THE IMPACT OWNERSHIP STRUCTURE ON THE

... for financial performance in organizations. Towards this end, the research sought to establish effect of liquidity and leverage on financial performance of commercial state corporations in the tourism industry in Kenya. The relationship between liquidity with leverage on financial performance was ex ...

... for financial performance in organizations. Towards this end, the research sought to establish effect of liquidity and leverage on financial performance of commercial state corporations in the tourism industry in Kenya. The relationship between liquidity with leverage on financial performance was ex ...

Bankruptcy Equilibrium: Secured and Unsecured assets

... individual state transference is contained in the span of the payoff matrix, then we need to check if the collateral constraint is satisfied. In case it is not, we can add unsecured assets without changing the matrix span. Next, in order to ensure that in equilibrium this span is not changed, we nee ...

... individual state transference is contained in the span of the payoff matrix, then we need to check if the collateral constraint is satisfied. In case it is not, we can add unsecured assets without changing the matrix span. Next, in order to ensure that in equilibrium this span is not changed, we nee ...

A Small Open Economy Model with Sovereign

... the model successfully captures the declines in output, consumption and investment that are actually associated with these episodes. Net exports and sovereign spreads are countercyclical because in the model the risk of default increases when the economy is either more indebted or transiting through ...

... the model successfully captures the declines in output, consumption and investment that are actually associated with these episodes. Net exports and sovereign spreads are countercyclical because in the model the risk of default increases when the economy is either more indebted or transiting through ...

Credit Availability, Start-up Financing, and Survival: Evidence from

... credit―rather than, for instance, a reduced demand for credit or other spurious factors―that is driving our results. To do so, we first rerun regressions without the start-ups founded in 2009, a year in which the demand-side effects of the crisis became more apparent. For instance, while gross fixed ...

... credit―rather than, for instance, a reduced demand for credit or other spurious factors―that is driving our results. To do so, we first rerun regressions without the start-ups founded in 2009, a year in which the demand-side effects of the crisis became more apparent. For instance, while gross fixed ...

Fiscal Monitor - Addressing Fiscal Challenges to Reduce Economic

... made good progress in reducing high deficits and specifying medium-term plans and have committed to enhancing fiscal institutions. Nevertheless, borrowing spreads have risen significantly in larger economies, including Italy and Spain, showing that market sentiment can change abruptly. In Japan and the ...

... made good progress in reducing high deficits and specifying medium-term plans and have committed to enhancing fiscal institutions. Nevertheless, borrowing spreads have risen significantly in larger economies, including Italy and Spain, showing that market sentiment can change abruptly. In Japan and the ...

Kampala Capital City Authority

... Kampala is the financial centre of Uganda, accounting for approximately 80% of industrial and commercial activity and contributing 65% to GDP. Thus, the city is considered critical to the country’s prosperity, implying strong government support. Government support has also been demonstrated thro ...

... Kampala is the financial centre of Uganda, accounting for approximately 80% of industrial and commercial activity and contributing 65% to GDP. Thus, the city is considered critical to the country’s prosperity, implying strong government support. Government support has also been demonstrated thro ...

Chapter 11

... a return of 7 percent. It was financed by debt costing 6 percent. In August, Mr. Rambo came up with an “entire bug colony destroying” device that had a return of 12 percent. The Chief Financial Officer, Mr. Roach, told him it was impractical because it would require the issuance of common stock at a ...

... a return of 7 percent. It was financed by debt costing 6 percent. In August, Mr. Rambo came up with an “entire bug colony destroying” device that had a return of 12 percent. The Chief Financial Officer, Mr. Roach, told him it was impractical because it would require the issuance of common stock at a ...

Working Paper 17-6: Does Greece Need More Official Debt Relief? If

... Since mid-2015, the International Monetary Fund (IMF), EU institutions, and European creditor countries have been arguing whether Greece requires additional official debt relief—and if so, how much.1 One-and-a-half years later, their positions seem as far apart as ever. In a report released on Febru ...

... Since mid-2015, the International Monetary Fund (IMF), EU institutions, and European creditor countries have been arguing whether Greece requires additional official debt relief—and if so, how much.1 One-and-a-half years later, their positions seem as far apart as ever. In a report released on Febru ...

Chapter 16 -- Operating and Financial Leverage

... Make an examination of the coverage ratios for Basket Wonders when EBIT=$500,000. Compare the equity and the debt financing alternatives. ...

... Make an examination of the coverage ratios for Basket Wonders when EBIT=$500,000. Compare the equity and the debt financing alternatives. ...

The “Mystery of the Printing Press” Monetary Policy and Self

... credible/desirable under budget separation are reasonably mild. These …ndings are important in light of concerns that, on the one hand, the central bank may not have the ability to expand its balance sheet on a su¢ cient scale to e¤ectively backstop government debt. On the other hand, even if a bac ...

... credible/desirable under budget separation are reasonably mild. These …ndings are important in light of concerns that, on the one hand, the central bank may not have the ability to expand its balance sheet on a su¢ cient scale to e¤ectively backstop government debt. On the other hand, even if a bac ...

Initial Phase - World Bank Group

... creditors receive more from future profits (or a sale of company) than the “auction value” of the assets; excess of “going-concern value” of assets over “auction value” (“going-concern premium”) is usually divided between creditors and stockholders so that in a successful reorganization, both groups ...

... creditors receive more from future profits (or a sale of company) than the “auction value” of the assets; excess of “going-concern value” of assets over “auction value” (“going-concern premium”) is usually divided between creditors and stockholders so that in a successful reorganization, both groups ...

0538479736_265849

... In connection with financing arrangements, it is common practice for a company to agree to maintain a minimum or average balance on deposit with a bank. These compensating balances are defined by the SEC as “that portion of any demand deposit maintained by a ...

... In connection with financing arrangements, it is common practice for a company to agree to maintain a minimum or average balance on deposit with a bank. These compensating balances are defined by the SEC as “that portion of any demand deposit maintained by a ...

Debt cycles, instability and fiscal rules: a Godley

... indebtedness of the US private sector was unsustainable and, therefore, private expenditures could not be considered as a source of steady growth in the medium run. He also pointed to the unsustainability of the rising US net foreign indebtedness. Using a stock-flow consistent analytical framework, ...

... indebtedness of the US private sector was unsustainable and, therefore, private expenditures could not be considered as a source of steady growth in the medium run. He also pointed to the unsustainability of the rising US net foreign indebtedness. Using a stock-flow consistent analytical framework, ...

household debt and unemployment

... When competitive firms post vacancies, they recognize that levered households will look for relatively high-paying jobs. Hence, an increase in household debt results in firms posting higher wages in order to attract workers. However, because they pay higher wages, firms must reduce the number of va ...

... When competitive firms post vacancies, they recognize that levered households will look for relatively high-paying jobs. Hence, an increase in household debt results in firms posting higher wages in order to attract workers. However, because they pay higher wages, firms must reduce the number of va ...

household debt and unemployment

... When competitive firms post vacancies, they recognize that levered households will look for relatively high-paying jobs. Hence, an increase in household debt results in firms posting higher wages in order to attract workers. However, because they pay higher wages, firms must reduce the number of va ...

... When competitive firms post vacancies, they recognize that levered households will look for relatively high-paying jobs. Hence, an increase in household debt results in firms posting higher wages in order to attract workers. However, because they pay higher wages, firms must reduce the number of va ...

Trying To Understand All-Equity Firms

... investments was larger than total debt. Between 1987 and 2009, on average 14,1% of firms show no debt, 16.8% show zero long-term debt and 41% zero net debt. Looking to the evolution in Table 1, we see a stable rising trend with a maximum in 2005. This extreme debt aversion exists in all firm sizes b ...

... investments was larger than total debt. Between 1987 and 2009, on average 14,1% of firms show no debt, 16.8% show zero long-term debt and 41% zero net debt. Looking to the evolution in Table 1, we see a stable rising trend with a maximum in 2005. This extreme debt aversion exists in all firm sizes b ...

LBO General Discussion

... • Mezzanine debt is issued with a cash pay interest rate of 12 to 12 1/2 percent and a maturity ranging from five to seven years. • The remainder of the required 18 to 20 percent all-in-return consists of warrants to buy common stock, which the investor values based on the outlook of the company, or ...

... • Mezzanine debt is issued with a cash pay interest rate of 12 to 12 1/2 percent and a maturity ranging from five to seven years. • The remainder of the required 18 to 20 percent all-in-return consists of warrants to buy common stock, which the investor values based on the outlook of the company, or ...

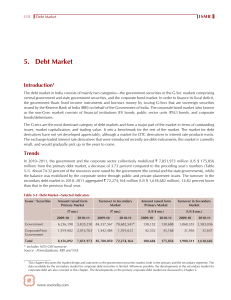

5. Debt Market

... their auction is made by the RBI through a Press Release that would be issued one day prior to the date of auction. The settlement of the auction is on a T+1 basis. Dated Government Securities: Dated government securities are long-term securities that carry a fixed or floating coupon (interest rate), ...

... their auction is made by the RBI through a Press Release that would be issued one day prior to the date of auction. The settlement of the auction is on a T+1 basis. Dated Government Securities: Dated government securities are long-term securities that carry a fixed or floating coupon (interest rate), ...

documentos de trabajo

... eventually lead to a generalized bank run. Second, the strong growth of non-performing debt, which started to be written off in recent years. Furthermore, some of the debtors voluntarily cancelled their loans, taking advantage of the possibilities provided by the government in 2001 to firms with del ...

... eventually lead to a generalized bank run. Second, the strong growth of non-performing debt, which started to be written off in recent years. Furthermore, some of the debtors voluntarily cancelled their loans, taking advantage of the possibilities provided by the government in 2001 to firms with del ...

Italy - Marcello Minenna

... based on the assessment of investors. The index spiked to 19% in November 2016 before recently moderating to 15%. This compared with the 2.5% average in 2012-1H16 and signals the increase in the market's concerns about ‘Italexit’ that emerged at the end of last year given the perceived systemic risk ...

... based on the assessment of investors. The index spiked to 19% in November 2016 before recently moderating to 15%. This compared with the 2.5% average in 2012-1H16 and signals the increase in the market's concerns about ‘Italexit’ that emerged at the end of last year given the perceived systemic risk ...

NBER WORKING PAPER SERIES INVESTMENT CYCLES AND SOVEREIGN DEBT OVERHANG Mark Aguiar

... This paper builds on the influential paper of Thomas and Worrall (1994), who introduce a model of foreign direct investment in an environment of limited commitment. Alburquerque and Hopenhayn (2004) develop a related model. Our analysis differs from these papers in several important respects. The fi ...

... This paper builds on the influential paper of Thomas and Worrall (1994), who introduce a model of foreign direct investment in an environment of limited commitment. Alburquerque and Hopenhayn (2004) develop a related model. Our analysis differs from these papers in several important respects. The fi ...

Chapter 11

... provided a return of 7 percent. It was financed by debt costing 6 percent. In August, Mr. Rambo came up with an “entire bug colony destroying” device that had a return of 12 percent. The Chief Financial Officer, Mr. Roach, told him it was impractical because it would require the issuance of common s ...

... provided a return of 7 percent. It was financed by debt costing 6 percent. In August, Mr. Rambo came up with an “entire bug colony destroying” device that had a return of 12 percent. The Chief Financial Officer, Mr. Roach, told him it was impractical because it would require the issuance of common s ...

INTER PIPELINE LTD. $3,000,000,000 Common Shares Preferred

... to the Subscription Receipts being offered. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to such Securities will be included in the Prospectus Supplement descri ...

... to the Subscription Receipts being offered. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to such Securities will be included in the Prospectus Supplement descri ...

Government, Household and Corporate Debt

... et al., 2014), while fewer have included private sector debt 3 (see e.g. Cecchetti et al., 2011). In research made, private debt is found to have a drag on growth above threshold levels of 80-100 percent of GDP (Arcand et al., 2015), similar to threshold levels found for public debt. Incorporating p ...

... et al., 2014), while fewer have included private sector debt 3 (see e.g. Cecchetti et al., 2011). In research made, private debt is found to have a drag on growth above threshold levels of 80-100 percent of GDP (Arcand et al., 2015), similar to threshold levels found for public debt. Incorporating p ...