My Life in Finance - The University of Chicago Booth School of

... economics published in the 1970-2005 period. It fathered an enormous literature. When Mike came to present the paper at Chicago, he began by claiming it would destroy the corporate finance material in what he called the “white bible” (Fama and Miller, The Theory of Finance 1972). Mert and I replied ...

... economics published in the 1970-2005 period. It fathered an enormous literature. When Mike came to present the paper at Chicago, he began by claiming it would destroy the corporate finance material in what he called the “white bible” (Fama and Miller, The Theory of Finance 1972). Mert and I replied ...

Market Portfolio

... Capital Market Theory 3. All investors have homogeneous expectations; that is, investors have identical estimates for the probability distributions of future rates of return. – This implies that all investors will estimate the efficient frontier to be in the exact same location (including using the ...

... Capital Market Theory 3. All investors have homogeneous expectations; that is, investors have identical estimates for the probability distributions of future rates of return. – This implies that all investors will estimate the efficient frontier to be in the exact same location (including using the ...

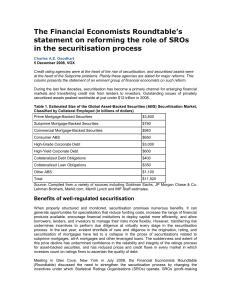

Roundtable`s Evaluation of the SEC`s Proposals for Reform

... appeared in the US. An active corporate bond market, largely in debt issued by railroad companies, emerged in the middle of the 19th century in the US more than half a century before the first SRO opened for business. SROs remained largely US-focused until the 1970s, when global capital markets bega ...

... appeared in the US. An active corporate bond market, largely in debt issued by railroad companies, emerged in the middle of the 19th century in the US more than half a century before the first SRO opened for business. SROs remained largely US-focused until the 1970s, when global capital markets bega ...

2014 Annual Report

... This Management’s Discussion and Analysis (“MD&A”) provides a review of the significant developments that have impacted CanWel Building Materials Group Ltd. (the “Company”) in the quarter and year ended December 31, 2014 relative to 2013. This discussion of the financial condition and results of ope ...

... This Management’s Discussion and Analysis (“MD&A”) provides a review of the significant developments that have impacted CanWel Building Materials Group Ltd. (the “Company”) in the quarter and year ended December 31, 2014 relative to 2013. This discussion of the financial condition and results of ope ...

Financial Innovation, Collateral and Investment

... definition their whole future value (assuming no transactions costs in seizing them). The most important difference is that we have uncertainty, and heterogeneity in how agents rank uncertain payoffs. Moreover, we have in mind other streams of future consumption, perhaps generated by other assets, tha ...

... definition their whole future value (assuming no transactions costs in seizing them). The most important difference is that we have uncertainty, and heterogeneity in how agents rank uncertain payoffs. Moreover, we have in mind other streams of future consumption, perhaps generated by other assets, tha ...

Chapter 4: Economic costs associated with the

... The costs of a banking crisis usually fall into two broad classes: …scal costs and economic costs. Fiscal costs re‡ect actual outlays of public funds generated by government intervention to prevent or resolve the crisis.4 Economic costs mirror direct and indirect negative e¤ects of a banking crisis ...

... The costs of a banking crisis usually fall into two broad classes: …scal costs and economic costs. Fiscal costs re‡ect actual outlays of public funds generated by government intervention to prevent or resolve the crisis.4 Economic costs mirror direct and indirect negative e¤ects of a banking crisis ...

uba capital plc - The Nigerian Stock Exchange

... in an orderly transaction in the principal (or most advantageous) market at the measurement date under current market conditions. Fair value under IFRS 13 is an exit price regardless of whether that price is directly observable or estimated using another valuation technique. Also, IFRS 13 includes e ...

... in an orderly transaction in the principal (or most advantageous) market at the measurement date under current market conditions. Fair value under IFRS 13 is an exit price regardless of whether that price is directly observable or estimated using another valuation technique. Also, IFRS 13 includes e ...

Meeting Financial Goals—Rate of Return

... Financial success depends primarily on two things: (i) developing a plan to meet your established goals and (ii) tracking your progress with respect to that plan. Too often people set vague goals (“I want to be rich.”), make unrealistic plans, or never bother to assess the progress toward their goal ...

... Financial success depends primarily on two things: (i) developing a plan to meet your established goals and (ii) tracking your progress with respect to that plan. Too often people set vague goals (“I want to be rich.”), make unrealistic plans, or never bother to assess the progress toward their goal ...

The Importance of Asset Management

... Most stakeholders in the European economy benefit from the asset management industry services. But ultimately most clients are individuals who thus are the final users of asset management services. Through pensions, insurance and retail investment, millions of individuals across Europe are ultimatel ...

... Most stakeholders in the European economy benefit from the asset management industry services. But ultimately most clients are individuals who thus are the final users of asset management services. Through pensions, insurance and retail investment, millions of individuals across Europe are ultimatel ...

On the Cross-Section of Expected Returns of German Stocks: A Re

... Size on Stock Returns,” JF 44 (1989): 483. See K. Chan and N. Chen, “An Unconditional Asset-Pricing Test,” JF 43 (1988): 309-325. See K. Chan and N. Chen, “Structural and Return Characteristics of Small and Large Firms,” JF 46 (1991): 1480 f. See E. Fama and K. French,”The Cross-Section of Expected ...

... Size on Stock Returns,” JF 44 (1989): 483. See K. Chan and N. Chen, “An Unconditional Asset-Pricing Test,” JF 43 (1988): 309-325. See K. Chan and N. Chen, “Structural and Return Characteristics of Small and Large Firms,” JF 46 (1991): 1480 f. See E. Fama and K. French,”The Cross-Section of Expected ...

the future of the belgian financial sector

... 24. Although major reforms have already been introduced to enhance the resilience of the financial system, some risks remain, especially if low interest rates would persist for some years. The first 5 recommendations address this issue. Recommendation 1 proposes to enhance the current regulatory and ...

... 24. Although major reforms have already been introduced to enhance the resilience of the financial system, some risks remain, especially if low interest rates would persist for some years. The first 5 recommendations address this issue. Recommendation 1 proposes to enhance the current regulatory and ...

Adverse Selection, Liquidity, and Market Breakdown

... to the tighter funding liquidity. (See Brunnermeier and Pedersen [11] for dividing the concept of liquidity into two categories: funding liquidity and market liquidity.) ...

... to the tighter funding liquidity. (See Brunnermeier and Pedersen [11] for dividing the concept of liquidity into two categories: funding liquidity and market liquidity.) ...

Financial Institutions Instruments and Markets, 5th Edition

... 58. Financial intermediaries can engage in credit risk transformation because they: A. obtain cost advantages owing to their size and business volumes transacted. B. can quickly convert financial assets into cash, close to the current market price. C. develop expertise in lending and diversifying l ...

... 58. Financial intermediaries can engage in credit risk transformation because they: A. obtain cost advantages owing to their size and business volumes transacted. B. can quickly convert financial assets into cash, close to the current market price. C. develop expertise in lending and diversifying l ...

The Market Microstructure Approach to Foreign Exchange: Looking

... depiction of the progress of science. For Popper, science is an evolutionary process in which theories are proposed, falsified by evidence, and then improved in light of the evidence. Such criticism is an essential activity and represents the only route through which science can achieve progress. FX ...

... depiction of the progress of science. For Popper, science is an evolutionary process in which theories are proposed, falsified by evidence, and then improved in light of the evidence. Such criticism is an essential activity and represents the only route through which science can achieve progress. FX ...

BANK-BASED AND MARKET-BASED FINANCIAL SYSTEMS

... terms of size, activity, and efficiency). Countries with larger ratios are classified as bank-based. Countries where the conglomerate ratio of banking sector development to stock market development is below the mean are classified as market-based. Thus, this grouping system produces two categories o ...

... terms of size, activity, and efficiency). Countries with larger ratios are classified as bank-based. Countries where the conglomerate ratio of banking sector development to stock market development is below the mean are classified as market-based. Thus, this grouping system produces two categories o ...

The General Ledger and Business Reporting

... • -------------------------------------------------– 1111 might mean petty cash 1112 might mean change fund 1121 might mean trade accounts receivable 1122 might mean receivables from officers ...

... • -------------------------------------------------– 1111 might mean petty cash 1112 might mean change fund 1121 might mean trade accounts receivable 1122 might mean receivables from officers ...

Finance as a Magnet for the Best and Brightest

... matter of rent-seeking, rather than true productivity”. The possibility that the financial sector engages in rent-seeking rather than delivering economic value has also been emphasized by Lord Turner, until recently Chairman of the Financial Service Authority (Turner, 2010). Similarly, Paul Woolley ...

... matter of rent-seeking, rather than true productivity”. The possibility that the financial sector engages in rent-seeking rather than delivering economic value has also been emphasized by Lord Turner, until recently Chairman of the Financial Service Authority (Turner, 2010). Similarly, Paul Woolley ...

What is Financial Stability? Financial Stability

... endogenously or as a result of significant adverse and unanticipated events”. This statement is unique in viewing financial stability as a continuum, rather than a single, static condition (ibid, p. 6). This implies that financial systems operate within a corridor, with stabi ...

... endogenously or as a result of significant adverse and unanticipated events”. This statement is unique in viewing financial stability as a continuum, rather than a single, static condition (ibid, p. 6). This implies that financial systems operate within a corridor, with stabi ...

The Crisis Aftermath: New Regulatory Paradigms

... economic agents in the banking system and questioned the capacity of financial markets to channel resources to their best use. While it is essential for the well functioning of economic activity that financial institutions do take risk, the decisions taken by financial intermediaries have proven ex ...

... economic agents in the banking system and questioned the capacity of financial markets to channel resources to their best use. While it is essential for the well functioning of economic activity that financial institutions do take risk, the decisions taken by financial intermediaries have proven ex ...

Towards a framework for financial stability

... the danger of too much finance being built on too little certainty or trust about the ...

... the danger of too much finance being built on too little certainty or trust about the ...

Bankruptcy Equilibrium: Secured and Unsecured assets

... Debt is an important financial tool to transfer wealth among dates and to insurance among different states of nature. We can separate debt into two categories: Secured debt, as mortgage loan, is backed by some collateral; it played an important role during the last financial crisis [14]. Unsecured d ...

... Debt is an important financial tool to transfer wealth among dates and to insurance among different states of nature. We can separate debt into two categories: Secured debt, as mortgage loan, is backed by some collateral; it played an important role during the last financial crisis [14]. Unsecured d ...