Islamic Private Equity,Derivatives and Structured Products Investment

... against interest rate or price risk of the primary market. • Normally, in future trading, the seller of a contract (known as a short) will notify the exchange of his intention to deliver contracts to a buyer (called the long) as the contract delivery month draws near. ©Copyrights reserved Amanie 200 ...

... against interest rate or price risk of the primary market. • Normally, in future trading, the seller of a contract (known as a short) will notify the exchange of his intention to deliver contracts to a buyer (called the long) as the contract delivery month draws near. ©Copyrights reserved Amanie 200 ...

Changing Interest Rates: The Impact on Your Portfolio

... have delivered strong historical returns during rising rate periods. • These investments tend to perform in line with the business cycle. As the economy grows or experiences higher inflation, these investments have outperformed more conservative investments like U.S. Government Bonds. • Duration-neu ...

... have delivered strong historical returns during rising rate periods. • These investments tend to perform in line with the business cycle. As the economy grows or experiences higher inflation, these investments have outperformed more conservative investments like U.S. Government Bonds. • Duration-neu ...

Analysis of the Discount Factors in Swap Valuation

... Currency swaps, introduced in the 1970s due to foreign exchange controls in Britain, have been an important tool for financing. [2] In a currency swap contract, Party A makes predetermined payments periodically to Party B in one currency like U.S. dollars, meanwhile, Party B pays a certain amount i ...

... Currency swaps, introduced in the 1970s due to foreign exchange controls in Britain, have been an important tool for financing. [2] In a currency swap contract, Party A makes predetermined payments periodically to Party B in one currency like U.S. dollars, meanwhile, Party B pays a certain amount i ...

Read on - Women`s Enterprise Centre

... afford it. A word of caution: your line of credit can sometimes become locked (no more room) if you are unable to make a regular payment on the principle and you may end up only able to make monthly interest payments. The lender has the right to convert it to a term loan, resulting in a monthly paym ...

... afford it. A word of caution: your line of credit can sometimes become locked (no more room) if you are unable to make a regular payment on the principle and you may end up only able to make monthly interest payments. The lender has the right to convert it to a term loan, resulting in a monthly paym ...

How the Affluent Manage Home Equity to Safely and Conservatively

... in the old way of paying off a mortgage, which is as soon as possible. Brother A bites the bullet and secures a fifteen-year mortgage at 6.38% APR and shells out all $40,000 of his savings as a 20% down payment, leaving him zero dollars to invest. This leaves him with a monthly payment of $1,383. Sin ...

... in the old way of paying off a mortgage, which is as soon as possible. Brother A bites the bullet and secures a fifteen-year mortgage at 6.38% APR and shells out all $40,000 of his savings as a 20% down payment, leaving him zero dollars to invest. This leaves him with a monthly payment of $1,383. Sin ...

Counterparty A

... One counterparty make periodic payments to the other at a fixed price for a given quantity of notional commodity, while the second counterparty pays the first counterparty a floating price for the same quantity of notional commodity. ...

... One counterparty make periodic payments to the other at a fixed price for a given quantity of notional commodity, while the second counterparty pays the first counterparty a floating price for the same quantity of notional commodity. ...

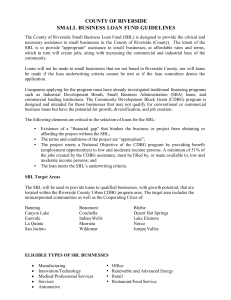

county of riverside small business loan fund guidelines

... capacity, conditions, social benefit, and building plan. The scale ranges from 0-10 in each of the e i gh t ( 8 ) categories. Application viability will require that an application receive a minimum score of seven (7) in each category. The credit score will take into consideration the applicant’s ex ...

... capacity, conditions, social benefit, and building plan. The scale ranges from 0-10 in each of the e i gh t ( 8 ) categories. Application viability will require that an application receive a minimum score of seven (7) in each category. The credit score will take into consideration the applicant’s ex ...

IOSR Journal of Business and Management (IOSR-JBM) ISSN: 2278-487X.

... ranging from 1.5 to 1.9 for nominal money balance, (his indicating that demand for money is not sensitive to interest rate. However, income elasticity for real balance using both narrow and broad money is less than unity, (v) The speed of adjustment is fast. Teriba (1974) carried out a study which h ...

... ranging from 1.5 to 1.9 for nominal money balance, (his indicating that demand for money is not sensitive to interest rate. However, income elasticity for real balance using both narrow and broad money is less than unity, (v) The speed of adjustment is fast. Teriba (1974) carried out a study which h ...

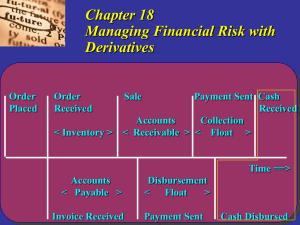

Chapter 17: Managing Interest Rate Risk

... react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is co ...

... react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is co ...