File

... Game Theory: a mathematical technique used to analyze competitive situations where the outcome of a participant’s choice depends on the actions of other participants Price War: competitive price cutting by firms, usually in an oligopoly, as each one tries to capture market share from rival firms Con ...

... Game Theory: a mathematical technique used to analyze competitive situations where the outcome of a participant’s choice depends on the actions of other participants Price War: competitive price cutting by firms, usually in an oligopoly, as each one tries to capture market share from rival firms Con ...

Session 0340-2017

... Many institutions, like FINVIZ.com, Yahoo Finance and Google Finance also provide stock chart and basic studies, but it is very time consuming to go through them one by one without an ideal graphical presentation. Sometimes, we want to add some criteria based on our own model, which could not be acc ...

... Many institutions, like FINVIZ.com, Yahoo Finance and Google Finance also provide stock chart and basic studies, but it is very time consuming to go through them one by one without an ideal graphical presentation. Sometimes, we want to add some criteria based on our own model, which could not be acc ...

- LSE Research Online

... failures. Therefore innovative ideas utilizing market forces are necessary to stimulate new investment efforts. Employing the benefits of both the previously described Advanced Market Commitment and a refined Call Options for Vaccines model, we describe herein a novel incentive mechanism, the Option ...

... failures. Therefore innovative ideas utilizing market forces are necessary to stimulate new investment efforts. Employing the benefits of both the previously described Advanced Market Commitment and a refined Call Options for Vaccines model, we describe herein a novel incentive mechanism, the Option ...

Red Hot Penny Shares - SilverBridge Holdings

... Back in 2012 I discovered a little known IT company. It was too small for investment funds to worry about, the media didn’t bother featuring the company’s results and the share was completely undervalued. The share I’m talking about was Adapt IT. It soared from 130c in 2012 to R13 this year. The sam ...

... Back in 2012 I discovered a little known IT company. It was too small for investment funds to worry about, the media didn’t bother featuring the company’s results and the share was completely undervalued. The share I’m talking about was Adapt IT. It soared from 130c in 2012 to R13 this year. The sam ...

Expected value

... market options open to a would-be investor in financial assets. Points on figure represent options available. For example, point A represents a risk-free asset such as money in a checking account. Asset B represents relatively risky stock. All other points on Figure 5-4 represent risks and returns a ...

... market options open to a would-be investor in financial assets. Points on figure represent options available. For example, point A represents a risk-free asset such as money in a checking account. Asset B represents relatively risky stock. All other points on Figure 5-4 represent risks and returns a ...

Relative Velocity Statistics: Their Application in Portfolio Analysis

... Velocity figures should not be used unless, as previously observed, certain of their limitations are recognized. For example, a case involving a miscellaneous list of twenty-one stocks, when first studied and appraised on July 19, 1943, had a valuation of $248,000. Only seven of the stocks in the li ...

... Velocity figures should not be used unless, as previously observed, certain of their limitations are recognized. For example, a case involving a miscellaneous list of twenty-one stocks, when first studied and appraised on July 19, 1943, had a valuation of $248,000. Only seven of the stocks in the li ...

Trade Reporting Notice - 12/21/11

... If the originator includes an allowable variance(s) regarding the settlement date or the final delivery amount in good faith as a condition in a transaction in an SBA pool or a Multi-Family MBS TBA (and is not establishing an allowable variance(s) for the purpose of avoiding trade reporting obligati ...

... If the originator includes an allowable variance(s) regarding the settlement date or the final delivery amount in good faith as a condition in a transaction in an SBA pool or a Multi-Family MBS TBA (and is not establishing an allowable variance(s) for the purpose of avoiding trade reporting obligati ...

synthetic zeros - SG Listed Products

... Protection Levels are typically set between 10 and 30 percent below the starting level of the stock or index at the time of launch. This increases the chance of receiving the fixed return at Maturity. Importantly though, if your view does not play out, and your chosen stock or index has fallen below ...

... Protection Levels are typically set between 10 and 30 percent below the starting level of the stock or index at the time of launch. This increases the chance of receiving the fixed return at Maturity. Importantly though, if your view does not play out, and your chosen stock or index has fallen below ...

Document

... for individual countries, a natural step is a composite series that measures the performance of all securities in a given country • This allows examination of benefits of diversification with a combination of asset classes such as stocks and bonds in addition to diversifying within the asset classes ...

... for individual countries, a natural step is a composite series that measures the performance of all securities in a given country • This allows examination of benefits of diversification with a combination of asset classes such as stocks and bonds in addition to diversifying within the asset classes ...

An Experimental Examination of the House Money Effect

... will receive and complete a post-experimental questionnaire. The purpose of the questionnaire is to collect general information about the participants and how they view the experiment. To assure anonymity and confidentiality, participants are called to the front of the room to collect their cash in ...

... will receive and complete a post-experimental questionnaire. The purpose of the questionnaire is to collect general information about the participants and how they view the experiment. To assure anonymity and confidentiality, participants are called to the front of the room to collect their cash in ...

Price Discovery in Iran Gold Coin Market

... 1. Introduction: Futures markets perform two important roles, hedging of risks and price discovery. The efficacy of the hedging function is dependent on the price discovery process or how well new information is reflected in price. Under perfectly efficient markets, new information is impounded sim ...

... 1. Introduction: Futures markets perform two important roles, hedging of risks and price discovery. The efficacy of the hedging function is dependent on the price discovery process or how well new information is reflected in price. Under perfectly efficient markets, new information is impounded sim ...

Paper on Speculative evidience

... of market place has no intent of taking futures to delivery, causing price volatility, commodity markets have started setting price of commodities as an asset. Therefore speculators can create a price distortion and speculative bubble with anticipating making significant profits form major movements ...

... of market place has no intent of taking futures to delivery, causing price volatility, commodity markets have started setting price of commodities as an asset. Therefore speculators can create a price distortion and speculative bubble with anticipating making significant profits form major movements ...

Plain-Vanilla Interest Rate Swap

... Due to the expected future interest rate scenario, you are exposed to the risk of devaluation. According to Internationalo Financial Reporting Standards you will have to depreciate your bond – portfolio. The depreciation of 2,215 mio € is going to worsen your profit and loss account. Bonds ...

... Due to the expected future interest rate scenario, you are exposed to the risk of devaluation. According to Internationalo Financial Reporting Standards you will have to depreciate your bond – portfolio. The depreciation of 2,215 mio € is going to worsen your profit and loss account. Bonds ...

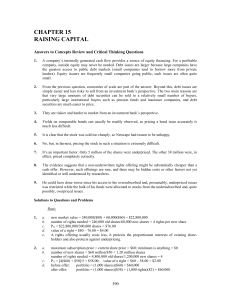

Answers to Concepts Review and Critical

... that very large amounts of debt securities can be sold to a relatively small number of buyers, particularly large institutional buyers such as pension funds and insurance companies, and debt securities are much easier to price. ...

... that very large amounts of debt securities can be sold to a relatively small number of buyers, particularly large institutional buyers such as pension funds and insurance companies, and debt securities are much easier to price. ...