Maker-Taker Pricing Effects on Market Quotations

... for stocks often trading at one-tick spreads. These results are important to practitioners, regulators, and academics. Practitioners are interested because access fees and liquidity rebates are often large components of overall transaction costs, especially for small trades in low price stocks. For ...

... for stocks often trading at one-tick spreads. These results are important to practitioners, regulators, and academics. Practitioners are interested because access fees and liquidity rebates are often large components of overall transaction costs, especially for small trades in low price stocks. For ...

Order Exposure and Liquidity Coordination

... pense of the public exchange. To understand the effects and determinants of hidden liquidity in a given market, it is therefore necessary to account for the interplay between inter-market and intra-market liquidity competition. We theoretically and empirically show that large hidden orders on publi ...

... pense of the public exchange. To understand the effects and determinants of hidden liquidity in a given market, it is therefore necessary to account for the interplay between inter-market and intra-market liquidity competition. We theoretically and empirically show that large hidden orders on publi ...

Overconfidence and Firm Decision Making: Evidence from

... Behavioral biases influence investment decisions. And that is also likely to hold for overconfidence, which is a commonly investigated behavioral bias in investment markets. The key challenge to investigate this has been to develop credible proxies for overconfidence. The early finance papers studie ...

... Behavioral biases influence investment decisions. And that is also likely to hold for overconfidence, which is a commonly investigated behavioral bias in investment markets. The key challenge to investigate this has been to develop credible proxies for overconfidence. The early finance papers studie ...

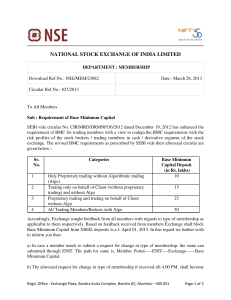

Ref No

... c) The Base Minimum Capital primarily shall be blocked from NSEIL deposits of Capital Market segment. In case the NSEIL deposits of Capital Market segment are not enough to cover the BMC requirement, NSEIL deposits of Futures & Options segment and Currency Derivatives segment shall also be utilised ...

... c) The Base Minimum Capital primarily shall be blocked from NSEIL deposits of Capital Market segment. In case the NSEIL deposits of Capital Market segment are not enough to cover the BMC requirement, NSEIL deposits of Futures & Options segment and Currency Derivatives segment shall also be utilised ...

Regulation and the National Regulatory Authority in

... Regulation and the National Regulatory Authority in Directive 97/67 Article 22 Each Member State shall designate one or more national regulatory authorities for the postal sector that are legally separate from and operationally independent of the postal operators. Member States shall inform the Com ...

... Regulation and the National Regulatory Authority in Directive 97/67 Article 22 Each Member State shall designate one or more national regulatory authorities for the postal sector that are legally separate from and operationally independent of the postal operators. Member States shall inform the Com ...

strAtegIc FINANcIAL MANAgeMeNt (sFM)

... benefits receivable thereon over the economic life of the asset or project for which investments are made. Estimating cost is relatively easier as it is made in the current period, but estimating benefits is very difficult as it relates to future period involving risk and uncertainty. For estimating ...

... benefits receivable thereon over the economic life of the asset or project for which investments are made. Estimating cost is relatively easier as it is made in the current period, but estimating benefits is very difficult as it relates to future period involving risk and uncertainty. For estimating ...

An Empirical Analysis of the Limit Order Book and the Order

... the depth at the quotes or the spread is large. Consistent with information effects, downward (upward) shifts in both bid and ask quotes occur after large sales (purchases). ...

... the depth at the quotes or the spread is large. Consistent with information effects, downward (upward) shifts in both bid and ask quotes occur after large sales (purchases). ...

Capped Leveraged Index Return Notes ® Linked - corporate

... Starting Value. If the Ending Value is less than the Threshold Value, you will lose a portion, which could be significant, of the principal amount of your notes. Payments on the notes, including the amount you receive at maturity, will be calculated based on the $10 principal amount per unit and wil ...

... Starting Value. If the Ending Value is less than the Threshold Value, you will lose a portion, which could be significant, of the principal amount of your notes. Payments on the notes, including the amount you receive at maturity, will be calculated based on the $10 principal amount per unit and wil ...

FORM 10-Q - Vanguard Natural Resources LLC

... and our representatives may from time to time make other oral or written statements that are also forward-looking statements. These statements are accompanied by cautionary language identifying important factors, though not necessarily all such factors, which could cause future outcomes to differ ma ...

... and our representatives may from time to time make other oral or written statements that are also forward-looking statements. These statements are accompanied by cautionary language identifying important factors, though not necessarily all such factors, which could cause future outcomes to differ ma ...

How Fast do Personal Computers Depreciate?

... In this regard, the recent debate about the contribution of information technology to economic growth has focused attention on the measurement of high-tech capital goods and, consequently, on the rate at which they depreciate. Over the years, economists have devoted considerable attention to the mea ...

... In this regard, the recent debate about the contribution of information technology to economic growth has focused attention on the measurement of high-tech capital goods and, consequently, on the rate at which they depreciate. Over the years, economists have devoted considerable attention to the mea ...

Interacting Limit Order Demand and Supply Curves

... product markets, demand elasticity depends on factors such as consumer preferences; while supply elasticity depends on factors such as production technologies and market power. In contrast, at least in the short-run, stock markets resemble a pure exchange economy: buyers become sellers and vice-vers ...

... product markets, demand elasticity depends on factors such as consumer preferences; while supply elasticity depends on factors such as production technologies and market power. In contrast, at least in the short-run, stock markets resemble a pure exchange economy: buyers become sellers and vice-vers ...

doc - CSUSAP - Charles Sturt University

... their borders, there must be some punishment or threat which is restraining governments from misbehaving, otherwise expropriation would be a common event. The lack of legal enforceability of the contract between the investor and the domestic government is the same for a direct investment as it is fo ...

... their borders, there must be some punishment or threat which is restraining governments from misbehaving, otherwise expropriation would be a common event. The lack of legal enforceability of the contract between the investor and the domestic government is the same for a direct investment as it is fo ...

Earnings Index Methodology

... Puerto Rico). Preferred stocks, closed-end funds, exchange-traded funds, and derivative securities such as warrants and rights are not eligible. The publicly traded security for WisdomTree Investments, Inc., ticker WETF, is not eligible for inclusion in any of WisdomTree’s equity indexes. Companies ...

... Puerto Rico). Preferred stocks, closed-end funds, exchange-traded funds, and derivative securities such as warrants and rights are not eligible. The publicly traded security for WisdomTree Investments, Inc., ticker WETF, is not eligible for inclusion in any of WisdomTree’s equity indexes. Companies ...

“buyer power” and economic policy

... in these three cases. Ricardian rent arises from differential productivity or costs per unit among factors of production. The core idea is that if a group of substitute inputs all are acquired at the minimum expenditure that is needed to induce them into the market, the resulting output per dollar o ...

... in these three cases. Ricardian rent arises from differential productivity or costs per unit among factors of production. The core idea is that if a group of substitute inputs all are acquired at the minimum expenditure that is needed to induce them into the market, the resulting output per dollar o ...

Incomplete Contracts in a Complete Contract World

... with any other default rule, parties can opt out of the RSI default if they anticipate that investment levels will not be an issue; in fact, the notice requirement encourages them to do so. After discussing the reasons for contractual incompleteness, Part II of this Article places the RSI default in ...

... with any other default rule, parties can opt out of the RSI default if they anticipate that investment levels will not be an issue; in fact, the notice requirement encourages them to do so. After discussing the reasons for contractual incompleteness, Part II of this Article places the RSI default in ...