multiple choice questions - TMC Finance Department Notes

... A. The 15-year bond price will decline more than the 30-year bond price B. The price of the 10-year bond will rise while the price of the 15-year bond will decline C. The prices of different bonds will move in a different way D. None of the above Question 3. The longer an investor parts with her fun ...

... A. The 15-year bond price will decline more than the 30-year bond price B. The price of the 10-year bond will rise while the price of the 15-year bond will decline C. The prices of different bonds will move in a different way D. None of the above Question 3. The longer an investor parts with her fun ...

Currency Risk: To hedge or Not To Hedge—Is That The Question?

... if you do have the ability to predict currency moves with meaningful accuracy, then you should consider taking currency risk. However, the key here is to determine if you truly do have that ability. In reality, many market participants are over-confident in their abilities, making this self-evaluati ...

... if you do have the ability to predict currency moves with meaningful accuracy, then you should consider taking currency risk. However, the key here is to determine if you truly do have that ability. In reality, many market participants are over-confident in their abilities, making this self-evaluati ...

- T. Rowe Price

... U.S. equities have outpaced most global markets, as better economic news and stronger corporate earnings have been rewarded with higher share prices. However, concerns over the likelihood of a sustainable recovery has meant that even in times of optimism, equity markets have seemed to climb a wall o ...

... U.S. equities have outpaced most global markets, as better economic news and stronger corporate earnings have been rewarded with higher share prices. However, concerns over the likelihood of a sustainable recovery has meant that even in times of optimism, equity markets have seemed to climb a wall o ...

Efficient Price Discovery in Stock Index Cash and Futures Markets

... Besides the traditional role of risk sharing assigned to futures markets, these markets play an important role in the aggregation of information (see, for example, GROSSMAN [1977], BRAY [1981] and BRANNEN and ULVELING [1984]). The case of stock index futures is analyzed in SUBRAHMANYAM [1991] and in ...

... Besides the traditional role of risk sharing assigned to futures markets, these markets play an important role in the aggregation of information (see, for example, GROSSMAN [1977], BRAY [1981] and BRANNEN and ULVELING [1984]). The case of stock index futures is analyzed in SUBRAHMANYAM [1991] and in ...

Instructions Double-Oral Auction Market Experiment, Fall 2004

... market. Thus, this is the minimum price you are willing to accept in a market transaction. Enter this value in the appropriate column of your record sheet. As a SELLER you will be making offers to sell in the market. You can offer for any price above the price listed on your card. For example, if yo ...

... market. Thus, this is the minimum price you are willing to accept in a market transaction. Enter this value in the appropriate column of your record sheet. As a SELLER you will be making offers to sell in the market. You can offer for any price above the price listed on your card. For example, if yo ...

Insurance, Weather, and Energy Derivatives

... • A typical product is a forward contract or an option on the cumulative CDD or HDD during a month • Weather derivatives are often used by energy companies to hedge the volume of energy required for heating or cooling during a particular month Options, Futures, and Other Derivatives, 5th edition © 2 ...

... • A typical product is a forward contract or an option on the cumulative CDD or HDD during a month • Weather derivatives are often used by energy companies to hedge the volume of energy required for heating or cooling during a particular month Options, Futures, and Other Derivatives, 5th edition © 2 ...

Do Presidential Elections Impact the Market?

... The danger of “confirmation bias” is very real. Many people, not just investors, are guilty of seeking out and interpreting information that confirms their preexisting beliefs or opinions, while giving much less consideration to alternative thinking. A lot of investment opportunities have been lost ...

... The danger of “confirmation bias” is very real. Many people, not just investors, are guilty of seeking out and interpreting information that confirms their preexisting beliefs or opinions, while giving much less consideration to alternative thinking. A lot of investment opportunities have been lost ...

derivatives_general_paper

... - futures: the parties agree about quality and price but for delivery in the future, typically a few months later. The biggest futures’ market is the one for foreign exchange, but futures are also widespread on fixed income markets (i.e. bonds), equities and commodities; - options: in the simplest f ...

... - futures: the parties agree about quality and price but for delivery in the future, typically a few months later. The biggest futures’ market is the one for foreign exchange, but futures are also widespread on fixed income markets (i.e. bonds), equities and commodities; - options: in the simplest f ...

REX Shares Introduces VolMAXXTM Family of VIX

... and expenses before investing. This and additional information can be found in the Funds’ prospectus, which may be obtained by calling 1-844REX-1414. Read the prospectus carefully before investing. Investing involves risk, including the possible loss of principal. These Funds are actively managed an ...

... and expenses before investing. This and additional information can be found in the Funds’ prospectus, which may be obtained by calling 1-844REX-1414. Read the prospectus carefully before investing. Investing involves risk, including the possible loss of principal. These Funds are actively managed an ...

Week 6 Slides

... Short cash means long (someone else’s) asset Basis risk comes from spreads between exposure and hedge instrument, e.g. default risk premiums Problem with production risk, e.g. interest rates up, needs for funds may be down with ...

... Short cash means long (someone else’s) asset Basis risk comes from spreads between exposure and hedge instrument, e.g. default risk premiums Problem with production risk, e.g. interest rates up, needs for funds may be down with ...

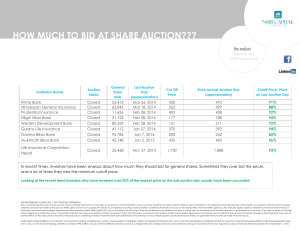

How Much to Bid in Share Auctions

... This is a promotional document and as such the views contained herein are not to be taken as an advice or recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtai ...

... This is a promotional document and as such the views contained herein are not to be taken as an advice or recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtai ...