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any ...

... ©2017 Morningstar Inc. All rights reserved. The information contained herein is proprietary to Morningstar and/or its content providers. It may not be copied or distributed and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any ...

Far Horizon Investments - Penn State Smeal College of Business

... FHI would make a small sum of money, but if the country did default (a very small chance), FHI could stand to lose a large sum. Since FHI would make this bet many times on many different countries, as long as the occurrence of defaults is not very positively correlated, the distribution of returns s ...

... FHI would make a small sum of money, but if the country did default (a very small chance), FHI could stand to lose a large sum. Since FHI would make this bet many times on many different countries, as long as the occurrence of defaults is not very positively correlated, the distribution of returns s ...

Mutual Funds Investment

... and bonds is completely done by the Professional Fund Managers employed by the Investment Management Company. In this case, the fund management remains in the hands of the fund managers of the mutual fund company. But, in case of Direct Investment in individual stocks, the total control remains in ...

... and bonds is completely done by the Professional Fund Managers employed by the Investment Management Company. In this case, the fund management remains in the hands of the fund managers of the mutual fund company. But, in case of Direct Investment in individual stocks, the total control remains in ...

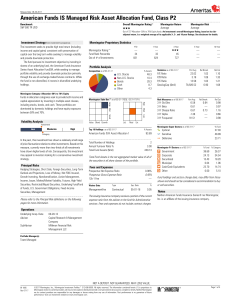

American Funds IS Managed Risk Asset Allocation Fund

... or endorsed by, any bank and is not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other U.S. governmental agency. Growth Investing Growth securities may be subject to increased volatility as the value of these securities is highly sensitive to market fluctua ...

... or endorsed by, any bank and is not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other U.S. governmental agency. Growth Investing Growth securities may be subject to increased volatility as the value of these securities is highly sensitive to market fluctua ...

Statement of investment policies and procedures

... shall retain responsibility and utilize suitable personnel for such activities and monitor the activities undertaken by the selected personnel. Any reference in the Policy to the Administrator shall be interpreted as referencing the appropriate delegate. ...

... shall retain responsibility and utilize suitable personnel for such activities and monitor the activities undertaken by the selected personnel. Any reference in the Policy to the Administrator shall be interpreted as referencing the appropriate delegate. ...

unitary boards and mutual fund governance

... resulting from economies of scale and demand advisory contracts more favorable to fund investors.2 There are also concerns involving unitary boards. First, unitary boards may exacerbate board directors’ career concerns because directors on unitary boards are generally compensated higher and fund adv ...

... resulting from economies of scale and demand advisory contracts more favorable to fund investors.2 There are also concerns involving unitary boards. First, unitary boards may exacerbate board directors’ career concerns because directors on unitary boards are generally compensated higher and fund adv ...

Grand Prix Award Best overall communication of company

... investors. Were there any relevant quantifiable results? This could be supported by quantifiable or ...

... investors. Were there any relevant quantifiable results? This could be supported by quantifiable or ...

Measuring CRI`s Impact on Performance

... rebalancing — result in a slightly different portfolio than the managers’ unscreened portfolio, there will be some variation in comparative performance on a short-term basis. However, our analysis of long-term performance clearly demonstrates that CBIS’ CRI screens do not constrain our ability to de ...

... rebalancing — result in a slightly different portfolio than the managers’ unscreened portfolio, there will be some variation in comparative performance on a short-term basis. However, our analysis of long-term performance clearly demonstrates that CBIS’ CRI screens do not constrain our ability to de ...

What Money Market Mutual Fund Reform Means for Banks And

... Amendments to Form PF, 79 Fed. Reg. 47735, 47932, 47794 (Aug. 14, 2014) (to be codified at 17 C.F.R. pts. 230, 239, 270, 274 & 279). 4. Id. at 47739. 5. Id. (“Rounded to the fourth decimal place (e.g., $1.0000).”). 6. Liquidity fees are a new tool allowing funds to impose a fee of up to 2% on shareh ...

... Amendments to Form PF, 79 Fed. Reg. 47735, 47932, 47794 (Aug. 14, 2014) (to be codified at 17 C.F.R. pts. 230, 239, 270, 274 & 279). 4. Id. at 47739. 5. Id. (“Rounded to the fourth decimal place (e.g., $1.0000).”). 6. Liquidity fees are a new tool allowing funds to impose a fee of up to 2% on shareh ...

Tsung Sheng Liu , Polaris Financial Group, Taiwan

... Year 1997 Completed liberalization of the investment trust business, foreign investors, banks had set-up or merged the existing counterparties ...

... Year 1997 Completed liberalization of the investment trust business, foreign investors, banks had set-up or merged the existing counterparties ...

Investment Policy - Rochester Area Community Foundation

... Performance of Key Decision Makers - Same portfolio manager (or portfolio management team) for 2-3 years, at least $100 million under management. Performance of Organization on Expense Control - Expense ratio, fees, execution, and reasonable soft-dollar arrangements. Performance of Overall Org ...

... Performance of Key Decision Makers - Same portfolio manager (or portfolio management team) for 2-3 years, at least $100 million under management. Performance of Organization on Expense Control - Expense ratio, fees, execution, and reasonable soft-dollar arrangements. Performance of Overall Org ...