The role of a financial transaction tax in sustainable finance

... century. A massive inflow of foreign capital – and later a sudden outflow – caused Korea to become part of the Asian financial crisis, alongside other Southeast Asian countries. Immediately after this crisis there was pressure from the IMF on Korea to implement an AngloAmerican financial model, and ...

... century. A massive inflow of foreign capital – and later a sudden outflow – caused Korea to become part of the Asian financial crisis, alongside other Southeast Asian countries. Immediately after this crisis there was pressure from the IMF on Korea to implement an AngloAmerican financial model, and ...

SLBE 5% Price Pref Explanation

... for application of the 5% price preference (or any other API under this SBLE Program), the certified Small Local Business Enterprise Joint Venture must perform at least 51% of the total contract cost, with its own forces, and the SLBE Joint Venture partner must own and manage at least 51% of the Joi ...

... for application of the 5% price preference (or any other API under this SBLE Program), the certified Small Local Business Enterprise Joint Venture must perform at least 51% of the total contract cost, with its own forces, and the SLBE Joint Venture partner must own and manage at least 51% of the Joi ...

Seasonality of Stock Market Returns

... returns are directly related. For when there is some kind of irregular activity As stated previously seasonality is the short term, however regular variances that occur over the course of a year. Whether it’s a change due to the month of year or even due to a holiday or announcement, these changes c ...

... returns are directly related. For when there is some kind of irregular activity As stated previously seasonality is the short term, however regular variances that occur over the course of a year. Whether it’s a change due to the month of year or even due to a holiday or announcement, these changes c ...

project finance

... Increased value is achieved for public services through the exploitation of private sector skills and competencies Transfer of appropriate level of risks and responsibility But, government maintains control where appropriate (e.g. regulation, transport policy) ...

... Increased value is achieved for public services through the exploitation of private sector skills and competencies Transfer of appropriate level of risks and responsibility But, government maintains control where appropriate (e.g. regulation, transport policy) ...

The Profit-Filled Back End of Velocity

... Market, Price To Market, and Market Days Supply. Dealers don't want to own used cars. They want access to gross profit potential, as much per unit as possible. Service contracts don't require any inventory. The return on investment is incalculable because there is no investment. As great as that is, ...

... Market, Price To Market, and Market Days Supply. Dealers don't want to own used cars. They want access to gross profit potential, as much per unit as possible. Service contracts don't require any inventory. The return on investment is incalculable because there is no investment. As great as that is, ...

130510496X_441953

... price agreed upon today; subject to a daily settlement of gains and losses and guaranteed against the risk that either party might default Exclusively traded on a derivatives exchanges Subject to daily settlement ...

... price agreed upon today; subject to a daily settlement of gains and losses and guaranteed against the risk that either party might default Exclusively traded on a derivatives exchanges Subject to daily settlement ...

Download attachment

... of a project and the payback. In a growth environment investors take more risks and actively seek such investments with more gearing beneath the surface. Smaller companies often fit this profile and performed well from 2002 – 05. When risk aversion returns, as no doubt it will, then investors will flee ...

... of a project and the payback. In a growth environment investors take more risks and actively seek such investments with more gearing beneath the surface. Smaller companies often fit this profile and performed well from 2002 – 05. When risk aversion returns, as no doubt it will, then investors will flee ...

Disentangling returns from hedged international equities

... returns. The investment return and principal value of an investment will fluctuate so that when realised, may be worth more or less than the original investment. Hedging foreign exchange risk is typically undertaken at periodic rebalance points so that exposures and hedges are rebalanced to reflect ...

... returns. The investment return and principal value of an investment will fluctuate so that when realised, may be worth more or less than the original investment. Hedging foreign exchange risk is typically undertaken at periodic rebalance points so that exposures and hedges are rebalanced to reflect ...

O novo mercado ea regulamentação

... At present, there is a project within the National Congress to reform the Corporate Law, aimed at adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater ...

... At present, there is a project within the National Congress to reform the Corporate Law, aimed at adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater ...

Chapter 2: The Basics of Supply and Demand Elasticities of Supply

... Risk premium – maximum amount of money a person will pay to avoid taking a risk. For a risk averse person, the plot of utility vs income is upward sloping but with diminishing marginal utility. The risk premium is the difference in income between the expected value of a risky proposition and incom ...

... Risk premium – maximum amount of money a person will pay to avoid taking a risk. For a risk averse person, the plot of utility vs income is upward sloping but with diminishing marginal utility. The risk premium is the difference in income between the expected value of a risky proposition and incom ...

The Myth of Diversification: Risk Factors vs. Asset Classes

... The portfolio analysis is based on the 2009 NACUBO-Commonfund Study of Endowments Average Endowment Style Portfolio and no representation is being made that the structure of the average portfolio or any account will remain the same or that similar returns will be achieved. Results shown may not be a ...

... The portfolio analysis is based on the 2009 NACUBO-Commonfund Study of Endowments Average Endowment Style Portfolio and no representation is being made that the structure of the average portfolio or any account will remain the same or that similar returns will be achieved. Results shown may not be a ...

WB Credentials (Nov 09)

... Currency Derivatives include the basic FX forwards, Swaps and Options ...

... Currency Derivatives include the basic FX forwards, Swaps and Options ...

Chap025 - U of L Class Index

... Example 1 • Suppose that on October 1, an investor purchases a call option to buy 100 shares of The Bank of Montreal (BOM) common stock: the expiration date is the third Friday in December; the exercise price is $30; the price of the option is quoted as $1½; the current market price of BOM stock is ...

... Example 1 • Suppose that on October 1, an investor purchases a call option to buy 100 shares of The Bank of Montreal (BOM) common stock: the expiration date is the third Friday in December; the exercise price is $30; the price of the option is quoted as $1½; the current market price of BOM stock is ...

CME Group customer forum

... Futures and swaps trading is not suitable for all investors, and involves the risk of loss. Futures and swaps are leveraged investments, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited for a futures an ...

... Futures and swaps trading is not suitable for all investors, and involves the risk of loss. Futures and swaps are leveraged investments, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited for a futures an ...

Appendix A University of Virginia Investment Management Company

... UVIMCO provides monthly reports to the University and Foundations displaying the Pool’s asset allocation relative to the Policy Portfolio and displaying the returns of the Pool and its component asset classes. UVIMCO provides quarterly narrative reports that explain and analyze the Pool’s investment ...

... UVIMCO provides monthly reports to the University and Foundations displaying the Pool’s asset allocation relative to the Policy Portfolio and displaying the returns of the Pool and its component asset classes. UVIMCO provides quarterly narrative reports that explain and analyze the Pool’s investment ...

ING Belgium International Finance (Luxembourg)

... - the trend in long term interest rates on financial markets (a rise in market long term interest rates can impact negatively on the value of the Notes and a drop in market long term interest rates can impact positively on the value of the Notes), - the evolution of the 3 month Euribor (a rise of th ...

... - the trend in long term interest rates on financial markets (a rise in market long term interest rates can impact negatively on the value of the Notes and a drop in market long term interest rates can impact positively on the value of the Notes), - the evolution of the 3 month Euribor (a rise of th ...

Chapter 14 The Money Market

... short-term rates if future short-term rates are expected to be higher than current short-term rates...and long-term rates fall below current shortterm rates if future expected short-term rates are expected to be less than the current level of shortterm rates. Copyright 2005 by Thomson Learning, In ...

... short-term rates if future short-term rates are expected to be higher than current short-term rates...and long-term rates fall below current shortterm rates if future expected short-term rates are expected to be less than the current level of shortterm rates. Copyright 2005 by Thomson Learning, In ...

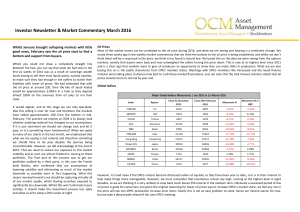

Market Commentary March 2016

... We are underweight on high yield assets globally as we believe that the volatility associated with a rise in credit spreads caused by rising interest rates in the US and the UK, means these assets are too risky to be included in a client’s portfolio and considered non-equity. As rates are expected t ...

... We are underweight on high yield assets globally as we believe that the volatility associated with a rise in credit spreads caused by rising interest rates in the US and the UK, means these assets are too risky to be included in a client’s portfolio and considered non-equity. As rates are expected t ...

The Financialization of Commodity Markets

... Commercial hedgers such as farmers, producers, and consumers regularly trade commodity futures to hedge spot-price risk inherent in their commercial activities. Non-commercial traders, such as hedge funds or other managed money vehicles, invest others’ money on a discretionary basis in commodities, ...

... Commercial hedgers such as farmers, producers, and consumers regularly trade commodity futures to hedge spot-price risk inherent in their commercial activities. Non-commercial traders, such as hedge funds or other managed money vehicles, invest others’ money on a discretionary basis in commodities, ...

Digging Deeper into Stock Diversification

... Once you’ve decided to own individual stocks, use the following guidelines to help diversify them: • Target How Many to Own – By holding a sufficient number of stocks, you can reduce the variation of the portfolio’s performance. We recommend owning a minimum of 15 stocks to reduce the volatility of ...

... Once you’ve decided to own individual stocks, use the following guidelines to help diversify them: • Target How Many to Own – By holding a sufficient number of stocks, you can reduce the variation of the portfolio’s performance. We recommend owning a minimum of 15 stocks to reduce the volatility of ...