Annual Report 2016

... In 2016, despite major efforts undertaken in a slightly declining market, the ams group did not succeed in repeating the outstanding financial results achieved in the year before. Over the past year, ams’ revenues and earnings did not meet our own expectations. The medium and long-term prospects of ...

... In 2016, despite major efforts undertaken in a slightly declining market, the ams group did not succeed in repeating the outstanding financial results achieved in the year before. Over the past year, ams’ revenues and earnings did not meet our own expectations. The medium and long-term prospects of ...

KEYW HOLDING CORP (Form: 10-K, Received: 03

... malicious cyber threats within customers' networks through the use of automated tools and continuous updates to cyber threat profiles and alert levels. Project G was derived from our work protecting Intelligence Community networks, and is intended to address new markets beyond the Intelligence Commu ...

... malicious cyber threats within customers' networks through the use of automated tools and continuous updates to cyber threat profiles and alert levels. Project G was derived from our work protecting Intelligence Community networks, and is intended to address new markets beyond the Intelligence Commu ...

PROXY STATEMENT - People`s United Bank

... SEC rules and regulations permit “householding,” meaning that we are allowed to deliver only one copy of the Notice or Annual Report on Form 10-K, notice of annual meeting and proxy statement to two or more shareholders who share an address. If you previously consented to householding, you will rece ...

... SEC rules and regulations permit “householding,” meaning that we are allowed to deliver only one copy of the Notice or Annual Report on Form 10-K, notice of annual meeting and proxy statement to two or more shareholders who share an address. If you previously consented to householding, you will rece ...

Download Dissertation

... (1997). These two papers show how security market data restrict the admissible region for means and standard deviations of intertemporal marginal rates of substitution (IMRS) which can be used to assess model specification. Specifically, Hansen and Jagannathan (1991) calculate the lower bound on the ...

... (1997). These two papers show how security market data restrict the admissible region for means and standard deviations of intertemporal marginal rates of substitution (IMRS) which can be used to assess model specification. Specifically, Hansen and Jagannathan (1991) calculate the lower bound on the ...

Avalon Advanced Materials Inc. (Form: 20-F

... Cautionary Note to United States Investors Concerning Reserve and Resource Estimates The reserve and resource estimates in this Annual Report have been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Unles ...

... Cautionary Note to United States Investors Concerning Reserve and Resource Estimates The reserve and resource estimates in this Annual Report have been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Unles ...

1) Determine if each lease is an operating or a capital lease. 2) For

... (a) the lease life exceeds 75% of the life of the asset (b) there is a transfer of ownership to the lessee at the end of the lease term (c) there is an option to purchase the asset at a "bargain price" at the end of the lease term. (d) the present value of the lease payments, discounted at an approp ...

... (a) the lease life exceeds 75% of the life of the asset (b) there is a transfer of ownership to the lessee at the end of the lease term (c) there is an option to purchase the asset at a "bargain price" at the end of the lease term. (d) the present value of the lease payments, discounted at an approp ...

RIO TINTO PLC (Form: 11-K/A, Received: 11/30/2015 15:47:39)

... participants will retire upon reaching age 65 and invest in various collective trust and mutual funds. Effective December 20, 2013, the Plan was amended to (1) limit the total amount of participant contributions to the Rio Tinto ADR Stock Fund to a maximum of 20% of the total amount of participant a ...

... participants will retire upon reaching age 65 and invest in various collective trust and mutual funds. Effective December 20, 2013, the Plan was amended to (1) limit the total amount of participant contributions to the Rio Tinto ADR Stock Fund to a maximum of 20% of the total amount of participant a ...

whole foods market, inc.

... We opened our first store in Austin, Texas in 1980 and completed our initial public offering in January 1992. As of September 30, 2007, we operated 276 stores organized into 11 geographic operating regions, each with its own leadership team: 263 stores in 37 U.S. states and the District of Columbia; ...

... We opened our first store in Austin, Texas in 1980 and completed our initial public offering in January 1992. As of September 30, 2007, we operated 276 stores organized into 11 geographic operating regions, each with its own leadership team: 263 stores in 37 U.S. states and the District of Columbia; ...

State-dependent fees for variable annuity guarantees

... complex guarantees have evolved partly for marketing purposes, to distinguish one insurer’s product from its competitors’, but also, in some cases, to avoid potentially costly lapse and re-entry incentives. Modern products offer a range of income and withdrawal benefits as optional riders, including ...

... complex guarantees have evolved partly for marketing purposes, to distinguish one insurer’s product from its competitors’, but also, in some cases, to avoid potentially costly lapse and re-entry incentives. Modern products offer a range of income and withdrawal benefits as optional riders, including ...

Real Options, Volatility, and Stock Returns∗

... of firms. Second, it does not require estimating the values of real options. Finally, it is robust to any type of real options that firms may possess. Following Leahy and Whited (1996) and Bulan (2005), we employ changes in volatility of stock returns as a proxy for changes in underlying volatility ...

... of firms. Second, it does not require estimating the values of real options. Finally, it is robust to any type of real options that firms may possess. Following Leahy and Whited (1996) and Bulan (2005), we employ changes in volatility of stock returns as a proxy for changes in underlying volatility ...

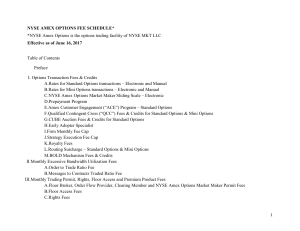

NYSE AMEX OPTIONS FEE SCHEDULE* *NYSE Amex

... absent, an ATP Holder that maintains a Reserve Floor Market Maker ATP is required to provide written notice to the Exchange, at least one business day in advance, that it will utilize such Reserve Floor Market Maker ATP. The notice will identify both the Floor Market Maker who will not be utilizing ...

... absent, an ATP Holder that maintains a Reserve Floor Market Maker ATP is required to provide written notice to the Exchange, at least one business day in advance, that it will utilize such Reserve Floor Market Maker ATP. The notice will identify both the Floor Market Maker who will not be utilizing ...

NIKE INC ( NKE ) 10−K

... Worldwide futures and advance orders for NIKE Brand athletic footwear and apparel, scheduled for delivery from June through November 2010, were $8.8 billion compared to $7.8 billion for the same period last year. This futures and advance order amount is calculated based upon our forecast of the actu ...

... Worldwide futures and advance orders for NIKE Brand athletic footwear and apparel, scheduled for delivery from June through November 2010, were $8.8 billion compared to $7.8 billion for the same period last year. This futures and advance order amount is calculated based upon our forecast of the actu ...

An Equilibrium Model of Catastrophe Insurance Futures and Spreads

... that of the insurer, this hedge will not be perfect. The splitting of the index into different regions, with some common pattern of risk exposures within each region, and with the risk inhomogeneity being between the regions, is clearly an advantage toward making the hedge more effective. Moreover, ...

... that of the insurer, this hedge will not be perfect. The splitting of the index into different regions, with some common pattern of risk exposures within each region, and with the risk inhomogeneity being between the regions, is clearly an advantage toward making the hedge more effective. Moreover, ...

Exchange-Traded Barrier Option and VPIN: Evidence from Hong Kong

... A bull contract is similar to a call warrant with underlying stock price S, maturity date T, strike price X and barrier H, where S > H ≥ X. If the contract is not called back before time T, it matures with a payoff of ST – X. ...

... A bull contract is similar to a call warrant with underlying stock price S, maturity date T, strike price X and barrier H, where S > H ≥ X. If the contract is not called back before time T, it matures with a payoff of ST – X. ...

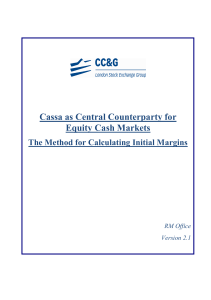

La Cassa Controparte Centrale dei Mercati Cash Azionari US

... In the case of portfolios also comprising options4 TIMS not only take into consideration extreme price variations within the Margin Interval, but also considers eight intermediate price scenarios. This is in order to properly evaluate the risk for those trading strategies whose maximum losses occur ...

... In the case of portfolios also comprising options4 TIMS not only take into consideration extreme price variations within the Margin Interval, but also considers eight intermediate price scenarios. This is in order to properly evaluate the risk for those trading strategies whose maximum losses occur ...

Financial Accounting and Accounting Standards

... company’s ¥100 par value ordinary shares. The company grants the options on January 1, 2011. The executives may exercise the options at any time within the next 10 years. The option price per share is ¥6,000, and the market price of the shares at the date of grant is ¥7,000 per share. Under the fair ...

... company’s ¥100 par value ordinary shares. The company grants the options on January 1, 2011. The executives may exercise the options at any time within the next 10 years. The option price per share is ¥6,000, and the market price of the shares at the date of grant is ¥7,000 per share. Under the fair ...

MAGELLAN HEALTH INC - Nasdaq`s INTEL Solutions

... cannot vote them for you and as a result, your shares will remain unvoted. Therefore, it is very important that you direct the vote of your shares on all items, including the election of directors, by filling out and returning a proxy card. Such broker non-votes are not considered to be entitled to ...

... cannot vote them for you and as a result, your shares will remain unvoted. Therefore, it is very important that you direct the vote of your shares on all items, including the election of directors, by filling out and returning a proxy card. Such broker non-votes are not considered to be entitled to ...

Introduction - Drake University

... Our goal is to explain the functioning of derivative markets in detail and then introduce how they can be used by business to manage both financial and non-financial risk. ...

... Our goal is to explain the functioning of derivative markets in detail and then introduce how they can be used by business to manage both financial and non-financial risk. ...

Adjusting the Black-Scholes Framework in the Presence of a Volatility Skew

... Try to create a model to improve the B-S model if there is a volatility smile. Why we need to use bisection method rather than Newton's method to get the volatility smile from the market, and why sometimes both these two methods ...

... Try to create a model to improve the B-S model if there is a volatility smile. Why we need to use bisection method rather than Newton's method to get the volatility smile from the market, and why sometimes both these two methods ...

Tax Treatment of Derivatives

... The US federal income taxation of derivative instruments is determined under numerous tax rules set forth in the US tax code, the regulations thereunder (and supplemented by various forms of published and unpublished guidance from the US tax authorities and by the case law).1 These tax rules dictate ...

... The US federal income taxation of derivative instruments is determined under numerous tax rules set forth in the US tax code, the regulations thereunder (and supplemented by various forms of published and unpublished guidance from the US tax authorities and by the case law).1 These tax rules dictate ...