HullFund8eCh03ProblemSolutions

... A trader owns 55,000 units of a particular asset and decides to hedge the value of her position with futures contracts on another related asset. Each futures contract is on 5,000 units. The spot price of the asset that is owned is $28 and the standard deviation of the change in this price over the l ...

... A trader owns 55,000 units of a particular asset and decides to hedge the value of her position with futures contracts on another related asset. Each futures contract is on 5,000 units. The spot price of the asset that is owned is $28 and the standard deviation of the change in this price over the l ...

First North Price List

... The annual fee payable by an Issuer is calculated on the basis of the market value of the shares traded. The market value of shares is calculated as the arithmetic average of the market values obtained by multiplying the number of shares by the closing prices for all trading days of the previous cal ...

... The annual fee payable by an Issuer is calculated on the basis of the market value of the shares traded. The market value of shares is calculated as the arithmetic average of the market values obtained by multiplying the number of shares by the closing prices for all trading days of the previous cal ...

OPTIONS AND FUTURES CONTRACTS IN ELECTRICITY FOR

... will trade the physical commodities, but in between, a large number of transactions in futures will take place. These operations allow the participant to benefit from managing their risks with the possibility of sharing them with other parties with inverse risk profiles. On the other hand, trade in ...

... will trade the physical commodities, but in between, a large number of transactions in futures will take place. These operations allow the participant to benefit from managing their risks with the possibility of sharing them with other parties with inverse risk profiles. On the other hand, trade in ...

IB Comment Letter to SEC Opposing New Margin Requirements for

... investment products on organized securities and futures exchanges worldwide. Timber Hill LLC is registered with the Commission as a broker-dealer and is a member in good standing of the Chicago Board Options Exchange, American Stock Exchange, National Association of Securities Dealers, Philadelphia ...

... investment products on organized securities and futures exchanges worldwide. Timber Hill LLC is registered with the Commission as a broker-dealer and is a member in good standing of the Chicago Board Options Exchange, American Stock Exchange, National Association of Securities Dealers, Philadelphia ...

The role of a financial transaction tax in sustainable finance

... transfer gains tax on listed stocks on principle. The GNP suggested taxing transfer gains over 40 million KRW, regardless of the major shareholders, while the Democratic Labor Party recommended levying not only listed securities but also derivatives. 3 However, the National Assembly anticipated grea ...

... transfer gains tax on listed stocks on principle. The GNP suggested taxing transfer gains over 40 million KRW, regardless of the major shareholders, while the Democratic Labor Party recommended levying not only listed securities but also derivatives. 3 However, the National Assembly anticipated grea ...

1 The Greek Letters

... See Figure 15.11 for the variation of n with respect to the stock price for a call or put option ...

... See Figure 15.11 for the variation of n with respect to the stock price for a call or put option ...

18Future Contracts,Options and Swaps

... you are under no obligation to go through with the sale. Of course, you still lose the $3,000 price of the option. ...

... you are under no obligation to go through with the sale. Of course, you still lose the $3,000 price of the option. ...

Daily - WordPress.com

... business entrepreneurs, engaged in the profit organization and non-profit organization, established on 1995. DT-investment is a very attractive investment and highly profitable, both the short and long term, because it is managed by an experienced management team, that has a dozen years experience i ...

... business entrepreneurs, engaged in the profit organization and non-profit organization, established on 1995. DT-investment is a very attractive investment and highly profitable, both the short and long term, because it is managed by an experienced management team, that has a dozen years experience i ...

NBER WORKING PAPER SERIES WHAT DOES FUTURES

... We find qualitatively similar, but statistically weaker, evidence for predictability of returns in currency, bond, and stock markets. We find that rising currency market interest, which signals higher US economic activity and rising inflation expectations, predicts appreciation of a portfolio of forei ...

... We find qualitatively similar, but statistically weaker, evidence for predictability of returns in currency, bond, and stock markets. We find that rising currency market interest, which signals higher US economic activity and rising inflation expectations, predicts appreciation of a portfolio of forei ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... position in underlying instruments. In many instances, traders find financial derivatives to be a more attractive instrument than the underlying security. This is mainly because of the greater amount of liquidity in the market offered by derivatives as well as the lower transaction costs associated ...

... position in underlying instruments. In many instances, traders find financial derivatives to be a more attractive instrument than the underlying security. This is mainly because of the greater amount of liquidity in the market offered by derivatives as well as the lower transaction costs associated ...

File

... Derivative is a generic term for contracts like futures, options and swaps. The values of these contracts depend on value of the underlying assets, called bases. For example if A agrees to buy US$ 1 lakh from B at Rs. 50/$ (exercise price), after 3 months and exchange rate is Rs. 50.20/$ on maturity ...

... Derivative is a generic term for contracts like futures, options and swaps. The values of these contracts depend on value of the underlying assets, called bases. For example if A agrees to buy US$ 1 lakh from B at Rs. 50/$ (exercise price), after 3 months and exchange rate is Rs. 50.20/$ on maturity ...

Analysis EC proposal for FTT - Insurance Association of Cyprus

... also considered as structured products. This is because the originator issues securities whose value and income payments are based (derived) on the value and cash flows of the assets that have been pooled (structured) together and perhaps even separated into tranches (mortgages, student loans, etc). ...

... also considered as structured products. This is because the originator issues securities whose value and income payments are based (derived) on the value and cash flows of the assets that have been pooled (structured) together and perhaps even separated into tranches (mortgages, student loans, etc). ...

Determination of Forward and Futures Prices

... and short one-year gold futures contracts to lock in a profit. If the actual gold futures price is less than 484.63, an investor who already owns gold can improve the return by selling the gold and buying gold futures contracts. Fundamentals of Futures and Options Markets, 5th Edition, Copyright © J ...

... and short one-year gold futures contracts to lock in a profit. If the actual gold futures price is less than 484.63, an investor who already owns gold can improve the return by selling the gold and buying gold futures contracts. Fundamentals of Futures and Options Markets, 5th Edition, Copyright © J ...

Part 5 Clearing and settlement facilities

... (b) a second contract between the seller and TNS Clearing Pty Limited in the same terms as the original contract. ...

... (b) a second contract between the seller and TNS Clearing Pty Limited in the same terms as the original contract. ...

Markit iBoxx Asia ex

... The indices serve as benchmarks for asset managers and investors and may form the basis for traded products, such as ETFs. Multiple-source pricing ensures that they are an accurate reflection of the underlying markets. ...

... The indices serve as benchmarks for asset managers and investors and may form the basis for traded products, such as ETFs. Multiple-source pricing ensures that they are an accurate reflection of the underlying markets. ...

The Black-Scoles Model The Binomial Model and Pricing American

... To price an option in the Binomial lattice we replace the growth rate of the stock by the by the riskless rate. The lattice converges to a Geometric Wiener process. For European options we can use simulation, where we replace the growth rate by the riskfree rate. Simulation, the Binomial lattice and ...

... To price an option in the Binomial lattice we replace the growth rate of the stock by the by the riskless rate. The lattice converges to a Geometric Wiener process. For European options we can use simulation, where we replace the growth rate by the riskfree rate. Simulation, the Binomial lattice and ...

FUTURES PRODUCT DISCLOSURE STATEMENT INTERACTIVE

... Before you trade Exchange Traded Derivatives you should, in conjunction with your adviser, give consideration to your objectives, financial situation and needs. You should also be aware of the risks involved and be satisfied that trading in Exchange Traded Derivatives is suitable for you in view of ...

... Before you trade Exchange Traded Derivatives you should, in conjunction with your adviser, give consideration to your objectives, financial situation and needs. You should also be aware of the risks involved and be satisfied that trading in Exchange Traded Derivatives is suitable for you in view of ...

PowerShares Dynamic US Market UCITS ETF 31 May 2017

... Persons interested in acquiring the ETF should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile: (ii) any foreign exchange controls: and (iii) tax consequences which might be relevant. This document is marketing mater ...

... Persons interested in acquiring the ETF should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile: (ii) any foreign exchange controls: and (iii) tax consequences which might be relevant. This document is marketing mater ...

Volatility - past, present and future

... Source Bloomberg L.P. Based on S&P 500 Index daily returns. Data as of Dec. 31, 2016. An investment cannot be made directly into an index. Past performance is not a guarantee of future results. ...

... Source Bloomberg L.P. Based on S&P 500 Index daily returns. Data as of Dec. 31, 2016. An investment cannot be made directly into an index. Past performance is not a guarantee of future results. ...

Chapter 5

... Amber sells a March futures contract and locks in the right to sell 500,000 Mexican pesos at $0.10958/Ps (peso). If the spot exchange rate at maturity is $0.095/Ps, the value of Amber’s position on settlement is: ...

... Amber sells a March futures contract and locks in the right to sell 500,000 Mexican pesos at $0.10958/Ps (peso). If the spot exchange rate at maturity is $0.095/Ps, the value of Amber’s position on settlement is: ...

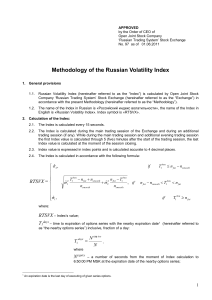

Methodology of the Volatility Index Calculation

... price of a futures contract, which is an underlying asset for nearby/next options series (hereinafter referred to as the “underlying futures contract”). ...

... price of a futures contract, which is an underlying asset for nearby/next options series (hereinafter referred to as the “underlying futures contract”). ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.