Bangladeshi Money Supply And Equity Returns: A Co-Integration Analysis:

... react to noteworthy news events by adjusting their investment portfolios because these events change the risk-return profile of securities. Therefore, changes in the money supply, particularly M1 money, are important indicators of changes in future macroeconomic conditions such as inflation, interes ...

... react to noteworthy news events by adjusting their investment portfolios because these events change the risk-return profile of securities. Therefore, changes in the money supply, particularly M1 money, are important indicators of changes in future macroeconomic conditions such as inflation, interes ...

fact sheet

... Business model: Our ownership interests are concentrated on key Norwegian industries that are international in scope and of which we have in-depth knowledge: oil and gas, seafood & marine biotechnology, and maritime assets. Through our participation on the board of directors, Aker drives operational ...

... Business model: Our ownership interests are concentrated on key Norwegian industries that are international in scope and of which we have in-depth knowledge: oil and gas, seafood & marine biotechnology, and maritime assets. Through our participation on the board of directors, Aker drives operational ...

SmartMoney - Dyan Machan.com

... last winter’s abyss, and a reforming White House trying to restore some order to the Wild West of the markets with new regulation, we’re starting to regain confidence in our investments. But when it comes to our feelings about big-name investors—well, it’s going to take a lot of wooing to teach us h ...

... last winter’s abyss, and a reforming White House trying to restore some order to the Wild West of the markets with new regulation, we’re starting to regain confidence in our investments. But when it comes to our feelings about big-name investors—well, it’s going to take a lot of wooing to teach us h ...

Impact of Union elections on the Stock volatility

... is important for several reasons. Firstly, volatility is synonymous with risk and therefore increase in risk associated with a given economic activity should therefore see a reduced level of participation in that activity. In other words, when the Indian stock market exhibits high volatility a reduc ...

... is important for several reasons. Firstly, volatility is synonymous with risk and therefore increase in risk associated with a given economic activity should therefore see a reduced level of participation in that activity. In other words, when the Indian stock market exhibits high volatility a reduc ...

Farm Business Management Part 1

... 21. Wendy Wheatgrower is considering adding a fee hunting service to her farm. If annual fixed costs to operate the service are $8,000 and variable costs are $25 per hunter, how many hunting days must be sold annually to breakeven assuming a price of $150/day? a. 50 days b. 64 days c. 77 days d. Non ...

... 21. Wendy Wheatgrower is considering adding a fee hunting service to her farm. If annual fixed costs to operate the service are $8,000 and variable costs are $25 per hunter, how many hunting days must be sold annually to breakeven assuming a price of $150/day? a. 50 days b. 64 days c. 77 days d. Non ...

Chapter 3. Securities Markets

... 1. Public offerings of both stocks and bonds typically are marketed by investment bankers who in this role are called underwriters. Therefore, underwriters purchase securities from the issuing company and resell them. Investment bankers advise the firm regarding the terms on which it should attempt ...

... 1. Public offerings of both stocks and bonds typically are marketed by investment bankers who in this role are called underwriters. Therefore, underwriters purchase securities from the issuing company and resell them. Investment bankers advise the firm regarding the terms on which it should attempt ...

Dividends and Other Payouts

... dividend for the first time). Recall that one of the assumptions underlying the dividend-irrelevance argument is: “The investment policy of the firm is set ahead of time and is not altered by changes in dividend policy.” ...

... dividend for the first time). Recall that one of the assumptions underlying the dividend-irrelevance argument is: “The investment policy of the firm is set ahead of time and is not altered by changes in dividend policy.” ...

Savings and Investing Common Forms of Investments

... Chapter 14: Savings and Investing Common Forms of Investments Common Stock Common stock represents general ownership in a corporation, carries voting privileges, and includes a right to share in its profits. However, there are no fixed dividend rates. Common stock is always liquid—it can be bought ...

... Chapter 14: Savings and Investing Common Forms of Investments Common Stock Common stock represents general ownership in a corporation, carries voting privileges, and includes a right to share in its profits. However, there are no fixed dividend rates. Common stock is always liquid—it can be bought ...

Fritz Meyer Presentation

... Diversification and asset allocation do not assure profit or eliminate the risk of loss. The S&P 500® Index is an unmanaged index considered representative of the U.S. stock market. Government securities, such as U.S. Treasury bills, notes and bonds offer a high degree of safety and they guarantee t ...

... Diversification and asset allocation do not assure profit or eliminate the risk of loss. The S&P 500® Index is an unmanaged index considered representative of the U.S. stock market. Government securities, such as U.S. Treasury bills, notes and bonds offer a high degree of safety and they guarantee t ...

The Speculative Nature of Stock Market

... listed securities, resulted from privatization programs at a lower price (discount privatization), are actually residual government securities of unattractive companies. On these markets there are very few new investors, and securities are traded primarily between existing participants, which is why ...

... listed securities, resulted from privatization programs at a lower price (discount privatization), are actually residual government securities of unattractive companies. On these markets there are very few new investors, and securities are traded primarily between existing participants, which is why ...

ADVANCED DRAINAGE SYSTEMS, INC. (Form: 8-K

... in the markets in which we operate, including, without limitation, factors relating to availability of credit, interest rates, fluctuations in capital and business and consumer confidence; cyclicality and seasonality of the non-residential and residential construction markets and infrastructure spen ...

... in the markets in which we operate, including, without limitation, factors relating to availability of credit, interest rates, fluctuations in capital and business and consumer confidence; cyclicality and seasonality of the non-residential and residential construction markets and infrastructure spen ...

15 - Finance

... Preliminary estimates indicate that next year's payroll will be about $6.1M. Next year's closing balance sheet date will be nine working days after a payday. 4. The combined state and federal income tax rate is 40%. 5. Interest on current and future borrowing will be at a rate of ...

... Preliminary estimates indicate that next year's payroll will be about $6.1M. Next year's closing balance sheet date will be nine working days after a payday. 4. The combined state and federal income tax rate is 40%. 5. Interest on current and future borrowing will be at a rate of ...

Strategy Overview Schroder International Equity Alpha Summary

... Important information: Schroders is a global asset management company with $462.1 billion under management as of December 31, 2015. Our clients are major financial institutions including banks and insurance companies, public and private pension funds, endowments and foundations, high net worth indiv ...

... Important information: Schroders is a global asset management company with $462.1 billion under management as of December 31, 2015. Our clients are major financial institutions including banks and insurance companies, public and private pension funds, endowments and foundations, high net worth indiv ...

Input Demand: The Capital Market and the Investment Decision

... When they evaluate a project, they estimate the future benefits from the investment and compare it to the possible alternative uses of the funds. ...

... When they evaluate a project, they estimate the future benefits from the investment and compare it to the possible alternative uses of the funds. ...

Further Reforms after the “BIG BANG”: The JGB Market

... aggravates market declines [Hong and Stein (2002)] Price reactions to quarterly earnings announcements are greater when short-sales are costly [Reed (2003)] Distribution of earnings announcement-day returns is more left-skewed and suffer from higher volatility when short-sales are costly [Reed (2003 ...

... aggravates market declines [Hong and Stein (2002)] Price reactions to quarterly earnings announcements are greater when short-sales are costly [Reed (2003)] Distribution of earnings announcement-day returns is more left-skewed and suffer from higher volatility when short-sales are costly [Reed (2003 ...

Does oil price transmit to emerging stock returns: A case study of Pakistan economy

... This study empirically determines the relationship between stock prices and oil prices To take the volatility clustering into account we use the GARCH model which is developed by Bollerslev (1986) with some variations. A GARCH (1,1) model is a specification that works well for stock returns in Pakis ...

... This study empirically determines the relationship between stock prices and oil prices To take the volatility clustering into account we use the GARCH model which is developed by Bollerslev (1986) with some variations. A GARCH (1,1) model is a specification that works well for stock returns in Pakis ...

Lesson: "Applications: Growth and Decay"

... Andy invests $2,700.00 in a CD at an interest rate of 4.6% for 9 months. If the interest gets compounded continuously, how much will he have at the end of the term? How many years will it take for an initial investment of $7,000.00 to grow to $9,500.00 at a rate of 6% compounded quarterly? ...

... Andy invests $2,700.00 in a CD at an interest rate of 4.6% for 9 months. If the interest gets compounded continuously, how much will he have at the end of the term? How many years will it take for an initial investment of $7,000.00 to grow to $9,500.00 at a rate of 6% compounded quarterly? ...

Paper - Careers Portal

... depreciate its vehicles at the rate of 15% of cost per annum calculated from the date of purchase to the date of disposal and to accumulate this depreciation in a Provision for Depreciation Account. On 1/1/2003, Ace Haulage Ltd. owned the following vehicles: No. 1 purchased on 1/1/1999 for €70,000 N ...

... depreciate its vehicles at the rate of 15% of cost per annum calculated from the date of purchase to the date of disposal and to accumulate this depreciation in a Provision for Depreciation Account. On 1/1/2003, Ace Haulage Ltd. owned the following vehicles: No. 1 purchased on 1/1/1999 for €70,000 N ...

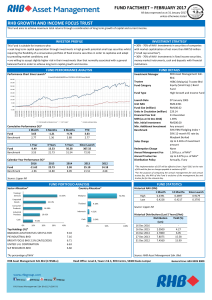

RHB Growth And Income Focus Trust

... inexpensive valuations, end of foreign investor capitulation and solid corporate fundamentals will continue to be the positive catalysts for the equity market. In terms of strategy, stock selections have become more important in the current volatile market. We will continue to focus in value investi ...

... inexpensive valuations, end of foreign investor capitulation and solid corporate fundamentals will continue to be the positive catalysts for the equity market. In terms of strategy, stock selections have become more important in the current volatile market. We will continue to focus in value investi ...

Existe-t-il une relation entre l*information sectorielle et le tableau

... Model to measure investment properties. Whereas companies not primarily in the real estate business should adopt the cost model to measure their investment property in order to avoid the procyclical effect of fair value. Hypothesis 2: Fair Value may have a pro-cyclical effect, allowing better ...

... Model to measure investment properties. Whereas companies not primarily in the real estate business should adopt the cost model to measure their investment property in order to avoid the procyclical effect of fair value. Hypothesis 2: Fair Value may have a pro-cyclical effect, allowing better ...

3 8 The economic impact of Private Equity and

... unit of currency. Inflation usually refers to consumer prices, but it can also be applied to other prices (wholesale goods, wages, assets, and so on). It is usually expressed as an annual percentage rate of change on an index number. ...

... unit of currency. Inflation usually refers to consumer prices, but it can also be applied to other prices (wholesale goods, wages, assets, and so on). It is usually expressed as an annual percentage rate of change on an index number. ...

RPM_Proyecciones

... Note: Figure A shows the stock flows as a percentage of GDP. B-D show the proportion of the firms that considered that their stock levels were higher than desired and also considered that: (B) actual demand was low, normal and high, respectively; (C) future production will go down, not change and go ...

... Note: Figure A shows the stock flows as a percentage of GDP. B-D show the proportion of the firms that considered that their stock levels were higher than desired and also considered that: (B) actual demand was low, normal and high, respectively; (C) future production will go down, not change and go ...