14.02 Quiz 2 Solutions Fall 2004 Multiple

... that only for the first two periods (t=1 and t=2) people form their expectations using θ=0. From t=3 on, they start using θ=1 forever. Assume that the government still wants to keep unemployment at 2%. What is the expected rate of inflation for t=4? A) B) C) D) E) ...

... that only for the first two periods (t=1 and t=2) people form their expectations using θ=0. From t=3 on, they start using θ=1 forever. Assume that the government still wants to keep unemployment at 2%. What is the expected rate of inflation for t=4? A) B) C) D) E) ...

An Intertemporal General Equilibrium Model of Asset Prices

... IN THIS PAPER, we develop a general equilibrium asset pricing model for use in applied research. An important feature of the model is its integration of real and financial markets. Among other things, the model endogenously determines the stochastic process followed by the equilibrium price of any f ...

... IN THIS PAPER, we develop a general equilibrium asset pricing model for use in applied research. An important feature of the model is its integration of real and financial markets. Among other things, the model endogenously determines the stochastic process followed by the equilibrium price of any f ...

Farms, Fertiliser, and Financial Frictions: Yields

... A critical feature of many LICs is that agriculture accounts for a relatively large proportion of GDP, and a larger proportion of employment; in 2008 in Kenya, agricultural value added represented 23% of GDP, while 79% of the population was rural (Karugia et al., 2010). As a result, volatile weather ...

... A critical feature of many LICs is that agriculture accounts for a relatively large proportion of GDP, and a larger proportion of employment; in 2008 in Kenya, agricultural value added represented 23% of GDP, while 79% of the population was rural (Karugia et al., 2010). As a result, volatile weather ...

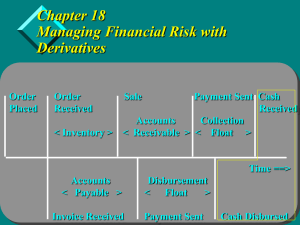

Document

... markets. Arbitrage opportunities exist because some markets react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to market. If, for instance, a corporation wants term floating-rate f ...

... markets. Arbitrage opportunities exist because some markets react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to market. If, for instance, a corporation wants term floating-rate f ...

A Summary of the Primary Causes of the Housing Bubble and the

... percent. If XYZ borrows $100 million on short-term loans at 4 percent interest in order to invest an additional $100 million in mortgagebacked securities paying 7 percent interest, XYZ is now leveraged at 10 to 1 ($10 in debt for every $1 in equity). XYZ’s return on equity will now be 37 percent (pr ...

... percent. If XYZ borrows $100 million on short-term loans at 4 percent interest in order to invest an additional $100 million in mortgagebacked securities paying 7 percent interest, XYZ is now leveraged at 10 to 1 ($10 in debt for every $1 in equity). XYZ’s return on equity will now be 37 percent (pr ...

Tips for Avoiding a Predatory Mortgage Loan

... Forbearance: Your mortgage payments are reduced or suspended for a period to which you and your servicer agree. At the end of that time, you resume making your regular payments as well as a lump sum payment or additional partial payments for a number of months to bring the loan current. Forbearance ...

... Forbearance: Your mortgage payments are reduced or suspended for a period to which you and your servicer agree. At the end of that time, you resume making your regular payments as well as a lump sum payment or additional partial payments for a number of months to bring the loan current. Forbearance ...

Deferred Fixed Annuities

... Selecting a fixed annuity just got easier Choosing a fixed annuity can be a complex and time-consuming process. Pricing can vary widely depending on the features you’ve chosen, and there are many different options available. It can be challenging to get the right mix for your situation. With The Fid ...

... Selecting a fixed annuity just got easier Choosing a fixed annuity can be a complex and time-consuming process. Pricing can vary widely depending on the features you’ve chosen, and there are many different options available. It can be challenging to get the right mix for your situation. With The Fid ...