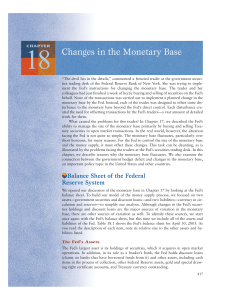

Changes in the Monetary Base

... Federal Reserve float. Federal Reserve float occurs during the check-clearing process when the Fed doesn’t credit a bank with payment at the same time that it debits the bank on which the check is drawn. Suppose that Bigco receives a check for $1 million from Engulf, drawn on Engulf’s bank, Megabank ...

... Federal Reserve float. Federal Reserve float occurs during the check-clearing process when the Fed doesn’t credit a bank with payment at the same time that it debits the bank on which the check is drawn. Suppose that Bigco receives a check for $1 million from Engulf, drawn on Engulf’s bank, Megabank ...

$doc.title

... was in place and those in which IMF support was absent. The aim is to get consistent estimates for β imf and β int -- the effects of IMF-support on output. Policies adopted in the absence of an IMF-supported program ( xit ) are directly observable only for non-program periods, and a key part of the ...

... was in place and those in which IMF support was absent. The aim is to get consistent estimates for β imf and β int -- the effects of IMF-support on output. Policies adopted in the absence of an IMF-supported program ( xit ) are directly observable only for non-program periods, and a key part of the ...

International Economics, 10e (Krugman/Obstfeld/Melitz) Chapter 17

... 21) What have we assumed when we conclude that a real depreciation of the currency improves the current account? A) The volume effect outweighs the value effect. B) The value effect outweighs the volume effect. C) All else equal and the volume effect outweighs the value effect. D) All else equal an ...

... 21) What have we assumed when we conclude that a real depreciation of the currency improves the current account? A) The volume effect outweighs the value effect. B) The value effect outweighs the volume effect. C) All else equal and the volume effect outweighs the value effect. D) All else equal an ...

NBER WORKING PAPER SERIES GLOBAL ECONOMIC ARCHITECTURE

... capital flows. The beneficial effect of hoarding reserves to deal with exposure to volatile TOT is reinforced by the evidence in Aghion et al. (2006), who found that real exchange rate volatility reduces growth for countries with relatively low levels of financial development. Hence, factors mitigat ...

... capital flows. The beneficial effect of hoarding reserves to deal with exposure to volatile TOT is reinforced by the evidence in Aghion et al. (2006), who found that real exchange rate volatility reduces growth for countries with relatively low levels of financial development. Hence, factors mitigat ...

Exchange Rates

... exchange rate and net export demand – Effects of changes in real interest rates • A rise in the domestic real interest rate (with the foreign real interest rate held constant) causes foreigners to want to buy domestic assets, increasing the demand for domestic currency and raising the exchange rate ...

... exchange rate and net export demand – Effects of changes in real interest rates • A rise in the domestic real interest rate (with the foreign real interest rate held constant) causes foreigners to want to buy domestic assets, increasing the demand for domestic currency and raising the exchange rate ...

Foreign Exchange Intervention Since the Plaza Accord

... account balances. The evidence from the 1980s does not refute that skepticism. However, the experience of the past 15 years shows that intervention can have important sustained effects if it is large enough. A number of countries—most notably China—have used massive and sustained intervention to hol ...

... account balances. The evidence from the 1980s does not refute that skepticism. However, the experience of the past 15 years shows that intervention can have important sustained effects if it is large enough. A number of countries—most notably China—have used massive and sustained intervention to hol ...

A Historical Assessment of the Rationale and Functions of Reserve

... to raise reserve requirements rather than sell securities from its portfolio seems justifiable. At the time of the initial reserve requirement increase in August 1936 excess reserves were approximately 3 billion dollars, while the Fed’s total portfolio of earning assets, by then essentially governme ...

... to raise reserve requirements rather than sell securities from its portfolio seems justifiable. At the time of the initial reserve requirement increase in August 1936 excess reserves were approximately 3 billion dollars, while the Fed’s total portfolio of earning assets, by then essentially governme ...

European Commission

... alone were estimated at €20 to €25 billion per year in the EU. With no exchange risks or costs, cross-border trade within the euro area is encouraged. Not only can companies sell into a much larger ‘home market’, but they can also find new suppliers offering better services or lower costs. More inte ...

... alone were estimated at €20 to €25 billion per year in the EU. With no exchange risks or costs, cross-border trade within the euro area is encouraged. Not only can companies sell into a much larger ‘home market’, but they can also find new suppliers offering better services or lower costs. More inte ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... it reflects the last year of “the previous regime” of highly restricted capital flows.1 The year 2003–4 is the most recent year observed. GDP: Over this eleven-year period, GDP measured in current dollars grew by an average of 9.4 percent per annum. Current account: India undertook major initiatives ...

... it reflects the last year of “the previous regime” of highly restricted capital flows.1 The year 2003–4 is the most recent year observed. GDP: Over this eleven-year period, GDP measured in current dollars grew by an average of 9.4 percent per annum. Current account: India undertook major initiatives ...

Competitiveness and its leverage in a currency union

... the quality and performance of the education system, the legal and judiciary system, labor relations and the functioning of the labor market, market structure and the degree of monopoly, as well as any other institution that contributes to the country’s better economic performance relative to other ...

... the quality and performance of the education system, the legal and judiciary system, labor relations and the functioning of the labor market, market structure and the degree of monopoly, as well as any other institution that contributes to the country’s better economic performance relative to other ...

Money, Banks, and the Federal Reserve System

... theory of money is not literally correct because the velocity of money is not constant, it is true that in the long run inflation results from the money supply growing faster than real GDP. When governments attempt to raise revenue by selling large quantities of bonds to the central bank, the money ...

... theory of money is not literally correct because the velocity of money is not constant, it is true that in the long run inflation results from the money supply growing faster than real GDP. When governments attempt to raise revenue by selling large quantities of bonds to the central bank, the money ...

bank-created money, monetary sovereignty, and the federal deficit

... huddled around kitchen tables, making tough choices about what they hold most dear and what they can learn to live without. They expect and deserve their leaders to do the same. The American people are counting on us to put politics aside, pull together not pull apart, and agree on a plan to live wi ...

... huddled around kitchen tables, making tough choices about what they hold most dear and what they can learn to live without. They expect and deserve their leaders to do the same. The American people are counting on us to put politics aside, pull together not pull apart, and agree on a plan to live wi ...

AbootalebiShahrooz1979

... of diverse accounting procedures for transactions in different currencies where there is not a continuing stable relationship between the currencies. Due to the slowly changing currency rate among industrial countries,prior to World War II, accounting for foreign currency translations did not receiv ...

... of diverse accounting procedures for transactions in different currencies where there is not a continuing stable relationship between the currencies. Due to the slowly changing currency rate among industrial countries,prior to World War II, accounting for foreign currency translations did not receiv ...

Relationships between Currency Carry Trade and Stock

... known as “forward premium puzzle”, to generate positive returns with “crash” risks associated with funding currencies. UIP states that the interest rate differential between two currencies should be offset by the expected appreciation of the low yielding currency. Carry trade investors, theoreticall ...

... known as “forward premium puzzle”, to generate positive returns with “crash” risks associated with funding currencies. UIP states that the interest rate differential between two currencies should be offset by the expected appreciation of the low yielding currency. Carry trade investors, theoreticall ...

LCcarG715_en.pdf

... regime. In smaller economies, current account transactions dominate their external transactions. In addition, capital markets are incipient and not fully developed markets. Their thinness may aggravate rather than cushion exchange rate variations. Finally, the exchange can act as the nominal anchor ...

... regime. In smaller economies, current account transactions dominate their external transactions. In addition, capital markets are incipient and not fully developed markets. Their thinness may aggravate rather than cushion exchange rate variations. Finally, the exchange can act as the nominal anchor ...

International Gold Standard and US Moentary Policy from World War

... Relief came without the suspension of the gold standard in the United States. On July 31, the New York Stock Exchange joined the world's other major exchanges in closing its doors, thus easing pressure on the gold standard by preventing the export of gold arising from foreign sales of U.S. corporate ...

... Relief came without the suspension of the gold standard in the United States. On July 31, the New York Stock Exchange joined the world's other major exchanges in closing its doors, thus easing pressure on the gold standard by preventing the export of gold arising from foreign sales of U.S. corporate ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.