Investment Modeling with StockPointer

... presence of canadian economy in some sectors No stock should weight for more than 7.5% of the portfolio Objective of 10% cash should be kept in portfolio ...

... presence of canadian economy in some sectors No stock should weight for more than 7.5% of the portfolio Objective of 10% cash should be kept in portfolio ...

Dr. Edward Yardeni, Chief Economist

... 34% above fair value. Immediately after the crash, stocks were about 10% undervalued. They were consistently undervalued from 1993 through 1995. Of course, theoretically, stock prices are equal to the present discounted value of future earnings (adjusted for risk), not just 12-month forward earnings ...

... 34% above fair value. Immediately after the crash, stocks were about 10% undervalued. They were consistently undervalued from 1993 through 1995. Of course, theoretically, stock prices are equal to the present discounted value of future earnings (adjusted for risk), not just 12-month forward earnings ...

smgclassroompresentation[1]

... 6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U.S. government. 8. Stock markets are open on business days around the clock, around the world. ...

... 6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U.S. government. 8. Stock markets are open on business days around the clock, around the world. ...

The Price Effects of Australian Structured Share Buybacks

... Abnormal Returns due to ATO Price Floor Buyback announcement day positive abnormal return Super funds may bid up the stock price on the buyback announcement date due to the price floor. But this effect is difficult to separate from the other signaling effects. ...

... Abnormal Returns due to ATO Price Floor Buyback announcement day positive abnormal return Super funds may bid up the stock price on the buyback announcement date due to the price floor. But this effect is difficult to separate from the other signaling effects. ...

outlook-on-us-and-bursa-equity-markets-the-days-ahead

... US Market Leads: ♦ Powered by Intel’s strong third quarter’s outlook and better-than-expected manufacturing data, the US major gauges rallied at least 3% on Wednesday by posting the best 3-day gain since Mar. ♦ In addition, sentiment was further boosted by the Federal Reserve’s upgrade on the 2009 G ...

... US Market Leads: ♦ Powered by Intel’s strong third quarter’s outlook and better-than-expected manufacturing data, the US major gauges rallied at least 3% on Wednesday by posting the best 3-day gain since Mar. ♦ In addition, sentiment was further boosted by the Federal Reserve’s upgrade on the 2009 G ...

April 2015 Factsheet - Electric and General Investment Fund

... Important Information The prices of shares in open ended investment companies and income received from them can go down as well as up and investors may not get back the full amount invested. Past performance is no guarantee of future performance. Changes in the rates of currency exchanges may have a ...

... Important Information The prices of shares in open ended investment companies and income received from them can go down as well as up and investors may not get back the full amount invested. Past performance is no guarantee of future performance. Changes in the rates of currency exchanges may have a ...

Summary Verbal Instructions PO tax on seller

... • Buyers move after the Sellers make their decisions. Buyers enter the market one by one, in random order. • What is known to Buyers? Buyers know their value per unit minus the tax per unit. This is private information. Buyers also know the Offers made by all the Sellers in the market. • What decisi ...

... • Buyers move after the Sellers make their decisions. Buyers enter the market one by one, in random order. • What is known to Buyers? Buyers know their value per unit minus the tax per unit. This is private information. Buyers also know the Offers made by all the Sellers in the market. • What decisi ...

Market Architecture - Market Design Inc.

... – Can this be done without consolidated market? Working hypothesis is ultimately yes - after many improvements to control gaming. ...

... – Can this be done without consolidated market? Working hypothesis is ultimately yes - after many improvements to control gaming. ...

Commodity forward curves: models and data

... • Commodity scarce today relative to what is expected in the future • Would like to bring stuff from the future to today, but can’t • The best we can do is NOT to store • May want to consume all inventories ...

... • Commodity scarce today relative to what is expected in the future • Would like to bring stuff from the future to today, but can’t • The best we can do is NOT to store • May want to consume all inventories ...

Futures - HSBC Broking Services

... 3. Margin trading can involve a high degree of risk. Price changes in the underlying asset can result in substantial losses to you that may in some instances exceed the amount of your initial margin funds, cash and other assets deposited as collateral with HSBC Broking Futures. You should not part ...

... 3. Margin trading can involve a high degree of risk. Price changes in the underlying asset can result in substantial losses to you that may in some instances exceed the amount of your initial margin funds, cash and other assets deposited as collateral with HSBC Broking Futures. You should not part ...

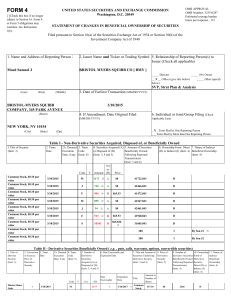

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... ( 1) Represents vesting of one-quarter of market share units granted on March 10, 2013. ( 2) Adjustment reflects additional shares acquired upon the vesting of market share units due to the performance factor. ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting ...

... ( 1) Represents vesting of one-quarter of market share units granted on March 10, 2013. ( 2) Adjustment reflects additional shares acquired upon the vesting of market share units due to the performance factor. ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting ...

Artificial Intelligence (AI) Equity Portfolio Fact Sheet

... performance results are provided for informational purposes only and have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under or over compensated for the impact, if any, ...

... performance results are provided for informational purposes only and have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under or over compensated for the impact, if any, ...

![smgclassroompresentation[1]](http://s1.studyres.com/store/data/021802581_1-1933bb9c9a7cfb38987e81a50d5e9b34-300x300.png)