Why We Should Never Pay Down the National Debt

... between the total federal debt and the “debt held by the public.”29 In the 2011 fiscal year, the federal budget deficit was approximately $1.3 trillion dollars, or about 9% of Gross Domestic Product (GDP, the broadest measure of the country’s annual income).30 This relatively large amount of new net ...

... between the total federal debt and the “debt held by the public.”29 In the 2011 fiscal year, the federal budget deficit was approximately $1.3 trillion dollars, or about 9% of Gross Domestic Product (GDP, the broadest measure of the country’s annual income).30 This relatively large amount of new net ...

An Introduction to Stapled Financing

... banks to decline to fund which the seller would not accept as a condition to completion under the SPA. Any well-advised purchaser will insist upon symmetry between the terms of its financing and its obligations under the SPA. ...

... banks to decline to fund which the seller would not accept as a condition to completion under the SPA. Any well-advised purchaser will insist upon symmetry between the terms of its financing and its obligations under the SPA. ...

Liquidity Ratios

... Andres is a very large company and they are one of the oldest wineries in Canada. It is considered a stable company in the mature phase of its lifecycle. Historically Andres was primarily a producer of table wine, however Andres has recognized the consumer trend towards premium wines. They have been ...

... Andres is a very large company and they are one of the oldest wineries in Canada. It is considered a stable company in the mature phase of its lifecycle. Historically Andres was primarily a producer of table wine, however Andres has recognized the consumer trend towards premium wines. They have been ...

The Faroese External Debt Statistics 2003 and

... enables the compilers to derive the gross external debt position directly by relying on IIP statement. In relation to Direct investment, defined as ownership of 10% or more of the ordinary shares or voting power, and together with equity capital and reinvested earnings, they are not consider being a ...

... enables the compilers to derive the gross external debt position directly by relying on IIP statement. In relation to Direct investment, defined as ownership of 10% or more of the ordinary shares or voting power, and together with equity capital and reinvested earnings, they are not consider being a ...

The Federal Budget and the National Debt

... reduce future capital stock by increasing current consumption, pushing up real interest rates, and retarding private investment. • The new classical theory argues that people will increase their savings in anticipation of the higher future taxes implied by additional debt, leaving interest rates, co ...

... reduce future capital stock by increasing current consumption, pushing up real interest rates, and retarding private investment. • The new classical theory argues that people will increase their savings in anticipation of the higher future taxes implied by additional debt, leaving interest rates, co ...

The Diversity of Debt Crises in Europe Jerome L. Stein

... product of capital. But those capital gains (housing price appreciation in Table 3) were not sustainable. The risk is that with the higher debt ratios, there would be a period when the capital gains fell below the interest rate, such as occurred in 2007 in Spain and Ireland. In fact the capital gain ...

... product of capital. But those capital gains (housing price appreciation in Table 3) were not sustainable. The risk is that with the higher debt ratios, there would be a period when the capital gains fell below the interest rate, such as occurred in 2007 in Spain and Ireland. In fact the capital gain ...

Uncertainty and the Disappearance of International Credit

... High-income countries must decide on how much new lending they are willing to provide emerging markets. Let B1* represent the aggregate amount of new short-term loans offered emerging markets in period one at a contractual interest rate of r. In period two, emerging markets must repay these loans pl ...

... High-income countries must decide on how much new lending they are willing to provide emerging markets. Let B1* represent the aggregate amount of new short-term loans offered emerging markets in period one at a contractual interest rate of r. In period two, emerging markets must repay these loans pl ...

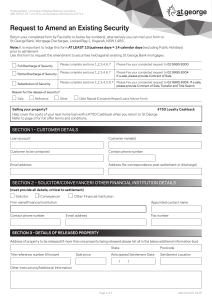

St George

... be received from 2 May 2016 and must settle within 6 months of discharge of the existing property • Offer only available for applications received under the Advantage Package for new home loan borrowings of $150,000 or more. Annual fee, currently $395, applies • At least one borrower on the new ho ...

... be received from 2 May 2016 and must settle within 6 months of discharge of the existing property • Offer only available for applications received under the Advantage Package for new home loan borrowings of $150,000 or more. Annual fee, currently $395, applies • At least one borrower on the new ho ...

Slide 1

... - Fiscal room to manoeuvre in case of unanticipated fiscal pressures - Solid economic performance despite strong headwinds in some years - Competitive provincial tax system - Favourable assessment of economic forecasts - Public sector pension plan governance ...

... - Fiscal room to manoeuvre in case of unanticipated fiscal pressures - Solid economic performance despite strong headwinds in some years - Competitive provincial tax system - Favourable assessment of economic forecasts - Public sector pension plan governance ...

The Autonomous Regions` funding model: Between the State

... The large increase in the overall stock of public debt as a result of the crisis has raised Spanish debt to GDP levels from below 40% to just slightly above 100%. Nevertheless, benign market conditions in 2016 allowed both the State and some Autonomous Regions to tap debt markets on very favourable ...

... The large increase in the overall stock of public debt as a result of the crisis has raised Spanish debt to GDP levels from below 40% to just slightly above 100%. Nevertheless, benign market conditions in 2016 allowed both the State and some Autonomous Regions to tap debt markets on very favourable ...

Dealing with debt Introduction

... than a “plain vanilla” recession, in which any lost output is recovered very quickly (New Zealand’s mild 1998 recession might have been an example of that sort of ...

... than a “plain vanilla” recession, in which any lost output is recovered very quickly (New Zealand’s mild 1998 recession might have been an example of that sort of ...

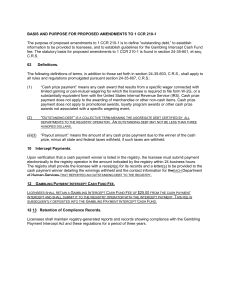

DEPARTMENT OF LABOR AND EMPLOYMENT

... “Cash prize payment” means any cash award that results from a specific wager connected with limited gaming or pari-mutuel wagering for which the licensee is required to file form W-2G, or a substantially equivalent form with the United States Internal Revenue Service (IRS). Cash prize payment does n ...

... “Cash prize payment” means any cash award that results from a specific wager connected with limited gaming or pari-mutuel wagering for which the licensee is required to file form W-2G, or a substantially equivalent form with the United States Internal Revenue Service (IRS). Cash prize payment does n ...

Legal/Bankruptcy Implications by Patrick “Rick” M. Shelby

... • The Court is not unsympathetic to Anadarko. It may be forced to bear a substantial cost as a result of ATP’s financial woes. Nevertheless, like many things in a bankruptcy case, the cost that Anadarko may bear is a reflection of the credit risk it took. Anadarko sold a portion of the Gomez Propert ...

... • The Court is not unsympathetic to Anadarko. It may be forced to bear a substantial cost as a result of ATP’s financial woes. Nevertheless, like many things in a bankruptcy case, the cost that Anadarko may bear is a reflection of the credit risk it took. Anadarko sold a portion of the Gomez Propert ...

Credit Cards and Other Forms of Credit

... a. the maximum amount that may be borrowed b. irrelevant when making purchases c. unrelated to her credit history d. always below $1,000 ...

... a. the maximum amount that may be borrowed b. irrelevant when making purchases c. unrelated to her credit history d. always below $1,000 ...

Chapter 13

... S/Hs to contribute funds for positive NPV projects – Occurs if S/Hs must contribute cash, but all project’s benefits accrue to bondholders. • Assume, as before, firm has $10,000,000 cash on hand and a bond worth $12,000,000 maturing in 30 days – Suppose firm is offered chance to purchase a competito ...

... S/Hs to contribute funds for positive NPV projects – Occurs if S/Hs must contribute cash, but all project’s benefits accrue to bondholders. • Assume, as before, firm has $10,000,000 cash on hand and a bond worth $12,000,000 maturing in 30 days – Suppose firm is offered chance to purchase a competito ...

BMS Finance completes its second senior debt financing of bfinance

... BMS Finance completes its second senior debt financing of bfinance Limited, a leading, management-owned provider of investment advisory, debt advisory and treasury solutions to global clients. BMS Finance, the boutique finance company specialising in providing debt finance to high growth SMEs, today ...

... BMS Finance completes its second senior debt financing of bfinance Limited, a leading, management-owned provider of investment advisory, debt advisory and treasury solutions to global clients. BMS Finance, the boutique finance company specialising in providing debt finance to high growth SMEs, today ...

On My Radar: Fed Stuck Between Three Rocks and a Hard Place

... As David Zervos puts it, “These implicit agreements now allow the Chinese to carefully unwind their domestic asset/debt bubble, and slowly decouple the CNH from the USD. Of course this is a fragile agreement, because if any one party deviates, the peg breaks and the 1998 style fireworks begin.” So I ...

... As David Zervos puts it, “These implicit agreements now allow the Chinese to carefully unwind their domestic asset/debt bubble, and slowly decouple the CNH from the USD. Of course this is a fragile agreement, because if any one party deviates, the peg breaks and the 1998 style fireworks begin.” So I ...

Sustainability of High Public Debt: What the

... There was thus a strong incentive to embark on "unsound finance" by wiping out the national debt, just as there was an incentive - advertised by the young John Maynard Keynes - to break with fiscal orthodoxy and start demand management policies. Instead, as Table 2 shows, the influence of the orthod ...

... There was thus a strong incentive to embark on "unsound finance" by wiping out the national debt, just as there was an incentive - advertised by the young John Maynard Keynes - to break with fiscal orthodoxy and start demand management policies. Instead, as Table 2 shows, the influence of the orthod ...

Spring 2017 Bursar Payment Worksheet

... TMS Account #__________________________ Spring Semester Budget Amount: _________________ *See enclosed Methods of Payment Sheet For Payment Instructions, then Enter Your Method Here: ___Check Enclosed Credit Card Confirmation No.____________________ E-Check Conf. # ______________ REQUIRED SIGNATURE: ...

... TMS Account #__________________________ Spring Semester Budget Amount: _________________ *See enclosed Methods of Payment Sheet For Payment Instructions, then Enter Your Method Here: ___Check Enclosed Credit Card Confirmation No.____________________ E-Check Conf. # ______________ REQUIRED SIGNATURE: ...

Chapter 1: An Introduction to Corporate Finance

... Booth/Cleary Introduction to Corporate Finance, Second Edition ...

... Booth/Cleary Introduction to Corporate Finance, Second Edition ...

United States of America Long-Term Rating Lowered To 'AA+' On

... We have taken the ratings off CreditWatch because the Aug. 2 passage of the Budget Control Act Amendment of 2011 has removed any perceived immediate threat of payment default posed by delays to raising the government's debt ceiling. In addition, we believe that the act provides sufficient clarity to ...

... We have taken the ratings off CreditWatch because the Aug. 2 passage of the Budget Control Act Amendment of 2011 has removed any perceived immediate threat of payment default posed by delays to raising the government's debt ceiling. In addition, we believe that the act provides sufficient clarity to ...

Credit Corp - Treasury.gov.au

... The proposal fails to take account of the substantial re-balancing of legal rights between debtors and creditors over the past two decades in Australia. Various enhancements to laws relating to the provision of utilities, telecommunication services and financial services, together with enhancements ...

... The proposal fails to take account of the substantial re-balancing of legal rights between debtors and creditors over the past two decades in Australia. Various enhancements to laws relating to the provision of utilities, telecommunication services and financial services, together with enhancements ...