The Economy and Financial Markets

... P/E Multiple: A tool for comparing the prices of different common stocks by assessing how much the market is willing to pay a share of each corporation’s earnings. It is calculated by dividing the current market price of a stock by the earnings per share. Past performance is no guarantee of future r ...

... P/E Multiple: A tool for comparing the prices of different common stocks by assessing how much the market is willing to pay a share of each corporation’s earnings. It is calculated by dividing the current market price of a stock by the earnings per share. Past performance is no guarantee of future r ...

STOCKHOLDERS` EQUITY

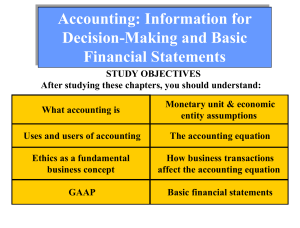

... Expenses are the decreases in stockholders’ equity that result from operating the business. They are the cost of assets consumed or services used in the process of earning revenue. Examples are: utility expense, rent expense, ...

... Expenses are the decreases in stockholders’ equity that result from operating the business. They are the cost of assets consumed or services used in the process of earning revenue. Examples are: utility expense, rent expense, ...

Latin American Growth Dynamics

... Latin American Growth IX • The contribution of labor output to growth in the future will likely be limited by some natural constraints • Population aging (the dependency ratio is expected to reach its minimum over the next years in several countries • Limited scope to further increase in labor part ...

... Latin American Growth IX • The contribution of labor output to growth in the future will likely be limited by some natural constraints • Population aging (the dependency ratio is expected to reach its minimum over the next years in several countries • Limited scope to further increase in labor part ...

Exploiting Market Anomalies in the Saudi Stock

... month, and increase positions during the end of March and October, where the TASI always showed the worst performance during these mentioned months and then recovered significantly. (2) Effect of valuation on market performance: The correlation between valuation parameters and stock market performan ...

... month, and increase positions during the end of March and October, where the TASI always showed the worst performance during these mentioned months and then recovered significantly. (2) Effect of valuation on market performance: The correlation between valuation parameters and stock market performan ...

2014 Market Outlook - KMG Private Wealth Management

... October 2013 deal was frozen temporarily for three months at the fiscal year 2013 level of $986 billion. The Senate and President Obama want to raise the cap from $986 billion while Republicans want to keep it, but ease cuts on defense spending. In any case, the market impact may be muted since the ...

... October 2013 deal was frozen temporarily for three months at the fiscal year 2013 level of $986 billion. The Senate and President Obama want to raise the cap from $986 billion while Republicans want to keep it, but ease cuts on defense spending. In any case, the market impact may be muted since the ...

Annual reports of listed issuers with financial year ended on 31st

... Northwest New Technology Industry Company (stock code: 8258) have not yet issued their annual reports for the year ended 31 December 2004; and Kinetana International Biotech Pharma Limited (stock code: 8031) has not yet issued its annual report for the year ended 28 February 2005. For details, pleas ...

... Northwest New Technology Industry Company (stock code: 8258) have not yet issued their annual reports for the year ended 31 December 2004; and Kinetana International Biotech Pharma Limited (stock code: 8031) has not yet issued its annual report for the year ended 28 February 2005. For details, pleas ...

2-2

... – Average – total tax bill / taxable income – If considering a project that will increase taxable income by $1 million, which tax rate should you use in your analysis? Return to ...

... – Average – total tax bill / taxable income – If considering a project that will increase taxable income by $1 million, which tax rate should you use in your analysis? Return to ...

Relationship Between Trading Volume And

... investors are classified as either "optimists" or "pessimists". Again, short positions are assumed to be more costly than long positions. In such a market, investors with short positions would be less responsive to price changes. Jennings, Starks, and Fellingham (1981) show that (generally) when the ...

... investors are classified as either "optimists" or "pessimists". Again, short positions are assumed to be more costly than long positions. In such a market, investors with short positions would be less responsive to price changes. Jennings, Starks, and Fellingham (1981) show that (generally) when the ...

IBD MEETUP/NORTHRIDGE

... techniques such as “selling short,” of which they know little and don’t care to learn. If the mainstream press continually positions investing as “good” or “safe” and trading as “bad” or “risky,” people are reluctant to align themselves with traders or even seek to understand what trading is about. ...

... techniques such as “selling short,” of which they know little and don’t care to learn. If the mainstream press continually positions investing as “good” or “safe” and trading as “bad” or “risky,” people are reluctant to align themselves with traders or even seek to understand what trading is about. ...

Chapter 3

... When competitive prices are not available, prices may be one sided. For example, at retail stores you can buy at the posted price, but you cannot sell the good to the store at that same price. One-sided prices determine the maximum value of the good (since it can always be purchased at that price), ...

... When competitive prices are not available, prices may be one sided. For example, at retail stores you can buy at the posted price, but you cannot sell the good to the store at that same price. One-sided prices determine the maximum value of the good (since it can always be purchased at that price), ...

study guide - Clemson University

... Cash problems: When expenses are more than income you should use savings, delay expenses, move sales, or borrow money. A Term-Debt Coverage Ratio: Measures if there is sufficient cash to cover all current term (farm and non-farm) debt payments. The ratio (1.60:1) indicates the farm business has $1.6 ...

... Cash problems: When expenses are more than income you should use savings, delay expenses, move sales, or borrow money. A Term-Debt Coverage Ratio: Measures if there is sufficient cash to cover all current term (farm and non-farm) debt payments. The ratio (1.60:1) indicates the farm business has $1.6 ...

Lecture 8

... attempt to “store” cash from one period to another. As a result, companies maintain their dividend payments conservatively and at a level that minimizes the need to constantly access the capital markets. BOTTOM LINE: companies will pay dividends if they do not need additional capital and they have c ...

... attempt to “store” cash from one period to another. As a result, companies maintain their dividend payments conservatively and at a level that minimizes the need to constantly access the capital markets. BOTTOM LINE: companies will pay dividends if they do not need additional capital and they have c ...

Understanding Derivative – Beyond Accounting Presented By Safwat Khalid

... Derivatives can be used to acquire risk, rather than to hedge against risk. Thus, some individuals and institutions will enter into a derivative contract to speculate on the value of the underlying asset, betting that the party seeking insurance will be wrong about the future value of the underlying ...

... Derivatives can be used to acquire risk, rather than to hedge against risk. Thus, some individuals and institutions will enter into a derivative contract to speculate on the value of the underlying asset, betting that the party seeking insurance will be wrong about the future value of the underlying ...

BUAD 611 – Managerial Finance

... 6. Show that if a companiy’s liabilities-to-equity ratio is 300 percent, its assets-to-equity ration is 300 percent. 7. In 1996, Natural Selection, a nationwide computer dating service, had $80 million of assets and $50 million of liabilities. Earnings before interest and taxes were $10 million, int ...

... 6. Show that if a companiy’s liabilities-to-equity ratio is 300 percent, its assets-to-equity ration is 300 percent. 7. In 1996, Natural Selection, a nationwide computer dating service, had $80 million of assets and $50 million of liabilities. Earnings before interest and taxes were $10 million, int ...

COMUNICACIÓN La Sociedad remite el contenido de la

... A history of growth based on skills that complement the needs of large companies worldwide. A successful turnaround story: • From a loss making industrial manufacturer in the 80s to a profitable value-added engineering and project development services provider • From a pure local player to an in ...

... A history of growth based on skills that complement the needs of large companies worldwide. A successful turnaround story: • From a loss making industrial manufacturer in the 80s to a profitable value-added engineering and project development services provider • From a pure local player to an in ...

Model of the Behavior of Stock Prices Chapter 12

... followed by x, Ito’s lemma tells us the stochastic process followed by some function G (x, t ) • Since a derivative security is a function of the price of the underlying and time, Ito’s lemma plays an important part in the analysis of derivative securities • Why it is called a lemma? ...

... followed by x, Ito’s lemma tells us the stochastic process followed by some function G (x, t ) • Since a derivative security is a function of the price of the underlying and time, Ito’s lemma plays an important part in the analysis of derivative securities • Why it is called a lemma? ...

Download Document

... 1999 into the future, the difference in these two risk estimates would continue to expand, as the conventional computation would produce ever lower numbers, while the computation based on conditional means would produce ever higher numbers (continuing outperformance is more and more surprising). For ...

... 1999 into the future, the difference in these two risk estimates would continue to expand, as the conventional computation would produce ever lower numbers, while the computation based on conditional means would produce ever higher numbers (continuing outperformance is more and more surprising). For ...

Leverage

... That said, just because a company's financial leverage is greater than that of the S&P 500 index doesn't mean it's reckless with its balance sheet. Take financials, such as bank holding company MBNA MBNA (best known for its credit cards) or financial conglomerate Citigroup C, which use far more leve ...

... That said, just because a company's financial leverage is greater than that of the S&P 500 index doesn't mean it's reckless with its balance sheet. Take financials, such as bank holding company MBNA MBNA (best known for its credit cards) or financial conglomerate Citigroup C, which use far more leve ...

Corporate Finance: Modigliani and Miller

... across firms in the same industry and use the rule: "buy firms with higher EPS-price ratios" The logic: stocks with higher EPS-price ratios yield a higher returns and must be better Since firms are in the same industry, their risks are presumably the same What is ignored is financial risk: lev ...

... across firms in the same industry and use the rule: "buy firms with higher EPS-price ratios" The logic: stocks with higher EPS-price ratios yield a higher returns and must be better Since firms are in the same industry, their risks are presumably the same What is ignored is financial risk: lev ...