assessment of investment portfolios of jordanian banks

... - Systematic Risk: The risk inherent to the entire market or entire market segment. It is the risk which is due to the factors which are beyond the control of the people working in the market and that's why risk free rate of return in used to just compensate this type of risk in market Also known as ...

... - Systematic Risk: The risk inherent to the entire market or entire market segment. It is the risk which is due to the factors which are beyond the control of the people working in the market and that's why risk free rate of return in used to just compensate this type of risk in market Also known as ...

William J

... As a member of the National Leadership team of the Corporate Solutions subpractice, he is responsible for the strategic positioning, design, management and marketing of personal financial counseling solutions in employer-sponsored programs. He has extensive experience assisting large organizations i ...

... As a member of the National Leadership team of the Corporate Solutions subpractice, he is responsible for the strategic positioning, design, management and marketing of personal financial counseling solutions in employer-sponsored programs. He has extensive experience assisting large organizations i ...

Chapter 3. From Recession to Recovery: How Soon and How

... that the severity of the Great Depression could be attributed to monetary policy mistakes—the Federal Reserve failed to counter the tightening in monetary conditions from bank failures and increased cashto-deposit ratios. Although subsequent research has qualified some of Friedman and Schwartz’s fin ...

... that the severity of the Great Depression could be attributed to monetary policy mistakes—the Federal Reserve failed to counter the tightening in monetary conditions from bank failures and increased cashto-deposit ratios. Although subsequent research has qualified some of Friedman and Schwartz’s fin ...

Some lessons from the financial crisis for the economic analysis

... to households, bank credit tightening was particularly linked to declining prospects for the housing market and the general macroeconomic outlook. The latter was also a key factor behind the tighter funding conditions faced by firms, albeit being reinforced by industry and firmspecific consideration ...

... to households, bank credit tightening was particularly linked to declining prospects for the housing market and the general macroeconomic outlook. The latter was also a key factor behind the tighter funding conditions faced by firms, albeit being reinforced by industry and firmspecific consideration ...

Is investing in structured products a form of betting?

... Certificates are always based on an underlying asset. This can be, for instance, equities in a particular company, an index such as the German DAX blue-chip index, a precious metal such as gold, or a commodity such as oil. The value of the certificate is dependent on the movements in the price of th ...

... Certificates are always based on an underlying asset. This can be, for instance, equities in a particular company, an index such as the German DAX blue-chip index, a precious metal such as gold, or a commodity such as oil. The value of the certificate is dependent on the movements in the price of th ...

Financialization and the nonfinancial corporation

... (Palley, 2007), and Flow of Funds data clearly documents rising leverage at the sector-level. At the firm level, however, rising mean leverage across NFCs is simultaneous with declining median leverage, shown in figure 2. The different trends in mean and median gross indebtedness points to rising lev ...

... (Palley, 2007), and Flow of Funds data clearly documents rising leverage at the sector-level. At the firm level, however, rising mean leverage across NFCs is simultaneous with declining median leverage, shown in figure 2. The different trends in mean and median gross indebtedness points to rising lev ...

Exercise 1.3

... a. the economy is operating outside of its production possibilities frontier b. the economy is operating on its production possibilities frontier c. there must have been an increase in technology to compensate for the labor shortage d. the opportunity cost of producing more of one good is negative e ...

... a. the economy is operating outside of its production possibilities frontier b. the economy is operating on its production possibilities frontier c. there must have been an increase in technology to compensate for the labor shortage d. the opportunity cost of producing more of one good is negative e ...

consolidated statement of financial position as at 31 march 2011

... Agreement have been recognized as an intangible asset, received in exchange for the construction services provided. Construction costs include besides others, expenditure incurred and provisions for outstanding capital commitments on the Ashram Flyover, which was significantly completed on the date ...

... Agreement have been recognized as an intangible asset, received in exchange for the construction services provided. Construction costs include besides others, expenditure incurred and provisions for outstanding capital commitments on the Ashram Flyover, which was significantly completed on the date ...

Islamic Mutual Funds` Financial Performance and Investment Style

... – prevents a pure profit focus but might be good long term risk management – restricts market risk timing abilities, which, on average, do not generate value (e.g. Bollen & Busse, 2001) ...

... – prevents a pure profit focus but might be good long term risk management – restricts market risk timing abilities, which, on average, do not generate value (e.g. Bollen & Busse, 2001) ...

Disentangling returns from hedged international equities

... investment advice of any kind, or a solicitation of an offer to buy or sell any securities, Record Currency Management Ltd products or investment services. The views about the methodology, investment strategy and its benefits are those held by Record Currency Management Limited. There is no guarante ...

... investment advice of any kind, or a solicitation of an offer to buy or sell any securities, Record Currency Management Ltd products or investment services. The views about the methodology, investment strategy and its benefits are those held by Record Currency Management Limited. There is no guarante ...

8. Financial statements - Australian Reinsurance Pool Corporation

... The members’ of the Australian Reinsurance Pool Corporation are responsible for the preparation of the financial statements that give a true and fair view in accordance with the Finance Minister’s Orders made under the Commonwealth Authorities and Companies Act 1997, including the Australian Account ...

... The members’ of the Australian Reinsurance Pool Corporation are responsible for the preparation of the financial statements that give a true and fair view in accordance with the Finance Minister’s Orders made under the Commonwealth Authorities and Companies Act 1997, including the Australian Account ...

One year later: How much have consumer attitudes

... Americans believe there is a retirement crisis in this country and fear they are unprepared. When asked, “Do you believe there is a retirement crisis in this country?” an overwhelming 92% of the respondents agreed. More than half (51%) of those aged 44-54 said they feel unprepared for retirement; an ...

... Americans believe there is a retirement crisis in this country and fear they are unprepared. When asked, “Do you believe there is a retirement crisis in this country?” an overwhelming 92% of the respondents agreed. More than half (51%) of those aged 44-54 said they feel unprepared for retirement; an ...

Career Track Snapshot for Accounting

... Focuses on external reporting and is governed by rules established by agencies such as the SEC, FASB and ISAC. These reports are used by equity investors and credit lenders to evaluate the financial ...

... Focuses on external reporting and is governed by rules established by agencies such as the SEC, FASB and ISAC. These reports are used by equity investors and credit lenders to evaluate the financial ...

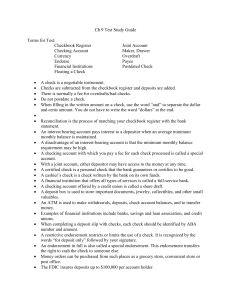

Ch 9 Test Study Guide

... An interest bearing account pays interest to a depositor when an average minimum monthly balance is maintained. A disadvantage of an interest-bearing account is that the minimum monthly balance requirement may be high. A checking account with which you pay a fee for each check processed is called a ...

... An interest bearing account pays interest to a depositor when an average minimum monthly balance is maintained. A disadvantage of an interest-bearing account is that the minimum monthly balance requirement may be high. A checking account with which you pay a fee for each check processed is called a ...

derivatives_general_paper

... companies than for banks. For a market participant in this hedging position, margin calls can become an enormous drain on cash reserves and, ironically, create new financial risks for the non-financial company and for its lending banks. It should be noted that no industrial company ever created a fi ...

... companies than for banks. For a market participant in this hedging position, margin calls can become an enormous drain on cash reserves and, ironically, create new financial risks for the non-financial company and for its lending banks. It should be noted that no industrial company ever created a fi ...

Early Warning System of Financial Distress Based On Credit Cycle

... incorporates time-varying covariates by using x timedependent, and thus provides more consistent and unbiased estimates of parameters. This article applies the logarithm of the number of calendar years that sample firms have been existed in Taiwan as firm age variable; the model is an accelerated fa ...

... incorporates time-varying covariates by using x timedependent, and thus provides more consistent and unbiased estimates of parameters. This article applies the logarithm of the number of calendar years that sample firms have been existed in Taiwan as firm age variable; the model is an accelerated fa ...

Chapter 9 : Finance: Acquiring and Using Funds to Maximize Value

... many firms in the financial sector invested heavily in the housing market—a strategy that offered the potential for high returns but was very risky. Many of these same firms chose to finance most of their investments by increasing their own debt, which made the risk even greater. When the housing ma ...

... many firms in the financial sector invested heavily in the housing market—a strategy that offered the potential for high returns but was very risky. Many of these same firms chose to finance most of their investments by increasing their own debt, which made the risk even greater. When the housing ma ...

CESifo Working Paper Series

... to Austrian bonds (Schwab, 1948). We therefore predict that the Austrian government bonds ceteris paribus experience a fall in value with an extension of the Nazi rule, i.e. the war, and a rise when its end becomes more likely. For both, Germany and Austria, we find systematic effects of major war e ...

... to Austrian bonds (Schwab, 1948). We therefore predict that the Austrian government bonds ceteris paribus experience a fall in value with an extension of the Nazi rule, i.e. the war, and a rise when its end becomes more likely. For both, Germany and Austria, we find systematic effects of major war e ...

Paulson Confronts Goldman Fallout

... John Paulson hasn't been accused of any wrongdoing. But the hedge-fund billionaire has gone on the offensive to reassure investors that his huge firm will emerge unscathed from a case that has drawn him into a political and legal vortex. The steps, including a conference call with about 100 investor ...

... John Paulson hasn't been accused of any wrongdoing. But the hedge-fund billionaire has gone on the offensive to reassure investors that his huge firm will emerge unscathed from a case that has drawn him into a political and legal vortex. The steps, including a conference call with about 100 investor ...

2017 Q1 Industry Investment Report - Private Equity Growth Capital

... increased rising from $17 billion in Q4 2016 to $29 billion in Q1 2017. In fact, investments in the Healthcare sector were the largest since Q4 2011, when volumes reached $29 billion. Other Sectors saw continued declines in investment volumes. Information Technology investment fell from $28 billion ...

... increased rising from $17 billion in Q4 2016 to $29 billion in Q1 2017. In fact, investments in the Healthcare sector were the largest since Q4 2011, when volumes reached $29 billion. Other Sectors saw continued declines in investment volumes. Information Technology investment fell from $28 billion ...

Financing the Capital Development of the Economy: A Keynes

... capital more quickly than non-financial firms. Indeed, the origins of the financial crisis and the massive and disproportionate growth of the financial sector began in the early 2000s when banks increasingly began to lend to other financial institutions via wholesale markets, lending mainly to hedge ...

... capital more quickly than non-financial firms. Indeed, the origins of the financial crisis and the massive and disproportionate growth of the financial sector began in the early 2000s when banks increasingly began to lend to other financial institutions via wholesale markets, lending mainly to hedge ...

February 2016 | No. 105 SYSTEMIC RISK IN DANISH BANKS

... relatively inexpensive and quick to compute in comparison with regulatory stress tests. This has led different authors to use SRISK, along with other market-based risk measures, for computing estimates of capital shortfalls to complement and question the results from different regulatory stress test ...

... relatively inexpensive and quick to compute in comparison with regulatory stress tests. This has led different authors to use SRISK, along with other market-based risk measures, for computing estimates of capital shortfalls to complement and question the results from different regulatory stress test ...

View PDF - Mackenzie Investments

... can, therefore, be viewed as alternatives to traditional equities and bonds. These include non-traditional forms of debt, such as asset- backed securities, leveraged loans, floating-rate Hedge funds are the most well-known type of alternative strategy loans, and inflation linked bonds, as well as ot ...

... can, therefore, be viewed as alternatives to traditional equities and bonds. These include non-traditional forms of debt, such as asset- backed securities, leveraged loans, floating-rate Hedge funds are the most well-known type of alternative strategy loans, and inflation linked bonds, as well as ot ...