![Since Slonczewski calculated [1] interfacial exchange - cerge-ei](http://s1.studyres.com/store/data/005381392_1-e9747be9e01b230768e0b5cde433f905-300x300.png)

Since Slonczewski calculated [1] interfacial exchange - cerge-ei

... gauge,” as it expresses the consensus view about the expected future stock market volatility (Whaley 2000). 1 In relation to the stock market, it spikes during high impact political and economic events (e.g. the Gulf wars, 9/11, recent financial crisis), and general market nervousness such as in 199 ...

... gauge,” as it expresses the consensus view about the expected future stock market volatility (Whaley 2000). 1 In relation to the stock market, it spikes during high impact political and economic events (e.g. the Gulf wars, 9/11, recent financial crisis), and general market nervousness such as in 199 ...

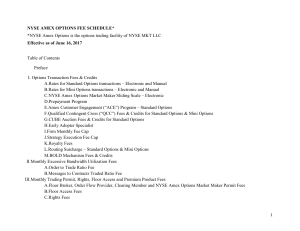

NYSE AMEX OPTIONS FEE SCHEDULE* *NYSE Amex

... Floor Market Maker during the temporary absence of a Floor Market Maker. A Reserve Floor Market Maker ATP is empowered to act as a qualified MMAT and Floor Market Maker in lieu of the absent Floor Market Maker. When a Floor Market Maker is or will be absent, an ATP Holder that maintains a Reserve Fl ...

... Floor Market Maker during the temporary absence of a Floor Market Maker. A Reserve Floor Market Maker ATP is empowered to act as a qualified MMAT and Floor Market Maker in lieu of the absent Floor Market Maker. When a Floor Market Maker is or will be absent, an ATP Holder that maintains a Reserve Fl ...

Hedge Funds - Presentation to BNM

... these, 114 are specifically global long/short equity fund of funds. 2 The amount of assets invested in fund of funds is expected to grow steadily. Multi-manager assets (fund of funds) are expected to maintain a 14% ...

... these, 114 are specifically global long/short equity fund of funds. 2 The amount of assets invested in fund of funds is expected to grow steadily. Multi-manager assets (fund of funds) are expected to maintain a 14% ...

Stock Market Uncertainty and the Stock-Bond - UNC

... of stocks versus bonds, then higher stock market uncertainty suggests a higher probability of observing a negative stock-bond return correlation in the near future. Our second empirical question has a contemporaneous focus and asks whether a day’s change in stock market uncertainty is associated wit ...

... of stocks versus bonds, then higher stock market uncertainty suggests a higher probability of observing a negative stock-bond return correlation in the near future. Our second empirical question has a contemporaneous focus and asks whether a day’s change in stock market uncertainty is associated wit ...

Dedicated Short Bias Hedge Funds

... funds typically exhibit a nonlinear relationship with the risk factors that are the source of their returns. A relationship which is nonlinear can be difficult to model. Traditional linear factor models such as CAPM are inadequate at modeling this relationship. ...

... funds typically exhibit a nonlinear relationship with the risk factors that are the source of their returns. A relationship which is nonlinear can be difficult to model. Traditional linear factor models such as CAPM are inadequate at modeling this relationship. ...

Sales Quiz

... to be considered open for six months from the date of its preparation.” Homeowner Harry, after considering several other bids, finally gets around to calling Bill to accept his bid four months later. On the phone, Bill refuses to honor the original bid claiming that it has expired. Harry sues Bill c ...

... to be considered open for six months from the date of its preparation.” Homeowner Harry, after considering several other bids, finally gets around to calling Bill to accept his bid four months later. On the phone, Bill refuses to honor the original bid claiming that it has expired. Harry sues Bill c ...

TBChap002-10e

... Copyright © 2014 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. ...

... Copyright © 2014 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. ...

Forward and Futures Contracts

... Two ways to buy the underlying asset for date-T delivery 1. Buy a forward or futures contract with maturity date T 2. Buy the underlying asset and store it until T ...

... Two ways to buy the underlying asset for date-T delivery 1. Buy a forward or futures contract with maturity date T 2. Buy the underlying asset and store it until T ...

exam133

... payments thus have both a 10% bond coupon payment and an embedded derivative for the knock-in payments. Does the embedded derivative meet the clearly-and-closely related tests to be accounted with the bonds or must this derivative be accounted for separately from its host contract? a. The embedded d ...

... payments thus have both a 10% bond coupon payment and an embedded derivative for the knock-in payments. Does the embedded derivative meet the clearly-and-closely related tests to be accounted with the bonds or must this derivative be accounted for separately from its host contract? a. The embedded d ...

NBER WORKING PAPER SERIES SIMPLE VARIANCE SWAPS Ian Martin Working Paper 16884

... weights in the definition (1). In principle, we could have put any other constants known at time 0 in the denominators of the fractions in (1). Had we done so, we would have to face the unappealing prospect of a hedging portfolio requiring positions in options of all maturities between 0 and T . Usi ...

... weights in the definition (1). In principle, we could have put any other constants known at time 0 in the denominators of the fractions in (1). Had we done so, we would have to face the unappealing prospect of a hedging portfolio requiring positions in options of all maturities between 0 and T . Usi ...

testing intraday volatility spillovers in turkish capital markets

... using asymmetric GARCH model. They showed that, even if the stock index started to decline after the stock index futures were introduced, the cash market was found to play a more dominant role in the price discovery process. Turkish Derivatives Exchange (TURKDEX) is a new established futures market ...

... using asymmetric GARCH model. They showed that, even if the stock index started to decline after the stock index futures were introduced, the cash market was found to play a more dominant role in the price discovery process. Turkish Derivatives Exchange (TURKDEX) is a new established futures market ...

FASB Accounting Rules and Implications for Natural Gas Purchase

... similar a similar response to changes in market factors. c. Requires or permits net settlement. Fair value is the common measure for financial instruments and the only relevant measure for derivative instruments. Under Generally Accepted Accounting principles (“GAAP”), the fair value of an asset on ...

... similar a similar response to changes in market factors. c. Requires or permits net settlement. Fair value is the common measure for financial instruments and the only relevant measure for derivative instruments. Under Generally Accepted Accounting principles (“GAAP”), the fair value of an asset on ...

Stochastic Efficiency Analysis of Community

... Data for this study were collected via a self-administered mail survey of CSA operations during the 1995-97 growing seasons. The response rate for the mail survey over the three growing seasons was 36%, and only two returned surveys were eliminated from the sample due to incomplete data. The mail su ...

... Data for this study were collected via a self-administered mail survey of CSA operations during the 1995-97 growing seasons. The response rate for the mail survey over the three growing seasons was 36%, and only two returned surveys were eliminated from the sample due to incomplete data. The mail su ...

"Leverage Effect" a Leverage Effect?

... the market fully incorporates the change in leverage into stock volatility and firm volatility is constant. If firm volatility also increases when firm value falls, a should be greater than 1. An a value less than 1 suggests that leverage changes are not fully impounded in stock volatility. The dumm ...

... the market fully incorporates the change in leverage into stock volatility and firm volatility is constant. If firm volatility also increases when firm value falls, a should be greater than 1. An a value less than 1 suggests that leverage changes are not fully impounded in stock volatility. The dumm ...

Managerial incentives to increase firm volatility provided by debt

... assume a risk-free rate of 2.25%, that the interest rate on debt is equal to the risk-free rate, and that the firm pays no dividends. The first set of rows shows the change in the value of firm debt, stock, and options for a 1% change in the standard deviation of the assets at various levels of leve ...

... assume a risk-free rate of 2.25%, that the interest rate on debt is equal to the risk-free rate, and that the firm pays no dividends. The first set of rows shows the change in the value of firm debt, stock, and options for a 1% change in the standard deviation of the assets at various levels of leve ...

Financial Accounting and Accounting Standards

... with interest payable on July 1 and January 1. The bonds sell for $108,111, which results in a bond premium of $8,111 and an effective interest rate of 8 percent. Graff records the purchase of the bonds on January 1, 2009, as follows. Available-for-Sale Securities ...

... with interest payable on July 1 and January 1. The bonds sell for $108,111, which results in a bond premium of $8,111 and an effective interest rate of 8 percent. Graff records the purchase of the bonds on January 1, 2009, as follows. Available-for-Sale Securities ...

Volatility at World`s End

... bond markets are not up, not down, but merely where ever central banks want them to be. When the monetary gods want you to buy risk assets, like it or not, you will be punished for not doing so in the form of ZIRP and lagging performance. What concerns me most is not how markets perform during monet ...

... bond markets are not up, not down, but merely where ever central banks want them to be. When the monetary gods want you to buy risk assets, like it or not, you will be punished for not doing so in the form of ZIRP and lagging performance. What concerns me most is not how markets perform during monet ...

State-dependent fees for variable annuity guarantees

... there is a misalignment of the fee income and the option cost. When markets fall, the option value is high, but the fee income is reduced. When markets rise, the fee income increases, but there is negligible guarantee liability. In this paper we investigate a dynamic fee structure for GMMBs and GMD ...

... there is a misalignment of the fee income and the option cost. When markets fall, the option value is high, but the fee income is reduced. When markets rise, the fee income increases, but there is negligible guarantee liability. In this paper we investigate a dynamic fee structure for GMMBs and GMD ...

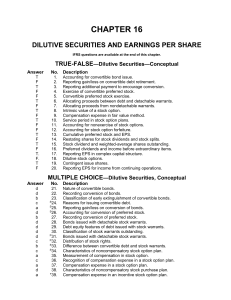

File

... capital that, assuming conversion, will arise when the original debt is converted. The other is a. the ease with which convertible debt is sold even if the company has a poor credit rating. b. the fact that equity capital has issue costs that convertible debt does not. c. that many corporations can ...

... capital that, assuming conversion, will arise when the original debt is converted. The other is a. the ease with which convertible debt is sold even if the company has a poor credit rating. b. the fact that equity capital has issue costs that convertible debt does not. c. that many corporations can ...