Screen Information, Trader Activity, and Bid-Ask

... calculations. The chronological difference between the trial period and the data used for model evaluation is then 15 weeks, the maximum that could be feasibly achieved with our data set. The data are obtained from trading activity in stock index futures contracts from the consolidated limit order b ...

... calculations. The chronological difference between the trial period and the data used for model evaluation is then 15 weeks, the maximum that could be feasibly achieved with our data set. The data are obtained from trading activity in stock index futures contracts from the consolidated limit order b ...

An Introduction to Niobium and Tantalum

... strength of the steel industry. Prices softened during the financial crisis but have remained strong more recently. Tantalum Market Tantalum has unique attributes that make it suitable for several specific purposes. It has an exceedingly high melting point, is highly corrosion-resistant, alloys well ...

... strength of the steel industry. Prices softened during the financial crisis but have remained strong more recently. Tantalum Market Tantalum has unique attributes that make it suitable for several specific purposes. It has an exceedingly high melting point, is highly corrosion-resistant, alloys well ...

Disclosure of Transaction Data to Forex Customers—NFA

... Transactions entered into through a Member to hedge currency exposure from positions on regulated exchanges are exempt from all forex requirements except sections (b) and (c) of this rule if the on-exchange transactions are handled by the same Member. (q)(r) Definitions For purposes of this rule: (1 ...

... Transactions entered into through a Member to hedge currency exposure from positions on regulated exchanges are exempt from all forex requirements except sections (b) and (c) of this rule if the on-exchange transactions are handled by the same Member. (q)(r) Definitions For purposes of this rule: (1 ...

Effects of level of investors confidence and herding behavior on

... affect the demand curve for a stock, the stock price and its volatility. I maintain that an important factor regarding the herding effects on the market lies in the effect of the information obtained by observing others, on one's confidence in her evaluation of the market. The study argues that sign ...

... affect the demand curve for a stock, the stock price and its volatility. I maintain that an important factor regarding the herding effects on the market lies in the effect of the information obtained by observing others, on one's confidence in her evaluation of the market. The study argues that sign ...

Opening and Closing the Market

... the call auction at the open as the ideal solution to the problem of assimilating diverse information from traders to achieve informational efficiency of prices, and thereby minimize adverse selection problems where some traders have superior information to others. Domowitz and Madhavan (2001) argue ...

... the call auction at the open as the ideal solution to the problem of assimilating diverse information from traders to achieve informational efficiency of prices, and thereby minimize adverse selection problems where some traders have superior information to others. Domowitz and Madhavan (2001) argue ...

The Market Microstructure Approach to Foreign Exchange: Looking

... the smaller banks (Lyons, 1998; Bjønnes and Rime 2005; Osler et al. 2011), whereas in equity and bond markets they are measured in days (Madhavan and Smidt 1993; Hansch et al. 1998). The dealers themselves trade actively with each other with interdealer trading accounting for over 60 percent of spot ...

... the smaller banks (Lyons, 1998; Bjønnes and Rime 2005; Osler et al. 2011), whereas in equity and bond markets they are measured in days (Madhavan and Smidt 1993; Hansch et al. 1998). The dealers themselves trade actively with each other with interdealer trading accounting for over 60 percent of spot ...

Optimal Dynamic Order Submission Strategies In Some Stylized

... Traders design order submission strategies to take advantage of the different properties of market orders and limit orders. Market orders typically produce quick executions at relatively high transaction costs. Limit orders provide lower cost executions if they execute, but they often do not execute ...

... Traders design order submission strategies to take advantage of the different properties of market orders and limit orders. Market orders typically produce quick executions at relatively high transaction costs. Limit orders provide lower cost executions if they execute, but they often do not execute ...

1 NASDAQ US Dividend Achievers™ 50 Index Methodology

... may, in Nasdaq’s discretion, be removed at a zero price. The zero price will be applied to the Index Security after the close of the market but prior to the time the official closing value of the Index is disseminated, which is ordinarily 17:16:00 ET. Index Maintenance Index Share changes are not ma ...

... may, in Nasdaq’s discretion, be removed at a zero price. The zero price will be applied to the Index Security after the close of the market but prior to the time the official closing value of the Index is disseminated, which is ordinarily 17:16:00 ET. Index Maintenance Index Share changes are not ma ...

Best execution mechanics: TBA specified pool

... TBA is an effective hedge against changing MBS prices TBA hedges interest rate risk TBA allows HFAs to lock in MBS price on new loan reservations, hedging the change in price due to rising interest rates ...

... TBA is an effective hedge against changing MBS prices TBA hedges interest rate risk TBA allows HFAs to lock in MBS price on new loan reservations, hedging the change in price due to rising interest rates ...

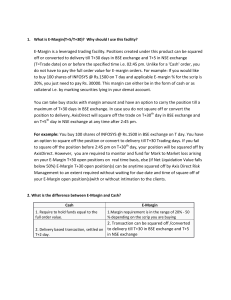

E-Margin is a leveraged trading facility. Positions

... (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full order value for E-margin orders. For example: If you would like to buy 100 shares of INFOSYS @ Rs.1500 on T day and applicable E-margin % for the scrip is 20%, you just need to pa ...

... (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full order value for E-margin orders. For example: If you would like to buy 100 shares of INFOSYS @ Rs.1500 on T day and applicable E-margin % for the scrip is 20%, you just need to pa ...

Causes and Consequences of Margin Levels in Futures Markets

... levels. Margins are important for investors because they tie up part of the investors’ capital, and they are important for the financial system because they reduce counterparty risk. The futures market provides an ideal venue for exploring the effect of funding constraints on financial markets, since h ...

... levels. Margins are important for investors because they tie up part of the investors’ capital, and they are important for the financial system because they reduce counterparty risk. The futures market provides an ideal venue for exploring the effect of funding constraints on financial markets, since h ...

PowerPoint for Chapter 8

... Short selling (or “going short”) is a very regulated type of market transaction. It involves selling shares of a stock that are borrowed in expectation of a fall in the security’s price. When and if the price declines, the investor buys an equivalent number of shares of the same stock at the new low ...

... Short selling (or “going short”) is a very regulated type of market transaction. It involves selling shares of a stock that are borrowed in expectation of a fall in the security’s price. When and if the price declines, the investor buys an equivalent number of shares of the same stock at the new low ...

usd/cnh options product information

... Exposure to multiple market parameters, e.g. spot rate, volatility and time ...

... Exposure to multiple market parameters, e.g. spot rate, volatility and time ...

Destabilizing Commodity Market Speculation

... We examine a related issue: whether speculative activities can have a large impact on spot/forward prices of commodity when all market participants have rational expectations. We consider a model economy with a single commodity, a single large speculator and two other groups of market participants: ...

... We examine a related issue: whether speculative activities can have a large impact on spot/forward prices of commodity when all market participants have rational expectations. We consider a model economy with a single commodity, a single large speculator and two other groups of market participants: ...

ANTICIPATING CORRELATIONS

... with a graduate student and hedge fund quant. • How correlated are loan defaults? • When the aggregate market is very low, the probability of default is greater for all companies. When it is high, the probability of default is low for all companies. Hence defaults are correlated and the distribution ...

... with a graduate student and hedge fund quant. • How correlated are loan defaults? • When the aggregate market is very low, the probability of default is greater for all companies. When it is high, the probability of default is low for all companies. Hence defaults are correlated and the distribution ...

Stock prices volatility and trading volume

... multiscale interdependence between the stock markets of Germany, Austria, France, and the United Kingdom. Inter alia, he proved that major financial market crises had a significant impact on return volatility of investigated stock markets as well. Among them, the global financial crisis of 2007-2008 ...

... multiscale interdependence between the stock markets of Germany, Austria, France, and the United Kingdom. Inter alia, he proved that major financial market crises had a significant impact on return volatility of investigated stock markets as well. Among them, the global financial crisis of 2007-2008 ...

Currency Investor Roundtable

... earliest currency dynamic hedging overlay strategies, for a Japanese client in the 1980’s. I don’t remember it being at all straightforward to implement! There were so many different moving parts it required skill and attention to monitor the underlying exposure, and the hedge, and to adjust it acco ...

... earliest currency dynamic hedging overlay strategies, for a Japanese client in the 1980’s. I don’t remember it being at all straightforward to implement! There were so many different moving parts it required skill and attention to monitor the underlying exposure, and the hedge, and to adjust it acco ...