wiiw Policy Note 12: What Remains of the Theory of Demand

... income. As a result, expenditure injected in the circular flow (as autonomous investment) can generate a matching amount of saving by raising income through the multiplier. In this framework higher saving is the consequence of higher investment, and the maximising principle of the individual agent ...

... income. As a result, expenditure injected in the circular flow (as autonomous investment) can generate a matching amount of saving by raising income through the multiplier. In this framework higher saving is the consequence of higher investment, and the maximising principle of the individual agent ...

tu-91-116 economics of european integration - MyCourses

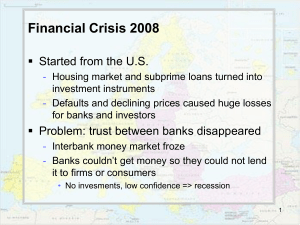

... Slow growth and negative growth (partly due to financial crisis) has worsened the situation in countires with large debt to begin with - Financial crisis affected banks and govenrments needed to support them ...

... Slow growth and negative growth (partly due to financial crisis) has worsened the situation in countires with large debt to begin with - Financial crisis affected banks and govenrments needed to support them ...

Personal Finance Unit Study Guide

... making to personal spending and saving choices. a. Explain that people respond to positive and negative incentives in predictable ways. b. Use a rational decision making model to select one option over another. c. Create a savings or financial investment plan for a future goal. SSEPF2 The student wi ...

... making to personal spending and saving choices. a. Explain that people respond to positive and negative incentives in predictable ways. b. Use a rational decision making model to select one option over another. c. Create a savings or financial investment plan for a future goal. SSEPF2 The student wi ...

Rethinking Japan`s “Lost Decade”: some Post

... The European crisis highlighted this point. In the immediate wake of the global financial crisis in 2008, blame was directed at the United States. Critics made a number of points, including reckless lending by mortgage companies, excessive borrowing by consumers, and inadequate oversight by regulato ...

... The European crisis highlighted this point. In the immediate wake of the global financial crisis in 2008, blame was directed at the United States. Critics made a number of points, including reckless lending by mortgage companies, excessive borrowing by consumers, and inadequate oversight by regulato ...

the financial crisis and economic stagnation in

... In a similar vein, the British government has claimed that any relaxation of fiscal austerity would prompt the Bank of England to tighten monetary policy in order to offset its inflationary effects. This ignores two brute facts: there remains considerable slack in the economy so an acceleration of ...

... In a similar vein, the British government has claimed that any relaxation of fiscal austerity would prompt the Bank of England to tighten monetary policy in order to offset its inflationary effects. This ignores two brute facts: there remains considerable slack in the economy so an acceleration of ...

3rd Biennial International Conference on Business, Banking & Finance Panel Discussion:

... Insurance and Pension Funds ...

... Insurance and Pension Funds ...

Stocks Are Not The New Bonds

... 2016 has been notable for droughts in some places and floods in others. There has been a disconnect, if you will, in normal weather patterns. Lately, we have witnessed a growing disconnect in the financial markets too. Asset class after asset class continues to rise in value despite stagnant global ...

... 2016 has been notable for droughts in some places and floods in others. There has been a disconnect, if you will, in normal weather patterns. Lately, we have witnessed a growing disconnect in the financial markets too. Asset class after asset class continues to rise in value despite stagnant global ...

When the United States Was an Emerging Market

... Affairs in 1998. “But the claims of enormous benefits from free capital mobility are not persuasive.”34 It can be said that the United States would not have become an economic superpower without waves of speculative investment from abroad. But these capital flows came at a great cost to economic st ...

... Affairs in 1998. “But the claims of enormous benefits from free capital mobility are not persuasive.”34 It can be said that the United States would not have become an economic superpower without waves of speculative investment from abroad. But these capital flows came at a great cost to economic st ...

World Crisis and Russia

... Financial crisis is fixing the paralysis of the credit and common loss of trust. Risk reallocation system has collapsed – it has to be rebuilt anew. This collapse is in itself important and severely strengthening the crisis in the industries that depend on the credit. Unfortunate regulatory moves, ...

... Financial crisis is fixing the paralysis of the credit and common loss of trust. Risk reallocation system has collapsed – it has to be rebuilt anew. This collapse is in itself important and severely strengthening the crisis in the industries that depend on the credit. Unfortunate regulatory moves, ...

Abstract - NUS Business School

... is a challenge. Yet extreme price movements, at odds with any reasonable economic explanation, are documented throughout history. Examples include the Dutch tulip mania (16341637), the Mississippi bubble (1719-1720), and the stock market boom and crash of the 1920s (see e.g., Kindelberger (1989), Ga ...

... is a challenge. Yet extreme price movements, at odds with any reasonable economic explanation, are documented throughout history. Examples include the Dutch tulip mania (16341637), the Mississippi bubble (1719-1720), and the stock market boom and crash of the 1920s (see e.g., Kindelberger (1989), Ga ...

Chapter 9 Sources of Capital

... Identify each of the different financial plans, and evaluate which one would be most beneficial to you at this stage of your life, Explain the difference between Financial Investment and Real Investment and explain which is better for the economy. ...

... Identify each of the different financial plans, and evaluate which one would be most beneficial to you at this stage of your life, Explain the difference between Financial Investment and Real Investment and explain which is better for the economy. ...

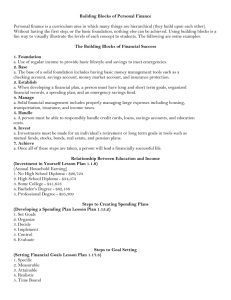

Building Blocks of Personal Finance

... a. When developing a financial plan, a person must have long and short term goals, organized financial records, a spending plan, and an emergency savings fund. 4. Manage a. Solid financial management includes properly managing large expenses including housing, transportation, insurance, and income t ...

... a. When developing a financial plan, a person must have long and short term goals, organized financial records, a spending plan, and an emergency savings fund. 4. Manage a. Solid financial management includes properly managing large expenses including housing, transportation, insurance, and income t ...