Financial Crises, Risk Premia, and the Term Structure of Risky Assets

... of the financial sector. I also show that the model generates recessions with and without financial crises, and that, as in the data, risk premia are significantly higher in the latter. I contribute to the literature on intermediaries and asset pricing by connecting these models to the literature on ...

... of the financial sector. I also show that the model generates recessions with and without financial crises, and that, as in the data, risk premia are significantly higher in the latter. I contribute to the literature on intermediaries and asset pricing by connecting these models to the literature on ...

Document

... government securities were a smaller fraction. (b) Life insurance reserves were a larger fraction of U.S. household portfolios, but pension reserves were a smaller fraction. (c) Money market mutual funds were a smaller fraction of U.S. household portfolios, but U.S. government securities were a larg ...

... government securities were a smaller fraction. (b) Life insurance reserves were a larger fraction of U.S. household portfolios, but pension reserves were a smaller fraction. (c) Money market mutual funds were a smaller fraction of U.S. household portfolios, but U.S. government securities were a larg ...

Superv. Inv. Companies

... 1. The Ministry of Economy and Finance, the Bank of Italy and Consob shall exercise the powers granted to them in harmony with the provisions of the European Union regulations apply and EU decisions and act on the recommendations on the matters covered by this decree. 2. The Bank of Italy and Consob ...

... 1. The Ministry of Economy and Finance, the Bank of Italy and Consob shall exercise the powers granted to them in harmony with the provisions of the European Union regulations apply and EU decisions and act on the recommendations on the matters covered by this decree. 2. The Bank of Italy and Consob ...

Balance-Sheets: A Financial/Liability Approach

... Market values thus naturally fluctuate strongly due to external factors and short term supply and demand of capital. But, even if so, the underlying nature of market values is that the capital stock is expected to generate some kind of economic benefit to the economic owner of the asset. The economi ...

... Market values thus naturally fluctuate strongly due to external factors and short term supply and demand of capital. But, even if so, the underlying nature of market values is that the capital stock is expected to generate some kind of economic benefit to the economic owner of the asset. The economi ...

Financial Competence, Overconfidence, and Trusting

... of investigation. A creditor provides funds to a debtor. This investment is used for expected wealth generating activities whereby a portion of the proceeds, along with the initial investment, are returned to the creditor. Numerous economic problems can arise (e.g., moral hazard, adverse selection, ...

... of investigation. A creditor provides funds to a debtor. This investment is used for expected wealth generating activities whereby a portion of the proceeds, along with the initial investment, are returned to the creditor. Numerous economic problems can arise (e.g., moral hazard, adverse selection, ...

Item 1 Cover Page - Capstone Investment Financial Group

... possibility that securities within the same group of industries will decline in price due to sector-specific market or economic developments. If a Fund invests more heavily in a particular sector, the value of its shares may be especially sensitive to factors and economic risks that specifically aff ...

... possibility that securities within the same group of industries will decline in price due to sector-specific market or economic developments. If a Fund invests more heavily in a particular sector, the value of its shares may be especially sensitive to factors and economic risks that specifically aff ...

Corporate Governance and Its Effect on the Corporate Financial

... interest of loan is the acceptable tax cost and this reduces the effective cost of loan especially if the rate of return resulted from these sources is higher than the cost rate of financing. Second, lenders cannot vote and shareholders can have more control of the larger companies with less money. ...

... interest of loan is the acceptable tax cost and this reduces the effective cost of loan especially if the rate of return resulted from these sources is higher than the cost rate of financing. Second, lenders cannot vote and shareholders can have more control of the larger companies with less money. ...

Financing Constraints and Entrepreneurship

... adverse selection, where only entrepreneurs starting the most risky projects would agree to the bank’s loan terms. In such an instance, the banks would face greater default probabilities, making the loans unprofitable in expectation. They show theoretically that in such an instance, banks may be fo ...

... adverse selection, where only entrepreneurs starting the most risky projects would agree to the bank’s loan terms. In such an instance, the banks would face greater default probabilities, making the loans unprofitable in expectation. They show theoretically that in such an instance, banks may be fo ...

New Critical Urban Theory

... the crisis and crisis policy responses to busts and recessions by governments and central banks in historical and comparative perspective and the debate on relations between the growth of income inequality and the crisis, which the 2008 crisis has opened up as a new area where urban inequality growt ...

... the crisis and crisis policy responses to busts and recessions by governments and central banks in historical and comparative perspective and the debate on relations between the growth of income inequality and the crisis, which the 2008 crisis has opened up as a new area where urban inequality growt ...

FREE Sample Here

... value of $500,000 in case of bankruptcy by the broker b. To protect investor from corporate insider trading and insure their accounts for $500,0000 in case corporate fraud caused a company to go bankrupt C. Cover the total market loss on an investor's brokerage account in case of bankruptcy of the b ...

... value of $500,000 in case of bankruptcy by the broker b. To protect investor from corporate insider trading and insure their accounts for $500,0000 in case corporate fraud caused a company to go bankrupt C. Cover the total market loss on an investor's brokerage account in case of bankruptcy of the b ...

External Sector

... and prepayments are assets and liabilities derived from the international trade (both goods and services) relationship. Usually trade credits are short-term but BoP allows for both short-term and long-term trade credits. Loans are one of the major components of Other Investments. BoP classifies them ...

... and prepayments are assets and liabilities derived from the international trade (both goods and services) relationship. Usually trade credits are short-term but BoP allows for both short-term and long-term trade credits. Loans are one of the major components of Other Investments. BoP classifies them ...

Liquidity risk and positive feedback

... To gain a better understanding of the model presented in section II and expanded upon in the appendix, two types of model simulations were conducted. In the first we assumed that there is only one type of value investor in the market, that these represent a fixed proportion of market participants, a ...

... To gain a better understanding of the model presented in section II and expanded upon in the appendix, two types of model simulations were conducted. In the first we assumed that there is only one type of value investor in the market, that these represent a fixed proportion of market participants, a ...

Strategic Asset Management (SAM)

... value of bonds generally have an inverse relationship to interest rates. Stocks will experience market fluctuations which can include loss of principal value while bonds offer a fixed-rate of return. Small-cap stocks may be subject to a higher degree of market risk than large-cap stocks, and the ill ...

... value of bonds generally have an inverse relationship to interest rates. Stocks will experience market fluctuations which can include loss of principal value while bonds offer a fixed-rate of return. Small-cap stocks may be subject to a higher degree of market risk than large-cap stocks, and the ill ...

International Accounting Standard 10

... major ordinary share transactions and potential ordinary share transactions after the reporting period (IAS 33 Earnings per Share requires an entity to disclose a description of such transactions, other than when such transactions involve capitalisation or bonus issues, share splits or reverse share ...

... major ordinary share transactions and potential ordinary share transactions after the reporting period (IAS 33 Earnings per Share requires an entity to disclose a description of such transactions, other than when such transactions involve capitalisation or bonus issues, share splits or reverse share ...

Nobody plans to fail....

... Future value is the amount to which current savings will increase based on a certain interest rate and a certain time period. Future value is also call compounding earning interest on previously earned interest. Future value can be computed for a single amount or for a series of deposits. ...

... Future value is the amount to which current savings will increase based on a certain interest rate and a certain time period. Future value is also call compounding earning interest on previously earned interest. Future value can be computed for a single amount or for a series of deposits. ...

Financial Reporting Council

... These amendments result from proposals that were contained in the Exposure Draft for proposed amendments to IFRS, Annual Improvements to IFRSs 2012– 2014 Cycle, published in December 2013. The IASB uses the Annual Improvements process to make necessary, but nonurgent, amendments to IFRSs if those am ...

... These amendments result from proposals that were contained in the Exposure Draft for proposed amendments to IFRS, Annual Improvements to IFRSs 2012– 2014 Cycle, published in December 2013. The IASB uses the Annual Improvements process to make necessary, but nonurgent, amendments to IFRSs if those am ...

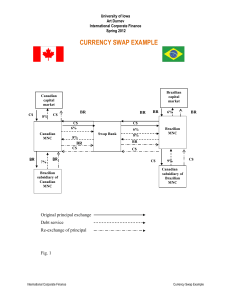

E4 - Art Durnev

... has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing five-year bonds at 8%. The parent then would convert C$ to BR to pay the project cost. The Brazilia ...

... has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing five-year bonds at 8%. The parent then would convert C$ to BR to pay the project cost. The Brazilia ...

Another Look at Risks in Financial Group Structures

... Transaction risks: all the risks involved in intra-group transactions, which may not be transparent, may result in inappropriate transfers, especially between regulated and unregulated entities, and may affect the soundness of regulated entities, etc. Moral hazard risks: when an entity of a group en ...

... Transaction risks: all the risks involved in intra-group transactions, which may not be transparent, may result in inappropriate transfers, especially between regulated and unregulated entities, and may affect the soundness of regulated entities, etc. Moral hazard risks: when an entity of a group en ...

25% 75% - Amundi

... Issued by Amundi, French joint stock company (“Société Anonyme”) with a registered capital of Euro 578 002 350 and approved by the French Securities Regulator (Autorité des Marchés Financiers-AMF) under number GP 04000036 as a portfolio management company, 90, boulevard Pasteur -75015 Paris-France – ...

... Issued by Amundi, French joint stock company (“Société Anonyme”) with a registered capital of Euro 578 002 350 and approved by the French Securities Regulator (Autorité des Marchés Financiers-AMF) under number GP 04000036 as a portfolio management company, 90, boulevard Pasteur -75015 Paris-France – ...