Foreign Currency Transactions

... Foreign Currency Transactions A U.S. company acquires 5,000 from its bank on January 1, 20X1; for use in further purchases from German companies. ...

... Foreign Currency Transactions A U.S. company acquires 5,000 from its bank on January 1, 20X1; for use in further purchases from German companies. ...

Foreign Exchange Market - KV Institute of Management and

... The foreign exchange market assists international trade and investment by enabling currency conversion. For example, it permits a business in the United States to import goods from the European Union member states especially Euro zone members and pay Euros, even though its income is in United St ...

... The foreign exchange market assists international trade and investment by enabling currency conversion. For example, it permits a business in the United States to import goods from the European Union member states especially Euro zone members and pay Euros, even though its income is in United St ...

cont`d

... commercial banks and other types of financial institutions, such as credit unions and mutual savings banks – Any accounts in financial institutions on which you can easily transmit debit-card and check payments without many restrictions ...

... commercial banks and other types of financial institutions, such as credit unions and mutual savings banks – Any accounts in financial institutions on which you can easily transmit debit-card and check payments without many restrictions ...

"#$%! DISCUSSION PAPER SERIES !!!"#$%&"'&()

... of the United States. The upsurge in global reserve growth confronts economists with an important puzzle. What has driven it, and is it likely to endure? The facts to be explained can be summarized as follows. Starting from the end of the Bretton Woods era, reserves as a fraction of GDP grew dramati ...

... of the United States. The upsurge in global reserve growth confronts economists with an important puzzle. What has driven it, and is it likely to endure? The facts to be explained can be summarized as follows. Starting from the end of the Bretton Woods era, reserves as a fraction of GDP grew dramati ...

NBER WORKING PAPER SERIES FEAR OF SUDDEN STOPS: Ricardo Caballero

... and Australia to recent external shocks and from Australia’s historical experience. Why Australia? While it is much more developed than Latin America, it has several structural features that make it similar to several countries in the region. Through its history it has been exposed to many external ...

... and Australia to recent external shocks and from Australia’s historical experience. Why Australia? While it is much more developed than Latin America, it has several structural features that make it similar to several countries in the region. Through its history it has been exposed to many external ...

FREE Sample Here

... of the depository bank of the securities dealer. Thus, open market purchases increase total reserves in the banking system directly, immediately, and dollar-for-dollar. During the financial crisis of 2007-2009, the Fed expanded open market operations from using only Treasury securities to buying lar ...

... of the depository bank of the securities dealer. Thus, open market purchases increase total reserves in the banking system directly, immediately, and dollar-for-dollar. During the financial crisis of 2007-2009, the Fed expanded open market operations from using only Treasury securities to buying lar ...

CHAPTER 2 THE FEDERAL RESERVE AND ITS POWERS

... reserve account of the depository bank of the securities dealer. Thus, open market purchases increase total reserves in the banking system directly, immediately, and dollar-for-dollar. During the financial crisis of 2007-2009, the Fed expanded open market operations from using only Treasury securiti ...

... reserve account of the depository bank of the securities dealer. Thus, open market purchases increase total reserves in the banking system directly, immediately, and dollar-for-dollar. During the financial crisis of 2007-2009, the Fed expanded open market operations from using only Treasury securiti ...

Proof of Stake Velocity: Building the Social

... and financial institutions or complement them? Is cryptocurrency designed for hoarding or spending? And, the most fundamental question of all: is cryptocurrency real currency or just virtual property for speculation [13]? So far innovation in the cryptocurrency world has been almost exclusively tech ...

... and financial institutions or complement them? Is cryptocurrency designed for hoarding or spending? And, the most fundamental question of all: is cryptocurrency real currency or just virtual property for speculation [13]? So far innovation in the cryptocurrency world has been almost exclusively tech ...

Exchange Rate Volatility and Democratization in Emerging Market

... But what of countries like Indonesia where democracy is just taking root? In incipient democraciesFthat is, countries where democratic institutions are emerging but the polity retains a significant degree of authoritarianismFthere is a greater possibility of coups and democratic reversals. Hence pol ...

... But what of countries like Indonesia where democracy is just taking root? In incipient democraciesFthat is, countries where democratic institutions are emerging but the polity retains a significant degree of authoritarianismFthere is a greater possibility of coups and democratic reversals. Hence pol ...

the yen: eye on intervention

... BoJ policy has become ineffective in slowing yen appreciation,” said Kenneth Broux at Lloyds TSB Corporate Markets. “In the context of a weakening U.S. economy and the clouded outlook for risk assets, I suspect the yen will stay supported in the short term.” August proved to be a crucial month for t ...

... BoJ policy has become ineffective in slowing yen appreciation,” said Kenneth Broux at Lloyds TSB Corporate Markets. “In the context of a weakening U.S. economy and the clouded outlook for risk assets, I suspect the yen will stay supported in the short term.” August proved to be a crucial month for t ...

A Currency Union or an Exchange Rate Union: Evidence from

... currency area in East Asia. Before the Asian financial crisis in 1997, most East Asian countries adopted a fixed exchange rate regime or a managed floating regime, virtually pegging to the U.S. dollar. This dollar peg makes the exports of the countries, which compete with Japan for exports, fluctuat ...

... currency area in East Asia. Before the Asian financial crisis in 1997, most East Asian countries adopted a fixed exchange rate regime or a managed floating regime, virtually pegging to the U.S. dollar. This dollar peg makes the exports of the countries, which compete with Japan for exports, fluctuat ...

The economics of digital currencies

... assessment of the risks that they may, in time, pose to the Bank of England’s objectives for monetary and financial stability. A companion piece provides an introduction to digital currency schemes, including some historical context for their development and an outline of how they work. From the per ...

... assessment of the risks that they may, in time, pose to the Bank of England’s objectives for monetary and financial stability. A companion piece provides an introduction to digital currency schemes, including some historical context for their development and an outline of how they work. From the per ...

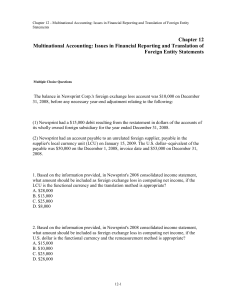

Ch12 – Financial Reporting and Translation of Foreign

... company on January 1, 2008, for $1,100,000. The British subsidiary's net assets amounted to 500,000 pounds on the date of acquisition. On January 1, 2008, the book values of its identifiable assets and liabilities approximated their fair values. As a result of an analysis of functional currency indi ...

... company on January 1, 2008, for $1,100,000. The British subsidiary's net assets amounted to 500,000 pounds on the date of acquisition. On January 1, 2008, the book values of its identifiable assets and liabilities approximated their fair values. As a result of an analysis of functional currency indi ...

G I , T D

... by Aylward (2007: 3), in the past few years “the IMF has on average issued over 30 working papers a year on exchange rate-related issues.” How do the IMF’s internal researchers feel about the June 15 decision? The IMF’s work on exchange rate surveillance draws considerable analytical support from th ...

... by Aylward (2007: 3), in the past few years “the IMF has on average issued over 30 working papers a year on exchange rate-related issues.” How do the IMF’s internal researchers feel about the June 15 decision? The IMF’s work on exchange rate surveillance draws considerable analytical support from th ...

Exchange Rate Regime Choice in Historical Perspective

... transactions costs of exchanging different currencies into each other. By 1900, most nations had switched away from silver and bimetallic standards and adhered to the gold standard. Fiat money and floating was considered to be a radical departure from fiscal and monetary stability and was only to b ...

... transactions costs of exchanging different currencies into each other. By 1900, most nations had switched away from silver and bimetallic standards and adhered to the gold standard. Fiat money and floating was considered to be a radical departure from fiscal and monetary stability and was only to b ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.