Ethan Frome - Eurex Exchange

... determining a particular opening price, additional orders and quotes may be entered until a time established by the Boards of Management of the Eurex Exchanges; a preliminary opening price will be continuously displayed during this period (the ”Pre-Opening Period”). Quotes may be individually cancel ...

... determining a particular opening price, additional orders and quotes may be entered until a time established by the Boards of Management of the Eurex Exchanges; a preliminary opening price will be continuously displayed during this period (the ”Pre-Opening Period”). Quotes may be individually cancel ...

The floating Greeks

... companies with boring but steady industrial patina. Consider that proceeds from TNP's offering are earmarked partly to finance the 10 ships on order (in addition to 16 trading now), hardly the stuff of a quick flip approach. With money raised from investors, representing a little over 37 per cent of ...

... companies with boring but steady industrial patina. Consider that proceeds from TNP's offering are earmarked partly to finance the 10 ships on order (in addition to 16 trading now), hardly the stuff of a quick flip approach. With money raised from investors, representing a little over 37 per cent of ...

Demystifying the gold market in Vietnam

... These measures taken by the Government of Vietnam are motivated by several factors to improve the functioning of the market. First, to promote financial stability by reducing banks’ exposure to risks related to gold assets and liabilities on their balance sheets. Second, reduce volatility in the gol ...

... These measures taken by the Government of Vietnam are motivated by several factors to improve the functioning of the market. First, to promote financial stability by reducing banks’ exposure to risks related to gold assets and liabilities on their balance sheets. Second, reduce volatility in the gol ...

Description of Financial Instruments and Principal

... The buyer of an option acquires the right to buy (a call option) or sell (a put option) a certain quantity of a security (the underlying security) or instrument at a certain price up to a specified point in time. The seller or writer of an option is obligated to sell (a call option) or buy ( a put o ...

... The buyer of an option acquires the right to buy (a call option) or sell (a put option) a certain quantity of a security (the underlying security) or instrument at a certain price up to a specified point in time. The seller or writer of an option is obligated to sell (a call option) or buy ( a put o ...

forward contract

... For example you can speculate on inflation going up. If inflation increases, then the price of gold (an inflation hedge) increases. Example: Each gold futures contract is for 100 oz. of gold. ...

... For example you can speculate on inflation going up. If inflation increases, then the price of gold (an inflation hedge) increases. Example: Each gold futures contract is for 100 oz. of gold. ...

Professor Venkatesh Panchapagesan

... This course examines the theory and practice behind the organization of world’s major financial markets. Students will learn about key economic principles that drive wellfunctioning financial markets along with practical, institutional details necessary to navigate them. The course covers equity, de ...

... This course examines the theory and practice behind the organization of world’s major financial markets. Students will learn about key economic principles that drive wellfunctioning financial markets along with practical, institutional details necessary to navigate them. The course covers equity, de ...

HEADER: XTX Markets joins Aquis Exchange as a member firm XTX

... membership of Aquis Exchange. The combination of natural liquidity demand from end users and our passive, low impact liquidity means this is a natural next step in the expansion of our business on equity exchanges globally.’ ...

... membership of Aquis Exchange. The combination of natural liquidity demand from end users and our passive, low impact liquidity means this is a natural next step in the expansion of our business on equity exchanges globally.’ ...

Research Paper No. 58: A Review of the Global and Local

... gains. At one point the index reached an 18-year high of over 20,000. In early 2015, the market rose steadily, underpinned by stronger economic prospects and solid domestic corporate earnings. Exporters paced gains on a weaker yen, which fell to a 12-year low at one point. Expectations of further st ...

... gains. At one point the index reached an 18-year high of over 20,000. In early 2015, the market rose steadily, underpinned by stronger economic prospects and solid domestic corporate earnings. Exporters paced gains on a weaker yen, which fell to a 12-year low at one point. Expectations of further st ...

David Aranzabal

... VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge”. ...

... VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge”. ...

CAMRI Global Perspectives On a Swing and a Prayer: Are Financial

... global search for investment safety. In addition, global demand for relatively higher yielding US Treasury securities has intensified in the past several months because of the recent proliferation of ...

... global search for investment safety. In addition, global demand for relatively higher yielding US Treasury securities has intensified in the past several months because of the recent proliferation of ...

ITS 4 - December 2015

... Commitment of trader reports 1. An investment firm or a market operator operating a trading venue (‘trading venue operator’) shall make public and communicate to the competent authority and to ESMA the weekly reports referred to in Article 58(1)(a) of Directive 2014/65/EU in the format set out in th ...

... Commitment of trader reports 1. An investment firm or a market operator operating a trading venue (‘trading venue operator’) shall make public and communicate to the competent authority and to ESMA the weekly reports referred to in Article 58(1)(a) of Directive 2014/65/EU in the format set out in th ...

Currency derivatives Currency derivatives are a contract between

... their harvest at a future date to eliminate the risk of a change in prices by that date. Such a transaction is an example of a derivative. The price of this derivative is driven by the spot price of wheat which is the "underlying". Derivative products initially emerged as hedging devices against flu ...

... their harvest at a future date to eliminate the risk of a change in prices by that date. Such a transaction is an example of a derivative. The price of this derivative is driven by the spot price of wheat which is the "underlying". Derivative products initially emerged as hedging devices against flu ...

Title goes here This is a sample subtitle

... variables and randomly generated “real world” trials ...

... variables and randomly generated “real world” trials ...

WB Credentials (Nov 09)

... OTC markets criticized for being opaque, but are the largest component of world financial markets ...

... OTC markets criticized for being opaque, but are the largest component of world financial markets ...

Mackenzie Maximum Diversification Emerging Markets Index ETF

... Strong ownership Part of IGM Financial (9th largest publicly traded asset manager in the world) and the Power Financial Group of Companies, trusted advice champions with over $700B in assets. ...

... Strong ownership Part of IGM Financial (9th largest publicly traded asset manager in the world) and the Power Financial Group of Companies, trusted advice champions with over $700B in assets. ...

Can Asia`s financial markets continue to grow without AEV`s

... engines, in some cases using a wide variety of order management systems leading to rise in demand for; – The rise in the need to effectively bridge platforms and markets for global price discovery and risk management purposes – Drive towards standardized connectivity to venues and counterparties acr ...

... engines, in some cases using a wide variety of order management systems leading to rise in demand for; – The rise in the need to effectively bridge platforms and markets for global price discovery and risk management purposes – Drive towards standardized connectivity to venues and counterparties acr ...

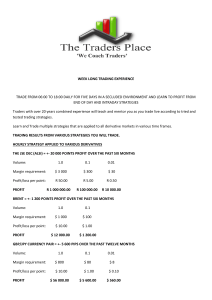

week long trading experience trade from 06:00 to 18:00 daily for five

... Warren began trading stocks in 2003 and progressed to Index and Forex trading in 2004. In 2005 he joined Share Direct, a financial market training company where he trained retail traders in Stocks, Index and Forex trading. He later joined Ideal CFD’s a CFD provider that was bought by IG Markets, he ...

... Warren began trading stocks in 2003 and progressed to Index and Forex trading in 2004. In 2005 he joined Share Direct, a financial market training company where he trained retail traders in Stocks, Index and Forex trading. He later joined Ideal CFD’s a CFD provider that was bought by IG Markets, he ...

Options Contract Mechanics, Canola Futures

... Part of an option contract’s value is tied to volatility in the underlying futures market. The wider futures prices swing from day to day, the higher the likelihood of an option moving into-the-money before the contract expires. An option’s volatility value is measured by its ‘delta’, which is calc ...

... Part of an option contract’s value is tied to volatility in the underlying futures market. The wider futures prices swing from day to day, the higher the likelihood of an option moving into-the-money before the contract expires. An option’s volatility value is measured by its ‘delta’, which is calc ...

Introduction to Money and the Financial System

... In real world, portfolios cannot be perfectly diversified because borrowers do not earn money and pay returns by flipping coins. Borrowers typically pay returns by earning money producing and selling goods, but since economies move up and down jointly through business cycles, returns have a common c ...

... In real world, portfolios cannot be perfectly diversified because borrowers do not earn money and pay returns by flipping coins. Borrowers typically pay returns by earning money producing and selling goods, but since economies move up and down jointly through business cycles, returns have a common c ...

trading hours euronext amsterdam, brussels, lisbon and

... 24 December 2013 to 3 January 2014, inclusive, can be summarised as described in the table on page 2. Members are reminded of the importance of ensuring that all trades executed during the Christmas and New Year period are correctly and promptly processed, e.g. allocated and/or claimed. For further ...

... 24 December 2013 to 3 January 2014, inclusive, can be summarised as described in the table on page 2. Members are reminded of the importance of ensuring that all trades executed during the Christmas and New Year period are correctly and promptly processed, e.g. allocated and/or claimed. For further ...

Glossary - Investment 2020

... A company is insolvent if it either does not have enough assets to cover its debts, or if it is unable to cover its debts ...

... A company is insolvent if it either does not have enough assets to cover its debts, or if it is unable to cover its debts ...

FREE Sample Here

... 97. From 1965 to 2003 large block trades of common stock traded on the New York Stock Exchange increased from 3.1 percent to almost 50 percent. This indicates that a. Individual investors are getting out of the market entirely b. Individual investors are avoiding a long term buy-and-hold strategy in ...

... 97. From 1965 to 2003 large block trades of common stock traded on the New York Stock Exchange increased from 3.1 percent to almost 50 percent. This indicates that a. Individual investors are getting out of the market entirely b. Individual investors are avoiding a long term buy-and-hold strategy in ...

13 characteristics of a successful trader

... primary markets they focus on are benchmark bond yields of the major currencies (U.S., German, UK, and Japanese ten-year government notes), oil, gold, and major global stock indexes. On an intraday basis, they look to these other markets for confirmation of short-term U.S. dollar directional bias. F ...

... primary markets they focus on are benchmark bond yields of the major currencies (U.S., German, UK, and Japanese ten-year government notes), oil, gold, and major global stock indexes. On an intraday basis, they look to these other markets for confirmation of short-term U.S. dollar directional bias. F ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.