THE DETERMINANTS OF CORPORATE CAPITAL STRUCTURE

... They argue that even if the tradeoffs between the costs and benefits of debt financing can lead to an optimal capital structure, there is a possibility that the relation between the debt ratio and corporate value is weak, so that the cost deviating from the optimum is quite small. The second theory ...

... They argue that even if the tradeoffs between the costs and benefits of debt financing can lead to an optimal capital structure, there is a possibility that the relation between the debt ratio and corporate value is weak, so that the cost deviating from the optimum is quite small. The second theory ...

Adjustment Difficulties and Debt Overhangs in the Eurozone Periphery

... making it possible to again have access to international capital markets. This paper aims to provide background material on the key parameters and mechanisms that will determine the success of the adjustment efforts. Before going into detail, it will be useful to emphasize one peculiarity of EMU: wi ...

... making it possible to again have access to international capital markets. This paper aims to provide background material on the key parameters and mechanisms that will determine the success of the adjustment efforts. Before going into detail, it will be useful to emphasize one peculiarity of EMU: wi ...

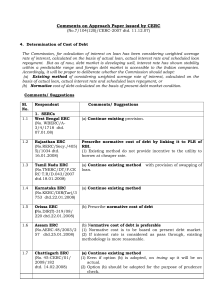

Comments on approach paper 04 - Central Electricity Regulatory

... 4. Determination of Cost of Debt The Commission, for calculation of interest on loan has been considering weighted average rate of interest, calculated on the basis of actual loan, actual interest rate and scheduled loan repayment. But as of now, debt market is developing well, interest rate has sho ...

... 4. Determination of Cost of Debt The Commission, for calculation of interest on loan has been considering weighted average rate of interest, calculated on the basis of actual loan, actual interest rate and scheduled loan repayment. But as of now, debt market is developing well, interest rate has sho ...

Wider Development Conference on Debt Relief

... tackling development from the point of view of a historian of economic thought. There might be other disadvantages but certainly one learn how to keep a close eye on three issues: -the need to take long-run time horizon, -the role of the initial conditions, -the implications for structural change, b ...

... tackling development from the point of view of a historian of economic thought. There might be other disadvantages but certainly one learn how to keep a close eye on three issues: -the need to take long-run time horizon, -the role of the initial conditions, -the implications for structural change, b ...

unaudited but reviewed

... In May 2003, a creditor forgave indebtedness of Baht 2.1 million (consisting of Tranche B debt of Baht 1.2 million and debt awaiting conversion to equity of Baht 0.9 million as discussed in the preceding paragraph) to the Company. In addition, in June 2003, a creditor sold Tranche B debt totaling Ba ...

... In May 2003, a creditor forgave indebtedness of Baht 2.1 million (consisting of Tranche B debt of Baht 1.2 million and debt awaiting conversion to equity of Baht 0.9 million as discussed in the preceding paragraph) to the Company. In addition, in June 2003, a creditor sold Tranche B debt totaling Ba ...

BIS Working Papers The future of public debt: prospects and implications No 300

... And none of these led to default. 4 In more recent times, Japan has been living with a public debt ratio of over 150% without any adverse effect on its cost. So it is possible that investors will continue to put strong faith in industrial countries’ ability to repay, and that worries about excessive ...

... And none of these led to default. 4 In more recent times, Japan has been living with a public debt ratio of over 150% without any adverse effect on its cost. So it is possible that investors will continue to put strong faith in industrial countries’ ability to repay, and that worries about excessive ...

Moody`s Credit Opinion - (16 Dec 2015)

... ending in December 2019. Fiscal policy continues to be the cornerstone of the government agenda, guided by the principles set out in the Medium Term Fiscal Strategy (MTFS) that the administration established upon taking office in August 2013. In the current 2015/16 fiscal year, the administration i ...

... ending in December 2019. Fiscal policy continues to be the cornerstone of the government agenda, guided by the principles set out in the Medium Term Fiscal Strategy (MTFS) that the administration established upon taking office in August 2013. In the current 2015/16 fiscal year, the administration i ...

New requirements for loss absorbing capacity: TLAC and MREL

... A significant phase-in is necessary Clarity is crucial. Investors need to know under what conditions they will assume losses The real test of the bail-in regime is practical application ...

... A significant phase-in is necessary Clarity is crucial. Investors need to know under what conditions they will assume losses The real test of the bail-in regime is practical application ...

This PDF is a selection from a published volume from... of Economic Research Volume Title: NBER International Seminar on Macroeconomics 2012

... trigger or, more importantly, lead to sovereign default situations. Currency overvaluation/undervaluation comes to mind. One could also investigate if troubles in the Periphery were not precipitated by similar issues in the Core just several periods earlier. This would be in line with the results of ...

... trigger or, more importantly, lead to sovereign default situations. Currency overvaluation/undervaluation comes to mind. One could also investigate if troubles in the Periphery were not precipitated by similar issues in the Core just several periods earlier. This would be in line with the results of ...

Russia`s Debt Crisis and the Unofficial Economy

... Debt obligations against multilateral creditors (47 percent) and Eurobonds (29 percent) constituted the largest shares in the post-Soviet debt, whilst the debt against the Paris Club official lenders (40 percent) and against the London Club of private lenders were the major components of the Soviet- ...

... Debt obligations against multilateral creditors (47 percent) and Eurobonds (29 percent) constituted the largest shares in the post-Soviet debt, whilst the debt against the Paris Club official lenders (40 percent) and against the London Club of private lenders were the major components of the Soviet- ...

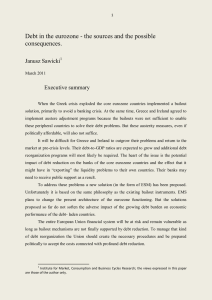

Debt in the eurozone - the sources and the possible consequences.

... citizens of the debt-laden countries are now being asked to make significant sacrifices for “adjustment plans” which will not solve the problem. Political capital is being wasted by this piecemeal process and there might not be enough support for future adjustment programs 3. The creditors who do no ...

... citizens of the debt-laden countries are now being asked to make significant sacrifices for “adjustment plans” which will not solve the problem. Political capital is being wasted by this piecemeal process and there might not be enough support for future adjustment programs 3. The creditors who do no ...

pse07 Bohn3 4738682 en

... exogenous wages provides a too-benign laboratory for fiscal analysis. The dynamics of debt are less stable when interest rates rise with the level of debt than in a fixed interest rate setting. The economy is destabilized further if income taxes decline as reduced capital reduces real wages. Fiscal ...

... exogenous wages provides a too-benign laboratory for fiscal analysis. The dynamics of debt are less stable when interest rates rise with the level of debt than in a fixed interest rate setting. The economy is destabilized further if income taxes decline as reduced capital reduces real wages. Fiscal ...

Cross River State Government of Nigeria

... to a high N13.4bn in F14, evidencing the relative success of the revenue generation policies being implemented. Nevertheless, IGR remains below the level required to fund recurrent expenditure, with personnel costs surpassing IGR in all the years under review. While cost rationalisation measures i ...

... to a high N13.4bn in F14, evidencing the relative success of the revenue generation policies being implemented. Nevertheless, IGR remains below the level required to fund recurrent expenditure, with personnel costs surpassing IGR in all the years under review. While cost rationalisation measures i ...

debt management objectives

... the ECCU, the Monetary Council articulated a comprehensive Eight Point Stabilisation and Growth Programme, designed to stabilise these economies and ultimately steer them towards a path of sustainable economic growth and development. In line with the Eight Point Stabilisation and Growth Programme, t ...

... the ECCU, the Monetary Council articulated a comprehensive Eight Point Stabilisation and Growth Programme, designed to stabilise these economies and ultimately steer them towards a path of sustainable economic growth and development. In line with the Eight Point Stabilisation and Growth Programme, t ...

Bankruptcy and Firm Value

... discouraged from working for such firms. Loss of Receivables: Firms in bankruptcy might be distracted and be less able to collect from trade debtors. Ordinarily, customers would pay in order to continue being able to do business with the firm – if a firm is in bankruptcy, this is less of an incentiv ...

... discouraged from working for such firms. Loss of Receivables: Firms in bankruptcy might be distracted and be less able to collect from trade debtors. Ordinarily, customers would pay in order to continue being able to do business with the firm – if a firm is in bankruptcy, this is less of an incentiv ...

CHAPTER 17 Financial Planning and Forecasting

... supported by the current level of assets is: ◦ Capacity sales = Actual sales / % of capacity ...

... supported by the current level of assets is: ◦ Capacity sales = Actual sales / % of capacity ...

Chapter 5

... Sales discounts are reductions of the normal selling price to encourage prompt payment. ...

... Sales discounts are reductions of the normal selling price to encourage prompt payment. ...

De Grauwe , Paul, Ji , Yuemei Steinbach , Armin. 'The EU debt crisis: Testing and revisiting conventional legal doctrine' LEQS Paper No. 108, April 2016

... debate. From a legal perspective, the no-bailout rule and the ban on monetary financing constitute the main principles governing the legality review of financial assistance and liquidity measures. Interpretation of these rules are full of empirical claims. According to conventional legal doctrine, b ...

... debate. From a legal perspective, the no-bailout rule and the ban on monetary financing constitute the main principles governing the legality review of financial assistance and liquidity measures. Interpretation of these rules are full of empirical claims. According to conventional legal doctrine, b ...

The Impact of Financial Crisis on Public Debt

... means that on average over the next 75 years revenue would have to increase by more than 50 percent or non-interest spending would have to be reduced by about 35 percent (or some combination of the two) to keep debt held by the public at the end of the period from exceeding its level at the beginnin ...

... means that on average over the next 75 years revenue would have to increase by more than 50 percent or non-interest spending would have to be reduced by about 35 percent (or some combination of the two) to keep debt held by the public at the end of the period from exceeding its level at the beginnin ...

real estate players must understand that the introduction of

... property values decline as they did during the late 1980s and early 1990s? How are property cash flows, capitalisation rates and exit strategies impacted by the upward movement of interest rates? Borrowers must decide if the increased returns justify the additional risks and costs that accompany the ...

... property values decline as they did during the late 1980s and early 1990s? How are property cash flows, capitalisation rates and exit strategies impacted by the upward movement of interest rates? Borrowers must decide if the increased returns justify the additional risks and costs that accompany the ...

characteristics, correction and challenges

... agents within each sector are usually considerably mixed. That means the analysis cannot confine itself solely to aggregate data and to historical and international comparisons of such figures, but that it must also delve into the informational wealth of microeconomic data. As a result, the estimate ...

... agents within each sector are usually considerably mixed. That means the analysis cannot confine itself solely to aggregate data and to historical and international comparisons of such figures, but that it must also delve into the informational wealth of microeconomic data. As a result, the estimate ...

ICG: The Rise of Private Debt as an Institutional Asset Class

... markets. There has been a shift in issuance from floating to fixed-rate bonds, favouring issuers when rates rise; as a result investors are shifting to private debt markets which still offer floating rate returns. (iii) Equity like returns As seen in our IRR analysis of median private debt returns, ...

... markets. There has been a shift in issuance from floating to fixed-rate bonds, favouring issuers when rates rise; as a result investors are shifting to private debt markets which still offer floating rate returns. (iii) Equity like returns As seen in our IRR analysis of median private debt returns, ...

T14.1 Chapter Outline

... Sallinger, Inc. is considering a project that will result in initial ...

... Sallinger, Inc. is considering a project that will result in initial ...

Financial Check Up

... 1. Debt ratio: • Total debt divided by total assets. • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • T ...

... 1. Debt ratio: • Total debt divided by total assets. • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • T ...

PowerPoint Ch. 16

... Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. ...

... Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. ...