Debt Levels and Share Price - a Sensitivity Analysis on Vestas

... In their seminal work, Miller and Modigliani (1958) posit that in a perfect market, the capital structure of the company is irrelevant and therefore, has no influence on the value of the company. However, their theory was based on numerous and quite restrictive assumptions which make their conclusio ...

... In their seminal work, Miller and Modigliani (1958) posit that in a perfect market, the capital structure of the company is irrelevant and therefore, has no influence on the value of the company. However, their theory was based on numerous and quite restrictive assumptions which make their conclusio ...

Debt, Equity and Hybrid Decoupling

... to include these rights (‘morphable crediting’). In both areas, investors can have control rights yet have negative economic ownership (sometimes loosely called a “net short” position) and thus have incentives to cause the firm’s value to fall. Equity and debt decoupling can be combined, producing w ...

... to include these rights (‘morphable crediting’). In both areas, investors can have control rights yet have negative economic ownership (sometimes loosely called a “net short” position) and thus have incentives to cause the firm’s value to fall. Equity and debt decoupling can be combined, producing w ...

Monetary and Fiscal Policy with Sovereign Default

... redistribute resources from foreign lenders to domestic citizens. The government may still choose not to repay its debt to relax its budget constraint and reduce distortionary taxes. The model is calibrated to the Mexican economy which has experienced periods of high inflation and sovereign risk in ...

... redistribute resources from foreign lenders to domestic citizens. The government may still choose not to repay its debt to relax its budget constraint and reduce distortionary taxes. The model is calibrated to the Mexican economy which has experienced periods of high inflation and sovereign risk in ...

accounting for long-term assets, long

... Accounting for tangible property, plant and equipment (PP&E) and intangible long-term assets centers on four events: • Acquiring or creating • Depreciating, amortizing or depleting • Impairing and revaluing (revaluations are only allowed under IFRS) ...

... Accounting for tangible property, plant and equipment (PP&E) and intangible long-term assets centers on four events: • Acquiring or creating • Depreciating, amortizing or depleting • Impairing and revaluing (revaluations are only allowed under IFRS) ...

What is a Sustainable Public Debt?∗

... Following the simple version of this framework presented in Mendoza and Oviedo (2009), assume that ...

... Following the simple version of this framework presented in Mendoza and Oviedo (2009), assume that ...

report - Standard Chartered Bank

... China’s rate of credit growth over GDP growth, which we think is the best gauge of leverage risk, has declined for eight consecutive quarters – it stands at 5.4ppt, slightly above our ‘safe’ threshold of 5ppt and down from a peak of 8.8ppt at end2013. This is exceeded in Asia only by Hong Kong, at 7 ...

... China’s rate of credit growth over GDP growth, which we think is the best gauge of leverage risk, has declined for eight consecutive quarters – it stands at 5.4ppt, slightly above our ‘safe’ threshold of 5ppt and down from a peak of 8.8ppt at end2013. This is exceeded in Asia only by Hong Kong, at 7 ...

Clamoring for Greenbacks: Explaining the

... monetary system, based on the U.S. dollar, the Euro, and the Chinese renminbi (RMB), would make the world economy more stable because it requires for the issuers of the key currencies to check and discipline their fiscal conditions. From that view, the weakening credibility of the Euro may contribut ...

... monetary system, based on the U.S. dollar, the Euro, and the Chinese renminbi (RMB), would make the world economy more stable because it requires for the issuers of the key currencies to check and discipline their fiscal conditions. From that view, the weakening credibility of the Euro may contribut ...

A Financial Optimization Approach to Quantitative

... strategies in a great number of simulated futures. This approach has a number of drawbacks, which might be handled by using a financial optimization approach based on Stochastic Programming. The objective of this master’s thesis is thus to apply financial optimization on the Swedish government’s str ...

... strategies in a great number of simulated futures. This approach has a number of drawbacks, which might be handled by using a financial optimization approach based on Stochastic Programming. The objective of this master’s thesis is thus to apply financial optimization on the Swedish government’s str ...

When managing the debt, Governments deal with the

... In recent years, Colombian debt has increased considerably. The Gross Non Financial Public Sector Debt was under 30% of GDP in 1996 and reached 63,3% of GDP in 2001. The Central Government has been responsible for a great deal of the debt’s growth, increasing from 17% of GDP in 1996 to 56% of GDP by ...

... In recent years, Colombian debt has increased considerably. The Gross Non Financial Public Sector Debt was under 30% of GDP in 1996 and reached 63,3% of GDP in 2001. The Central Government has been responsible for a great deal of the debt’s growth, increasing from 17% of GDP in 1996 to 56% of GDP by ...

What Drives Long-term Capital Flows? A Theoretical and Empirical

... in external debt. More specifically, the evidence presented here suggests that the cross-country variations in net foreign liabilities conform rather well to the qualitative predictions of a simple neoclassical model with collateral constraints in which countries with high savings rates tend to accu ...

... in external debt. More specifically, the evidence presented here suggests that the cross-country variations in net foreign liabilities conform rather well to the qualitative predictions of a simple neoclassical model with collateral constraints in which countries with high savings rates tend to accu ...

PDF Download

... The paper starts by presenting a comprehensive new dataset on sovereign debt restructurings with private external creditors over the past decades. We define preemptive and post-default restructurings and document our first stylized fact: that preemptive exchanges account for 38% of all restructuring ...

... The paper starts by presenting a comprehensive new dataset on sovereign debt restructurings with private external creditors over the past decades. We define preemptive and post-default restructurings and document our first stylized fact: that preemptive exchanges account for 38% of all restructuring ...

Presentación de PowerPoint

... (2) As defined in the New Money Financing Commitment Letter (3) Minimum Anchor Allocation: With respect to an Anchor Funder, the portion of its Anchor Commitment in respect of each Tranche, specified as such in its Anchor Acceptance Confirmation, provided that must not be more than 50% of its Anchor ...

... (2) As defined in the New Money Financing Commitment Letter (3) Minimum Anchor Allocation: With respect to an Anchor Funder, the portion of its Anchor Commitment in respect of each Tranche, specified as such in its Anchor Acceptance Confirmation, provided that must not be more than 50% of its Anchor ...

A Surplus of Ambition: Can Europe Rely on Large Primary

... are more likely when growth is strong and the current account of the balance of payments is in surplus (when savings rates are high). Europe’s highly indebted countries certainly feel strong external pressure to adjust. Some also have the advantage of relatively high saving rates. But the other fact ...

... are more likely when growth is strong and the current account of the balance of payments is in surplus (when savings rates are high). Europe’s highly indebted countries certainly feel strong external pressure to adjust. Some also have the advantage of relatively high saving rates. But the other fact ...

DOC 477KB - Board of Taxation

... Prior to the introduction of the debt and equity rules, the distinction between debt and equity under general income tax principles could be said to have mainly manifested in a distinction between the costs of operations that produce assessable income (in particular, the cost of debt), and returns t ...

... Prior to the introduction of the debt and equity rules, the distinction between debt and equity under general income tax principles could be said to have mainly manifested in a distinction between the costs of operations that produce assessable income (in particular, the cost of debt), and returns t ...

The Existence of Corporate Bond Clawbacks

... Section 2. Section 3 illustrates a basic numerical analysis of the model. We present data and sample characteristics in Section 4. Section 5 provides multivariate analysis and empirical results. Section 6 discusses the results with some implications for policy. ...

... Section 2. Section 3 illustrates a basic numerical analysis of the model. We present data and sample characteristics in Section 4. Section 5 provides multivariate analysis and empirical results. Section 6 discusses the results with some implications for policy. ...

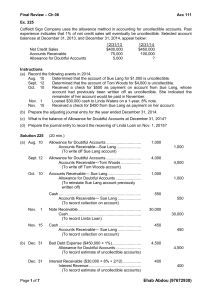

Final Review – Ch 08 Acc 111 Ex. 225 Coffeldt Sign Company uses

... The December 31, 2013 balance sheet of Sauder Company had Accounts Receivable of ₤500,000 and a credit balance in Allowance for Doubtful Accounts of ₤33,000. During 2014, the following transactions occurred: sales on account ₤1,300,000; sales returns and allowances, ₤50,000; collections from custome ...

... The December 31, 2013 balance sheet of Sauder Company had Accounts Receivable of ₤500,000 and a credit balance in Allowance for Doubtful Accounts of ₤33,000. During 2014, the following transactions occurred: sales on account ₤1,300,000; sales returns and allowances, ₤50,000; collections from custome ...

Public Debt and Deficits

... DISCLAIMER This was prepared by Chartered Accountants Australia and New Zealand with the assistance of Deloitte Access Economics. This publication contains general information only, none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Netw ...

... DISCLAIMER This was prepared by Chartered Accountants Australia and New Zealand with the assistance of Deloitte Access Economics. This publication contains general information only, none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Netw ...

Count the Limbs: Designing Robust Aggregation Clauses in

... then number two at the IMF and the U.S. Treasury, respectively, gave the battle epic academic and policy stature, and an air of Beltway intrigue (Krueger 2002, Taylor 2002). Investor groups sprang up to resist all official sovereign debt restructuring initiatives as creeping encroachments on credito ...

... then number two at the IMF and the U.S. Treasury, respectively, gave the battle epic academic and policy stature, and an air of Beltway intrigue (Krueger 2002, Taylor 2002). Investor groups sprang up to resist all official sovereign debt restructuring initiatives as creeping encroachments on credito ...

Accounts and Notes Receivable

... A receivable is an amount due from another party. Receivables are usually one of the largest current assets on a company’s books. The control and analysis of this asset is very important, because receivables are usually the biggest source of a company’s cash flow. What happens when your cash flow at ...

... A receivable is an amount due from another party. Receivables are usually one of the largest current assets on a company’s books. The control and analysis of this asset is very important, because receivables are usually the biggest source of a company’s cash flow. What happens when your cash flow at ...

Transactions Costs and Capital Structure Choice: Evidence from

... large enough to plausibly explain leverage choices by most firms (Myers (1984), Shyam-Sunder and Myers (1995)). Transactions costs are potentially very important to financially distressed firms. The debt adjustments contemplated by these firms are quite large, and financial distress may have pushed ...

... large enough to plausibly explain leverage choices by most firms (Myers (1984), Shyam-Sunder and Myers (1995)). Transactions costs are potentially very important to financially distressed firms. The debt adjustments contemplated by these firms are quite large, and financial distress may have pushed ...

November 28, 2006

... CORPORATIONS Creditors • Modigliani and Miller (1958) argued that in the absence of bankruptcy costs and tax subsidies on the payment of interest, the value of the firm is independent of the financial structure. • Modigliani and Miller later (1963) argued that the existence of tax subsidies on inte ...

... CORPORATIONS Creditors • Modigliani and Miller (1958) argued that in the absence of bankruptcy costs and tax subsidies on the payment of interest, the value of the firm is independent of the financial structure. • Modigliani and Miller later (1963) argued that the existence of tax subsidies on inte ...

FM11 Ch 14 Instructors Manual

... variable costs, will be the same percent of sales in 2005 as in 2004; (2) that the payout ratio is held constant at 40 percent; (3) that external funds needed are financed 50 percent by notes payable and 50 percent by long-term debt (no new common stock will be issued); (4) that all debt carries an ...

... variable costs, will be the same percent of sales in 2005 as in 2004; (2) that the payout ratio is held constant at 40 percent; (3) that external funds needed are financed 50 percent by notes payable and 50 percent by long-term debt (no new common stock will be issued); (4) that all debt carries an ...

Growth and Productivity: the role of Government Debt

... aftermath of the Lehman Brothers bankruptcy in autumn 2008, fiscal imbalances increased in most European economies and the euro area in particular, reflecting the high fiscal cost of the measures taken to contain the fallout from the credit crisis. These developments have been followed by a sovereig ...

... aftermath of the Lehman Brothers bankruptcy in autumn 2008, fiscal imbalances increased in most European economies and the euro area in particular, reflecting the high fiscal cost of the measures taken to contain the fallout from the credit crisis. These developments have been followed by a sovereig ...

NBER WORKING PAPER SERIES INTERNATIONAL RESERVES AND ROLLOVER RISK Javier Bianchi

... do not allow the government to accumulate assets for insurance purposes. Alfaro and Kanczuk (2009) study a model with one-period debt where assets are only useful for transferring resources to default states. In contrast, we study the role of reserves in hedging against rollover risk. Telyukova (20 ...

... do not allow the government to accumulate assets for insurance purposes. Alfaro and Kanczuk (2009) study a model with one-period debt where assets are only useful for transferring resources to default states. In contrast, we study the role of reserves in hedging against rollover risk. Telyukova (20 ...

Delay in the Expansion from 2.5G to 3G Wireless Networks

... of customers does not appear to have materialized. • Chapter 11 is often used in the United States by companies that have fundamentally strong businesses and loyal customer base to restructure their financial position and debts to strategically strengthen their businesses. WorldCom clearly falls int ...

... of customers does not appear to have materialized. • Chapter 11 is often used in the United States by companies that have fundamentally strong businesses and loyal customer base to restructure their financial position and debts to strategically strengthen their businesses. WorldCom clearly falls int ...