Word 2002 Format

... based upon the purposes for which they are to be spent and the means by which spending activities are controlled. The district’s basic financial statements in this report consist of: GOVERNMENT-WIDE FINANCIAL STATEMENTS Overall governmental activities (i.e., all non-fiduciary activities) are reporte ...

... based upon the purposes for which they are to be spent and the means by which spending activities are controlled. The district’s basic financial statements in this report consist of: GOVERNMENT-WIDE FINANCIAL STATEMENTS Overall governmental activities (i.e., all non-fiduciary activities) are reporte ...

Mutal Funds - BYU Personal Finance

... Classes of Mutual Funds (continued) • Class C Shares: These shares generally have a lower front- and back-end load fees, but higher management fees • Class R Shares: These shares are generally for retirement purposes. Check the loads and management fees which may be substantial • No-Load Shares: Th ...

... Classes of Mutual Funds (continued) • Class C Shares: These shares generally have a lower front- and back-end load fees, but higher management fees • Class R Shares: These shares are generally for retirement purposes. Check the loads and management fees which may be substantial • No-Load Shares: Th ...

IFM7 Chapter 27

... businesses encounter when they attempt to implement the trade-off theory? The major problem is their lack of flexibility in raising equity capital. Not-for-profit firms do not have access to the typical equity markets. It’s harder for them to raise fund capital. It is often necessary for not-f ...

... businesses encounter when they attempt to implement the trade-off theory? The major problem is their lack of flexibility in raising equity capital. Not-for-profit firms do not have access to the typical equity markets. It’s harder for them to raise fund capital. It is often necessary for not-f ...

Summary of Investment Objectives

... desired weight for each asset class. The minimum and maximum weights are designed to allow for normal market fluctuations and to allow for temporary over/under weight allocations that are believed to be desirable by either the Budget and Finance Committee or the Investment Consultant. The Budget and ...

... desired weight for each asset class. The minimum and maximum weights are designed to allow for normal market fluctuations and to allow for temporary over/under weight allocations that are believed to be desirable by either the Budget and Finance Committee or the Investment Consultant. The Budget and ...

View PDF - Mackenzie Investments

... Although liquid alternatives have become increasingly popular investments, many investors, some advisors and certain regulators have yet to fully embrace them. This somewhat reluctant attitude reflects, to some extent, the limited track record, the perception that such investments are both complex a ...

... Although liquid alternatives have become increasingly popular investments, many investors, some advisors and certain regulators have yet to fully embrace them. This somewhat reluctant attitude reflects, to some extent, the limited track record, the perception that such investments are both complex a ...

BPI Philippine Infrastructure Equity Index Fund

... infrastructure industry and derived its revenues largely on infrastructure related business activities. The BPI Philippine Equity Index Fund on the other hand invests in companies that are part of the Philippine Stock Exchange index (PSEi) and in the same weight as the index.To qualify for the PSEi, ...

... infrastructure industry and derived its revenues largely on infrastructure related business activities. The BPI Philippine Equity Index Fund on the other hand invests in companies that are part of the Philippine Stock Exchange index (PSEi) and in the same weight as the index.To qualify for the PSEi, ...

Blue Quay Investment Grade Credit Fund

... Any offer of Units in the Fund or invitation to apply for Units is only extended to a person in Australia if that person is a wholesale client for the purposes of section 761G of the Corporations Act of Australia. This Information Memorandum must not be distributed or passed on, directly or indirect ...

... Any offer of Units in the Fund or invitation to apply for Units is only extended to a person in Australia if that person is a wholesale client for the purposes of section 761G of the Corporations Act of Australia. This Information Memorandum must not be distributed or passed on, directly or indirect ...

Mutual Funds

... Fee Structure of Investment Funds (2 of 2) • Other fees charges by mutual funds include: ─ contingent deferred sales charge: a back end fee that may disappear altogether after a specific period. ─ redemption fee: another name for a back end load ─ exchange fee: a fee (usually low) for transferring ...

... Fee Structure of Investment Funds (2 of 2) • Other fees charges by mutual funds include: ─ contingent deferred sales charge: a back end fee that may disappear altogether after a specific period. ─ redemption fee: another name for a back end load ─ exchange fee: a fee (usually low) for transferring ...

The International Diversification Fallacy of Exchange

... similar results as Officer and Hoffmeister, but they suggest that the optimal number of ADRs to hold is at least seven. Webb, Officer, and Boyd (1995) agree that ADRs allow investors to circumvent currency exchange and other transactions costs, but they suggest that ADRs behave very similarly to the ...

... similar results as Officer and Hoffmeister, but they suggest that the optimal number of ADRs to hold is at least seven. Webb, Officer, and Boyd (1995) agree that ADRs allow investors to circumvent currency exchange and other transactions costs, but they suggest that ADRs behave very similarly to the ...

Types of Investment - Lancashire County Council

... Transitional provisions allowed a period of 6 months from 1 April 2004 for current reemployed pensioners to make an election to the administering authority to continue to have the option to combine their benefits upon retirement (for as long as they remain in the same employment). Election to Aggreg ...

... Transitional provisions allowed a period of 6 months from 1 April 2004 for current reemployed pensioners to make an election to the administering authority to continue to have the option to combine their benefits upon retirement (for as long as they remain in the same employment). Election to Aggreg ...

Costs of Eliminating Discretionary Broker Voting on Uncontested

... The portion of shares held by retail investors will significantly affect the cost of soliciting votes in an uncontested election of directors, as institutional investors are more likely to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for ...

... The portion of shares held by retail investors will significantly affect the cost of soliciting votes in an uncontested election of directors, as institutional investors are more likely to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for ...

The case for investing in smaller companies

... to track a group of factors that have been shown to enhance stock performance. These include: ...

... to track a group of factors that have been shown to enhance stock performance. These include: ...

Baltic Property Fund Quarterly Report April - June 2016

... Vilnius industrial supply amounts to 532,000 sqm, with four industrial projects under construction (29,700 sqm) expected to be completed by 1H 2017 at the latest. Most of the projects under construction are built-to-suit as this sector enjoys the highest demand in the market. A slight growth in rent ...

... Vilnius industrial supply amounts to 532,000 sqm, with four industrial projects under construction (29,700 sqm) expected to be completed by 1H 2017 at the latest. Most of the projects under construction are built-to-suit as this sector enjoys the highest demand in the market. A slight growth in rent ...

Colfax CORP (Form: 11-K, Received: 06/19/2015 16:44:14)

... Plan) as of December 31, 2014 and 2013, and the related statement of changes in net assets available for benefits for the year ended December 31, 2014. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statement ...

... Plan) as of December 31, 2014 and 2013, and the related statement of changes in net assets available for benefits for the year ended December 31, 2014. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statement ...

Custody Policy Statement Final-1

... advisory clients. This term includes clients from which your firm receives no compensation, such as family members of your supervised persons. If your firm also provides other services (e.g., accounting services), this term does not include clients that are not investment advisory clients.” The Divi ...

... advisory clients. This term includes clients from which your firm receives no compensation, such as family members of your supervised persons. If your firm also provides other services (e.g., accounting services), this term does not include clients that are not investment advisory clients.” The Divi ...

Implications of Behavioural Economics for Mandatory

... However, a growing research literature in behavioural economics suggests that plan members make systematic errors with respect to their retirement saving, leading ultimately to reductions in economic welfare. While lack of adequate disclosure or knowledge over financial matters may be partially res ...

... However, a growing research literature in behavioural economics suggests that plan members make systematic errors with respect to their retirement saving, leading ultimately to reductions in economic welfare. While lack of adequate disclosure or knowledge over financial matters may be partially res ...

Life-cycle management of PERCO company pension savings

... Employees enrolling in a PERCO must be offered at least three investment vehicles with different profiles. These are generally Employee Investment Funds (FCPEs), and one of them must be an Social impact fund1. Employees are free to choose their investment; if they do not express a specific preferen ...

... Employees enrolling in a PERCO must be offered at least three investment vehicles with different profiles. These are generally Employee Investment Funds (FCPEs), and one of them must be an Social impact fund1. Employees are free to choose their investment; if they do not express a specific preferen ...

Realpool Investment Fund - British Columbia Investment

... Comprehensive Income. The Fund’s investments are designated as FVTPL. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value of financial assets and liabilities trad ...

... Comprehensive Income. The Fund’s investments are designated as FVTPL. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value of financial assets and liabilities trad ...

dynamic analysis of hedge funds - Markov Processes International Inc.

... In this paper, we review one of the most effective financial multi-factor models, called Returns Based Style Analysis (RBSA), from the standpoint of its performance in detecting dynamic factor exposures of hedge funds using only fund performance data. We analyze the shortcomings of earlier models in ...

... In this paper, we review one of the most effective financial multi-factor models, called Returns Based Style Analysis (RBSA), from the standpoint of its performance in detecting dynamic factor exposures of hedge funds using only fund performance data. We analyze the shortcomings of earlier models in ...

68 KB - Financial System Inquiry

... Recommendation 11: Consider increasing the maximum size for SMSF’s to encourage family units for greater engagement, education, risk reduction and cost efficiency. My most troubling issues over the last 40years in dealings in financial services relate to advisors with conflicts of interest and a fai ...

... Recommendation 11: Consider increasing the maximum size for SMSF’s to encourage family units for greater engagement, education, risk reduction and cost efficiency. My most troubling issues over the last 40years in dealings in financial services relate to advisors with conflicts of interest and a fai ...

Download attachment

... purchase units that entitle the holder to a proportional share of the value of the fund’s portfolio. The open fund itself is managed by a financial company, which may be a legal entity exclusively dedicated to this task or may have other business interests. Like other corporations, the financial com ...

... purchase units that entitle the holder to a proportional share of the value of the fund’s portfolio. The open fund itself is managed by a financial company, which may be a legal entity exclusively dedicated to this task or may have other business interests. Like other corporations, the financial com ...

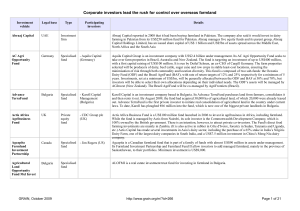

The new farm owners table

... APG (All Pensions Group) was established in March 2008 and is one of the largest managers of pension assets in the world, handling about €217 billion from the pensions of 2.7 million Dutch. APG recently established a Farmland Fund to invest in "structures that lease out farmland as well as structure ...

... APG (All Pensions Group) was established in March 2008 and is one of the largest managers of pension assets in the world, handling about €217 billion from the pensions of 2.7 million Dutch. APG recently established a Farmland Fund to invest in "structures that lease out farmland as well as structure ...

Apresentação do PowerPoint - Portal do Governo da Cidade de

... Public-Private Partnership(PPP) Law; Environmental Law; Foreign Exchange Law. ...

... Public-Private Partnership(PPP) Law; Environmental Law; Foreign Exchange Law. ...

Does portfolio manager ownership affect fund performance? Finnish

... In the U.S., the new regulation was subject to a broad debate. There were a lot of discussion about whether it is useful for an investor to know the manager’s stake in the fund or does the information only tell whether the fund makes sense for the manager’s personal portfolio. However, according to ...

... In the U.S., the new regulation was subject to a broad debate. There were a lot of discussion about whether it is useful for an investor to know the manager’s stake in the fund or does the information only tell whether the fund makes sense for the manager’s personal portfolio. However, according to ...

The Importance of Fees on Your Retirement Savings

... applied when you purchase units of a fund. A percentage of your purchase is deducted and the remaining money is used to purchase units of the fund, meaning less money is available to purchase fund units. Deferred sales charge (DSC) - A fee applied when you sell units of a fund. Usually calculated as ...

... applied when you purchase units of a fund. A percentage of your purchase is deducted and the remaining money is used to purchase units of the fund, meaning less money is available to purchase fund units. Deferred sales charge (DSC) - A fee applied when you sell units of a fund. Usually calculated as ...