David Gray Remarks CBOE Update OIC Conference, Miami, Florida

... funds and closed-end funds that use exchange-listed options for portfolio management. I’d like to share two of the main highlights from the study: 1) The number of funds using options grew sharply over the last fifteen years -- from 10 in 2000 to 119 in 2014. And those 119 funds have an aggregate va ...

... funds and closed-end funds that use exchange-listed options for portfolio management. I’d like to share two of the main highlights from the study: 1) The number of funds using options grew sharply over the last fifteen years -- from 10 in 2000 to 119 in 2014. And those 119 funds have an aggregate va ...

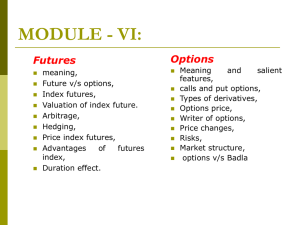

Derivatives - WordPress.com

... a contract which derives its value from the prices, or index of prices, of underlying securities; ...

... a contract which derives its value from the prices, or index of prices, of underlying securities; ...

Black-Scholes and the Volatility Surface

... 2. At any given maturity, T , the skew cannot be too steep. Otherwise butterfly arbitrages will exist. 3. Likewise the term structure of implied volatility cannot be too inverted. Otherwise calendar spread arbitrages will exist. In practice the implied volatility surface will not violate any of thes ...

... 2. At any given maturity, T , the skew cannot be too steep. Otherwise butterfly arbitrages will exist. 3. Likewise the term structure of implied volatility cannot be too inverted. Otherwise calendar spread arbitrages will exist. In practice the implied volatility surface will not violate any of thes ...

K 1 K 2

... What can be achieved when an option is traded in conjunction with other assets? Examine the properties of portfolios consisting of positions in: (1) an option and a zero-coupon bond (2) an option and the asset underlying the option (3) two or more options on the same underlying asset ...

... What can be achieved when an option is traded in conjunction with other assets? Examine the properties of portfolios consisting of positions in: (1) an option and a zero-coupon bond (2) an option and the asset underlying the option (3) two or more options on the same underlying asset ...

Chapter 5

... forcing the holders to update daily to the price of an equivalent forward purchased that day. This means that there will be very little additional money due on the final day to settle the futures contract: only the final day's gain or loss, not the gain or loss over the life of the contract. ...

... forcing the holders to update daily to the price of an equivalent forward purchased that day. This means that there will be very little additional money due on the final day to settle the futures contract: only the final day's gain or loss, not the gain or loss over the life of the contract. ...

Chapter 9 Put and Call Options

... Weekly (explained later) there were five expiration dates listed for August 2014 alone (August 1, 8, 22, and 29, all Weeklys, and August 16, a traditional monthly market). 3. When we discussed writing a call, which as I said small traders often do, we discovered that if the call goes above the strik ...

... Weekly (explained later) there were five expiration dates listed for August 2014 alone (August 1, 8, 22, and 29, all Weeklys, and August 16, a traditional monthly market). 3. When we discussed writing a call, which as I said small traders often do, we discovered that if the call goes above the strik ...

Modern Strategic Mine Planning

... investment and scheduling decisions, nor to value correctly the suite of decisions that it does suggest. Although current mine planning decisions yield suboptimal solutions, it is difficult to estimate the degree of suboptimality. We might estimate that there is 15% to 25% of additional value left ...

... investment and scheduling decisions, nor to value correctly the suite of decisions that it does suggest. Although current mine planning decisions yield suboptimal solutions, it is difficult to estimate the degree of suboptimality. We might estimate that there is 15% to 25% of additional value left ...

The exercise price is equal to the market price of $24 per share

... the option price at which they can be acquired. If the market and exercise price are equal on the date of grant, no compensation expense is recognized even if the options provide executives with substantial income. ...

... the option price at which they can be acquired. If the market and exercise price are equal on the date of grant, no compensation expense is recognized even if the options provide executives with substantial income. ...

Special Comment US Executive Pay Structure and Metrics

... Moody’s believes the structure of executive pay affects credit quality and therefore comments on it in our Corporate Governance Assessment reports. Executive pay structures sometimes include incentives that increase credit risk, and undisciplined pay patterns may suggest senior management’s accounta ...

... Moody’s believes the structure of executive pay affects credit quality and therefore comments on it in our Corporate Governance Assessment reports. Executive pay structures sometimes include incentives that increase credit risk, and undisciplined pay patterns may suggest senior management’s accounta ...

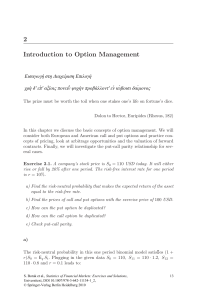

2 Introduction to Option Management

... ∆132 + β(1 + 0.1) = 32, ∆88 + β(1 + 0.1) = 0. Finally, we get ∆ = 0.73, β = −58.18. This means that one should buy 0.73 shares of stock and borrow 58.18 USD at a risk-free rate. ...

... ∆132 + β(1 + 0.1) = 32, ∆88 + β(1 + 0.1) = 0. Finally, we get ∆ = 0.73, β = −58.18. This means that one should buy 0.73 shares of stock and borrow 58.18 USD at a risk-free rate. ...

notes - University of Essex

... 1. Option payoff (gross of premium): $4000 = 1000 × (94 − 90) 2. One futures contract is received from option writer – In frictionless market: futures contract could be sold without loss – In a frictionless market: payoff from selling option ≥ exercise Why? For American call options, C ≥ f − X, wher ...

... 1. Option payoff (gross of premium): $4000 = 1000 × (94 − 90) 2. One futures contract is received from option writer – In frictionless market: futures contract could be sold without loss – In a frictionless market: payoff from selling option ≥ exercise Why? For American call options, C ≥ f − X, wher ...

Lecture 6 - IEI: Linköping University

... • A US company will pay £10 million for imports from Britain in 3 months and decides to hedge using a long position in a forward contract, he fixed his cost of £ 10 million with the forward exchange rate of 2,60$/£, total cost $26 M. • If the 3-M call option premium is 0,02 dollars per call option, ...

... • A US company will pay £10 million for imports from Britain in 3 months and decides to hedge using a long position in a forward contract, he fixed his cost of £ 10 million with the forward exchange rate of 2,60$/£, total cost $26 M. • If the 3-M call option premium is 0,02 dollars per call option, ...

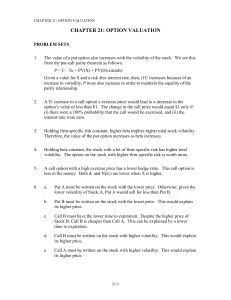

solutions

... waiting to exercise, but there is a “volatility benefit” from waiting. To show this more rigorously, consider the following portfolio: lend $X and short one share of stock. The cost to establish the portfolio is (X – S 0). The payoff at time T (with zero interest earnings on the loan) is (X – S T). ...

... waiting to exercise, but there is a “volatility benefit” from waiting. To show this more rigorously, consider the following portfolio: lend $X and short one share of stock. The cost to establish the portfolio is (X – S 0). The payoff at time T (with zero interest earnings on the loan) is (X – S T). ...

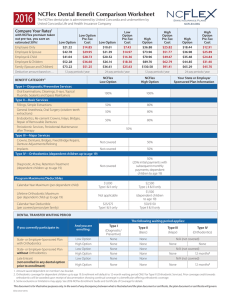

NCFlex Dental Benefit Comparison Worksheet

... 1. Amount saved dependent on member’s tax bracket. 2. Orthodontic coverage for dependent children up to age 19. Enrollment will default to 12-month waiting period ONLY for Type IV (Orthodontic Services). Prior coverage credit towards orthodontics will be awarded upon receipt of documentation showi ...

... 1. Amount saved dependent on member’s tax bracket. 2. Orthodontic coverage for dependent children up to age 19. Enrollment will default to 12-month waiting period ONLY for Type IV (Orthodontic Services). Prior coverage credit towards orthodontics will be awarded upon receipt of documentation showi ...

The Good Times Keep Rolling

... Negative returns on property, international equities and fixed interest for the month of March did nothing to halt the ongoing strength of Australia’s major super funds with the median balanced investment option returning 1.00% for the month. This was solely attributable to a raging Australian equit ...

... Negative returns on property, international equities and fixed interest for the month of March did nothing to halt the ongoing strength of Australia’s major super funds with the median balanced investment option returning 1.00% for the month. This was solely attributable to a raging Australian equit ...

Valuation

... enough to estimate the variance directly • Estimate based on Gruy et al. [1982]: developed reserve prices tend to be 1/3 of crude oil prices • Therefore, use the variance of the rate of change of crude oil prices as a proxy for the variance of the rate of change of developed reserve prices ...

... enough to estimate the variance directly • Estimate based on Gruy et al. [1982]: developed reserve prices tend to be 1/3 of crude oil prices • Therefore, use the variance of the rate of change of crude oil prices as a proxy for the variance of the rate of change of developed reserve prices ...

Chapter Ten

... March is the near term contract. The contract size is for $100,000 face value T-bonds and the price quotes (Open, High, Low and Settle) are percentages of face value where the price quotes are in 32nds. For example 112-09 is 112 9/32% of $100,000. The change (CHG) is the change in 32nds from the pri ...

... March is the near term contract. The contract size is for $100,000 face value T-bonds and the price quotes (Open, High, Low and Settle) are percentages of face value where the price quotes are in 32nds. For example 112-09 is 112 9/32% of $100,000. The change (CHG) is the change in 32nds from the pri ...

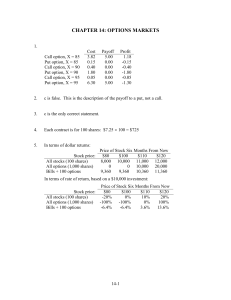

Puts and calls

... option is the right but not the obligation to sell 100 shares of the stock at a stated exercise price on or before a stated expiration date. The price of the option is not the exercise price. ...

... option is the right but not the obligation to sell 100 shares of the stock at a stated exercise price on or before a stated expiration date. The price of the option is not the exercise price. ...

Disadvantages of futures

... All rights reserved. Reproduction or translation of this work beyond that permitted in section 117 of the 1976 United States Copyright Act without express permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & So ...

... All rights reserved. Reproduction or translation of this work beyond that permitted in section 117 of the 1976 United States Copyright Act without express permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & So ...