LG3 \KEY STRATEGIES for REACHING GLOBAL MARKETS

... • High value of the dollar – Dollar is trading for more foreign currency; foreign goods are less expensive. • Low value of the dollar – Dollar is trading for less foreign currency; foreign goods are more expensive. • Currencies float in value depending on the supply and demand for them in the global ...

... • High value of the dollar – Dollar is trading for more foreign currency; foreign goods are less expensive. • Low value of the dollar – Dollar is trading for less foreign currency; foreign goods are more expensive. • Currencies float in value depending on the supply and demand for them in the global ...

The international Monetary system note 3

... System • An Eclectic Currency Arrangement (1973 – Present) – Since March 1973, exchange rates have become much more volatile and less predictable than they were during the “fixed” period – There have been numerous, significant world currency events over the past 30 years ...

... System • An Eclectic Currency Arrangement (1973 – Present) – Since March 1973, exchange rates have become much more volatile and less predictable than they were during the “fixed” period – There have been numerous, significant world currency events over the past 30 years ...

The New US-Asian Dollar Bloc

... imports decline and the nation begins to live within its means—that is, no longer consumes in imports more than it produces. But America has little need to fear this kind of stress right now. China, India, and much of the rest of Asia, to keep their currencies from rising against the dollar, must bu ...

... imports decline and the nation begins to live within its means—that is, no longer consumes in imports more than it produces. But America has little need to fear this kind of stress right now. China, India, and much of the rest of Asia, to keep their currencies from rising against the dollar, must bu ...

B. Exchange Rates and the Foreign Exchange Market Exchange

... Impact of changes in the current exchange rate on expected returns ...

... Impact of changes in the current exchange rate on expected returns ...

The Devaluation of the Yuan* Prabhat Patnaik

... appreciated by as much as 50 percent since 2005. Even compared to the year 2009 which had witnessed a major appreciation, China’s TWER had appreciated by a further 20 percent until recently, which means that other countries’ goods were becoming relatively cheaper compared to the Chinese goods, witho ...

... appreciated by as much as 50 percent since 2005. Even compared to the year 2009 which had witnessed a major appreciation, China’s TWER had appreciated by a further 20 percent until recently, which means that other countries’ goods were becoming relatively cheaper compared to the Chinese goods, witho ...

Реч на управителя на Българската народна банка Иван Искров

... 2001 as a consequence of the terrorist attacks in the US, and the crash in the prices of high tech companies’ stocks, the war in Iraq, and the unprecedented price increases of energy resources and the global imbalances in the recent years. In this period Bulgaria developed with relatively high and s ...

... 2001 as a consequence of the terrorist attacks in the US, and the crash in the prices of high tech companies’ stocks, the war in Iraq, and the unprecedented price increases of energy resources and the global imbalances in the recent years. In this period Bulgaria developed with relatively high and s ...

Liaquat Ahmad, Currency Wars, Then and Now, Foreign Affairs

... problems of adjustment faced by Germany and the United Kingdom during the early 1930s. They are, however, being given some temporary assistance through the European Central Bank and the European Financial Stability Facility to help them weather the storm. The other major exception is the so-called d ...

... problems of adjustment faced by Germany and the United Kingdom during the early 1930s. They are, however, being given some temporary assistance through the European Central Bank and the European Financial Stability Facility to help them weather the storm. The other major exception is the so-called d ...

EVERYONE AGREES – Currency Manipulation is a Problem Arthur

... sanction surplus countries, especially to counter and deter competitive currency policies. Indeed, this systemic failure almost assures that the problem will continue because the manipulators get away with it and thus are presented a policy option, especially attractive in tough economic times, thro ...

... sanction surplus countries, especially to counter and deter competitive currency policies. Indeed, this systemic failure almost assures that the problem will continue because the manipulators get away with it and thus are presented a policy option, especially attractive in tough economic times, thro ...

CHAPTER 16

... sometimes called an infant industries tariff High tariffs may protect jobs at home Retaliatory tariffs can cost us money ...

... sometimes called an infant industries tariff High tariffs may protect jobs at home Retaliatory tariffs can cost us money ...

Exchange Rate

... Arbitrage • Arbitrage—the activity of simultaneously buying a currency in one market while selling in another to take advantage of profit opportunities. • For example: in our textbook the XR quotation is ...

... Arbitrage • Arbitrage—the activity of simultaneously buying a currency in one market while selling in another to take advantage of profit opportunities. • For example: in our textbook the XR quotation is ...

Argentina: Goodbye Currency Restrictions, Welcome Foreign I

... However, the government is aware of the risks, as several comments by Minister Prat Gay suggest. The market will give the government a “window of opportunity” (considering that their beginnings have been auspicious and the government has been fulfilling electoral promises). But the market will also ...

... However, the government is aware of the risks, as several comments by Minister Prat Gay suggest. The market will give the government a “window of opportunity” (considering that their beginnings have been auspicious and the government has been fulfilling electoral promises). But the market will also ...

Lecture15-ForeignExchangeMarketB

... goods (exports) tends to appreciate the dollar, because the American goods will continue to sell well even at a higher value for the dollar. ...

... goods (exports) tends to appreciate the dollar, because the American goods will continue to sell well even at a higher value for the dollar. ...

ECON 401 November 12, 2012 Export-led growth and the 1980s

... depended on the availability of foreign exchange Foreign exchange shortage emerged as one the most important barriers to the industrialization process during the last years of the 1970s. The shortage of foreign exchange also led to the shortages of key intermediate goods such as oil and electricity ...

... depended on the availability of foreign exchange Foreign exchange shortage emerged as one the most important barriers to the industrialization process during the last years of the 1970s. The shortage of foreign exchange also led to the shortages of key intermediate goods such as oil and electricity ...

Background of European Union

... high deficits that they were forced to adopt a low interest rate policy ◦ currency devaluation would help the devaluing country by boosting exports, and allowing the country to regain the flexibility it needed to stimulate its economy through interest rate cuts ...

... high deficits that they were forced to adopt a low interest rate policy ◦ currency devaluation would help the devaluing country by boosting exports, and allowing the country to regain the flexibility it needed to stimulate its economy through interest rate cuts ...

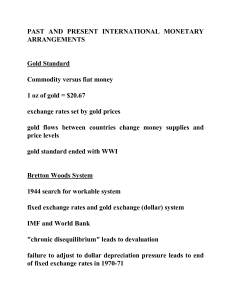

past and present international monetary

... *prices could fall in Malaysia relative to Indonesia *the ringgit could fall in value relative to the rupiah (thereby changing relative prices) If resources are immobile, then flexible exchange rates help to adjust relative prices when the monetary authorities try to limit price changes ...

... *prices could fall in Malaysia relative to Indonesia *the ringgit could fall in value relative to the rupiah (thereby changing relative prices) If resources are immobile, then flexible exchange rates help to adjust relative prices when the monetary authorities try to limit price changes ...

Argentina Crisis Presentation

... Mexico Crisis 1995 (Argentina recovered) Asian Crisis 1997 ( terms of trade) Russian Crisis 1998 (K-flows dried out) Brazilian devaluation January 1999 Euro depreciation against dollar 2000 World recession 2001 ...

... Mexico Crisis 1995 (Argentina recovered) Asian Crisis 1997 ( terms of trade) Russian Crisis 1998 (K-flows dried out) Brazilian devaluation January 1999 Euro depreciation against dollar 2000 World recession 2001 ...

Macro_5.2-_Foreign_Exchange_FOREX

... Imagine a huge table with all the different currencies from every country This is the Foreign Exchange Market! Just like at a product market, you can’t take things without paying. If you demand one currency, you must supply your currency. Ex: If Canadians what Russian Rubles. The demand for Rubles i ...

... Imagine a huge table with all the different currencies from every country This is the Foreign Exchange Market! Just like at a product market, you can’t take things without paying. If you demand one currency, you must supply your currency. Ex: If Canadians what Russian Rubles. The demand for Rubles i ...

SIMON FRASER UNIVERSITY Department of Economics Econ 345 Prof. Kasa

... employment (while not exacerbating an already problematic government budget deficit). [Hint: See the recent working paper, “Fiscal Devaluations” by Emmanuel Farhi, Gita Gopinath, and Oleg Itskhoki]. In general, this is a complicated question, so please be generous with partial credit. I asked it bec ...

... employment (while not exacerbating an already problematic government budget deficit). [Hint: See the recent working paper, “Fiscal Devaluations” by Emmanuel Farhi, Gita Gopinath, and Oleg Itskhoki]. In general, this is a complicated question, so please be generous with partial credit. I asked it bec ...

Currency war

Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. As the price to buy a country's currency falls so too does the price of exports. Imports to the country become more expensive. So domestic industry, and thus employment, receives a boost in demand from both domestic and foreign markets. However, the price increase for imports can harm citizens' purchasing power. The policy can also trigger retaliatory action by other countries which in turn can lead to a general decline in international trade, harming all countries.Competitive devaluation has been rare through most of history as countries have generally preferred to maintain a high value for their currency. Countries have generally allowed market forces to work, or have participated in systems of managed exchanges rates. An exception occurred when currency war broke out in the 1930s. As countries abandoned the Gold Standard during the Great Depression, they used currency devaluations to stimulate their economies. Since this effectively pushes unemployment overseas, trading partners quickly retaliated with their own devaluations. The period is considered to have been an adverse situation for all concerned, as unpredictable changes in exchange rates reduced overall international trade.According to Guido Mantega, the Brazilian Minister for Finance, a global currency war broke out in 2010. This view was echoed by numerous other government officials and financial journalists from around the world. Other senior policy makers and journalists suggested the phrase ""currency war"" overstated the extent of hostility. With a few exceptions, such as Mantega, even commentators who agreed there had been a currency war in 2010 generally concluded that it had fizzled out by mid-2011.States engaging in possible competitive devaluation since 2010 have used a mix of policy tools, including direct government intervention, the imposition of capital controls, and, indirectly, quantitative easing. While many countries experienced undesirable upward pressure on their exchange rates and took part in the ongoing arguments, the most notable dimension of the 2010–11 episode was the rhetorical conflict between the United States and China over the valuation of the yuan. In January 2013, measures announced by Japan which were expected to devalue its currency sparked concern of a possible second 21st century currency war breaking out, this time with the principal source of tension being not China versus the US, but Japan versus the Eurozone. By late February, concerns of a new outbreak of currency war had been mostly allayed, after the G7 and G20 issued statements committing to avoid competitive devaluation. After the European Central Bank launched a fresh programme of quantitative easing in January 2015, there was once again an intensification of discussion about currency war.