Optimal Consumption and Portfolio Choices with Risky

... Our analysis of alternative housing-choice policies indicates that housing choice has a significant impact on the investors’ portfolio decisions. Compared with the optimal portfolio choice, which allows investors to endogenously choose renting versus owning a house, investors overweigh in equity whe ...

... Our analysis of alternative housing-choice policies indicates that housing choice has a significant impact on the investors’ portfolio decisions. Compared with the optimal portfolio choice, which allows investors to endogenously choose renting versus owning a house, investors overweigh in equity whe ...

An Overview of Fee Structures in Real Estate Funds and Their

... Clearly, extensions can be easily drawn to fees based on cash flow or rental income. Furthermore, extensions can be made to other methodologies (e.g., commitment, drawn commitment, invested equity, etc.) however, the assumptions (e.g., the rate at which committed capital is drawn) may become more te ...

... Clearly, extensions can be easily drawn to fees based on cash flow or rental income. Furthermore, extensions can be made to other methodologies (e.g., commitment, drawn commitment, invested equity, etc.) however, the assumptions (e.g., the rate at which committed capital is drawn) may become more te ...

Herd Behavior in the NASDAQ OMX Baltic Stock Market

... herding is the lack of centralized coordination (Raafat et al., 2009). When it comes to stock markets, herding trends have been noticed both in developed and emerging markets, in both cases especially strongly during market up- and down- turns, as these times can be driven more by emotions rather th ...

... herding is the lack of centralized coordination (Raafat et al., 2009). When it comes to stock markets, herding trends have been noticed both in developed and emerging markets, in both cases especially strongly during market up- and down- turns, as these times can be driven more by emotions rather th ...

Certificates of Deposit Linked to the J.P. Morgan Efficiente Plus DS 5

... The J.P. Morgan Efficiente Plus DS 5 Index (Net ER) (the “Index”) was developed and is maintained and calculated by J.P. Morgan Securities plc (“JPMS plc”), one of our affiliates. JPMS plc acts as the calculation agent for the Index (the “index calculation agent”). The Index is a notional dynamic ba ...

... The J.P. Morgan Efficiente Plus DS 5 Index (Net ER) (the “Index”) was developed and is maintained and calculated by J.P. Morgan Securities plc (“JPMS plc”), one of our affiliates. JPMS plc acts as the calculation agent for the Index (the “index calculation agent”). The Index is a notional dynamic ba ...

Systemic Contingent Claims Analysis -- Estimating Market

... arrangementsboth institutional and market-basedthat could either lead directly to system-wide distress in the financial sector and/or significantly amplify its consequences (with adverse effects on other sectors, in particular capital formation in the real economy). Typically, such distress manife ...

... arrangementsboth institutional and market-basedthat could either lead directly to system-wide distress in the financial sector and/or significantly amplify its consequences (with adverse effects on other sectors, in particular capital formation in the real economy). Typically, such distress manife ...

Rise of Cross-Asset Correlations

... Correlation measures the degree to which prices of assets move together. Over the past decade, investors witnessed a significant increase of correlation between equities as well as an increase of correlation between other risky assets such as credit, foreign exchange, interest rates, and commodities ...

... Correlation measures the degree to which prices of assets move together. Over the past decade, investors witnessed a significant increase of correlation between equities as well as an increase of correlation between other risky assets such as credit, foreign exchange, interest rates, and commodities ...

The Effect of Economic Factors on the Performance of the Australian

... 4.6.2. The Stock Market the Commodity Price Index .................................................... 131 4.7. Foreign Exchange Market and Stock Market .............................................................. 134 4.7.1. Exchange Rate and Macroeconomic Variables ............................... ...

... 4.6.2. The Stock Market the Commodity Price Index .................................................... 131 4.7. Foreign Exchange Market and Stock Market .............................................................. 134 4.7.1. Exchange Rate and Macroeconomic Variables ............................... ...

The Leverage Effect on Stock Returns-EFMA

... (Fama et al. 1969). Next, the study estimates abnormal returns in excess of the riskfree rate using Sharpe (1964)’s Capital Asset Pricing Model, Fama-French (1993) model and Carhart (1997) model. For CAPM, the paper estimates the intercept term alpha by performing the regression: Rt-rft= αCAPM+ β1Ex ...

... (Fama et al. 1969). Next, the study estimates abnormal returns in excess of the riskfree rate using Sharpe (1964)’s Capital Asset Pricing Model, Fama-French (1993) model and Carhart (1997) model. For CAPM, the paper estimates the intercept term alpha by performing the regression: Rt-rft= αCAPM+ β1Ex ...

A prudent margin setting methodology that controls the frequency of margin changes

... minimum capital level, pay up a guarantee fund, or report regularly its firm capital, to name just a few. Among all the risk management measures, the most substantial one is to put up an initial/maintenance margin, and to require members to do likewise for their clients. The purpose of a margin requ ...

... minimum capital level, pay up a guarantee fund, or report regularly its firm capital, to name just a few. Among all the risk management measures, the most substantial one is to put up an initial/maintenance margin, and to require members to do likewise for their clients. The purpose of a margin requ ...

Equilibrium interest rate and liquidity premium under

... a decreasing stream of lal)or income over their lifetimes. In addition they can invest in long-term assets ...

... a decreasing stream of lal)or income over their lifetimes. In addition they can invest in long-term assets ...

Inflation and Real Estate Investments

... Real estate prices may, of course, change in response to several factors other than inflation itself, and these may be difficult to isolate in the empirical analysis. Most notably, exogenous supply/demand shocks (as well as endogenous cycles within the real estate market) will affect asset prices a ...

... Real estate prices may, of course, change in response to several factors other than inflation itself, and these may be difficult to isolate in the empirical analysis. Most notably, exogenous supply/demand shocks (as well as endogenous cycles within the real estate market) will affect asset prices a ...

Financial Crises, Risk Premia, and the Term Structure of Risky Assets

... marginal value of wealth is tied to financial crises.2 As further evidence of this, I also split U.S. recessions into those containing a financial crisis and those which do not. I find similar effects: recessions without financial crises result in significantly lower changes in volatility and risk p ...

... marginal value of wealth is tied to financial crises.2 As further evidence of this, I also split U.S. recessions into those containing a financial crisis and those which do not. I find similar effects: recessions without financial crises result in significantly lower changes in volatility and risk p ...

four reasons to consider an allocation to international small cap

... Investors first fell in love with American small cap stocks in the late 1970s when small companies became recognized as more nimble, fast growing, and more able to adapt to changes to technology than their bloated, plodding large competitors. Since their first great boom, US small caps have proven t ...

... Investors first fell in love with American small cap stocks in the late 1970s when small companies became recognized as more nimble, fast growing, and more able to adapt to changes to technology than their bloated, plodding large competitors. Since their first great boom, US small caps have proven t ...

BARCLAYS BANK PLC /ENG/ (Form: 424B2, Received: 12

... the “Early Redemption at the Option of the Issuer” provision), you will receive a quarterly contingent payment equal to the Quarterly Contingent Rate times the principal amount of your Notes if and only if the Closing Value of the Lowest Performing Reference Asset on the related Valuation Date is gr ...

... the “Early Redemption at the Option of the Issuer” provision), you will receive a quarterly contingent payment equal to the Quarterly Contingent Rate times the principal amount of your Notes if and only if the Closing Value of the Lowest Performing Reference Asset on the related Valuation Date is gr ...

NBER WORKING PAPER SERIES INTERNATIONAL CONSUMPTION RISK IS SHARED AFTER ALL:

... to country ’s output in world markets at time as ∗ . The agent’s optimization problem can be written: ...

... to country ’s output in world markets at time as ∗ . The agent’s optimization problem can be written: ...

The Role of Operating Leverage in Asset Pricing

... higher degree of financial distress, higher financial leverage and substantial uncertainty in future earnings performance. In addition, Chen and Zhang (1998) notice an interesting point of geographical difference in value effects4. In contrast with the traditional view which holds that value effect ...

... higher degree of financial distress, higher financial leverage and substantial uncertainty in future earnings performance. In addition, Chen and Zhang (1998) notice an interesting point of geographical difference in value effects4. In contrast with the traditional view which holds that value effect ...

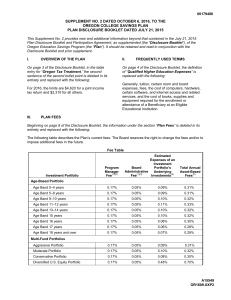

Disclosure Booklet - Oregon College Savings Plan

... with positive duration will generally decline if interest rates increase. Certain other investments, such as inverse floaters and certain derivative instruments, may have a negative duration. The value of instruments with a negative duration will generally decline if interest rates decrease. Inverse ...

... with positive duration will generally decline if interest rates increase. Certain other investments, such as inverse floaters and certain derivative instruments, may have a negative duration. The value of instruments with a negative duration will generally decline if interest rates decrease. Inverse ...

A Wealth-Dependent Investment Opportunity Set

... limited partnerships, hedge funds — these funds are known to be aggressive in employing modern investment techniques — and individual stocks as well as banking accounts and mutual funds. There is also an explicit law which prohibits small investors from trading some securities. In the U.S., the rule ...

... limited partnerships, hedge funds — these funds are known to be aggressive in employing modern investment techniques — and individual stocks as well as banking accounts and mutual funds. There is also an explicit law which prohibits small investors from trading some securities. In the U.S., the rule ...

The volatility of banks in the financial crisis

... Whereas the real economic activity always has a major impact on volatility, financial leverages’ impact depends on the state of the economy. To clarify, financial leverage is the degree to which an investor or business is using borrowed money. Highly leveraged companies may be at risk of bankruptcy ...

... Whereas the real economic activity always has a major impact on volatility, financial leverages’ impact depends on the state of the economy. To clarify, financial leverage is the degree to which an investor or business is using borrowed money. Highly leveraged companies may be at risk of bankruptcy ...

Risk measures and robust optimization problems

... • Cash invariance: If m ∈ R, then ρ(X + m) = ρ(X) − m. The financial meaning of monotonicity is clear. Cash invariance is also called translation invariance. It is motivated by the interpretation of ρ(X) as a capital requirement: if the amount m is added to the position and invested in a risk-free m ...

... • Cash invariance: If m ∈ R, then ρ(X + m) = ρ(X) − m. The financial meaning of monotonicity is clear. Cash invariance is also called translation invariance. It is motivated by the interpretation of ρ(X) as a capital requirement: if the amount m is added to the position and invested in a risk-free m ...

Securities Processing: The Effects of a T+3 System on Security Prices

... the risk that the buyer may not have the money to pay him on the settlement date. The buyer is exposed to the risk of the seller‟s failure to deliver, meaning that the seller may not deliver the securities on the settlement date. Counterparty risk can be very high if trades are bilateral agreements, ...

... the risk that the buyer may not have the money to pay him on the settlement date. The buyer is exposed to the risk of the seller‟s failure to deliver, meaning that the seller may not deliver the securities on the settlement date. Counterparty risk can be very high if trades are bilateral agreements, ...

Forecasting stock market returns: The sum of the parts is more than

... (2010), in which returns and dividend growth are assumed to be predictable. We find that the root mean square error (RMSE) of the simplest version of the SOP method (relative to the true expected return, which is known in the simulation) is 2.87%, compared with 4.94% for the historical mean and 3.73 ...

... (2010), in which returns and dividend growth are assumed to be predictable. We find that the root mean square error (RMSE) of the simplest version of the SOP method (relative to the true expected return, which is known in the simulation) is 2.87%, compared with 4.94% for the historical mean and 3.73 ...

A Model of Competitive Stock Trading Volume Jiang Wang

... It provides no additional information about prices given characterizations of the aggregate risk. The weak empirical performance of the representative agent models has led researchers to develop models with heterogeneous investors and an incomplete asset market (see, e.g., Mankiw 1986; Scheinkman an ...

... It provides no additional information about prices given characterizations of the aggregate risk. The weak empirical performance of the representative agent models has led researchers to develop models with heterogeneous investors and an incomplete asset market (see, e.g., Mankiw 1986; Scheinkman an ...

Friends Life Investment Bond Fund Guide

... Derivatives: Where a fund uses derivatives for investment purposes, there may be an increase in the risk and volatility of the fund. Some derivative investments also expose investors to counterparty or default risk where another party is unable to meet its obligations and pay what is due, which coul ...

... Derivatives: Where a fund uses derivatives for investment purposes, there may be an increase in the risk and volatility of the fund. Some derivative investments also expose investors to counterparty or default risk where another party is unable to meet its obligations and pay what is due, which coul ...

Measuring Historical Volatility

... parameter. While sophisticated volatility estimation procedures, such as GARCH, are popular among finance researchers, these require econometrics software which is difficult for the average undergraduate student or casual options trader to obtain or master so have not found their way into most deriv ...

... parameter. While sophisticated volatility estimation procedures, such as GARCH, are popular among finance researchers, these require econometrics software which is difficult for the average undergraduate student or casual options trader to obtain or master so have not found their way into most deriv ...

Beta (finance)

In finance, the beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not go up or down a lot, so it has a low beta. An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market.A beta greater than one generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like equity put options can have large negative betas.Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. In the capital asset pricing model, beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest.The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio. Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types.Beta decay refers to the tendency for a company with a high beta coefficient (β > 1) to have its beta coefficient decline to the market beta. It is an example of regression toward the mean.