Plan Summary - Meteor Asset Management

... 15% per annum (simple) for each year the Plan is in force, so the returns at each possible early maturity date would be 15% (end of year 1), 30% (end of year 2), 45% (end of year 3); 60% (end of year 4); 75% (end of year 5) or if the plan runs a full six year term and the Final Levels of eight or mo ...

... 15% per annum (simple) for each year the Plan is in force, so the returns at each possible early maturity date would be 15% (end of year 1), 30% (end of year 2), 45% (end of year 3); 60% (end of year 4); 75% (end of year 5) or if the plan runs a full six year term and the Final Levels of eight or mo ...

Balance Sheets Methodology

... table and identify which item pertains to a pension when appropriate. In the process, we net out pension fund assets that are liabilities of the parent government. For example, the Z1 data will include as assets of the pension fund Treasury securities in the federal government defined benefit pensio ...

... table and identify which item pertains to a pension when appropriate. In the process, we net out pension fund assets that are liabilities of the parent government. For example, the Z1 data will include as assets of the pension fund Treasury securities in the federal government defined benefit pensio ...

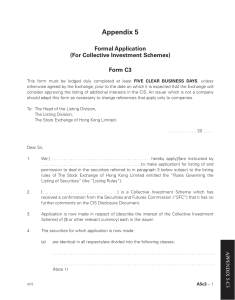

Appendix 5

... Schemes and with the Listing Rules from time to time of The Stock Exchange of Hong Kong Limited so far as applicable to the Collective Investment Scheme. ...

... Schemes and with the Listing Rules from time to time of The Stock Exchange of Hong Kong Limited so far as applicable to the Collective Investment Scheme. ...

U.S. Treasury Department Unveils New Reporting Requirement for

... The U.S. Government imposes a wide range of reporting requirements on U.S.-resident entities with regard to their cross-border transactions. The two largest systems of reporting are those of the Treasury Department and the Commerce Department. The Treasury Department’s forms are part of the Treasury ...

... The U.S. Government imposes a wide range of reporting requirements on U.S.-resident entities with regard to their cross-border transactions. The two largest systems of reporting are those of the Treasury Department and the Commerce Department. The Treasury Department’s forms are part of the Treasury ...

MTS Group Regulatory Structure

... Disclaimer: Capitalised terms in the communication shall have the meaning ascribed to them in the MTS Glossary document here: http://mtsmarkets.com/Legal. Additional regulatory information can be found here: http://www.mtsmarkets.com/ Documents/Regulatory-structure. This communication is addressed t ...

... Disclaimer: Capitalised terms in the communication shall have the meaning ascribed to them in the MTS Glossary document here: http://mtsmarkets.com/Legal. Additional regulatory information can be found here: http://www.mtsmarkets.com/ Documents/Regulatory-structure. This communication is addressed t ...

Bank Investment in Other Financial Institution Debt

... The Total Loss Absorbing Capacity (TLAC) Notice of Proposed Rulemaking (NPR) issued on October 30, 2015, adds senior BHC debt issued by 8 U.S. Global Systemically Important Banks (GSIBs) (covered BHCs) to the list of instruments potentially deducted from the investing financial institution’s regula ...

... The Total Loss Absorbing Capacity (TLAC) Notice of Proposed Rulemaking (NPR) issued on October 30, 2015, adds senior BHC debt issued by 8 U.S. Global Systemically Important Banks (GSIBs) (covered BHCs) to the list of instruments potentially deducted from the investing financial institution’s regula ...

MacroGenics Enters Collaboration and License Agreement with

... such forward-looking statements as a result of various important factors, including: the uncertainties inherent in the initiation and enrollment of future clinical trials, expectations of expanding ongoing clinical trials, availability and timing of data from ongoing clinical trials, expectations fo ...

... such forward-looking statements as a result of various important factors, including: the uncertainties inherent in the initiation and enrollment of future clinical trials, expectations of expanding ongoing clinical trials, availability and timing of data from ongoing clinical trials, expectations fo ...

Answers to end of chapter questions

... Indirect investing involves the purchase and sale of investment company shares. Since investment companies hold portfolios of securities, an investor owning investment company shares indirectly owns a pro-rata share of a portfolio of securities. ...

... Indirect investing involves the purchase and sale of investment company shares. Since investment companies hold portfolios of securities, an investor owning investment company shares indirectly owns a pro-rata share of a portfolio of securities. ...

Financial Statement Analysis and Security Valuation

... Amortized cost is based on the historical cost measurement rule and avoids manipulation in the financial statements. But historical cost does not capture any change in value since acquisition. Market prices give the change in value since acquisition. But (fair) market values can be biased if market ...

... Amortized cost is based on the historical cost measurement rule and avoids manipulation in the financial statements. But historical cost does not capture any change in value since acquisition. Market prices give the change in value since acquisition. But (fair) market values can be biased if market ...

DOC - ESW Group

... LLP (“MSCM”), the Company’s independent registered public accountants, merged with MNP LLP (“MNP”). Most of the professional staff of MSCM continued with MNP either as employees or partners of MNP and will continue their practice with MNP. MSCM’s reports on the Company’s financial statements as of a ...

... LLP (“MSCM”), the Company’s independent registered public accountants, merged with MNP LLP (“MNP”). Most of the professional staff of MSCM continued with MNP either as employees or partners of MNP and will continue their practice with MNP. MSCM’s reports on the Company’s financial statements as of a ...

I. INTRODUCTION TO SECURITIES TRADING AND MARKETS

... difficult for our national economy to sustain continued growth: indeed, the state of U.S. capital market development, more advanced than that of any other industrial country, is an important contributing factor in the rapid economic growth this country has experienced. Securities brokers support the ...

... difficult for our national economy to sustain continued growth: indeed, the state of U.S. capital market development, more advanced than that of any other industrial country, is an important contributing factor in the rapid economic growth this country has experienced. Securities brokers support the ...

PIMCO VIT Income Portfolio — Advisor Class

... The investment seeks to maximize current income; long-term capital appreciation is a secondary objective. The portfolio seeks to achieve its investment objectives by investing under normal circumstances at least 65% of its total assets in a multi-sector portfolio of Fixed Income Instruments of varyi ...

... The investment seeks to maximize current income; long-term capital appreciation is a secondary objective. The portfolio seeks to achieve its investment objectives by investing under normal circumstances at least 65% of its total assets in a multi-sector portfolio of Fixed Income Instruments of varyi ...

Investment products risk and fees disclosure

... instrument. The so-called hedge funds are legally less regulated and may often use leverage and/or invest into different financial instruments of high risk (read below for more detail). Often presuming a large initial investment and setting restrictions on withdrawing your money from the fund, such ...

... instrument. The so-called hedge funds are legally less regulated and may often use leverage and/or invest into different financial instruments of high risk (read below for more detail). Often presuming a large initial investment and setting restrictions on withdrawing your money from the fund, such ...

Green bonds - Squarespace

... have professional experience in matters relating to investments who fall within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 and (b) persons to whom it may otherwise lawfully be communicated (together “relevant persons”). The investments to which this ...

... have professional experience in matters relating to investments who fall within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 and (b) persons to whom it may otherwise lawfully be communicated (together “relevant persons”). The investments to which this ...

Bond - McGraw Hill Higher Education

... • Initial Public Offering (IPO) -- The first offering of a corporation’s stock. ...

... • Initial Public Offering (IPO) -- The first offering of a corporation’s stock. ...

DISADVANTAGES of ISSUING BONDS LG4

... • Initial Public Offering (IPO) -- The first offering of a corporation’s stock. ...

... • Initial Public Offering (IPO) -- The first offering of a corporation’s stock. ...

FSI Statement on Introduction of Senate Regulatory Reform

... is to determine the appropriate obligations of brokers, dealers, investment advisers, and their associated persons relating to the provision of personalized investment advice about securities sales to retail customers. The SEC would be required to report the results of the study to Congress within t ...

... is to determine the appropriate obligations of brokers, dealers, investment advisers, and their associated persons relating to the provision of personalized investment advice about securities sales to retail customers. The SEC would be required to report the results of the study to Congress within t ...

Multiple Choice

... Tom, and accountant for Universal Company, learns that Vicky, a Universal director, has violated insidertrading laws. Tom does not suffer a loss in trading with Vicky, but reports her to the Securities and Exchange Commission. Tom may be entitled to a. a bounty payment. b. damages equal to the amoun ...

... Tom, and accountant for Universal Company, learns that Vicky, a Universal director, has violated insidertrading laws. Tom does not suffer a loss in trading with Vicky, but reports her to the Securities and Exchange Commission. Tom may be entitled to a. a bounty payment. b. damages equal to the amoun ...

MR0159 - Loan Value granted to Significant Security Positions Held

... regulatory rates that are required to be used for Member firm and customer account positions and they are set based on the type of security (i.e., debt or equity) and other factors such a credit rating, traded price, market on which the security trades, et cetera. In addition to the basic margin req ...

... regulatory rates that are required to be used for Member firm and customer account positions and they are set based on the type of security (i.e., debt or equity) and other factors such a credit rating, traded price, market on which the security trades, et cetera. In addition to the basic margin req ...

purchase and sale of company securities

... which securities are to be purchased or sold on the person’s behalf (or a written formula by which the amount, price and dates of trades will be determined). The affirmative defense afforded by Rule 10b5-1 will be unavailable if the trading person alters or deviates from the contract, instruction or ...

... which securities are to be purchased or sold on the person’s behalf (or a written formula by which the amount, price and dates of trades will be determined). The affirmative defense afforded by Rule 10b5-1 will be unavailable if the trading person alters or deviates from the contract, instruction or ...

TIAA-CREF Emerging Markets Debt Fund

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standard ...

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standard ...

Provisions on Issues concerning the Implementation of the

... by Qualified Foreign Institutional Investors For the purpose of further improving the pilot program on qualified foreign institutional investors (hereinafter referred to as the “QFII”), the issues concerning the implementation of the Administrative Measures for Securities Investment made in China by ...

... by Qualified Foreign Institutional Investors For the purpose of further improving the pilot program on qualified foreign institutional investors (hereinafter referred to as the “QFII”), the issues concerning the implementation of the Administrative Measures for Securities Investment made in China by ...

Provisions on Issues concerning the Implementation of the

... by Qualified Foreign Institutional Investors For the purpose of further improving the pilot program on qualified foreign institutional investors (hereinafter referred to as the “QFII”), the issues concerning the implementation of the Administrative Measures for Securities Investment made in China by ...

... by Qualified Foreign Institutional Investors For the purpose of further improving the pilot program on qualified foreign institutional investors (hereinafter referred to as the “QFII”), the issues concerning the implementation of the Administrative Measures for Securities Investment made in China by ...

Cemeent

... business or any branch or department thereof and to use, exercise, develop, grant licences in respect of or otherwise turn to account any property, rights and information so acquired, subject to any permission required under the law. ...

... business or any branch or department thereof and to use, exercise, develop, grant licences in respect of or otherwise turn to account any property, rights and information so acquired, subject to any permission required under the law. ...

DOC - ESW Group

... On May 31, 2013, Environmental Solution Worldwide Inc. (the “Company”) received notice that, effective as of June 1, 2013, MSCM LLP (“MSCM”), the Company’s independent registered public accountants, merged with MNP LLP (“MNP”). Most of the professional staff of MSCM continued with MNP either as empl ...

... On May 31, 2013, Environmental Solution Worldwide Inc. (the “Company”) received notice that, effective as of June 1, 2013, MSCM LLP (“MSCM”), the Company’s independent registered public accountants, merged with MNP LLP (“MNP”). Most of the professional staff of MSCM continued with MNP either as empl ...