Chapter 08 - Canvas (canvas.park.edu)

... •LO9 Discuss the influence of currency exchange controls on international business. •LO10 Summarize the influences of differences in taxation and inflation rates on international business. •LO11 Explain the significance of the balance of payments (BOP) to international business decisions. ...

... •LO9 Discuss the influence of currency exchange controls on international business. •LO10 Summarize the influences of differences in taxation and inflation rates on international business. •LO11 Explain the significance of the balance of payments (BOP) to international business decisions. ...

Chapter15 - University of San Diego Home Pages

... capital outflow Change in foreign holdings of U.S. assets statistical discrepancy – capital inflow The difference represents Net Capital Flow ...

... capital outflow Change in foreign holdings of U.S. assets statistical discrepancy – capital inflow The difference represents Net Capital Flow ...

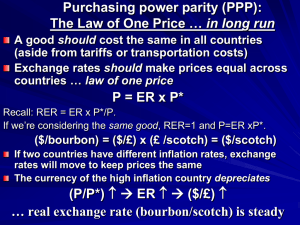

1 - UCSB Economics

... purposes: stock and bond trades denominated entirely in euros, all transactions between banks, bank customers can write checks in euros. Euro notes were introduced in January, 2002, with time limits on using/converting the old national notes. This is an extreme version of fixed exchange rates, as it ...

... purposes: stock and bond trades denominated entirely in euros, all transactions between banks, bank customers can write checks in euros. Euro notes were introduced in January, 2002, with time limits on using/converting the old national notes. This is an extreme version of fixed exchange rates, as it ...

Fixed Rate System: Preview of Results

... – Your currency depreciates – Your exports become more attractive – Your export industries aren’t hurt as badly as they would otherwise be – Your country’s terms of trade worsen ...

... – Your currency depreciates – Your exports become more attractive – Your export industries aren’t hurt as badly as they would otherwise be – Your country’s terms of trade worsen ...

When Does Integration Pay?

... “In the face of market pressure against a currency, a central bank committed to the external goal of a fixed exchange rate must raise domestic interest rates, even if this means forgoing the internal goal of setting interest rates with an eye toward domestic economic conditions. The only way to ma ...

... “In the face of market pressure against a currency, a central bank committed to the external goal of a fixed exchange rate must raise domestic interest rates, even if this means forgoing the internal goal of setting interest rates with an eye toward domestic economic conditions. The only way to ma ...

Single currency - IS MU

... • US dollar was convertible to gold by fixed rate and exchange rates for other currencies were fixed in multilateral agreements • These rates aintained with interventions on highly regulated currency markets. • Loans of the International Monetary Fund should maintain this stability. • It contributed ...

... • US dollar was convertible to gold by fixed rate and exchange rates for other currencies were fixed in multilateral agreements • These rates aintained with interventions on highly regulated currency markets. • Loans of the International Monetary Fund should maintain this stability. • It contributed ...

Chpt.7

... Background: the high unemployment conditions of the Great Depression and the malevolent competitive currency devaluations of the 1930s.-----------”Beggar thy neighbor” Contents of The Bretton Woods System: • Set up in July 1944. • Three outcomes: WB, GATT, IMF • A quais self-adjusting mechanism: An ...

... Background: the high unemployment conditions of the Great Depression and the malevolent competitive currency devaluations of the 1930s.-----------”Beggar thy neighbor” Contents of The Bretton Woods System: • Set up in July 1944. • Three outcomes: WB, GATT, IMF • A quais self-adjusting mechanism: An ...

3.E Money in the European Union High School Lesson Plan

... Then, teacher will guide students to practice using current exchange rates, which can be found online. Using proportional reasoning and ratios, students will convert prices from US Dollars to Euros and will convert between other types of currencies. After some guided practice, students will work on ...

... Then, teacher will guide students to practice using current exchange rates, which can be found online. Using proportional reasoning and ratios, students will convert prices from US Dollars to Euros and will convert between other types of currencies. After some guided practice, students will work on ...

PDF Download

... levels – more exactly: at the level of the anchor currency. Moreover, a currency board (in contrast to circulating foreign currency in the domestic economy, for example, “dollarisation”) creates some seigniorage revenues. But there are drawbacks too: International de- and revaluations of the foreign ...

... levels – more exactly: at the level of the anchor currency. Moreover, a currency board (in contrast to circulating foreign currency in the domestic economy, for example, “dollarisation”) creates some seigniorage revenues. But there are drawbacks too: International de- and revaluations of the foreign ...

Khon Kaen University International College

... An alternative to exporting (global reach) Often because of incentives from governments ...

... An alternative to exporting (global reach) Often because of incentives from governments ...

International Money and the International Monetary System

... • but may not be able to exhibit all the desirable properties Government intervention to enhance acceptability • Preserving trust in money, and avoiding situations that may result in high transaction costs (forgery, hyperinflation, ...

... • but may not be able to exhibit all the desirable properties Government intervention to enhance acceptability • Preserving trust in money, and avoiding situations that may result in high transaction costs (forgery, hyperinflation, ...

Lecture Slides Chapter 15

... o counters a balance of payment deficit by making exports less expensive ...

... o counters a balance of payment deficit by making exports less expensive ...

SS6CG5B

... • One result of the EU is the creation of the Euro • The European countries have their own currencies • The Euro is the currency of most of the EU • Member countries can choose to give up their own currencies and exchange them for euros ...

... • One result of the EU is the creation of the Euro • The European countries have their own currencies • The Euro is the currency of most of the EU • Member countries can choose to give up their own currencies and exchange them for euros ...

The Role of Exchange Rate

... A rise in U.S. interest rates relative to those abroad will increase demand for U.S. assets. The demand for dollars will increase. The supply of dollars will decrease as fewer Americans sell their dollars to buy foreign assets. ...

... A rise in U.S. interest rates relative to those abroad will increase demand for U.S. assets. The demand for dollars will increase. The supply of dollars will decrease as fewer Americans sell their dollars to buy foreign assets. ...

Module Exchange Rates and Macroeconomic Policy

... fixed exchange rate regime • Why open-economy considerations affect macroeconomic policy under floating exchange rates ...

... fixed exchange rate regime • Why open-economy considerations affect macroeconomic policy under floating exchange rates ...

Brazil: Policy Responses to the Global Crisis and the

... • The authorities´ current concerns over how to reignite growth and private domestic investment in the midst of fiscal headwinds and monetary “tsunamis” from developed countries imply a different sense of urgency regarding currency internationalization and further integration with the BRICs economie ...

... • The authorities´ current concerns over how to reignite growth and private domestic investment in the midst of fiscal headwinds and monetary “tsunamis” from developed countries imply a different sense of urgency regarding currency internationalization and further integration with the BRICs economie ...

exchange rates

... The value of a country’s A) money B) currency C) exchange rate is extremely important to all businesses engaged in international A) commerce B) stock market C) trade – imports and exports. For over a quarter of a century after the Second World War, most currencies were A) pegged B) measured C) excha ...

... The value of a country’s A) money B) currency C) exchange rate is extremely important to all businesses engaged in international A) commerce B) stock market C) trade – imports and exports. For over a quarter of a century after the Second World War, most currencies were A) pegged B) measured C) excha ...

china currency conundrum - Quist Wealth Management

... dollar, yen, or euro) to currencies that are pegged to another currency (or basket of currencies) or currencies that use a “managed float” system, like the yuan. Although China has made noises about letting the yuan float freely, until it does, it cannot even be considered in the same league as the ...

... dollar, yen, or euro) to currencies that are pegged to another currency (or basket of currencies) or currencies that use a “managed float” system, like the yuan. Although China has made noises about letting the yuan float freely, until it does, it cannot even be considered in the same league as the ...

By dint of railing at fools, we risk becoming fools

... subject to change without notice and might not be followed with a specific ad-hoc document. This material should not be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the general in ...

... subject to change without notice and might not be followed with a specific ad-hoc document. This material should not be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the general in ...

Currency war

Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. As the price to buy a country's currency falls so too does the price of exports. Imports to the country become more expensive. So domestic industry, and thus employment, receives a boost in demand from both domestic and foreign markets. However, the price increase for imports can harm citizens' purchasing power. The policy can also trigger retaliatory action by other countries which in turn can lead to a general decline in international trade, harming all countries.Competitive devaluation has been rare through most of history as countries have generally preferred to maintain a high value for their currency. Countries have generally allowed market forces to work, or have participated in systems of managed exchanges rates. An exception occurred when currency war broke out in the 1930s. As countries abandoned the Gold Standard during the Great Depression, they used currency devaluations to stimulate their economies. Since this effectively pushes unemployment overseas, trading partners quickly retaliated with their own devaluations. The period is considered to have been an adverse situation for all concerned, as unpredictable changes in exchange rates reduced overall international trade.According to Guido Mantega, the Brazilian Minister for Finance, a global currency war broke out in 2010. This view was echoed by numerous other government officials and financial journalists from around the world. Other senior policy makers and journalists suggested the phrase ""currency war"" overstated the extent of hostility. With a few exceptions, such as Mantega, even commentators who agreed there had been a currency war in 2010 generally concluded that it had fizzled out by mid-2011.States engaging in possible competitive devaluation since 2010 have used a mix of policy tools, including direct government intervention, the imposition of capital controls, and, indirectly, quantitative easing. While many countries experienced undesirable upward pressure on their exchange rates and took part in the ongoing arguments, the most notable dimension of the 2010–11 episode was the rhetorical conflict between the United States and China over the valuation of the yuan. In January 2013, measures announced by Japan which were expected to devalue its currency sparked concern of a possible second 21st century currency war breaking out, this time with the principal source of tension being not China versus the US, but Japan versus the Eurozone. By late February, concerns of a new outbreak of currency war had been mostly allayed, after the G7 and G20 issued statements committing to avoid competitive devaluation. After the European Central Bank launched a fresh programme of quantitative easing in January 2015, there was once again an intensification of discussion about currency war.