Future Equity Patterns and Baby Boomer Retirements

... is inconclusive (3 papers) or is only of slight relevance to this research (7 papers). Note that some of the papers rejecting the asset meltdown hypothesis also support the thesis that there will be moderate asset value reductions. One paper, Kedar-Levy (2006), No. 13 in the literature review, not o ...

... is inconclusive (3 papers) or is only of slight relevance to this research (7 papers). Note that some of the papers rejecting the asset meltdown hypothesis also support the thesis that there will be moderate asset value reductions. One paper, Kedar-Levy (2006), No. 13 in the literature review, not o ...

Dynamic Monitoring of Financial Intermediaries with Subordinated

... component. The systematic component is associated with market conditions such as the state of the stock market, the bond market, the Treasury yield curve, the state of the business cycle, etc. The idiosyncratic component is associated with the special characteristics of the security, such as embedd ...

... component. The systematic component is associated with market conditions such as the state of the stock market, the bond market, the Treasury yield curve, the state of the business cycle, etc. The idiosyncratic component is associated with the special characteristics of the security, such as embedd ...

Stock market performance and pension fund investment policy

... funding ratio of the pension fund.1 During the nineties abundant equity returns led to premium reductions and even contribution holidays for pension plan sponsors. However, the risks of equity holdings surfaced after the collapse of the stock market in 2000-2002, which resulted in large losses for p ...

... funding ratio of the pension fund.1 During the nineties abundant equity returns led to premium reductions and even contribution holidays for pension plan sponsors. However, the risks of equity holdings surfaced after the collapse of the stock market in 2000-2002, which resulted in large losses for p ...

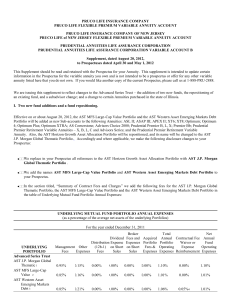

PRUCO LIFE INSURANCE COMPANY PRUCO LIFE FLEXIBLE

... annuity listed here that you do not own. If you would like another copy of the current Prospectus, please call us at 1-888-PRU-2888. We are issuing this supplement to reflect changes to the Advanced Series Trust – the addition of two new funds, the repositioning of an existing fund, and a subadvisor ...

... annuity listed here that you do not own. If you would like another copy of the current Prospectus, please call us at 1-888-PRU-2888. We are issuing this supplement to reflect changes to the Advanced Series Trust – the addition of two new funds, the repositioning of an existing fund, and a subadvisor ...

Time-varying risk premia and the cost of capital

... attributable to movements in equity risk premia. Yet, perhaps owing to the longstanding intellectual divide between macroeconomics and finance, surprisingly little empirical research has been devoted to understanding the dynamic link between movements in equity risk premia and macroeconomic variables ...

... attributable to movements in equity risk premia. Yet, perhaps owing to the longstanding intellectual divide between macroeconomics and finance, surprisingly little empirical research has been devoted to understanding the dynamic link between movements in equity risk premia and macroeconomic variables ...

2nd Con Doc on NBNI G

... their current or future regulatory proposals or of their rulemaking or standards implementation work. This report thus does not reflect a judgment by, or limit the choices of, these authorities with regard to their proposed or final versions of their rules or standards. ...

... their current or future regulatory proposals or of their rulemaking or standards implementation work. This report thus does not reflect a judgment by, or limit the choices of, these authorities with regard to their proposed or final versions of their rules or standards. ...

Investor Scale and Performance in Private Equity Investments

... vintage years effects or breakdown returns separately for venture and buyout fund programs. Given these data limitations, the CEM performance data is less appropriate for assessments of absolute PE performance than studies that take advantage of fund-level cash flow information. At the same time, da ...

... vintage years effects or breakdown returns separately for venture and buyout fund programs. Given these data limitations, the CEM performance data is less appropriate for assessments of absolute PE performance than studies that take advantage of fund-level cash flow information. At the same time, da ...

CTAs: Shedding light on the black box

... 7. One less publicised convex property of CTAs is that a unit of (CTA outperformance over a CTA index) return increases more than proportionally to a unit of (CTA relative riskiness) risk. Riskier and levered CTAs display a better up/down capture ratio (vs CTA indices). We therefore seek maximum con ...

... 7. One less publicised convex property of CTAs is that a unit of (CTA outperformance over a CTA index) return increases more than proportionally to a unit of (CTA relative riskiness) risk. Riskier and levered CTAs display a better up/down capture ratio (vs CTA indices). We therefore seek maximum con ...

Document

... of the higher risk involved for equityholders in a company with debt. The formula is derived from the theory of weighted average cost of capital (WACC). ...

... of the higher risk involved for equityholders in a company with debt. The formula is derived from the theory of weighted average cost of capital (WACC). ...

TITEL - VBA beleggingsprofessionals

... Modeling credit risk – Expected loss • Loss given default – The fraction of the outstanding loan that will not be recovered once default occurred. – Influenced by: • Collateral • Guarantees ...

... Modeling credit risk – Expected loss • Loss given default – The fraction of the outstanding loan that will not be recovered once default occurred. – Influenced by: • Collateral • Guarantees ...

AMICE response to EIOPA Consultation on the review of specific

... Undertakings should not be required to quantify the degree of model error in precise quantitative terms or to recalculate the SCR using a more accurate method in order to demonstrate that the difference between the result of the chosen method and the result of a more accurate method is immaterial. I ...

... Undertakings should not be required to quantify the degree of model error in precise quantitative terms or to recalculate the SCR using a more accurate method in order to demonstrate that the difference between the result of the chosen method and the result of a more accurate method is immaterial. I ...

The Composite Index of Propensity to Risk – CIPR

... The spectrum of risk attitudes is related to the form of utility functions reflecting the behavior of individuals when choosing between risky, uncertain outcomes and certain equivalents. For example, consider two possible monetary outcomes or lotteries, z1 and z2 that may occur with chances p and (1 ...

... The spectrum of risk attitudes is related to the form of utility functions reflecting the behavior of individuals when choosing between risky, uncertain outcomes and certain equivalents. For example, consider two possible monetary outcomes or lotteries, z1 and z2 that may occur with chances p and (1 ...

Cumulative Prospect Theory, Option Prices, and the Variance

... implied option returns (red crosses) line up remarkably well with the actual data for both puts and calls, which stands in sharp contrast to the poor t of the CRRA model. Because pricing returns of puts and calls is a su cient condition for explaining the variance premium, the results in Figure 1 a ...

... implied option returns (red crosses) line up remarkably well with the actual data for both puts and calls, which stands in sharp contrast to the poor t of the CRRA model. Because pricing returns of puts and calls is a su cient condition for explaining the variance premium, the results in Figure 1 a ...

Allocation of risks and equilibrium in markets with finitely many traders

... Several authors have extended the framework to include the presence of background risk and have considered the allocation problem also in the context of financial risks (see Leland (1980), Chavallier and Müller (1994), and Barrieu and El Karoui (2004, 2005), Dana and Scarsini (2005), Chateauneuf, D ...

... Several authors have extended the framework to include the presence of background risk and have considered the allocation problem also in the context of financial risks (see Leland (1980), Chavallier and Müller (1994), and Barrieu and El Karoui (2004, 2005), Dana and Scarsini (2005), Chateauneuf, D ...

Fallacy of the Log-Normal Approximation to

... mean or the expected log of outcomes, it was hoped, would provide an asymptotically exact criterion for rational action, implying as a bonus the efficiency of a diversification-of-portfolio strategy constant through time (i.e., a ‘myopic’ rule, the same for every period, even when probabilities of d ...

... mean or the expected log of outcomes, it was hoped, would provide an asymptotically exact criterion for rational action, implying as a bonus the efficiency of a diversification-of-portfolio strategy constant through time (i.e., a ‘myopic’ rule, the same for every period, even when probabilities of d ...

Thinking Alternative

... valuations; for details, see The 5% Solution (2012) or Alternative Thinking, January 2014. Stocks are represented by the Standard&Poor’s 500 Index since 1957 and before it other broad indices of large-cap U.S. stocks. The equity real yield is a 50/50 mix of two measures: Shiller’s (10year average, c ...

... valuations; for details, see The 5% Solution (2012) or Alternative Thinking, January 2014. Stocks are represented by the Standard&Poor’s 500 Index since 1957 and before it other broad indices of large-cap U.S. stocks. The equity real yield is a 50/50 mix of two measures: Shiller’s (10year average, c ...

Investors` Horizons and the Amplification of Market Shocks

... VIX index, which reflects the probability of a market meltdown. Since our results are robust to various specifications, we can conclude that differences in the stocks’ exposures to liquidity risk and to the probability of a market meltdown cannot explain our findings. Another possible concern is tha ...

... VIX index, which reflects the probability of a market meltdown. Since our results are robust to various specifications, we can conclude that differences in the stocks’ exposures to liquidity risk and to the probability of a market meltdown cannot explain our findings. Another possible concern is tha ...

Knowledge in a nutshell - UBS

... No. First, you should understand how they work. As an investor, I can choose to invest directly in equities, gold or currencies or indirectly in a warrant on these underlying assets. Let’s say I have 10,000 Swiss francs. Instead of investing this entire amount in a stock, I can spend part of it on a ...

... No. First, you should understand how they work. As an investor, I can choose to invest directly in equities, gold or currencies or indirectly in a warrant on these underlying assets. Let’s say I have 10,000 Swiss francs. Instead of investing this entire amount in a stock, I can spend part of it on a ...

The Cross-Section of Expected Trading Activity

... To proxy for the extent to which estimation uncertainty about fundamental values plays a significant role in price formation, we consider measures of earnings surprises and earnings volatility. The notion is that if absolute earnings surprises are high then large rebalancing trades could be triggered ...

... To proxy for the extent to which estimation uncertainty about fundamental values plays a significant role in price formation, we consider measures of earnings surprises and earnings volatility. The notion is that if absolute earnings surprises are high then large rebalancing trades could be triggered ...

Reference manual - Index derivatives

... by maintaining a diverse portfolio of stocks, rather than a concentrated position in a limited number of equity issues or in a narrow sector of the market. The challenge to investors, then, is to assemble a portfolio of stocks that will maximize the expected return for a given measure of risk. Portf ...

... by maintaining a diverse portfolio of stocks, rather than a concentrated position in a limited number of equity issues or in a narrow sector of the market. The challenge to investors, then, is to assemble a portfolio of stocks that will maximize the expected return for a given measure of risk. Portf ...

Dividend Policy as a Signaling Mechanism Under Different Market

... Gompers et al. (2003) document superior stock price performance of firms with lower agency problems relative to firms with higher agency problems. In this paper, we aim to study whether the arguments put forward in the prior literature regarding the signaling value of dividend policy hold across di ...

... Gompers et al. (2003) document superior stock price performance of firms with lower agency problems relative to firms with higher agency problems. In this paper, we aim to study whether the arguments put forward in the prior literature regarding the signaling value of dividend policy hold across di ...

Credit Risk

... pays a high (leveraged) coupon in return for accepting with this the risk that the payments will stop (or be significantly reduced) if there are one or more defaults in the pool. The cash-flows might also be packaged in the form of lower-yielding money market instruments, thus earning profits for ...

... pays a high (leveraged) coupon in return for accepting with this the risk that the payments will stop (or be significantly reduced) if there are one or more defaults in the pool. The cash-flows might also be packaged in the form of lower-yielding money market instruments, thus earning profits for ...

expected returns

... * Based on the German yield curve ** European rates *** Worldwide. Source: Robeco ...

... * Based on the German yield curve ** European rates *** Worldwide. Source: Robeco ...

Risk Transformation Aligning risk and the pursuit of

... operational standpoint and further integrate risk management practices into business unit processes and activities. This in turn assists management in deploying capital more effectively for higher shareholder returns. Needs vary by organization, and specific responses will be particular to the organ ...

... operational standpoint and further integrate risk management practices into business unit processes and activities. This in turn assists management in deploying capital more effectively for higher shareholder returns. Needs vary by organization, and specific responses will be particular to the organ ...

Contagion and competitive intra-industry effects of

... how much of the information in the bankruptcy announcement is firm-specific and how much is industry-wide, nor does it tell us whether other firms in the industry benefit from the difficulties of the bankrupt firm. To address these issues, we study the effect of bankruptcy announcements on the bankr ...

... how much of the information in the bankruptcy announcement is firm-specific and how much is industry-wide, nor does it tell us whether other firms in the industry benefit from the difficulties of the bankrupt firm. To address these issues, we study the effect of bankruptcy announcements on the bankr ...

Beta (finance)

In finance, the beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not go up or down a lot, so it has a low beta. An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market.A beta greater than one generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like equity put options can have large negative betas.Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. In the capital asset pricing model, beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest.The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio. Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types.Beta decay refers to the tendency for a company with a high beta coefficient (β > 1) to have its beta coefficient decline to the market beta. It is an example of regression toward the mean.