pdf

... function which defines the volatility swap. The left-hand side is the value of the desired volatility or variance contract. The right-hand side is the value of a contract on a function of price, and is therefore model-independently given by the values of European options. Thus our formula for the v ...

... function which defines the volatility swap. The left-hand side is the value of the desired volatility or variance contract. The right-hand side is the value of a contract on a function of price, and is therefore model-independently given by the values of European options. Thus our formula for the v ...

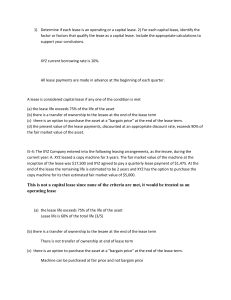

1) Determine if each lease is an operating or a capital lease. 2) For

... I5-4: The XYZ Company entered into the following leasing arrangements, as the lessee, during the current year: A. XYZ leased a copy machine for 3 years. The fair market value of the machine at the inception of the lease was $17,500 and XYZ agreed to pay a quarterly lease payment of $1,475. At the en ...

... I5-4: The XYZ Company entered into the following leasing arrangements, as the lessee, during the current year: A. XYZ leased a copy machine for 3 years. The fair market value of the machine at the inception of the lease was $17,500 and XYZ agreed to pay a quarterly lease payment of $1,475. At the en ...

Catastrophe Insurance Products in Markov Jump Diffusion Model

... lognormal diffusion and the directing process is a homogeneous Poisson and thus derive the option pricing formula as a risk-neutral Poisson sum of Black's prices. The extent of the usefulness of this pricing equation is determined only by a careful empirical evaluation using market data. Unfortunate ...

... lognormal diffusion and the directing process is a homogeneous Poisson and thus derive the option pricing formula as a risk-neutral Poisson sum of Black's prices. The extent of the usefulness of this pricing equation is determined only by a careful empirical evaluation using market data. Unfortunate ...

An Information-Based Framework for Asset Pricing: X

... appropriate set of X-factors, which are assumed to be independent of one another in an appropriate choice of measure, typically the preferred pricing measure, e.g., the riskneutral measure. To each X-factor we associate an information process that consists of two terms: a signal component, and a noi ...

... appropriate set of X-factors, which are assumed to be independent of one another in an appropriate choice of measure, typically the preferred pricing measure, e.g., the riskneutral measure. To each X-factor we associate an information process that consists of two terms: a signal component, and a noi ...

Telling from Discrete Data Whether the Underlying Continuous

... can we tell whether the underlying model that gave rise to the data was a diffusion, or should jumps be allowed into the model? Intuition suggests that the answer should be no. After all, the discrete data are purely discontinuous even if the continuous-time sample is not. Thus, faced with two disco ...

... can we tell whether the underlying model that gave rise to the data was a diffusion, or should jumps be allowed into the model? Intuition suggests that the answer should be no. After all, the discrete data are purely discontinuous even if the continuous-time sample is not. Thus, faced with two disco ...

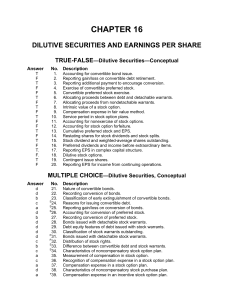

chapter 16

... equity capital that, assuming conversion, will arise when the original debt is converted. The other is a. the ease with which convertible debt is sold even if the company has a poor credit rating. b. the fact that equity capital has issue costs that convertible debt does not. c. that many corporatio ...

... equity capital that, assuming conversion, will arise when the original debt is converted. The other is a. the ease with which convertible debt is sold even if the company has a poor credit rating. b. the fact that equity capital has issue costs that convertible debt does not. c. that many corporatio ...

AcSB Implementation Guide Hedging Relationships Typescript

... 1.03 Interpretation of paragraph 3 Question: Is hedge accounting appropriate when gains, losses, revenues and expenses for a hedged item and the hedging item will be recognized in the same accounting period regardless of whether hedge accounting is applied? For example, may hedge accounting be appli ...

... 1.03 Interpretation of paragraph 3 Question: Is hedge accounting appropriate when gains, losses, revenues and expenses for a hedged item and the hedging item will be recognized in the same accounting period regardless of whether hedge accounting is applied? For example, may hedge accounting be appli ...

A new approach for option pricing under stochastic volatility

... swap rate of a single maturity.1 He assumes a particular diffusion process for the variance swap rate and shows that the payoff to volatility derivatives of the same maturity can be replicated by dynamic trading in variance swaps. Like Duanmu, Potter (2004) also proposes completing markets by dynami ...

... swap rate of a single maturity.1 He assumes a particular diffusion process for the variance swap rate and shows that the payoff to volatility derivatives of the same maturity can be replicated by dynamic trading in variance swaps. Like Duanmu, Potter (2004) also proposes completing markets by dynami ...

handbook(2014.10)

... A futures contract is an agreement to buy or sell the specified asset of a specific volume at the predetermined price on a specific future date. Futures transactions were introduced to the financial market with a background where adoption of floating rate system for US dollar and interest-rate liber ...

... A futures contract is an agreement to buy or sell the specified asset of a specific volume at the predetermined price on a specific future date. Futures transactions were introduced to the financial market with a background where adoption of floating rate system for US dollar and interest-rate liber ...

More Than You Ever Wanted to Know About

... This material is for your private information, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. Certain transactions ...

... This material is for your private information, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. Certain transactions ...

MF2458 Grain Marketing Plans for Farmers

... prices has a major effect on the approach taken in the development of marketing plans. In practical terms, this issue can be addressed with the following question: “Do grain marketing strategies exist that are more profitable than selling at harvest?” Whether economists believe such strategies exist ...

... prices has a major effect on the approach taken in the development of marketing plans. In practical terms, this issue can be addressed with the following question: “Do grain marketing strategies exist that are more profitable than selling at harvest?” Whether economists believe such strategies exist ...

A Study of Implied Risk-Neutral Density Functions in

... holder the right to buy the underlying asset by a certain date for a certain price. A put option gives the holder the right to sell the underlying asset by a certain date for a certain price. Note that the holder is not obliged to exercise this right. The underlying assets include stocks, stock indi ...

... holder the right to buy the underlying asset by a certain date for a certain price. A put option gives the holder the right to sell the underlying asset by a certain date for a certain price. Note that the holder is not obliged to exercise this right. The underlying assets include stocks, stock indi ...

Chapter XV (pdf format)

... 93.57, 93.12 and 92.77, respectively -see Example XV.4. The December-March interest rate con be fixed today on the forthcoming USD 2,000,000 by purchasing two December Eurodollar futures. The rate is fixed at 6% annually, or 1.5% for the December-March period. If in December 1994 the 3-mo Eurodollar ...

... 93.57, 93.12 and 92.77, respectively -see Example XV.4. The December-March interest rate con be fixed today on the forthcoming USD 2,000,000 by purchasing two December Eurodollar futures. The rate is fixed at 6% annually, or 1.5% for the December-March period. If in December 1994 the 3-mo Eurodollar ...

Tax Treatment of Derivatives

... taxpayers. Generally, under section 1092, a “mixed straddle” is a “straddle” containing a mix of non-section 1256 contracts and section 1256 contracts (a straddle composed only of section 1256 contracts or only of non-section 1256 contracts is not a “mixed straddle”).19 A taxpayer deemed to hold a m ...

... taxpayers. Generally, under section 1092, a “mixed straddle” is a “straddle” containing a mix of non-section 1256 contracts and section 1256 contracts (a straddle composed only of section 1256 contracts or only of non-section 1256 contracts is not a “mixed straddle”).19 A taxpayer deemed to hold a m ...

Open Price Agreements: Good Faith Pricing in the Franchise

... Section 2-305(2) predates the modern statutes governing franchise law and instead resulted from extensive discussion and debate about how to accommodate other industries that rely on open price terms for practically every contract.34 In particular, industries that deal in commodities subject to rapi ...

... Section 2-305(2) predates the modern statutes governing franchise law and instead resulted from extensive discussion and debate about how to accommodate other industries that rely on open price terms for practically every contract.34 In particular, industries that deal in commodities subject to rapi ...

Futures Contracts

... between a buyer and a seller who are obligated to complete a transaction at a date in the future. • The buyer and the seller know each other. – The negotiation process leads to customized agreements. – What to trade; Where to trade; When to trade; How much to trade—all can be customized. ...

... between a buyer and a seller who are obligated to complete a transaction at a date in the future. • The buyer and the seller know each other. – The negotiation process leads to customized agreements. – What to trade; Where to trade; When to trade; How much to trade—all can be customized. ...

Option-Implied Volatility Measures and Stock

... minus-at” of calls, and “out-minus-at” of puts. 5 Results in their study show that differences between at-the-money call and put implied volatilities and those between out-of-the-money and at-the-money put implied volatilities both capture information about future equity returns. From these studies ...

... minus-at” of calls, and “out-minus-at” of puts. 5 Results in their study show that differences between at-the-money call and put implied volatilities and those between out-of-the-money and at-the-money put implied volatilities both capture information about future equity returns. From these studies ...

Document

... Delta is at best an approximation for the nonlinear relationship between the price of the option and the underlying security. Delta changes as the value of the underlying security changes. This change is measure by the gamma of the option. Gamma can be used to adjust the delta to better approximate ...

... Delta is at best an approximation for the nonlinear relationship between the price of the option and the underlying security. Delta changes as the value of the underlying security changes. This change is measure by the gamma of the option. Gamma can be used to adjust the delta to better approximate ...

Forecasting Stock Market Volatility and the Informational Efficiency

... The expected volatility of financial markets is a key variable in financial investment decisions. For example, it is common practice to reduce asset allocation decisions to a two–dimensional decision problem by focusing solely on the expected return and risk of an asset or portfolio, with risk being r ...

... The expected volatility of financial markets is a key variable in financial investment decisions. For example, it is common practice to reduce asset allocation decisions to a two–dimensional decision problem by focusing solely on the expected return and risk of an asset or portfolio, with risk being r ...

Index Derivatives Reference Manual

... This adjustment ensures that users get meaningful results when comparing index values at two different points in time, even though its composition may not be the same on those two occasions. ...

... This adjustment ensures that users get meaningful results when comparing index values at two different points in time, even though its composition may not be the same on those two occasions. ...