Market, Land and Real Estate

... A market is said to be perfect when all the potential buyers and seller are promptly aware of the prices at which transactions take place and all the offers made by the other sellers and buyers, and when any buyer can purchase From any seller and conversely. Under such condition, the price of a comm ...

... A market is said to be perfect when all the potential buyers and seller are promptly aware of the prices at which transactions take place and all the offers made by the other sellers and buyers, and when any buyer can purchase From any seller and conversely. Under such condition, the price of a comm ...

The Optimal Extraction of Exhaustible Resources

... How do such fluctuations affect inflation, and how should policy respond? More fundamentally, what makes prices of commodities like this fluctuate so much? The usual analysis with a simple supply-and-demand diagram is inadequate for answering this question. What, after all, is the supply curve for a ...

... How do such fluctuations affect inflation, and how should policy respond? More fundamentally, what makes prices of commodities like this fluctuate so much? The usual analysis with a simple supply-and-demand diagram is inadequate for answering this question. What, after all, is the supply curve for a ...

Commodity Chains and Marketing Strategies: Nike and the

... Continued phenomenal rates of growth Highly segmented by consumer age groups Teenagers the most important consumers ...

... Continued phenomenal rates of growth Highly segmented by consumer age groups Teenagers the most important consumers ...

June 21, 2016 by Steve Freed, VP of Research Corn, soybeans and

... provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to ...

... provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to ...

True False Questions – set 2

... say in late June, 2011. Suppose also that I want to park these funds in US Treasuries when I receive them. One way to hedge against higher (Treasury) prices in the future would be to buy June 2011 futures contracts now so that I can lock in the price of Treasuries today! 2. If you are a speculator a ...

... say in late June, 2011. Suppose also that I want to park these funds in US Treasuries when I receive them. One way to hedge against higher (Treasury) prices in the future would be to buy June 2011 futures contracts now so that I can lock in the price of Treasuries today! 2. If you are a speculator a ...

CBML Expert Group 4th Meeting Summary Minutes

... The impacts of pre- and post-trade transparency on liquidity should be further developed for the policy implications. The role of electronic trading in creating liquidity was debated. It was noted that it could be possible to express dissenting opinions in the report. Liquidity enhancing solutions, ...

... The impacts of pre- and post-trade transparency on liquidity should be further developed for the policy implications. The role of electronic trading in creating liquidity was debated. It was noted that it could be possible to express dissenting opinions in the report. Liquidity enhancing solutions, ...

Document

... FUTURES CONTRACTS • WHAT ARE FUTURES? – Definition: an agreement between two investors under which the seller promises to deliver a specific asset on a specific future date to the buyer for a predetermined price to be paid on the delivery date ...

... FUTURES CONTRACTS • WHAT ARE FUTURES? – Definition: an agreement between two investors under which the seller promises to deliver a specific asset on a specific future date to the buyer for a predetermined price to be paid on the delivery date ...

Financial Market Its Types and Roles in Industry

... witnessed a flurry of IPOs serially. The market saw many new companies spanning across different industry segments and business began to flourish. The launch of the NSE (National Stock Exchange) and the OTCEI (Over the Counter Exchange of India) in the mid-1990s helped in regulating a smooth and tra ...

... witnessed a flurry of IPOs serially. The market saw many new companies spanning across different industry segments and business began to flourish. The launch of the NSE (National Stock Exchange) and the OTCEI (Over the Counter Exchange of India) in the mid-1990s helped in regulating a smooth and tra ...

Weekly Economic Update

... & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerl ...

... & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerl ...

Australian Dollar Outlook

... AUD Outlook – Thursday, 2 February 2017 The Australian economy has been growing at just a modest pace while the unemployment rate has tracked sideways over the past year. Inflation and wage growth has been subdued, and suggest that there exists spare capacity within the economy. Without strong pros ...

... AUD Outlook – Thursday, 2 February 2017 The Australian economy has been growing at just a modest pace while the unemployment rate has tracked sideways over the past year. Inflation and wage growth has been subdued, and suggest that there exists spare capacity within the economy. Without strong pros ...

DOC - Europa.eu

... Derivatives are financial contracts that trade and redistribute risks generated in the real economy, and are accordingly important tools for economic agents to transfer risk. They can accordingly be used for insuring against risk (hedging). However, derivatives have increasingly become used to acqui ...

... Derivatives are financial contracts that trade and redistribute risks generated in the real economy, and are accordingly important tools for economic agents to transfer risk. They can accordingly be used for insuring against risk (hedging). However, derivatives have increasingly become used to acqui ...

day 6

... change can cause thousands of dollars per year change in cash flows. A very small investment, can produce returns (positive or negative) of several thousand percent. ...

... change can cause thousands of dollars per year change in cash flows. A very small investment, can produce returns (positive or negative) of several thousand percent. ...

securities investment services

... launched a global securities trading platform to provide customers with a wider variety of product options. The global financial markets run 24 hours a day with no respite. The Company has provided the customers with global securities trading services that span across time zones and regions, includi ...

... launched a global securities trading platform to provide customers with a wider variety of product options. The global financial markets run 24 hours a day with no respite. The Company has provided the customers with global securities trading services that span across time zones and regions, includi ...

The Financialization of Commodity Markets

... Before we dive into the intensive debate about the effects of financialization, we first review several economic mechanisms through which futures market trading can impact commodity prices. We first describe the standard theory of storage, in which the spread between futures price and spot price ser ...

... Before we dive into the intensive debate about the effects of financialization, we first review several economic mechanisms through which futures market trading can impact commodity prices. We first describe the standard theory of storage, in which the spread between futures price and spot price ser ...

- Schroders

... from reasonable to totally unreasonable, with many in between. The logic which we apply to business valuation is based on the economics outlined in the “growth” example above, but to apply it in practice, let’s apply the logic to one of the current resource boom darlings, Fortescue Metals. Taking no ...

... from reasonable to totally unreasonable, with many in between. The logic which we apply to business valuation is based on the economics outlined in the “growth” example above, but to apply it in practice, let’s apply the logic to one of the current resource boom darlings, Fortescue Metals. Taking no ...

What are derivatives

... Hedging is a mechanism to reduce price risk inherent in open positions. Derivatives are widely used for hedging. A Hedge can help lock in existing profits. Its purpose is to reduce the volatility of a portfolio, by reducing the risk. Hedging does not mean maximization of return. It only means reduct ...

... Hedging is a mechanism to reduce price risk inherent in open positions. Derivatives are widely used for hedging. A Hedge can help lock in existing profits. Its purpose is to reduce the volatility of a portfolio, by reducing the risk. Hedging does not mean maximization of return. It only means reduct ...

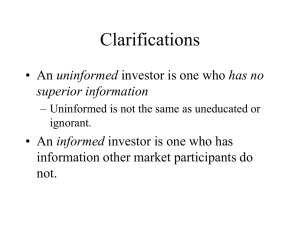

Commodity forward curves: models and data

... Forward Curves for Seasonals • The basic economic insight about intertemporal allocation suggests that prices should be at full carry for delivery dates prior to the next harvest, but “new crop” forward prices are likely to be less than “old crop” prices • Big slug of new supply due to harvest: sho ...

... Forward Curves for Seasonals • The basic economic insight about intertemporal allocation suggests that prices should be at full carry for delivery dates prior to the next harvest, but “new crop” forward prices are likely to be less than “old crop” prices • Big slug of new supply due to harvest: sho ...

OCA - Federation of European Securities Exchanges

... What should be the regulatory response to globalisation? Do we need a “world regulator”? The case-by case-approach • Historically, derivative exchanges have benefited from the CFTC’s no-action letter regime • No retail investor protection concerns A new multilateral approach? • The SEC’s expected c ...

... What should be the regulatory response to globalisation? Do we need a “world regulator”? The case-by case-approach • Historically, derivative exchanges have benefited from the CFTC’s no-action letter regime • No retail investor protection concerns A new multilateral approach? • The SEC’s expected c ...

THE PRIVATISATION OF THE COMMODITIES EXCHANGE AND

... arable, with the discovery of oil, Nigeria permitted its agricultural sector to stagnate and eventually the country became a net importer of food. According to the Central Bank of Nigeria (CBN) report, a sum of $949 million was spent on the importation of sundry food items within the first five mont ...

... arable, with the discovery of oil, Nigeria permitted its agricultural sector to stagnate and eventually the country became a net importer of food. According to the Central Bank of Nigeria (CBN) report, a sum of $949 million was spent on the importation of sundry food items within the first five mont ...

Set 8 - Matt Will

... Futures contracts allow cheap entry & exit from markets Index contracts can be used to alter portfolio allocation for short periods of time Use index contracts when large outflows are expected ...

... Futures contracts allow cheap entry & exit from markets Index contracts can be used to alter portfolio allocation for short periods of time Use index contracts when large outflows are expected ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.