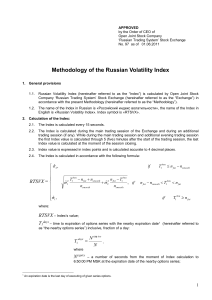

Methodology of the Volatility Index Calculation

... Ti – calendar period until an expiration date of nearby/next options series inclusive, fraction of a day: days ...

... Ti – calendar period until an expiration date of nearby/next options series inclusive, fraction of a day: days ...

Financial Derivatives - William & Mary Mathematics

... – Pats win, you win $1,000 - $500 = $500 – Pats lose, you lose $4,000 – $4,000 - $500 = -$500 ...

... – Pats win, you win $1,000 - $500 = $500 – Pats lose, you lose $4,000 – $4,000 - $500 = -$500 ...

Key

... 3. Paying dividends to a firm’s stockholders changes the firm in such a way that the firm’s bondholders are worse off. List (but do not discuss) these changes. 1) Reduction in firm’s assets, 2) payout of riskless assets leaves firm’s assets riskier. 4. List (but do not discuss) two reasons that the ...

... 3. Paying dividends to a firm’s stockholders changes the firm in such a way that the firm’s bondholders are worse off. List (but do not discuss) these changes. 1) Reduction in firm’s assets, 2) payout of riskless assets leaves firm’s assets riskier. 4. List (but do not discuss) two reasons that the ...

“The U.S. economy seems to be firming up as more people are

... per share at its March 2009 low. Pepsi in the past year or what we felt was earned $3.77 per share in 2009 so a $44 two. Although these are real companies fair value. We will keep an eye on the stock price divided by $3.77 = 11.7. and most of them are actually turning sector as valuations may become ...

... per share at its March 2009 low. Pepsi in the past year or what we felt was earned $3.77 per share in 2009 so a $44 two. Although these are real companies fair value. We will keep an eye on the stock price divided by $3.77 = 11.7. and most of them are actually turning sector as valuations may become ...

OPTIONS

... 64. The market price of ABC stock has been very volatile and you think this volatility will continue for a few weeks. Thus, you decide to purchase a one-month call option contract on ABC stock with a strike price of $25 and an option price of $1.30. You also purchase a one-month put option on ABC st ...

... 64. The market price of ABC stock has been very volatile and you think this volatility will continue for a few weeks. Thus, you decide to purchase a one-month call option contract on ABC stock with a strike price of $25 and an option price of $1.30. You also purchase a one-month put option on ABC st ...

The Black-Scholes Analysis

... substituted in the Black-Scholes, gives the option price • In practice it must be found by a “trial and error” iterative procedure ...

... substituted in the Black-Scholes, gives the option price • In practice it must be found by a “trial and error” iterative procedure ...

Sumitomo Corporation Announces the Exercise Price of Stock Options

... number of shares subject to such new share acquisition rights. The Exercise Price shall be JPY 1,124. When the Company issues new shares at a price below the market price following the issuance of new share acquisition rights, the Exercise Price shall be adjusted using the following formula, roundin ...

... number of shares subject to such new share acquisition rights. The Exercise Price shall be JPY 1,124. When the Company issues new shares at a price below the market price following the issuance of new share acquisition rights, the Exercise Price shall be adjusted using the following formula, roundin ...

Binomial Trees

... One principle underlying two angles If you can replicate, you can hedge: Long the option contract, short the replicating portfolio. The replication portfolio is composed of stock and bond. Since bond only generates parallel shifts in payoff and does not play any role in offsetting/hedging risks, it ...

... One principle underlying two angles If you can replicate, you can hedge: Long the option contract, short the replicating portfolio. The replication portfolio is composed of stock and bond. Since bond only generates parallel shifts in payoff and does not play any role in offsetting/hedging risks, it ...

chapter 2: the structure of options markets

... A call option priced at $2 with a stock price of $30 and an exercise price of $35 allows the holder to buy the stock at a. ...

... A call option priced at $2 with a stock price of $30 and an exercise price of $35 allows the holder to buy the stock at a. ...

STAT 473. Practice Problems for Exam 2 Spring 2015 Description

... (G) Any material seen in class could potentially be tested in your actual exam. ...

... (G) Any material seen in class could potentially be tested in your actual exam. ...

Options

... – an exchange of one set of assets (e.g. a fixed amount of money, cash flow from a project) against another set of assets (e.g. a fixed number of shares, a fixed amount of material, another cash flow stream) – at a specific time or at some time during a specific time interval, to be determined by on ...

... – an exchange of one set of assets (e.g. a fixed amount of money, cash flow from a project) against another set of assets (e.g. a fixed number of shares, a fixed amount of material, another cash flow stream) – at a specific time or at some time during a specific time interval, to be determined by on ...

Real options Primer

... risk can be avoided because the financial markets have priced the appropriate bundle of risk. ...

... risk can be avoided because the financial markets have priced the appropriate bundle of risk. ...

Options Contract Mechanics, Canola Futures

... Here’s an example. If you own a $400-strike November call option and the futures contract is trading at $410 per tonne, in theory you could exercise your option, buy the futures at $400 and make a quick $10 by selling them back at the going market price. For this reason, options are always worth as ...

... Here’s an example. If you own a $400-strike November call option and the futures contract is trading at $410 per tonne, in theory you could exercise your option, buy the futures at $400 and make a quick $10 by selling them back at the going market price. For this reason, options are always worth as ...