Futures Contracts

... Derivative An asset, such as a futures contract or an option contract, that derives its economic value from an underlying asset, such as a stock or a bond. Hedge To take action to reduce risk by, for example, purchasing a derivative contract that will increase in value when another asset in an inve ...

... Derivative An asset, such as a futures contract or an option contract, that derives its economic value from an underlying asset, such as a stock or a bond. Hedge To take action to reduce risk by, for example, purchasing a derivative contract that will increase in value when another asset in an inve ...

Money, Banking, and the Financial System

... 1. Futures contracts are traded on exchanges, such as the Chicago Board of Trade (CBOT) and the New York Mercantile Exchange (NYMEX). 2. Futures contracts typically specify a quantity of the underlying asset to be delivered but do not fix the price. 3. Futures contracts are standardized in terms of ...

... 1. Futures contracts are traded on exchanges, such as the Chicago Board of Trade (CBOT) and the New York Mercantile Exchange (NYMEX). 2. Futures contracts typically specify a quantity of the underlying asset to be delivered but do not fix the price. 3. Futures contracts are standardized in terms of ...

colour ppt

... development of the Globex, electronic trading platform traders through out the world trade futures even when the exchanges are not officially open. ...

... development of the Globex, electronic trading platform traders through out the world trade futures even when the exchanges are not officially open. ...

Efficient Price Discovery in Stock Index Cash and Futures Markets

... example, GROSSMAN [1977], BRAY [1981] and BRANNEN and ULVELING [1984]). The case of stock index futures is analyzed in SUBRAHMANYAM [1991] and in KUMAR and SEPPI [1994]. Futures and cash markets contribute to the discovery of a unique and common unobservable price that is the efficient price. The co ...

... example, GROSSMAN [1977], BRAY [1981] and BRANNEN and ULVELING [1984]). The case of stock index futures is analyzed in SUBRAHMANYAM [1991] and in KUMAR and SEPPI [1994]. Futures and cash markets contribute to the discovery of a unique and common unobservable price that is the efficient price. The co ...

IOSR Journal of Economics and Finance (IOSR-JEF) e-ISSN: 2321-5933, p-ISSN: 2321-5925.

... The Laws of operation of the market as introduced in „Wealth of Nations‟ is based on the concept of an Effectual Demand. In Adam Smith, words “The market price of every particular commodity is regulated by the proportion between the quantity which is actually brought to market, and the demand of tho ...

... The Laws of operation of the market as introduced in „Wealth of Nations‟ is based on the concept of an Effectual Demand. In Adam Smith, words “The market price of every particular commodity is regulated by the proportion between the quantity which is actually brought to market, and the demand of tho ...

Can the CFTC and SEC Work Together to Prevent Another Madoff?

... investor redemption demands.11 Allan Horwich, a senior lecturer of securities litigation at Northwestern University Law School, says Madoff was able to keep his scheme going for so long by paying promised returns.12 “By meeting the demands of insistent investors, Madoff was able to deflect any suspi ...

... investor redemption demands.11 Allan Horwich, a senior lecturer of securities litigation at Northwestern University Law School, says Madoff was able to keep his scheme going for so long by paying promised returns.12 “By meeting the demands of insistent investors, Madoff was able to deflect any suspi ...

STATE UNIVERSITY – THE HIGHER SCHOOL OF ECONOMICS

... Most common types of market derivatives are taken into account in the course: Forwards and futures – as instruments providing definite forward projection of final profit if not cash flows. Exchange trading habits and certain issues such as offset dealing or private defaults form the focus of the par ...

... Most common types of market derivatives are taken into account in the course: Forwards and futures – as instruments providing definite forward projection of final profit if not cash flows. Exchange trading habits and certain issues such as offset dealing or private defaults form the focus of the par ...

Extended Hours Trading Risk Disclosure Statement

... Generally, the more orders that are available in a market, the greater the liquidity. Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased ...

... Generally, the more orders that are available in a market, the greater the liquidity. Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased ...

International Derivatives Brochure

... Notice how, during the contract period, the futures price moved a total of R70 higher. This represented a total profit to the buyer of R70.00 and a total loss to the seller of R70. The margining system is effective in ensuring that both buyer and seller are constantly upto-date in their profits and ...

... Notice how, during the contract period, the futures price moved a total of R70 higher. This represented a total profit to the buyer of R70.00 and a total loss to the seller of R70. The margining system is effective in ensuring that both buyer and seller are constantly upto-date in their profits and ...

I_Ch03

... for several stocks (but for each security, it is assigned to one single specialist) Make a market (造市): be always ready, willing, and able to trade a particular security at quoted bid and asked prices The task of dealers is to make a market, but in dealer markets, there could be many dealers for one ...

... for several stocks (but for each security, it is assigned to one single specialist) Make a market (造市): be always ready, willing, and able to trade a particular security at quoted bid and asked prices The task of dealers is to make a market, but in dealer markets, there could be many dealers for one ...

ETFs: A Call for Greater Transparency and Consistent

... Securities that provide exposure to physical commodities but are structured as debt instruments and not backed by the physical underlying commodity should not be considered an ETC. ...

... Securities that provide exposure to physical commodities but are structured as debt instruments and not backed by the physical underlying commodity should not be considered an ETC. ...

private equity in mining - Berwin Leighton Paisner

... one or two deals each throughout the year. Again, gold was the most popular commodity for funds to increase their stakes or follow their investment with eight deals, while other investments spread across a range of commodities. Management team backing was split between base metals, coking coal and g ...

... one or two deals each throughout the year. Again, gold was the most popular commodity for funds to increase their stakes or follow their investment with eight deals, while other investments spread across a range of commodities. Management team backing was split between base metals, coking coal and g ...

Measuring market quality - Association of Futures Markets

... Informed traders possess private information that isn’t available to the general public and enables predictions of future price movements and spotting of market inefficiencies. This information could, for example, come from superior forecasts by advanced algorithms or superior news sources and can h ...

... Informed traders possess private information that isn’t available to the general public and enables predictions of future price movements and spotting of market inefficiencies. This information could, for example, come from superior forecasts by advanced algorithms or superior news sources and can h ...

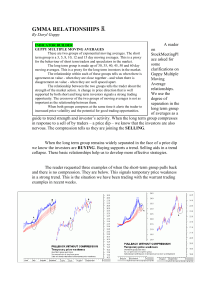

gmma relationships

... The relationship within each of these groups tells us when there is agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A chang ...

... The relationship within each of these groups tells us when there is agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A chang ...

Soln Ch 21 Futures intro

... should earn the risk-free rate of return. The six-month risk-free rate of return is 5.00% (annualized), which produces a return of $24.70 over a six-month period: ...

... should earn the risk-free rate of return. The six-month risk-free rate of return is 5.00% (annualized), which produces a return of $24.70 over a six-month period: ...

David Gray Remarks CBOE Update OIC Conference, Miami, Florida

... study of options-based funds that CBOE released in January. The study analyzed investment companies such as mutual funds, exchange-traded funds and closed-end funds that use exchange-listed options for portfolio management. I’d like to share two of the main highlights from the study: 1) The number o ...

... study of options-based funds that CBOE released in January. The study analyzed investment companies such as mutual funds, exchange-traded funds and closed-end funds that use exchange-listed options for portfolio management. I’d like to share two of the main highlights from the study: 1) The number o ...

December 9, 2005 Dear Market Participant, Over the past few years

... exposed to reputational risk if it is linked to a chain of transactions that result in dissatisfaction or litigation or both. Reputational risk is the current and prospective impact on earnings and capital caused by negative public opinion regarding an institution's products or activities. This risk ...

... exposed to reputational risk if it is linked to a chain of transactions that result in dissatisfaction or litigation or both. Reputational risk is the current and prospective impact on earnings and capital caused by negative public opinion regarding an institution's products or activities. This risk ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.