Reporting of Derivative Instruments - NAIC I-Site

... deposit in cash or securities. This deposit is to protect the counterparty in the event the insurer cannot make required payments. Insurers exposed to interest rate risk can take short positions in U.S. Treasury futures contracts. In this case, the insurer receives payments if interest rates increas ...

... deposit in cash or securities. This deposit is to protect the counterparty in the event the insurer cannot make required payments. Insurers exposed to interest rate risk can take short positions in U.S. Treasury futures contracts. In this case, the insurer receives payments if interest rates increas ...

Optimal Hedge Ratio and Hedge Efficiency

... The evidence on options can be divided into five areas: (i) The effect of listing of options on volatility and liquidity (bid-ask spread) of underlying cash market (Trennepohl and Dukes, 1979; Skinner, 1989; Watt, Yadav and Draper, 1992; Chamberlain, Cheung and Kwan, 1993; Kumar, Sarin and Shastri, ...

... The evidence on options can be divided into five areas: (i) The effect of listing of options on volatility and liquidity (bid-ask spread) of underlying cash market (Trennepohl and Dukes, 1979; Skinner, 1989; Watt, Yadav and Draper, 1992; Chamberlain, Cheung and Kwan, 1993; Kumar, Sarin and Shastri, ...

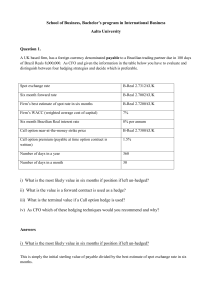

Sample questions

... A long call option + long put option with the same underlying asset, expiration date and strike price A long call option + short put option with the same underlying asset, expiration date and strike price A short call option + long put option with the same underlying asset, expiration date and strik ...

... A long call option + long put option with the same underlying asset, expiration date and strike price A long call option + short put option with the same underlying asset, expiration date and strike price A short call option + long put option with the same underlying asset, expiration date and strik ...

Towards a Theory of Volatility Trading

... If the futures price process is a continuous semi-martingale, then Itô’s lemma implies that E0 ln FFT0 ...

... If the futures price process is a continuous semi-martingale, then Itô’s lemma implies that E0 ln FFT0 ...

GASB Statement No. 72 – Fair Value Measurement and Application

... (b) Long/short equity – This category includes investments in hedge funds that invest domestically and globally in both long and short common stocks across all market capitalizations. These investments offer a low correlation to traditional long-only equity benchmarks in order to achieve absolute re ...

... (b) Long/short equity – This category includes investments in hedge funds that invest domestically and globally in both long and short common stocks across all market capitalizations. These investments offer a low correlation to traditional long-only equity benchmarks in order to achieve absolute re ...

Contd…

... a figure reflecting predictions made by analysts or by the company itself. More often than not they aren't very accurate. This is the problem: trailing earnings are known but are relatively less important since investors are more interested in the future earning potential of a company. ...

... a figure reflecting predictions made by analysts or by the company itself. More often than not they aren't very accurate. This is the problem: trailing earnings are known but are relatively less important since investors are more interested in the future earning potential of a company. ...

VPFF Risk Derivates

... instruments can be used to create a hedge against an anticipated unfavourable price development in the underlying asset. They can also be used to achieve a profit or yield with a smaller capital investment than would be required in order to make an equivalent deal directly in the underlying asset. D ...

... instruments can be used to create a hedge against an anticipated unfavourable price development in the underlying asset. They can also be used to achieve a profit or yield with a smaller capital investment than would be required in order to make an equivalent deal directly in the underlying asset. D ...

Discrete Barrier and Lookback Options

... Asian options is of separate interest, and requires totally different techniques. Discrete American options are closely related to numerical pricing of American options; there is a separate survey in this handbook on them. Due to the similarity between discrete barrier options and discrete lookback ...

... Asian options is of separate interest, and requires totally different techniques. Discrete American options are closely related to numerical pricing of American options; there is a separate survey in this handbook on them. Due to the similarity between discrete barrier options and discrete lookback ...

Hedging

... Options are traded the same way futures contracts are traded, with the exception of margin requirements. Most option buyers and sellers elect to liquidate their option positions by an offsetting sale or purchase at or prior to expiration. ...

... Options are traded the same way futures contracts are traded, with the exception of margin requirements. Most option buyers and sellers elect to liquidate their option positions by an offsetting sale or purchase at or prior to expiration. ...

NBER WORKING PAPER SERIES RESOLVING MACROECONOMIC UNCERTAINTY IN STOCK AND BOND MARKETS

... on individual equity options for firms that are part of the S&P 100 index, since an explicit requirement for membership in this index is to have a liquid options market.10 We then sort stocks into industries and further into groups of industries that we anticipate to be cyclical or non-cyclical. Spe ...

... on individual equity options for firms that are part of the S&P 100 index, since an explicit requirement for membership in this index is to have a liquid options market.10 We then sort stocks into industries and further into groups of industries that we anticipate to be cyclical or non-cyclical. Spe ...

Homework - Purdue Math

... Good Standing at the issue of the policy. Calculate the annual benefit premium (paid at the beginning of the year by those in Good Standing and those Out of Favor) for an employee who is In Good Standing at the issue of the policy. Calculate the reserve that Italian Life should hold at the end of th ...

... Good Standing at the issue of the policy. Calculate the annual benefit premium (paid at the beginning of the year by those in Good Standing and those Out of Favor) for an employee who is In Good Standing at the issue of the policy. Calculate the reserve that Italian Life should hold at the end of th ...

Chapter 15

... on or before a certain expiration date. B. There are two types of options: call options and put options. C. Each offers an opportunity to take advantage of futures price moves without actually having a futures position. D. Options are not marginable so there is no possibility of a margin call Dr. Da ...

... on or before a certain expiration date. B. There are two types of options: call options and put options. C. Each offers an opportunity to take advantage of futures price moves without actually having a futures position. D. Options are not marginable so there is no possibility of a margin call Dr. Da ...

3 Comparison of installment option and vanilla option

... The next example deals with the representation of American option in the graphical decomposition model. In much the same way as its European counterpart there are two states to consider, see figure 2. The distinctive feature of the American option is that the second state, option exercised can be at ...

... The next example deals with the representation of American option in the graphical decomposition model. In much the same way as its European counterpart there are two states to consider, see figure 2. The distinctive feature of the American option is that the second state, option exercised can be at ...

The Option Greeks and Market Making

... • To illustrate delta hedging for a multiple option book, recall our earlier three-option book that had delta -17,100, gamma = -3600 and vega = -1,730,000. Here the dealer must purchase 17,100 shares of the underlying stock in order to instantaneously delta hedge the book. Rebalancing occurs thereaf ...

... • To illustrate delta hedging for a multiple option book, recall our earlier three-option book that had delta -17,100, gamma = -3600 and vega = -1,730,000. Here the dealer must purchase 17,100 shares of the underlying stock in order to instantaneously delta hedge the book. Rebalancing occurs thereaf ...

A Fully-Dynamic Closed-Form Solution for ∆-Hedging

... illiquidity no longer maintains the zero-liquidity-cost optimal portfolio targett but instead trades towards it to correct this ‘misholding’. Furthermore, also as in Garleanu and Pedersen (2009), the agent’s trading intensity θt is proportional to the difference between his current holdings and the ...

... illiquidity no longer maintains the zero-liquidity-cost optimal portfolio targett but instead trades towards it to correct this ‘misholding’. Furthermore, also as in Garleanu and Pedersen (2009), the agent’s trading intensity θt is proportional to the difference between his current holdings and the ...

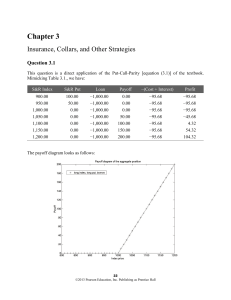

Chapter 3

... The strategy of buying a call (or put) and selling a call (or put) at a higher strike is called call (put) bull spread. In order to draw the profit diagrams, we need to find the future value of the cost of entering in the bull spread positions. We have: Cost of call bull spread: ($120.405 − $93.809) ...

... The strategy of buying a call (or put) and selling a call (or put) at a higher strike is called call (put) bull spread. In order to draw the profit diagrams, we need to find the future value of the cost of entering in the bull spread positions. We have: Cost of call bull spread: ($120.405 − $93.809) ...

Full text - Высшая школа экономики

... reveal the deviations from market efficiency. Second was that option returns make it possible to study very particular types of risks. In their particular work, they use delta-neutral straddles as an example of a strategy that is immune to either small market fluctuations or sharp crashes, but that ...

... reveal the deviations from market efficiency. Second was that option returns make it possible to study very particular types of risks. In their particular work, they use delta-neutral straddles as an example of a strategy that is immune to either small market fluctuations or sharp crashes, but that ...

Term Structure Lattice Models

... term-structure of interest rates in the market place. The 2 − 8 terminology means that the swaption is an option that expires in 2 months to enter an 8-month swap. The swap is settled in arrears so that payments would take place in months 3 through 10 based on the prevailing short-rate of the previo ...

... term-structure of interest rates in the market place. The 2 − 8 terminology means that the swaption is an option that expires in 2 months to enter an 8-month swap. The swap is settled in arrears so that payments would take place in months 3 through 10 based on the prevailing short-rate of the previo ...

16: Asset Valuation: Derivative Investments

... underlying asset declining by an amount greater then what was protected with the hedge. ...

... underlying asset declining by an amount greater then what was protected with the hedge. ...